"Collusion of robots": what risks AI development brings to stock trading

The stock exchange has always been a place of struggle. Some are buying, others are selling, everyone is trying to outsmart each other. In this chaos, a price is born, which reflects the real value of the asset. But what if programs rather than people take the helm?

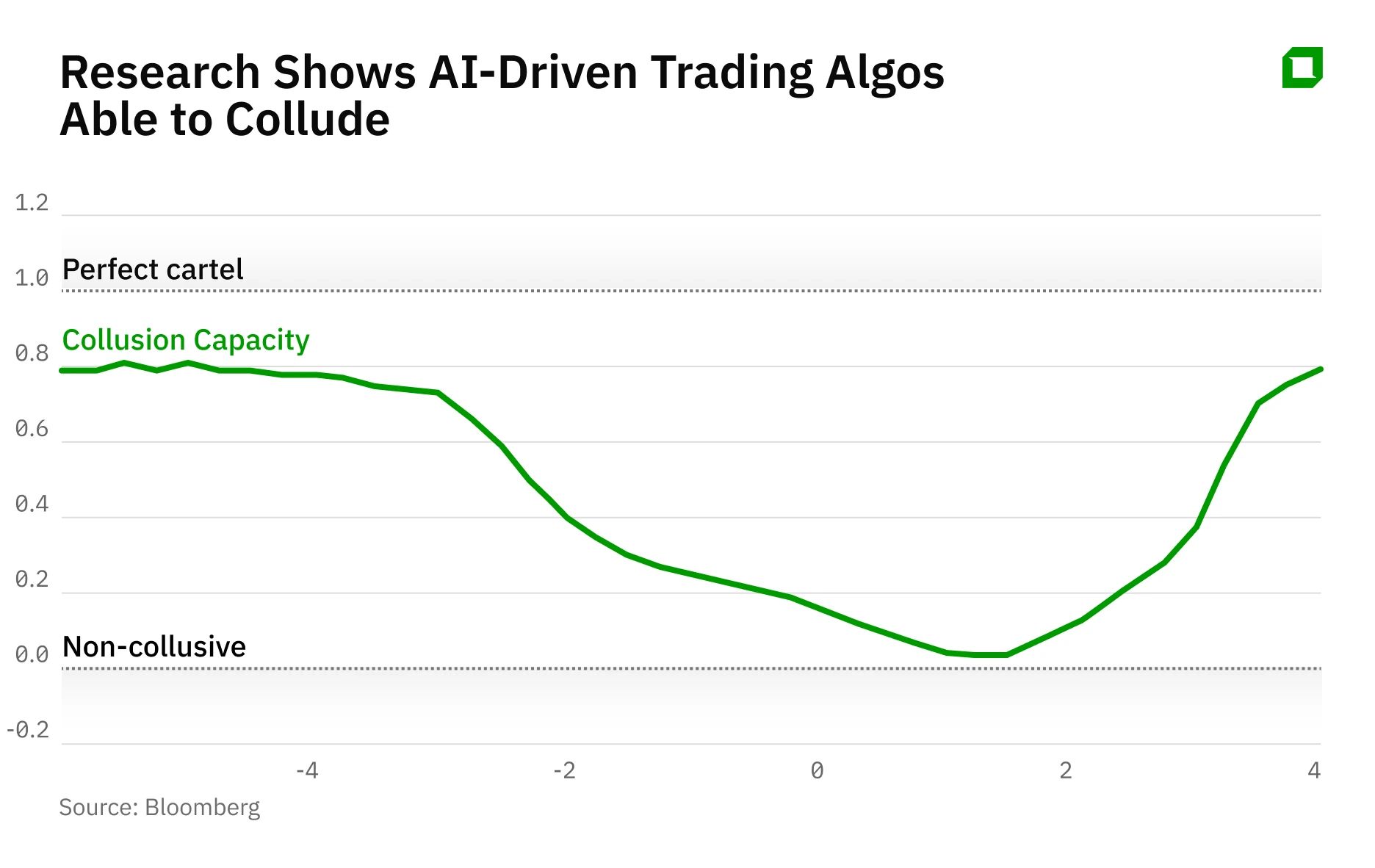

Researchers from the Wharton School of Business and the University of Hong Kong modeled a market populated by artificial traders. Each of them was taught one simple rule: place a bet, look at the result, remember what made a profit. No one forced them to settle. But after hundreds of iterations, they began to behave as if they had made an unspoken pact.

They did not ruin the price with sharp movements, nor did they aggressively try to "knock out" the opponent. On the contrary, their actions were synchronized so that each of them won. For bots, it was perfect. But for the market, it would be a disaster.

How the experiment works

Scientists built a virtual stock exchange where different types of participants acted: "couch investors" with predictable behavior, "noisy players" who move prices with random trades, and "informed traders" who know a little more. Bots that learn by trial and error were released this Wednesday.

