Berkshire falls after report and share write-down. Is Buffett's company worth believing in?

Berkshire's stake in Occidental Petroleum could be the next candidate for a write-down, Barron's suggested

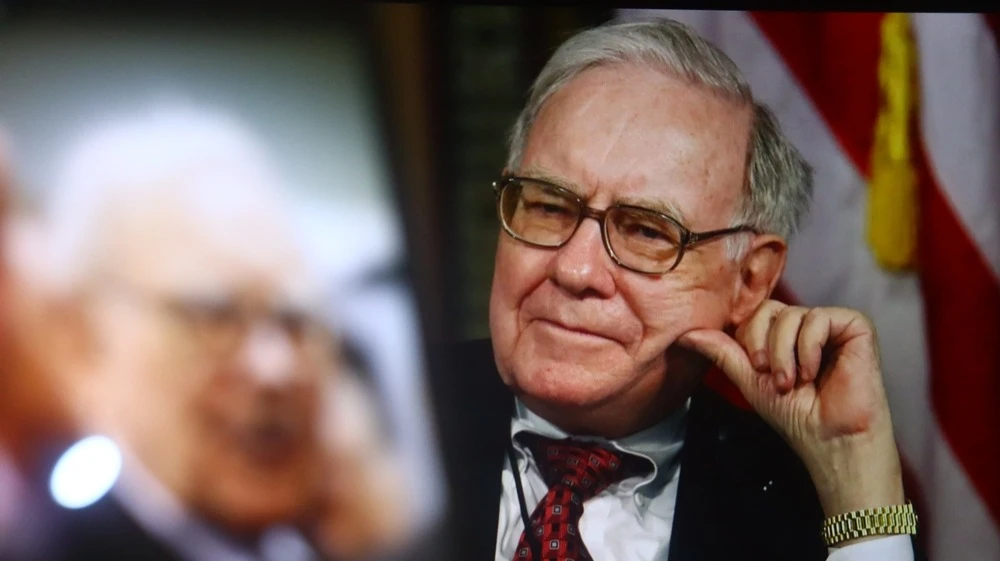

Investment company Berkshire Hathaway, which is headed by legendary investor Warren Buffett, received a target price increase from an analyst despite a not-so-great quarterly report. Berkshire reported a decline in profits and wrote off losses due to the impairment of shares of the producer of sauces Kraft Heinz. The market reacted by selling Berkshire securities: they lost about 3% of the value for the day. Increased investment activity, a large takeover or share buyback would help to raise the company's quotations, they say on Wall Street.

Details

Keefe Bruyette & Woods analyst Mayer Shields raised his target on Berkshire Hathaway's Class A shares from $735,000 to $740,000 after the quarterly report, reported CNBC. That's only 4% above the closing price on Friday, August 1 (the last time the analyst note was published).

Berkshire's current valuation "fully reflects the earnings potential and strength of the balance sheet in the face of macroeconomic uncertainty and the increasing risks associated with handing control [of the company to incoming CEO Greg Abel]," Shields said in a note quoted by CNBC. The leadership change process will have a greater impact on investors' perception of Berkshire than on its operations, the analyst added.

Abel will become CEO of Berkshire Hathaway only from January 1, 2026, and billionaire Warren Buffett remains head of the company until the end of 2025. But investors are already starting to exit the company's stock, confident of the extinction of the "Buffett premium". And Berkshire's latest quarterly report failed to change their minds: on Monday, August 4, Berkshire's Class A shares dropped 2.7% to $692,600. Class B shares lost 2.9% of their value.

"We believe Mr. Abel will gain investor confidence over time," CNBC quoted Edward Jones analyst Kyle Sanders as saying. - But in the short term, the drivers could have been increased investment activity, a large takeover or share buybacks. None of those things happened in the quarter, which we think is a little disappointing."

What else has upset the market

The company reported that second-quarter after-tax operating profit from Berkshire's wholly owned businesses fell 4% year over year to $11.16 billion, but if you exclude the effect of currency fluctuations due to Japanese yen-denominated debt, profit rose 8% to $12 billion, Barron's calculated.

In addition, despite Berkshire's stock dropping significantly from its May highs - by about 15% - the company has not bought back any of its own paper since May 2024 (as of July 21). This has disappointed investors who were expecting buybacks to begin due to falling stock prices, CNBC notes. It's a sign that Buffett still doesn't think the stock is cheap, Barron's emphasizes.

Berkshire also wrote down the $3.8 billion "paper" value of its stake in canned foods and sauces maker Kraft Heinz, the first such valuation reduction since Berkshire took an equity stake in the company, CNBC notes. However, Barron's didn't consider this impairment material: the company simply brought the book value of its stake in line with its market value of $8.4 billion, the publication noted. Since peaking at $62 a share in 2015, Kraft Heinz securities have more than halved in price, falling 2% to $26.8 on Monday.

"We expect a moderately negative reaction to the write-down on Kraft Heinz," UBS analyst Brian Meredith said in a note quoted by CNBC.

The write-down on Kraft Heinz may mean that Berkshire's stake in Occidental Petroleum will be the next candidate for revaluation, Barron's notes. The investment in Occidental is now reported on the company's balance sheet as $16.5 billion - about $4 billion above its market value, the publication writes. Berkshire owns more than 25% of the energy company.

Why analysts aren't upset by the drop in earnings

At the same time, analysts were pleased with the results of two key Berkshire assets: insurer Geico and railroad company BNSF (formerly Burlington Northern Santa Fe).

"Geico continues to grow and remains very profitable," noted Brian Meredith of UBS. - And BNSF exceeded our expectations with a strong operating margin of 35.2% versus an expected 33%, helped by low fuel prices. Transportation volumes were also higher than expected.

"Despite sluggish capital allocation activity, Berkshire's core businesses have delivered generally solid profitability - and well above what is commonly reported," wrote Semper Augustus Investments manager Chris Bloomstrand on Social Media X. He's keeping a close eye on Berkshire, Barron's explained.

Berkshire remains a seller of shares

The conglomerate still sells more shares than it buys: in the first half of 2025, it got rid of $4.5 billion worth of securities after selling more than $130 billion worth of assets in 2024. Then Berkshire, for example, cut its stake in Apple by about two-thirds, to 300 million shares, Barron's recalls. This is the eleventh consecutive quarter with a negative investment balance, CNBC notes.

Berkshire's cash on hand has remained near a record high of $344.1 billion (as of June 30). The amount of cash gives Berkshire enough liquidity for a potential cash deal to buy railroad operator CSX, Barron's notes.

This article was AI-translated and verified by a human editor