Ethos IPO: US insurance marketplace goes public

The company listed on the Nasdaq under the ticker symbol LIFE

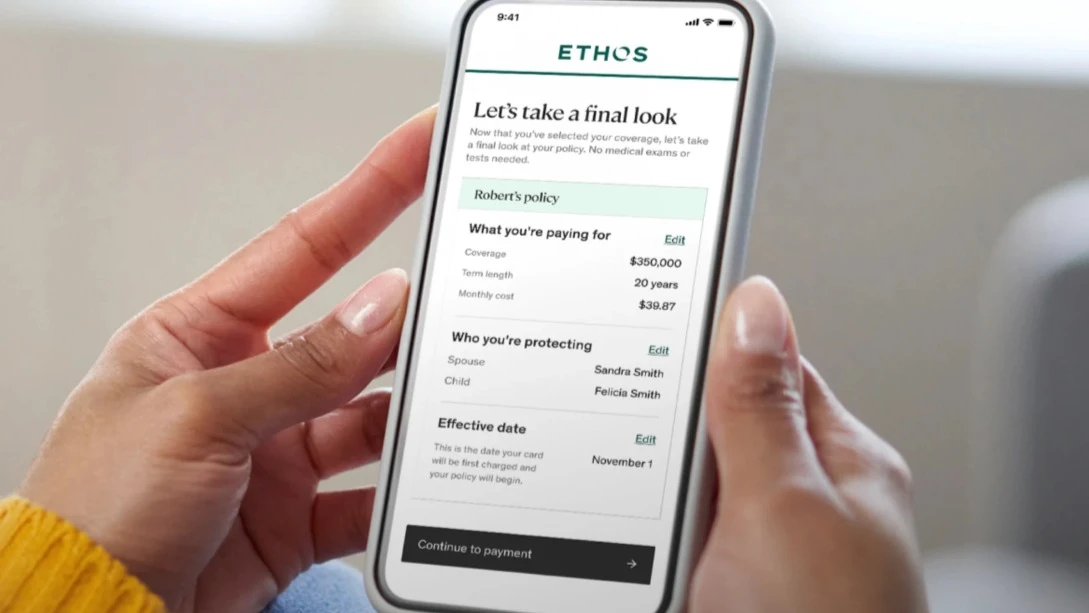

Preliminary trading in shares of Ethos Technologies Corp, a technology company in the life insurance segment, has begun on the Freedom customer trading system / Photo: Ethos

Preliminary trading in shares of Ethos Technologies Corp, a technology company in the life insurance segment, has begun on the Freedom customer trading system. The company develops digital solutions and operates an online platform for buying and selling insurance policies that simplifies the application process for consumers and agents and replaces traditional paper-based procedures. Ethos securities will appear on the Nasdaq exchange under the ticker symbol LIFE later on Jan. 29. To participate, click on the LIFE ticker.

Details

Ethos Technologies has successfully raised $200 million in an IPO. The company placed 10.5 million shares at $19 per paper - this valuation is in the middle of the previously announced price range ($18-20). Based on the results of the IPO, the value of the entire company can be estimated at $1.2 billion, Reuters writes.

The deal was organized by Goldman Sachs, JPMorgan, BofA Securities, Citigroup, Deutsche Bank Securities, Citizens, William Blair and Baird.

Over the years, Ethos has received support from major venture capitalists, including Sequoia Capital, Accel, GV - the venture capital arm of Alphabet, SoftBank and General Catalyst. Some of them will sell shares in the company as part of the IPO, while others, in particular Sequoia and Accel, retain their stakes, Tech Funding News reports .

Before the IPO, in 2021, Ethos was valued at $2.7 billion, a valuation the company received as part of an investment round led by SoftBank Vision Fund 2. The total amount of investments raised by that time amounted to $400 million, TechCrunch reports . After that, the company attracted funding only in limited amounts, follows from the PitchBook data cited by TechCrunch.

What the company is notable for

Based in San Francisco, California, Ethos was founded in 2016 by Peter Kolis and Linke Wang. The company offers life insurance for U.S. citizens throughout the United States, with the exception of New York State. Ethos develops digital solutions to sell policies on its online platform, while earning a commission on each contract signed. It works with insurance partners to automate policy distribution, underwriting, payment and administration processes through technology, replacing traditional paper-based procedures, Tech Funding News points out.

Ethos' platform focuses on speed and convenience, allowing customers to take out life insurance without lengthy procedures and voluminous questionnaires, according to the company's website. This technological approach has helped Ethos expand its customer base and attract long-term investor interest, Tech Funding News notes. According to Ethos' website, it's possible to sign up for insurance in as little as 10 minutes - without having to undergo a medical exam. By September 2025, Seeking Alpha points out, Ethos has issued more than 450,000 active life and term insurance policies in the United States. At the same time, the company does not assume the balance sheet risks of the insurance policies, it receives only a commission for bringing the parties together and processing applications.

In general, Ethos targets three types of marketers: consumers, insurance companies and agents, using a multi-channel approach that includes direct-to-consumer sales, working with agents and fintech companies, Seeking Alpha explains.

For the nine months ended Sept. 30 last year, the company posted net income of $46.6 million on revenue of $277.5 million - compared to earnings of $39.3 million and revenue of $188.4 million a year earlier, the company said in a prospectus it filed with the Securities and Exchange Commission in the United States. According to the IPO documents, profitable Ethos has remained profitable for years, TechCrunch notes.

What the market is saying

The Ethos IPO follows a number of other U.S. insurance company listings, including Neptune Insurance, Slide Insurance and Aspen Insurance, which have gone public in recent months, Bloomberg notes.

Ethos is experiencing rapid and profitable growth, strong revenue and gross margin momentum, and has recently turned positive operating cash flow, says Donovan Jones, an analyst at investment firm IPO Edge (quoted in Seeking Alpha). Among Ethos' "strengths" he cites its "digital and vertically integrated three-party platform, as well as its multi-channel approach to the market." The company's key risks include - high concentration of revenue to a limited number of insurance companies and agencies, and a two-class share structure that limits the voting rights of public investors, Seeking Alpha writes.

Context

Ethos was considered one of the fastest-growing startups of its time and actively attracted large investment rounds until 2021, TechCrunch writes. Early on, the company was backed by the family offices of well-known public figures, including actors Will Smith, Robert Downey - Jr. as well as basketball player Kevin Durant and rapper Jay-Z, the publication reported in 2018.

_______________________

Freedom clients will be able to get access to shares of Ethos Technologies Corp before the opening of the main exchange session. Trading will begin in the early pre-market format 2-3 hours before the opening of the U.S. exchanges (from 15:30-16:30 Astana time). To participate, click on the ticker LIFE.

This article was AI-translated and verified by a human editor