'Huge luck': Nebius shares soar 44% after $19.4 billion deal with Microsoft

Volozha's Nebius investors include global AI processor market leader Nvidia

Dutch AI startup Nebius Group of Arkady Volozh - a native of Kazakhstan and co-founder of Yandex - has signed a multi-billion dollar deal with Microsoft to provide infrastructure for the development of artificial intelligence. Following the news, Nebius quotes jumped more than 60% in extended trading. The agreement will allow Nebius to significantly expand its cloud business, becoming a "big deal" for the startup, and Microsoft to solve the problem of a shortage of computing power, according to Bloomberg.

Details

Under the terms of the contract, Nebius will provide Microsoft with infrastructure capacity based on graphics processing units (GPUs, used to work with AI) in a five-year deal worth $17.4 billion, with Microsoft having the right to purchase additional capacity, which could bring the total value of the deal to $19.4 billion, according to documents filed with the U.S. Securities and Exchange Commission (SEC).

Nebius will give the tech giant access to dedicated infrastructure with GPUs based on a new data center in the US Vineland, New Jersey. It is scheduled to start later in 2025.

"The financial terms of the deal are attractive in their own right, but importantly, it will also allow us to accelerate the growth of our cloud AI business in 2026 and beyond," Nebius CEO Arkady Volozh said, he was quoted as saying in a company statement.

Market Reaction

After the announcement of the deal with Microsoft, Nebius securities on the Nasdaq exchange in the United States rose by 44% in the aftermarket. At the same time, during extended trading, the price grew by more than 60% at the moment. On over-the-counter trading organized by the Blue Ocean ATS platform (BOATS), the securities of the company of the founder of Yandex rose by 47%. Quotes of Microsoft on the postmarket added 0.6%.

The agreement with Microsoft is a "huge windfall" for Nebius, which is spending money to expand its data centers in an effort to capitalize on the hype around artificial intelligence, Bloomberg writes. The tech giant, in turn, is trying to address the lack of capacity for cloud-based AI computing. Microsoft CFO Amy Hood told investors in July that she expects the capacity shortage to persist through the end of 2025.

What Wall Street thinks about stocks

According to FactSet, all five analysts who have analyst coverage on Nebius stock recommend them as a buy (four rated Buy and one rated Overweight). Their average target price of $89.4 per paper implies a 40% upside to the price at the close of primary trading on Sept. 8. However, this is 3% below $92.5 - the level at which the post-market closed after Nebius jumped on the news of the deal with Microsoft.

Context

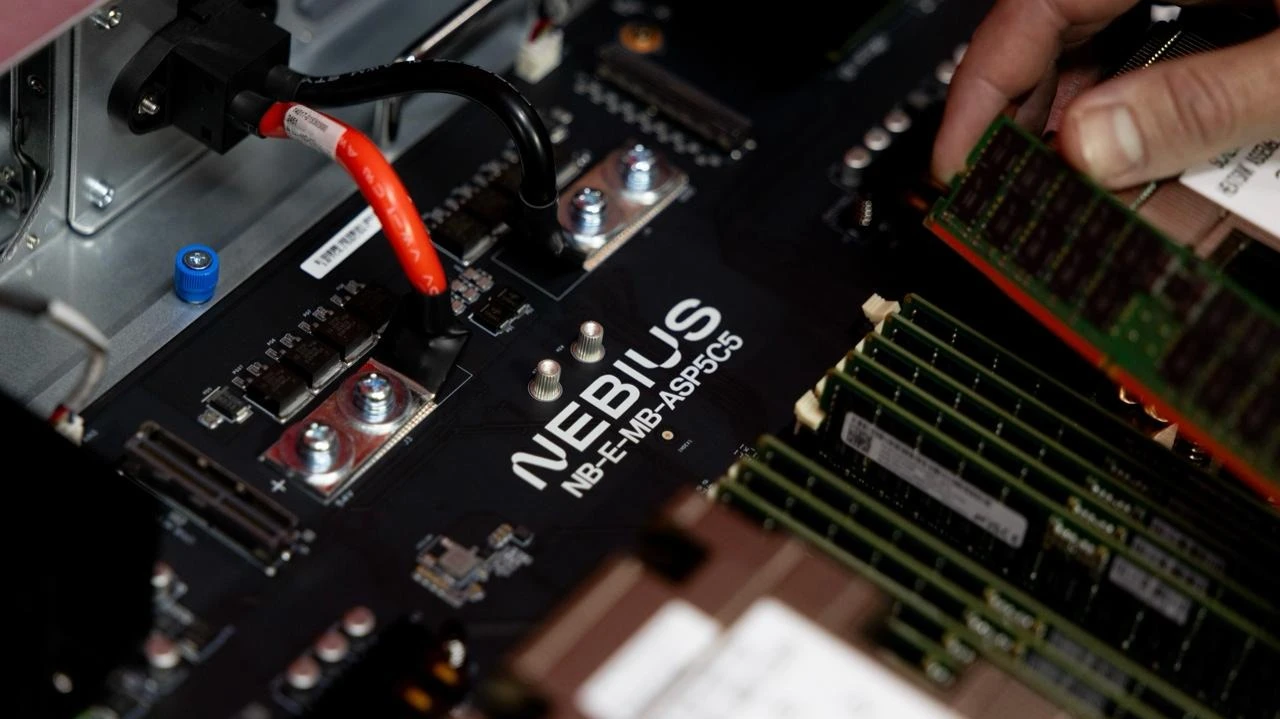

Nebius offers AI developers Nvidia GPU-based computing power, storage, managed services and tools to build, customize and run AI models on its cloud-based software architecture and proprietary hardware. Microsoft is the largest customer of CoreWeave, one of Nebius' competitors. In March 2025, CoreWeave denied rumors that Microsoft had allegedly terminated some of its agreements with it due to delivery issues and deadlines.

CoreWeave shares were up nearly 5% in extended trading Monday.

This article was AI-translated and verified by a human editor