Over the past three years, the classic 60/40 portfolio concept has proven to be very disappointing - the gold standard of 60% invested in stocks and 40% in bonds has proven to be unprofitable. There is no universal answer to what to do, but there are benchmarks that allow you to check your allocation against the way the world's capital is structured. For example, The World Portfolio, a new research project by Goldman Sachs, which for the first time analyzes the entire "world portfolio" - from stocks and bonds to gold and cryptocurrencies.

Global Portfolio from Goldman Sachs

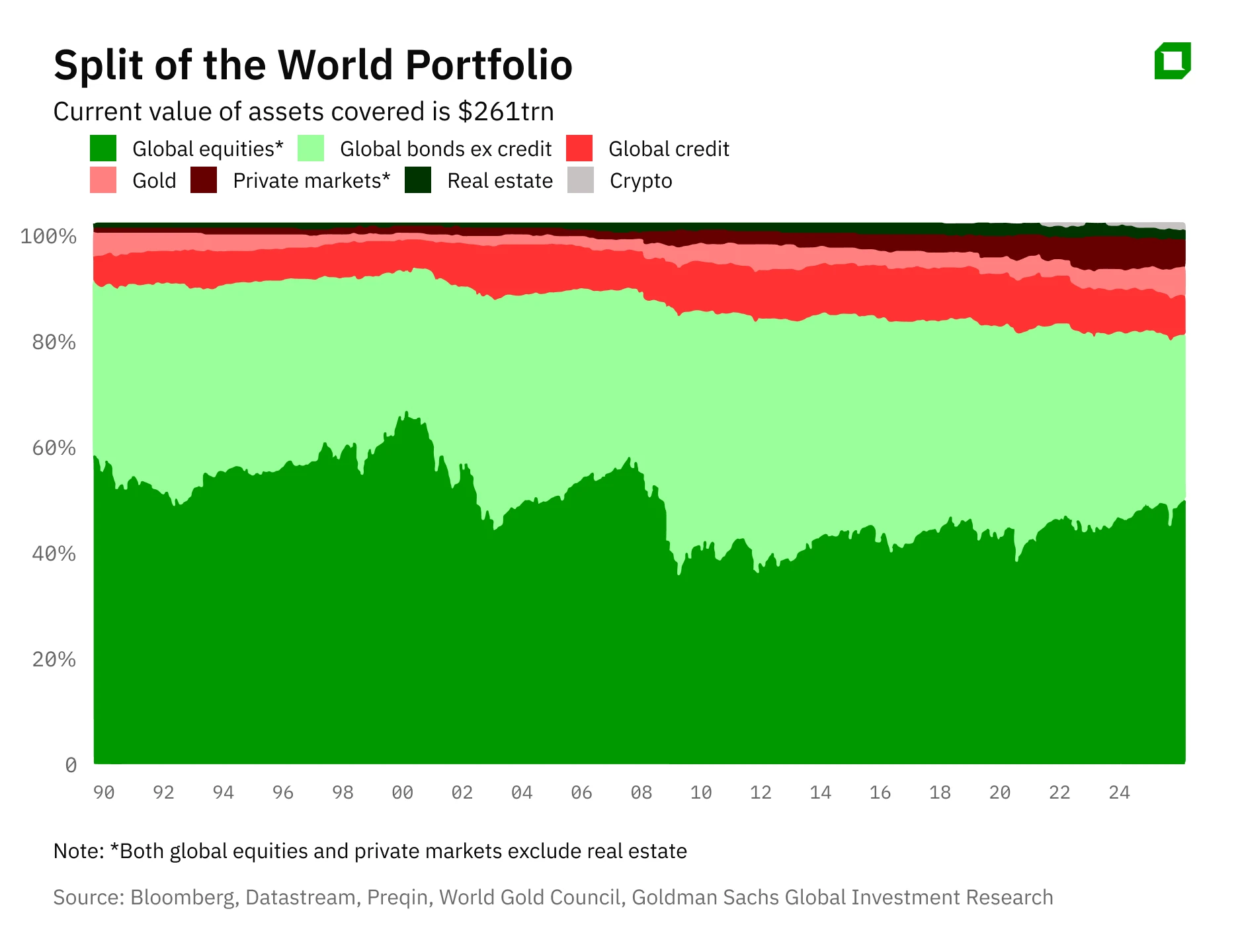

The authors of the report collected data on how the capitalization of each asset class has changed since 1950. Goldman Sachs' global investment portfolio is currently valued at $261 trillion, which is essentially a map of global capital. It shows how equities have gradually grown in popularity since the middle of the 20th century, how gold's share soared in the 70s, how in the 80s and 90s equities began to supplant everything else, and how the role of new "participants" - real estate, cryptocurrencies, and a whole range of non-public investments, including venture capital, private equity, and private credit - has grown in the structure of global assets over the past decade.

