GM was stronger than rivals: analysts raised targets after strong report

At least 13 analysts have increased their target price on shares of the Chevrolet maker

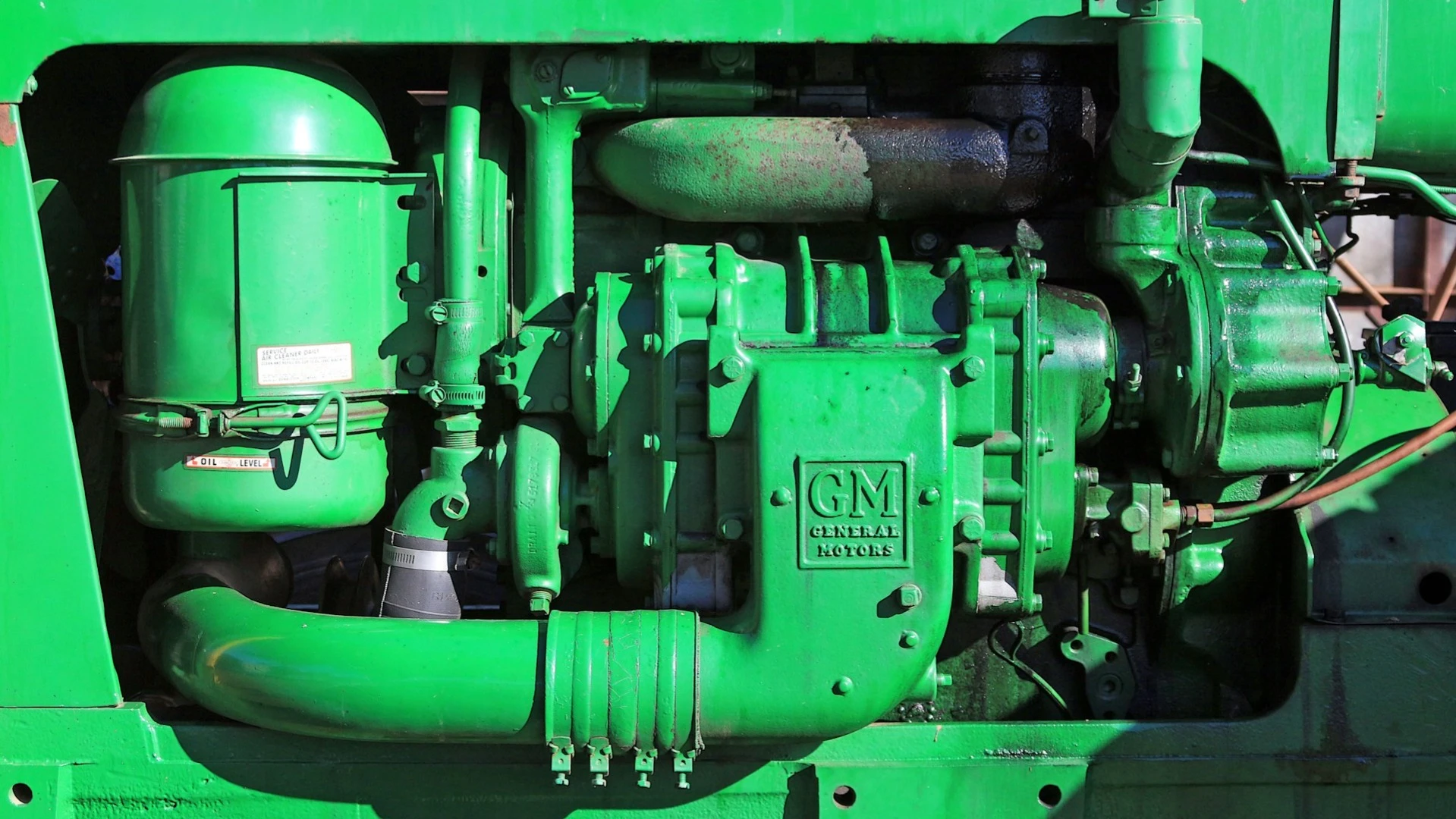

Photo: Unsplash/John Cardamone

At least 13 analysts, according to Bloomberg, raised their target price on the securities of automaker General Motors after the publication of the quarterly report, which the agency called "outstanding". TD Cowen set a new high of $122 a share among all estimates, while Citigroup, Barclays and RBC Capital Markets were also among the investment banks that revised their forecasts. The revision of targets is a signal to investors that the growth of GM stock prices is far from over, Bloomberg said.

How analysts reacted to the report

UBS analyst Joseph Spak raised his target price on GM shares to $102 from $97. That's up 20% from the closing price on Wednesday, January 28th. "This outlook confirms our upgrade on [the stock] - GM has a broad arsenal of tools to build earnings," Spak wrote in a Bloomberg statement. In September, UBS raised its recommendation on the stock from neutral to "buy."

For the U.S. auto industry now is a difficult time: regulation is changing, the sustainability of consumer demand is in question, uncertainty due to trade duties remains, reminds Bloomberg. Against this background, GM's competitors have shown much more modest results: Ford's shares rose by about 37% over the year, and Tesla's - by less than 10%, while GM's - by 70%. According to Wedbush analyst Dan Ives, GM has managed to "navigate through this challenging environment flawlessly." He kept his target price at $95 after raising it in December from $75.

Barclays analyst Dan Levy noted that GM has previously followed the "strong results but sluggish market reaction" formula. However, after the third quarter of 2025, GM posted its best post-report rally in at least a decade. Levy added that the rally has only intensified since then. On Wednesday, he raised his target price from $100 to $110, maintaining an "above market" rating (Overweight).

Morgan Stanley analyst Andrew Persoco raised his target price to $100 from $90 on Tuesday, also maintaining an "above market" rating. He noted that despite ongoing risks such as trade talks between the U.S. and South Korea, commodity price inflation and DRAM memory chip shortages, the automaker could likely reach the top end of its 2026 guidance range: roughly $15 billion in EBIT and $13 in EPS.

Piper Sandler analyst Alexander Potter raised his target price to $105 from $98. "After the fourth-quarter results, it's clear that GM still has earnings that are too strong to ignore," he wrote. - The bottom line is that we think investors should continue to hold these securities."

According to MarketWath, 29 analysts are now tracking GM stock, and most of them have a positive view on the automaker's stock. They have 18 buy ratings, nine hold ratings in their portfolios, and only two sell ratings.

Context

The Detroit-based auto giant reported strong earnings on Tuesday, January 27, and provided an upbeat outlook for 2026, as well as announcing a share buyback program of up to $6 billion and a dividend increase. Adjusted pretax profit rose 13% year-over-year to $2.84 billion, with earnings per share of $2.51, beating the $2.21 expected by analysts surveyed by Reuters.

On Tuesday, January 27, GM securities rose in price by 8.7%, bringing the annual growth to 70%. On Wednesday, quotations corrected by 1.7%.

This article was AI-translated and verified by a human editor