Billionaire Dalio invited traders to ask him questions. What are they most concerned about?

The questions and answers Dalio collected are going to be used to train his "AI clone"

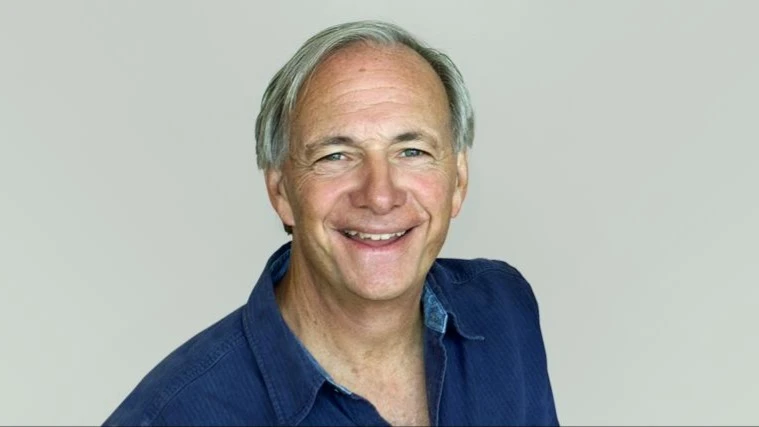

Ray Dalio, founder of Bridgewater Associates, the largest hedge fund by assets, invited investors to ask him questions about preserving and protecting capital amid geopolitical risks. The billionaire collected almost a thousand comments under his post. Investors were most interested in what assets are better to seek refuge in - gold or bitcoin, as well as the best way to invest in precious metal - directly in bullion or through ETFs.

Details

Ray Dalio invited investors in a post on social network X to ask him questions about capital preservation tools in the context of changing geopolitical conditions. "If you have questions for me, ask them in the comments - I'll try to answer them here," the billionaire wrote, specifying that he will use the questions and answers to them to train his AI clone.

Dalio did not specify when exactly he will start answering questions, but X users actively responded: at the time of publishing this news Dalio's post has already collected almost a thousand comments.

What Dalio was asked about.

Most users were interested in gold and the state of the US economy. The comment with the highest number of likes was a question from journalist Natalie Brannell, one of the most prominent figures in the US bitcoin community. She asked the billionaire's opinion on the current financial situation, the changing world order, the U.S. national debt and the so-called "hard money" - bitcoin or gold.

The most frequently asked questions about gold were whether it is better to invest in physical gold or in precious metal-related exchange-traded funds (ETFs). In addition, investors are worried about a gold bubble in the market given the rapid appreciation of the precious metal: they want to understand at what price it will no longer make sense to buy it. Some also asked Dalio's opinion on silver and copper as alternative means of capital preservation.

The founder of Bridgewater also received a lot of questions about the first largest cryptocurrency in the world - bitcoin. Users wondered whether the "hybrid era of gold and bitcoin" had arrived and which of these two assets is still better to invest in.

What Dalio thinks about gold.

Dalio has long been a proponent of investing in gold as a hedge against the risks associated with depreciating assets like government bonds and fiat currencies. In the same X post, he wrote, "I've been explaining for some time now my view of gold (I love it) and debt assets (I don't love them) as capital preservation tools in the context of a changing world order." He said the precious metal has now become even "hotter" than stocks of artificial intelligence-related companies. "And it's increasingly recognized that it may even be a better value preservation vehicle than tech stocks," Dalio added.

In the summer, the billionaire said that against the background of the growing U.S. national debt and the risks associated with it, about 15% of the investment portfolio should be allocated to gold or bitcoin. The billionaire noted that he himself prefers gold, but admitted that bitcoin could act as "alternative money," especially against the backdrop of declining confidence in fiat currencies.

In October, Dalio warned of the risks posed by the skyrocketing U.S. national debt: it is creating an environment "very similar" to the years before World War II, according to the Bridgewater founder. In his view, a "civil war of a certain kind" is brewing because of "irreconcilable differences" in the US and other parts of the world.

What's up with gold prices

In trading on October 16, spot gold prices rose more than 1% to $4262. The precious metal has risen in price by almost 60% in 2025, setting 21 new all-time highs over the past 63 trading days, Barron's calculated. By comparison, the S&P 500 is up about 13% over the same period, while the "Magnificent Seven" leader, AI chipmaker Nvidia, has added about 34%.

This article was AI-translated and verified by a human editor