This view is much broader than the usual 60/40 portfolio argument. For it shows not how an investor should allocate assets, but how humanity has already done it. And in this sense, The World Portfolio becomes not a theory, but an empirical benchmark - a mirror of how the world's capital allocation really works.

In search of the investment Grail

Perhaps for the first time the principle of forming an investment portfolio was formulated in the Talmud: one third in real estate, one third in commodities - working capital - and the remaining third in liquid assets, wrote in the Financial Times former New York investment banker and former head of the investment committee of the Chilean sovereign wealth fund Arturo Sifuentis.But it was mathematically substantiated by Harry Markowitz, the creator of modern portfolio theory and Nobel Prize winner in economics, who in the early 1950s showed that the combination of assets with different volatility and different returns allows you to get high returns without taking too much risk. Later, the American investment industry translated this academic thought into practical language: "put in a basket of stocks - they are responsible for growth - and bonds, which will serve as protection. In the 1980s and 1990s, against the backdrop of falling interest rates and a rising U.S. stock market, the simple 60/40 ratio became a convenient standard for both pension plans and balanced funds - it provided high real returns with moderate drawdowns and therefore quickly became the norm.

But this standard was held to two things that we can no longer consider permanent today: the long trend of declining bond yields and the fact that bonds almost always behaved opposite to equities in a crisis. In 2022, both pillars broke: an inflationary shock hit two asset classes at once. Investors, for the first time in many decades, saw double-digit real declines in the value of a "balanced" portfolio. This is where the "isn't 60/40 dead?" conversation started.

The boomer formula for quiet times

The CFA Institute, a global non-profit association of investment professionals, detailed the crisis of the 60/40 concept in its study on the actual returns of blended portfolios: diversification between equities and debt is no longer free when one macro factor hits both asset classes at the same time.

The study also notes that the 60/40 scheme works well in calm times. So boomers, who were not hit by the worst of the markets due to the world wars and the Great Depression, have enjoyed explosive stock gains as a result of the recovery. From 1950 to the present, the average real return on stocks for them has been 6.7% per year, with a 60/40 portfolio yielding an average of 5.6% per year. Generation X and Millennials did not have the postwar boom, but they did experience the dot-com bubble, the Great Recession, and the COVID-19 pandemic, for whom long-term stock returns were 5.2% and 4.2%, respectively

60/40 is dead. Long live 60/40!

At the same time, large managers do not bury 60/40. For example, Vanguard believes that after the recent failure this concept has a greater margin of stability, because coupons are now higher and the real expected yield of the portfolio has become more attractive. BlackRock formulates softer: it makes sense to keep 60/40 as a basis for portfolio formation, but it should be supplemented with alternatives - commodities, infrastructure, private assets. All this should now also be added to the portfolio to increase its ability to survive inflationary and political shocks without significant losses. Resonanz Capital takes a much tougher stance: in a world where both fiscal deficits, geopolitical tensions and inflation are moving in one direction - towards expansion - it is no longer possible to rely on two differently behaving "legs". A broader basket of benchmarks is needed.

That is, the consensus now is that 60/40 has not disappeared, but has lost the right to be called the only "right" portfolio.

Real benchmark

And here we come back to the work of Goldman Sachs: if the whole world has distributed capital not only in stocks and bonds, but also in gold, real estate, private markets and even crypto, then we should focus on the real map of global capital, not on the norm from old textbooks. Morningstar went even further, and based on the Goldman Sachs study, gave some simple recommendations for private investors: don't get carried away with focusing only on the U.S. market, don't neglect bonds, be cautious about alternatives, and check your own portfolio more often with how it looks to the world as a whole.

This article was AI-translated and verified by a human editor