Digital infra investor DigitalBridge soars on potential SoftBank takeover deal

Shares of DigitalBridge, a mid-cap digital infrastructure firm investing across data centers, cell towers, fiber networks, small cells, and edge infrastructure, soared more than 45% on Friday, December 5. The company’s market capitalization thus exceeded $2.75 billion. This followed reports from Bloomberg and Reuters that SoftBank is in talks to buy DigitalBridge. Wall Street analysts believe that even after Friday’s surge, its shares still have more than 26% upside.

Details

DigitalBridge shares jumped more than 45% to $14.12 per share on the New York Stock Exchange on Friday. This was the largest one-day increase in the company’s history, Bloomberg notes. Trading volume reached 55.9 million shares, almost 13.5 times the average daily figure, according to Yahoo Finance data.

SoftBank is in talks to acquire DigitalBridge, a source familiar with the matter told Reuters on Friday. A deal could be reached by the end of the year, the source said. That said, Bloomberg's sources caution that the deliberations are ongoing and there’s no certainty they will lead to an agreement.

DigitalBridge and SoftBank declined to comment.

About DigitalBridge

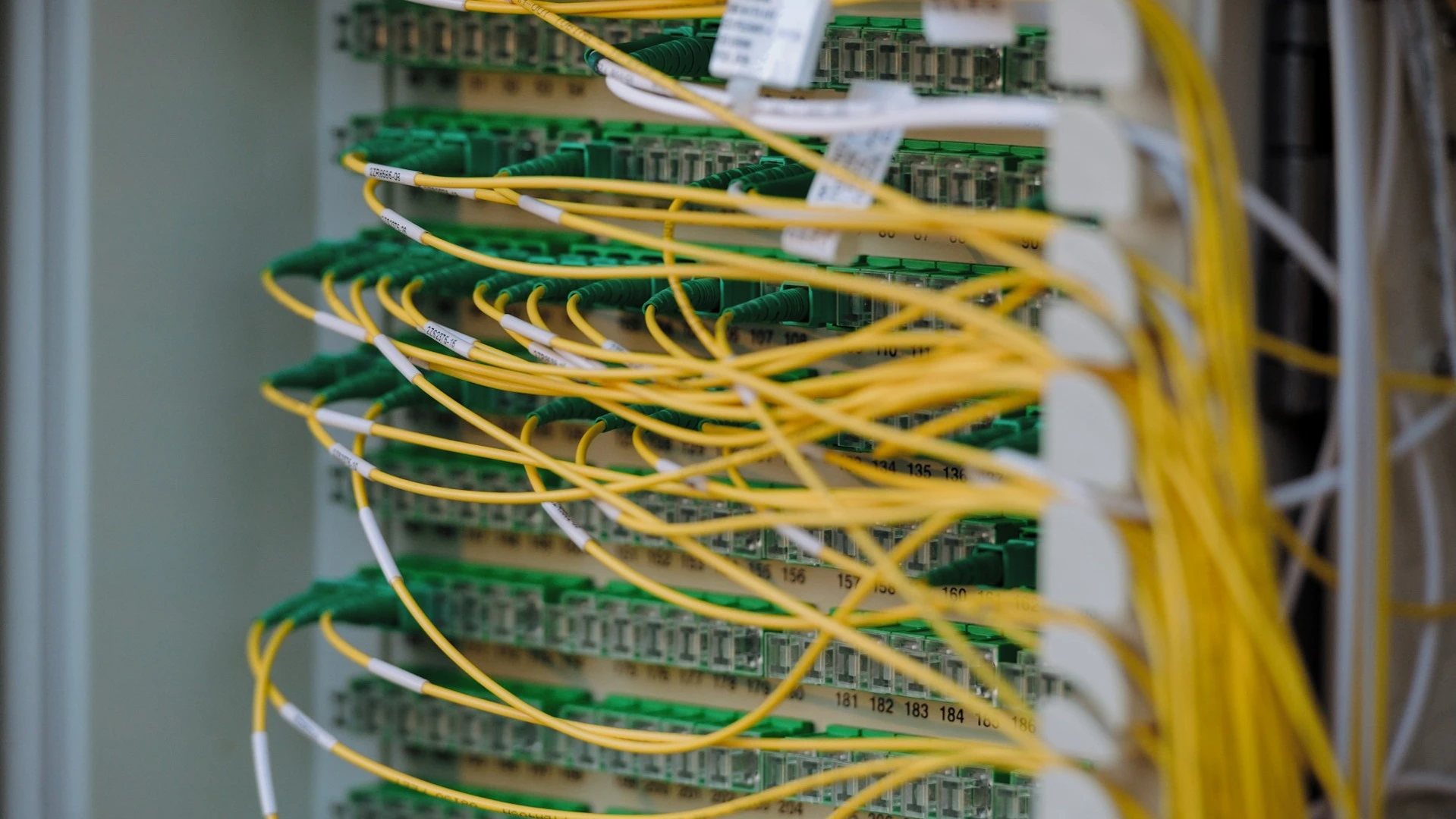

DigitalBridge invests in digital infrastructure: data centers, cell towers, fiber networks, small cells, and edge infrastructure, which represent low-power nodes that sit between major towers to improve network coverage.

It had about $108 billion in assets under management at the end of September, with Switch, DataBank, and Yondr Group among its data-center holdings, the company said in its third-quarter-earnings presentation.

SoftBank, for its part, seeks to tap the firm's AI-linked portfolio amid surging demand for the computing capacity underpinning AI applications. The Japanese conglomerate, together with OpenAI, Oracle, and Abu Dhabi’s MGX, is part of a $500 billion project called Stargate to build data centers in the U.S.

In an October 30 research note quoted by Bloomberg, Raymond James analyst Ric Prentiss wrote that it makes sense for a larger alternative asset manager that has scale and fundraising infrastructure to buy DigitalBridge rather than it remain standalone. "We feel DigitalBridge would consider selling, but only at the right (and much higher than current levels) cash price and terms," Prentiss wrote.

McKinsey projects spending on AI-linked infrastructure could reach $6.7 trillion by 2030, Reuters notes. Investors have already funneled record capital into digital infrastructure this year, betting that rising power demand will turn data centers into lucrative real estate.

Stock performance

Since the beginning of the year, DigitalBridge shares have risen 25%. Wall Street sees further upside, according to MarketWatch data. The consensus target price for the shares, based on the views of nine analysts, is $17.73 per share, 26.4% above the closing price on December 5. Eight of the analysts rate DigitalBridge a "buy," while the other analyst has a "hold."