Two fintech companies founded by Russian natives have become direct competitors in the Mexican banking market. They are Nikolay Storonsky's Revolut neobank and Plata Card, a startup by former top managers of Tinkoff Bank with investments from the bank's founder Oleg Tinkov and Baring Vostok founder Michael Calvey. Both companies have received full banking licenses from the national regulator, are focused on aggressive growth and are seeking IPOs. What will they fight for and what challenges might they face in Mexico?

Storonsky's Mexican campaign

British neobank Revolut, founded by Russian-born Nikolay Storonsky (he renounced Russian citizenship in 2022), received a full banking license in Mexico at the end of October. Europe's most expensive fintech startup, whose value is now estimated at $75 billion, said it will begin expansion into the Mexican market with its flagship products - currency exchange, international money transfers, debit cards and current accounts. These were the products that allowed Revolut to spin off in Europe earlier.

The Mexican neobank's Mexican page is still uninformative: Revolut does not disclose a timeline for launching operations in Mexico, nor the full list of services that will be available to customers. It simply suggests downloading a mobile app and signing up for a waiting list. A Revolut representative in Mexico declined to disclose data on the start of operations and current demand for its products to Oninvest, calling this information "sensitive and therefore confidential".

For Revolut, entering the Mexican market is part of its global strategy, during which the fintech startup plans to grow its customer base to 100 million people from the current 65 million and add 30 new markets to the existing 160. In early October, for example, Neobank announced that it had secured the support of Colombia's national regulator and passed the first of two stages required to obtain a local banking license. It promises to enter the Colombian market in 2026 also with its flagship products - foreign exchange, international transfers and cards.

Revolut is preparing for an IPO and is considering a dual listing in New York and London at the same time, The Times wrote in September, citing sources.

On the same field as Tinkov.

In the Mexican market, Revolut will compete with another fintech startup with Russian roots - Plata Card, a project of former Tinkoff Bank top managers Danil Anisimov, Alexander Bro and Neri Tollardo.

Unlike Revolut, the Mexican market for Plata is a home market. The partners came up with the idea of making a fintech startup here in September 2022.

Already in six months Plata launched its first product - a debit card with cashback, then a credit card, then offered installment programs (buy now, pay later, BNPL services) under the name Plata Difiere. The project has a fully digital service.

Tinkoff launched in Russia in 2006 with a similar business model and products: the bank, which had no physical offices, quickly gained a client base by offering citizens card products with cashback and consumer loans.

What does Plata offer in Mexico? The project promises customers to review an online application for a card in 5 minutes, and the plastic card is handed over with a courier. Cardholders can choose 4 categories of cashback up to 15% of the purchase amount each month and receive it in local currency. Withdrawals with commission can only be made at third-party ATMs that accept Mastercard. Plata offers installments of up to 200 thousand pesos for 3-24 months. The decision is considered within 3 minutes right during the purchase process in an offline store or on the website of 21 Plata partner merchants. The customer will pay Plata a fixed commission for the issuance of the installments. He will also pay a commission and VAT on the monthly installment payment.

In early 2025, Plata raised $160 million from a pool of investors led by U.S. fund Kora with a $1.5 billion valuation. It became one of the few "unicorns" with Mexican "residence": according to CB Insights, there are only nine of them in the country. Plata's valuation climbed to $3.1 billion in the latest round this October. Like Revolut, Plata is hoping for an IPO. "We will do an IPO within two years for ten billion," Tinkov told the Elizaveta Osetinskaya Project.

Tinkov was one of the first key early investors in Plata. "Since I had a villa in Mexico, I always looked at this market," he admitted in an interview with Osetinskaya. Until 2022, he said, Mexico was one of the priority regions for Tinkoff's international expansion, but the outbreak of hostilities in Ukraine canceled those plans.

But they were realized by the bank's top managers who left the team. Tinkov stated that he is not the founder of Plata, does not hold any positions in the startup and only provides mentoring support to his former colleagues. Plata did not respond to Oninvest's request.

Mexican Eldorado

According to the Bank of Mexico, there are now 52 classical banks in the country. The five largest - BBVA, Santander, HSBC, Banorte and Banamex - accumulated 60% of the assets of the entire banking system of the country.

Non-banks in the country generally operate as SOFIPOs (Sociedad Financiera Popular), less regulated financial institutions that can accept deposits, make small loans to households and small businesses, and engage in money transfers and conversion operations. NuBank, Financiera Sustentable, Libertad Servicios Financieros, STORI and Klar are Plata and Revolut's largest competitors. They account for 84.8% of the SOFIPO market, according to the Bank of Mexico.

