Chair of small cap IonQ challenges Nvidia CEO on quantum computing; IonQ soars

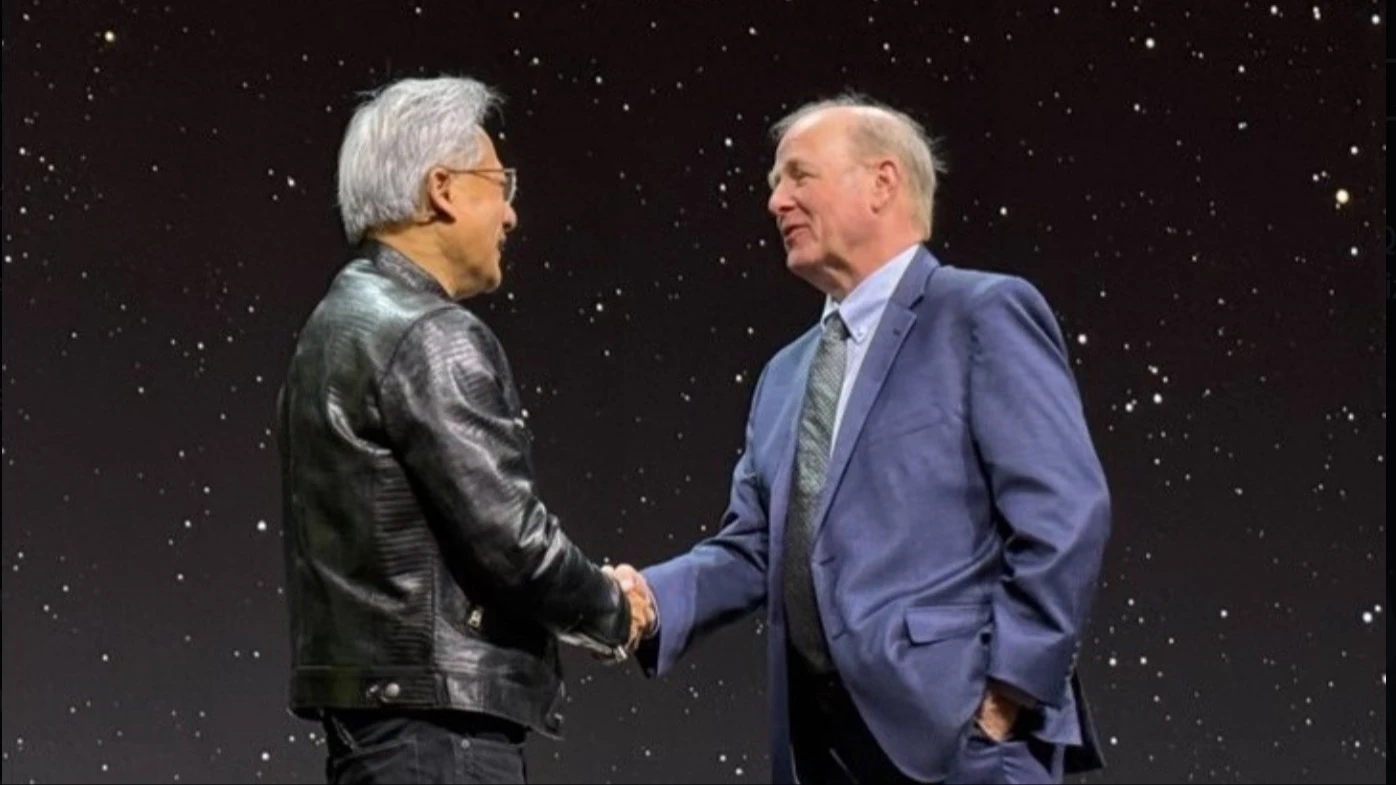

IonQ chair Peter Chapman (right) and Nvidia CEO Jensen Huang (left) shake hands. In January, Huang’s comment about the future of quantum technologies caused IonQ to lose almost 40% of market value in a single day. / Photo: X/IonQ

Peter Chapman, chair of the board at IonQ, a small-cap quantum computing hardware and software company, challenged Jensen Huang, the CEO of IT giant Nvidia, on the outlook for quantum technologies. This sent IonQ stock soaring almost 23% over two sessions.

Details

In an interview with Bloomberg Technology on March 20, Chapman claimed that quantum technology is just a few years away from making a breakthrough in the market. The next day, speaking to Investor’s Business Daily, he speculated that the quantum sector would experience a “ChatGPT moment” — a sudden boom similar to the AI hype that followed the launch of OpenAI’s ChatGPT. However, he added that it's not worth spending too much time trying to convince people that “quantum is coming.”

“If I was [OpenAI CEO] Sam Altman five years ago, would I have spent even any energy trying to convince the world that AI is coming?” Chapman said. “You could have had Sam Altman buck naked on a corner street in San Francisco with a sandwich board saying AI is coming, and no one would have listened.”

Chapman’s remarks served as a rebuttal to Nvidia CEO Huang, who said in January that it could take 15-30 years for quantum technologies to become commercially viable. This triggered a massive selloff in quantum-computing stocks: On January 8, IonQ tumbled 39%, D-Wave Quantum more than 36%, Quantum Computing over 43%, and Rigetti Computing more than 45%.

On March 20, at Nvidia’s annual developer conference, Huang led a panel discussion featuring leaders of quantum computing companies, including Chapman, and admitted he had been wrong.

“My first reaction was, ‘I didn’t know they were public! How could a quantum computer company be public?’” Huang said.

He explained that his reaction stemmed from his own experience building computing platforms — Nvidia took more than 20 years to develop its hardware and software business. He also noted that the quantum computing industry suffers from being poorly positioned, as quantum machines are evaluated by traditional computing standards despite serving a different purpose. “I think there is an unnecessary expectation, and it actually sets the industry back, frankly, an unnecessary expectation that somehow these forms of computers are going to be better at spreadsheets,” he said.

Market reaction

Chapman’s optimistic remarks boosted IonQ stock, as reported by the Motley Fool, an investment advisory service. Over two trading sessions (on Friday, March 21, and yesterday, March 24), the stock soared 22.64%, while the S&P 500 and the Nasdaq Composite gained 1.84% and 2.79%, respectively. Yesterday, IonQ closed at $26.12 per share before slipping more than 1% in premarket trading today.

Other quantum computing stocks also rallied yesterday: D-Wave Quantum climbed 4.31%, Quantum Computing jumped 18.40%, and Rigetti Computing gained 7.83%.

The Motley Fool notes that while IonQ and other quantum computing companies are developing what could be a revolutionary technology, it is still in its early stages, and it may take much longer for quantum computing to reach commercial viability.