Analysts warned of the risk of a 20% fall in US stocks due to accelerating inflation

Inflation may rise due to high oil prices amid Israel-Iran conflict

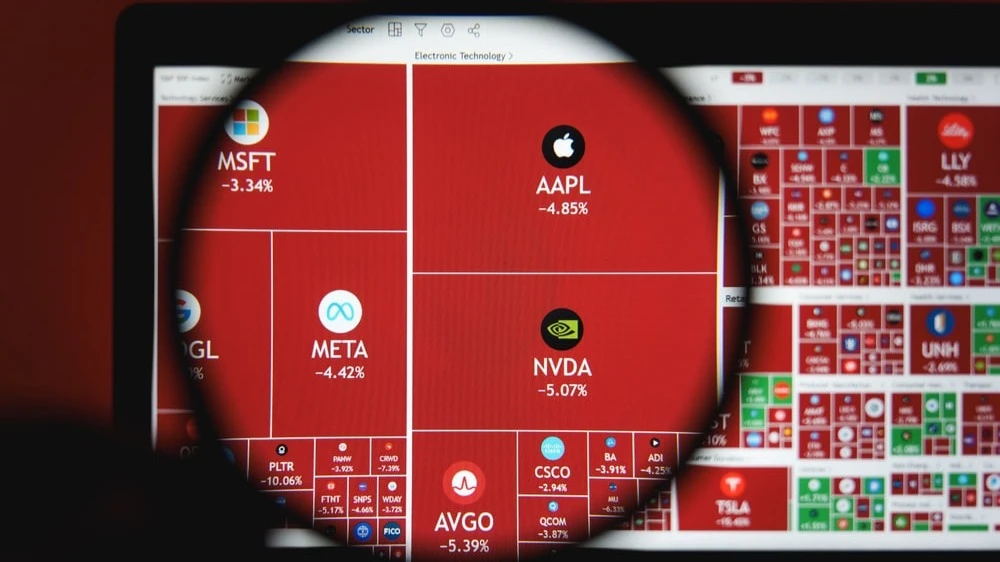

The main index of U.S. stocks S&P 500 risks falling by 20% if inflation rises sharply due to high oil prices, strategists at RBC Capital Markets warned. According to their assessment, the more the conflict in the Middle East drags on, the more negative it will be for U.S. stocks. Other strategists, particularly from Morgan Stanley, remain optimistic about the prospects for corporate earnings and the U.S. stock market.

Details

In a worst-case scenario for the U.S. stock market, the S&P 500 Index could fall 20 percent to 4,800 points if inflation rises sharply amid rising oil prices, according to a report by strategists at RBC Capital Markets, which is reported by Bloomberg.

In total, they described three downside scenarios for the S&P 500 index. According to them, the wider the conflict in the Middle East becomes and the longer it lasts, the more negative it will be for U.S. stocks. According to the most pessimistic scenario, a drop in the index to 4800 points is likely under the following conditions: inflation in the U.S. will accelerate to 4%, corporate profits will stop growing, the Fed will cut rates only twice, and yields on 10-year Treasury bonds will remain at current levels;

In a less negative scenario, the index could fall by about 13%, to a level of about 5,200, RBC strategists expect. In that situation, they expect corporate earnings growth of 7% this year. RBC's year-end target for the index is 5,730, about 4% below current levels.

What other strategists are saying

Other strategists remain optimistic about the outlook for corporate earnings and the U.S. stock market, Bloomberg notes. Michael Wilson of Morgan Stanley in his note on June 16 noted that some indicators suggest that corporate earnings next year will be higher than expected.

Context

The spike in oil prices following mutual strikes between Israel and Iran has increased the risks of stagflation in the U.S., a situation in which prices rise and the economy slows, Apollo Global Management warned. On June 13, oil prices rose 7%, posting their biggest one-day gain in three years. On June 16, oil continued to rise in price.

If the escalation triggers disruptions in shipping through the Strait of Hormuz that persist through the end of the year, oil prices could double to $150 a barrel, surpassing the 2008 high, said Warren Patterson, head of commodities strategy at ING Groep NV.