In the Mexican market, large banks and fintechs have developed their own specialization and their customer bases hardly overlap.

The former are engaged in servicing corporate clients and investment banking services, while when working with individuals, they primarily target the affluent part of the population, says Maxim Chebotarev, managing partner of the CATS.VC venture fund, to Oninvest. The fund invests in Mexico. According to him, classic banks in Mexico "have not learned to work with the new class of population, such as digital nomads and people engaged in IT outsourcing for international companies". Fintechs, on the other hand, have focused on the mass customer and the needs of small businesses and individual entrepreneurs.

The entry of another major digital player will not lead to an oversaturation of the digital banking market in Mexico - due to the low involvement of banks in the mass retail segment, there is a high demand for fintech services in the country, Chebotarev believes.

But Pavel Myasnikov, a partner at venture capital firm Funders.VC, also operating in the country, notes that Revolut has so far said it will develop payment solutions in Mexico. "There are a lot of those in the country, and Revolut is getting into a truly 'scarlet ocean,'" Myasnikov believes.

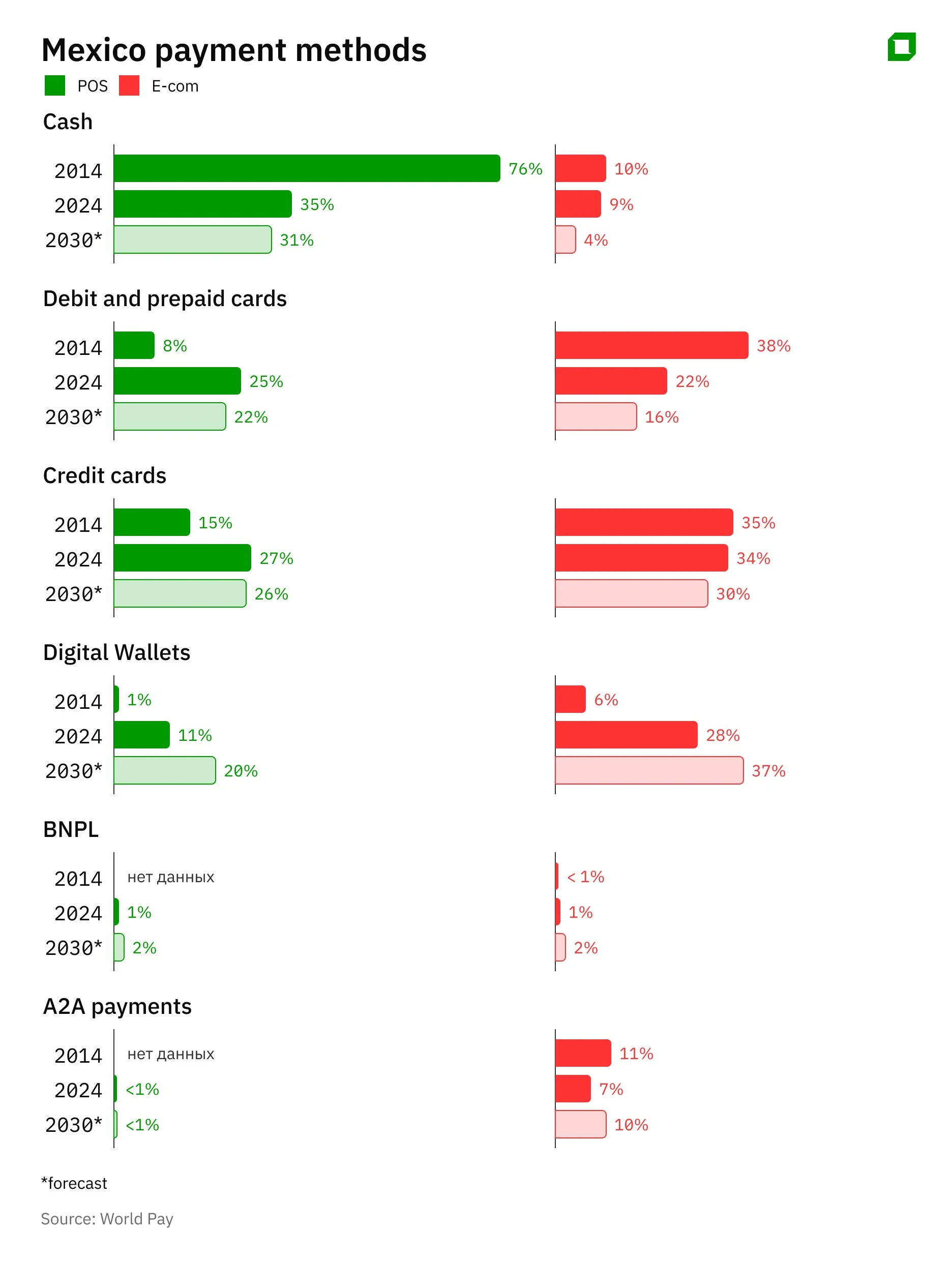

Mexico has the highest cash usage among Latin American countries, with 35% of all point-of-sale transactions in 2024, according to a Worldpay report.

