The Motley Fool spotlights three quantum computing stocks

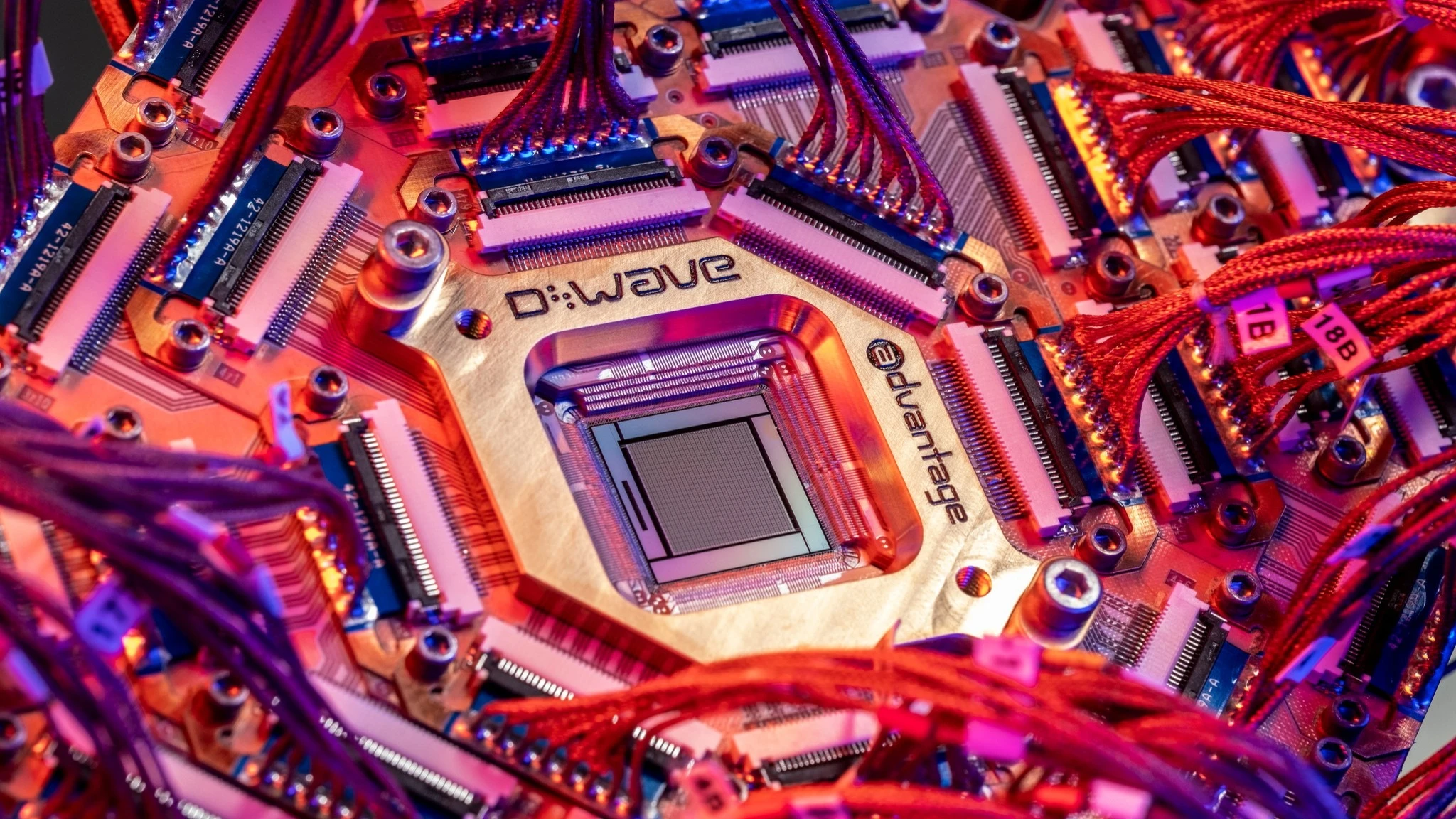

D-Wave is among the quantum stocks highlighted by the Motley Fool. / Photo: Facebook / dwavequantum

The Motley Fool has spotlighted three stocks for investors interested in quantum computing. The picks vary in size — from the small-cap D-Wave to tech giant IBM — but the investing news and analysis outlet believes all three could deliver solid long-term returns.

D-Wave Quantum

D-Wave, which specializes in quantum computing, may appeal to investors interested in more practical applications for quantum computers, according to the Motley Fool. This small-cap company, with a market capitalization of $2 billion, is consistently upgrading its solutions, striving to find ways to process large amounts of data that require as little computing power as possible, notes the outlet. For example, its new processor can solve problems 25,000 times faster than its predecessor. Among D-Wave clients are consulting firms Deloitte and Accenture, payment giant Mastercard, and defense contractor Lockheed Martin. The Motley Fool believes the company’s focus on using quantum tools for more practical purposes could attract even more clients.

By 2027, Wall Street analysts expect the company’s revenue to grow more than eightfold to $72.1 million and the net loss to shrink 63.5% to $52.4 million, says the Motley Fool.

IonQ

Quantum computer developer IonQ, with a market capitalization of just over $6 billion, could become a leader in the emerging quantum computing market, writes the Motley Fool. The company already offers three tiers of quantum computers and plans to launch a fourth system later this year. IonQ also operates a cloud-based platform for developing quantum applications. Today, its products and services are mainly used by government agencies, such as the U.S. Air Force Research Lab, and major universities.

According to the consensus forecast cited by the Motley Fool, IonQ’s revenue is expected to reach $289.8 million by 2027, 6.7 times the amount in 2024, and the net loss to narrow almost 29% to $236.8 million.

IBM

U.S. tech giant IBM, unlike the other two companies on the list, may suit investors with a lower risk tolerance, the Motley Fool notes.

IBM deployed the world’s first cloud-based quantum computing system back in 2016. Today, it has more than 80 quantum systems, which are used to run over 3 trillion programs daily. Since IBM does not reveal its quantum revenue separately, there are no forecasts specific to that segment. However, the Motley Fool believes the stock could be “the least stressful way to profit from the long-term growth of the quantum, cloud, and AI markets.”