Dalio is concerned about U.S. government debt. Which assets does he advise to allocate 15% of the portfolio to?

The U.S. national debt has reached 125% of GDP. Dalio compares the situation to the 1970s

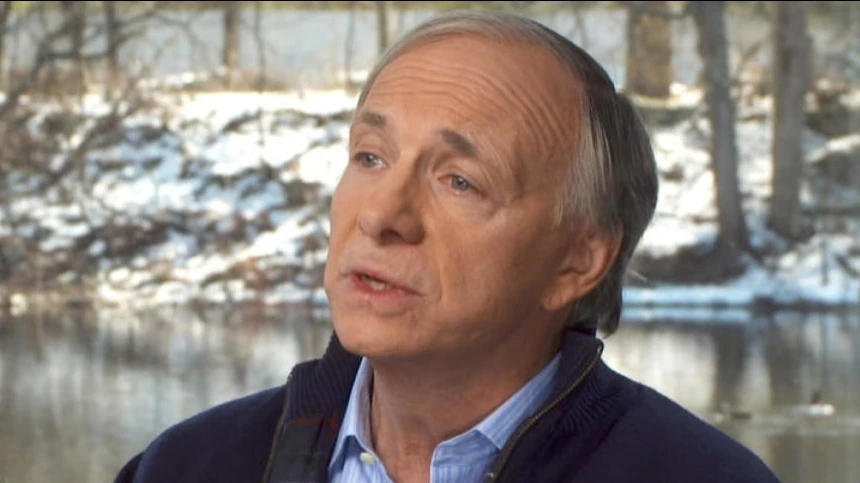

Ray Dalio, founder of Bridgewater Associates, the largest hedge fund by assets, warned investors against underestimating the risks associated with the growing US government debt. He advises to allocate up to 15% of the portfolio to protective assets - gold or bitcoin;

Details

In a recent episode of the Master Investor podcast, Dalio said that in the face of a devalued dollar, investors should strengthen the defensive block in their portfolios.

"If you want to optimize the return per unit of risk and still remain neutral to all assets, it's reasonable to hold about 15% in gold or bitcoin," he said (quote by Business Insider).

Although the billionaire himself prefers gold, he recognized that bitcoin could act as "alternative money," especially against the backdrop of declining confidence in fiat currencies. He also emphasized that similar macroeconomic conditions were already seen in the 1930s and 1970s, when investors sought protection in hard assets.

Both gold and bitcoin are feeling confident: they have added about 25% since the beginning of the year, while the U.S. broad stock market index S&P 500 is up only 8%. John Hare, manager of financial services company Swan Bitcoin, predicts bitcoin could reach $200,000 as early as this year, notes Fortune.

Context

In 2022, Dalio recommended investing no more than 1-2% of a portfolio in bitcoin, but has now reconsidered the stance, writes the Cointribune. The reason is growing fears of a "debt loop": over the next year, the U.S. Treasury Department may float $12 trillion in new bonds to service a national debt that has reached $36.7 trillion.

According to the latest Treasury Department report, the U.S. plans to borrow $1 trillion in the third quarter, up $453 billion from previous forecasts. In the fourth quarter, another $590 billion.

Dalio believes that the situation is approaching a "financial infarction" and that such borrowing levels are not yet embedded in quotations in the currency and debt markets.

As finance professor Stephen Shipe of Wake Forest University explains, "When investors lose faith in the government's ability to control the deficit and service the debt, rates rise and the price of previously issued bonds falls. They cease to be a reliable safe haven" (quote by Fortune).

This article was AI-translated and verified by a human editor