But over the past 10 years, through the efforts of fintech, the country's payment market has been greatly transformed, and the share of cashless payment has grown significantly.

Worldpay predicts that the situation will not change much by 2030.

The share of e-wallets in offline retail will rise, while debit and credit cards and cash will fall slightly.

"Today, cash circulation in Mexico is not only a legacy of the past, but also a status of the present. One factor is the Mexican cartels [criminal groups involved in drug trafficking, human trafficking, arms trafficking and robbery - Oninvest note], which have a vested interest in maintaining a large cash turnover in the country".

According to Myasnikov, the main competition among fintechs in Mexico is not in the conversion market or in money transfers, but around credit instruments, as access to finance among Mexicans is historically very low. "This is one of the reasons why Plata works specifically with loans," the expert explains.

In his view, Mexico now presents a "huge opportunity in the credit market," so the main intrigue is whether Revolut will lend.

The need for credit among Mexicans is great. According to the country's government, 54.3% of citizens work in the informal sector. They have "gray" or "black" income. For large banks, such people are usually unbankable - informal employment often becomes a formal reason for refusing a loan. This is why partnerships between fintech and e-commerce and the launch of buy now, pay later products have become growth points: it is a combination of mass demand and high margins, explains Chebotarev.

Such solutions allow citizens to bypass traditional barriers to accessing banking services.

However, there is a major danger in working with such clients - their solvency is difficult to assess, and fintechs may face mass non-payments when increasing the volume of installments and loans.

According to Myasnikov, neobanks and fintech projects in Mexico are more likely to create their own systems for assessing clients' solvency, as a rise in defaults of even 0.1% in their volumes can have a noticeable impact on the financial result.

"Most credit scoring in Mexico is based on residential address: if you have a rental agreement and a GPS location in Mexico City's upscale Polanco neighborhood, you probably have the money to pay back the loan. Other factors other than residence give a very low statistical result in predicting whether the borrower will pay back the loan"

In the latest Financial Stability Review, the Bank of Mexico writes that fintech delinquency as a share of total household delinquency reached 18% in Q1 2025, holding below 15% from 2021 to 2024.

The regulator estimated the total volume of non-performing loans of banks and regulated organizations as low for the first quarter, without giving absolute figures.

Battle after battle

Revolut and the Tinkoff alumni bankers have a long history of competition. Seven years ago, Revolut and Tinkoff almost became competitors on the Russian market. At that time, the British fintech startup announced a partnership with Qiwi Group, on whose banking infrastructure it planned to work.

The possible emergence of a new technology player excited many Russian bankers at the time. During a plenary discussion on Fintech as a Platform at the Finopolis Forum in 2018, Tinkov rebuked Storonsky, who was sitting on the same stage with him, that Revolut was making money on "commission arbitrage and regulatory arbitrage" instead of technological innovation.

"We welcome fintechs, we want to buy them and copy them. But just removing commissions is not rocket science. This is not the level for a graduate of phystech," he added. He was supported by Vladimir Verkhoshinsky, head of Alfa Bank, who said that Revolut should not hope for "rapid growth in Russia" and that the startup lacks the scale to compete with leading Russian banks.

Storonsky responded to opponents that Revolut could be more efficient than the big banks that have been copying his ideas as of late, due to highly automated processes and an unbloated top management team.

But already in 2021, in Tinkov's YouTube program "Business Secrets", Storonsky said that the Russian market was no longer a priority for Revolut: the startup abandoned its plans to launch in Russia without explaining why. "I agree with you. Competing with Tinkoff in Russia is empty," the banker commented on the decision. Revolut's partner in the failed project - Qiwi - had its license revoked by the Bank of Russia in 2024.

TCS Group (the parent structure of the holding company, which included Tinkoff) tried to indirectly compete with Revolut in the European market: in 2020, it invested €25 million in the fintech project Vivid Money, which was launched in Germany by Tinkoff employees Artem Yamanov and Alexander Emeshev.

Tinkov claimed on the Clubhouse social network that Vivid Money "is not our project, but we entered it with technology and money". In 2022, according to Tadviser, TCS fully exited the project. At the beginning of the same year, investors valued the company at $885 million. Oninvest sent an inquiry to Vivid Money.

This article was AI-translated and verified by a human editor