Freedom: D-Wave offers 40% upside on two-month horizon amid U.S. government support

Shares of quantum computing company D-Wave could rise about 40% over the next two months, Freedom Broker argues in a short-term trade idea seen by Oninvest. A potential increase in U.S. government involvement in the sector is seen as the key growth driver. At the same time, concrete details remain limited, as “sector shares are capable of reacting sharply even to rumors,” and market dynamics “largely determined by sentiment,” Freedom wrote. Year to date, D-Wave shares have about doubled, yet Wall Street believes the rally is not over.

Details

Shares of D-Wave Quantum, a developer of quantum computing systems, could climb to $33.36 apiece within the next two months, Freedom Broker estimates. Versus a close of $23.80 per share on Wednesday, December 17, that implies two-month upside of about 39%.

Freedom has set a short-term "buy" with a recommended stop-loss level of $20.29 per share.

Freedom's rationale

Freedom said the key driver of D-Wave’s share-price gains in the coming months should be expanding U.S. government support for the quantum industry. In early November, the U.S. Department of Energy announced $625 million in funding for the next phase of five national quantum research centers. Shortly before that, the Wall Street Journal reported, citing sources, the White House was discussing the acquisition of equity stakes in several quantum companies in exchange for federal funding.

Although talks about direct government investments in quantum companies remain at the discussion stage, the sector’s shares are capable of reacting sharply even to rumors and isolated signals, Freedom argues. That was evident in October, when reports of U.S. government interest triggered a surge in quantum stocks.

Against this backdrop, D-Wave set up a dedicated unit in early December support D-Wave’s enterprise-wide U.S. government-related initiatives and “the call to use quantum technologies to address our nation’s interests.” U.S. Under Secretary of Defense (War) for Research and Engineering Emil Michael has described quantum technologies as "imperatives" so that "the American warfighter will wield the most advanced technology to maximize lethality."

At the same time, Freedom warned of the elevated risks of investing in quantum stocks: in particular, future demand for quantum computing remains difficult to assess using traditional metrics, leaving share-price movements largely driven by sentiment.

What other analysts say

This week, D-Wave was initiated on by two Wall Street firms.

On Wednesday, Wedbush initiated coverage with a “buy” recommendation and set a 12-month target price of $35, implying upside of about 47% from the most recent close. The firm issued similar recommendations for D-Wave competitors IonQ and Rigetti, while advising investors to hold shares of Quantum Computing. “Quantum computing remains in its nascent stages, but we view it as a transformational technology with significant long-term potential which we believe will ultimately represent the next frontier of computing,” Wedbush analyst Antoine Legault said in a note.

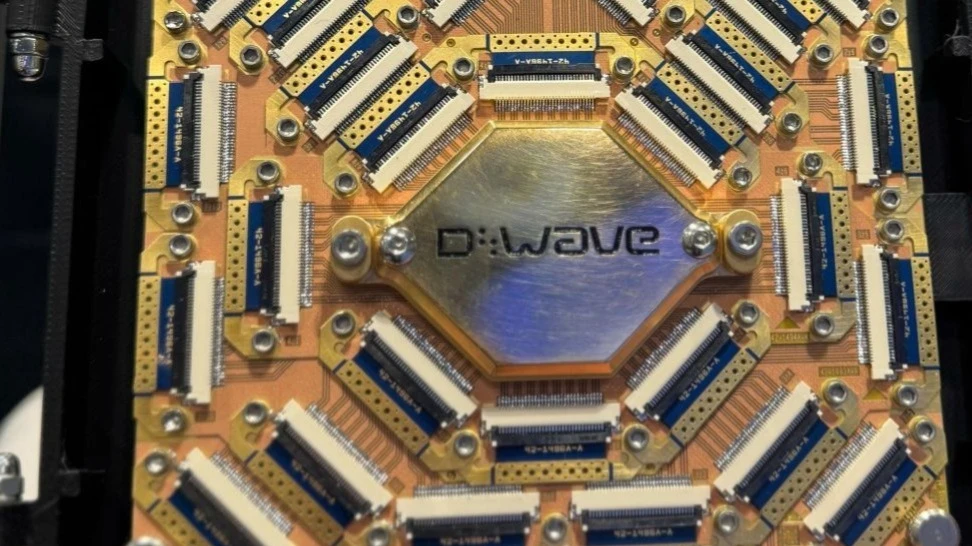

On Tuesday, Jefferies assigned a “buy” rating to D-Wave shares, with a target price 89% above the company’s current market value. The bank highlighted the commercial availability of D-Wave’s Advantage2 quantum computer, which it said is capable of solving computationally complex problems in business and science.

According to Freedom, the growing attention from Wall Street analysts reflects rising institutional interest in D-Wave, supports investor confidence, and could prompt a reassessment of the company’s investment story in the near term.

All 14 analysts currently covering D-Wave have “buy” ratings on the shares, according to MarketWatch data. The average target price implies upside of about 67% from the December 17 close.