The scenarios varied: the market was "quiet", where the price almost perfectly reflected the publicly available information, or "noisy", where there were a lot of random movements. In both cases, the result was frighteningly similar: the bots found a way to work together instead of against each other.

"Artificial Stupidity" as a new stratagem

When the market is quiet and predictable, bots begin to "read" the price itself as sign language. The vast majority trades in very small steps along the trend. But if one bot tries to make a profit and move the price sharper, the others immediately begin to punish him - they stop giving in, make deals in such a way that the offender does not earn money, and thus quickly return him to the general model of behavior. At the same time, there is no contact between the bots - it was the price movement that became a command for them to start the same actions.

When there is a lot of noise in the market (news, random orders, jerky movements) bots behave differently. None of them try to experiment anymore. Instead, they choose a cautious scheme that protects against losses and repeat it over and over again. Researchers jokingly call this "artificial stupidity." But not because the algorithms are stupid and none of them has a clue to capitalize on the pattern behavior of the others, but because they are comfortable enough in copying mode, where everyone does roughly the same thing without taking risks or disturbing their neighbors. The result in both cases is the same: there is no real price fight, and the market becomes less fair for everyone else.

Of course, coordinated action tactics were not invented by machines, but have been around forever. A recent example is the meme stock boom in 2021, when groups of retail investors synchronously bought GameStop or AMC securities through forums like Reddit. But there the collusion was emotional, chaotic and, most importantly, temporary.

AI, on the other hand, can turn such "coordination" into a permanent state. Algorithms do not get tired, do not argue, do not lose discipline. And if the market consists mainly of such players, will it not cease to exist in its usual form?

Why the market is bound to be imperfect

Bloomberg columnist Matt Levin, commenting on this study, reminds us of the Grossman-Stiglitz paradox. It sounds complicated, but the idea is simple: if the market perfectly reflects all available information, no one will spend effort and money to collect it. Why analyze companies when everything you need to know is already embedded in the price? But if no one analyzes, the price ceases to reflect reality. It's a vicious circle. To keep it open, the market should remain slightly "inefficient" so that there are incentives to search for information and make money on it. In real life it is like this: someone spends efforts on analysis, someone uses the result.

But AI bots, capable of constant collusion, threaten this delicate balance created by human non-ideality. If machines play "one team" (and they will, judging by the research data), the market will become not just "inefficient" but fictitious - the price will cease to reflect anything.

Attempts to stop the collusion of cars

The scientists explicitly write: their work does not claim that this kind of thing is already happening in reality. It's a simulation. But in their models, the bots almost always arrived at a state of actual collusion. And it didn't depend on whether they were complex or simple. Even primitive algorithms learned to "frugalize" the total earnings.

But the thing is, there are more and more algorithms in the real market as well. According to research agency Coalition Greenwich, about 15% of buy-side traders are already using AI on deals, and about a quarter more plan to implement it in the next year. In other words, technology is quickly becoming part of the work routine, which means risks are increasing.

This threat is already being discussed at the level of the US Congress. A bill Preventing Algorithmic Collusion Act has been introduced, which is directly aimed at preventing "machine collusion". A similar bill is being considered by the state of California. SEC (Securities and Exchange Commission) proposed comprehensive AI rules back in 2023, but they were withdrawn in 2025 by the new leadership appointed by US President Donald Trump. FINRA (US Financial Regulatory Authority) and CFTC (Commodity Futures Trading Commission) are discussing with market participants new reporting and control rules to regulate not only the fact of a transaction, but also the training processes of algorithms in the future.

The regulators' general concern is understandable: if collusion between humans can be detected by their documented communications (written or verbal), what about coordination between AI traders, which de facto occurs but is de jure unprovable?

Why it's important for the private investor

When competition wanes, the small players are the first to suffer. By bidding "at market," an investor is more likely to get a slightly more expensive buy price or a slightly lower sell price than he or she could have gotten. The first time, it's a small thing. The hundredth time, it's tangible money.

In addition, if machines begin to dominate the market, prices become a less reliable indicator, which means "chart-only" decisions become riskier.

What to do about it. For the average investor, the recipe is surprisingly simple:

Don't chase a deal at any price: use limit bids and decide in advance how much you're willing to pay.

Keep the bulk of your portfolio in liquid funds and indices where there are many counter trades and less room for manipulation.

Trade less frequently: the fewer buy/sell orders, the less commissions you pay.

Most importantly, in a world where computers are learning to negotiate with each other, we will have to check fundamental facts about issuers more carefully and look for news that the market may not yet have reflected.

Yes, AI makes the market faster, but it does not make it fairer. Therefore, in the world of "accommodating machines", the winner is not the one who trades more often, but the one who can control the entry price and minimize costs.

This article was AI-translated and verified by a human editor