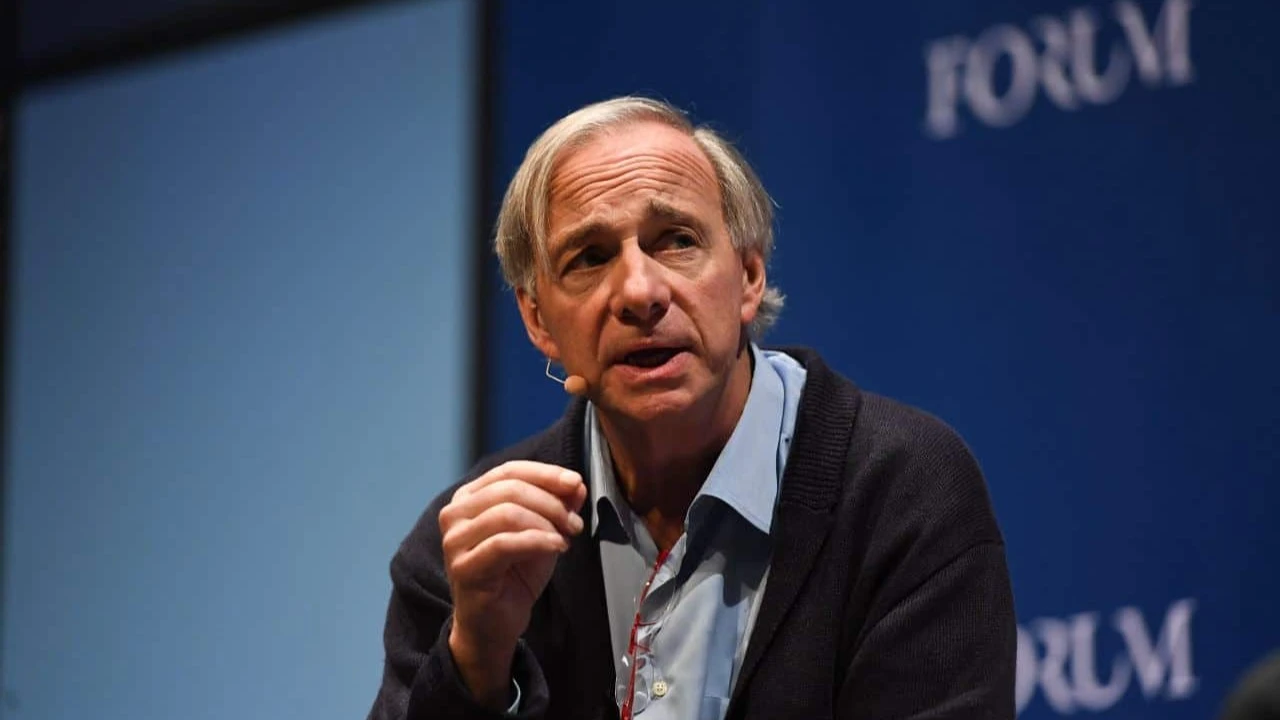

'A perfect ending': Ray Dalio sold the remaining stake in the hedge fund he founded

The management transfer process at the world's largest hedge fund is complete

American investor Ray Dalio has sold the rest of his stake in Bridgewater Associates, the world's largest hedge fund, which he founded in 1975. The company bought the last shares from him, and Dalio himself left the board, according to a letter to clients, wroteThe Wall Street Journal.

Dalio, 75, said he will continue to support the company as a client and mentor while remaining an investor in its funds. However, at the management level, his involvement has ended.

Details

Following the deal, Bridgewater issued new shares that were purchased by Brunei's sovereign wealth fund. As sources told WSJ, we are talking about an investment of several billion dollars. Brunei Investment Agency became the owner of almost 20% in the capital of the American investment company. This deal was not previously covered in the media, and the official letter does not mention the name of the fund.

Brunei Investment Agency has long invested in Bridgewater's funds and has now reallocated some of its assets into an equity stake in the management company itself. According to sources, the fund has become one of the largest co-owners of Bridgewater - second, however, to co-investment director Bob Prince.

Bridgewater expects Dalio's eventual departure from the board and shareholder ranks to simplify its internal governance structure. Although he has long since stepped down as CEO, co-investment director and chairman of the board, the founder's influence continued to be felt - he regularly voiced opinions on key issues and initiated discussions, WSJ notes.

The transfer of Bridgewater's management proved to be a protracted process: Dalio first talked about it back in 2011, promising to complete the process in 10 years. However, the search for an effective management model was accompanied by CEO changes, disputes and even lawsuits. In a letter to clients, CEO Nir Bar Dea and co-chairman Mike McGavick called Dalio's exit "the perfect end to the transition."

Context

Despite its iconic status and scale, Bridgewater has seen its assets under management decline in recent years, from $168 billion in 2019 to $92.1 billion at the end of 2024. The reason for this includes artificially limiting the size of its largest fund, Pure Alpha, which focuses on macroeconomic strategies.

The fund's performance has improved since the cap was put in place. Pure Alpha returned 11.3% in 2024 and 17% in the first six months of 2025, according to The Wall Street Journal. For the five-year period from 2020 through 2024, the fund yielded 5.9% annually, while the stock market rose at a record pace during that period.

This article was AI-translated and verified by a human editor