Industry, Energy, IT: Royce's small-cap investment ideas for 2026

Amentum is one of Royce's investment ideas for 2026. / Photo: X / Amentum

Royce Investment Partners, founded by Wall Street legend Chuck Royce, has specialized in small-cap investing since 1972. Over that period, Royce built a broad lineup of funds focused on micro-cap, small-cap, and mid-cap stocks. Chuck Royce’s investment philosophy has historically centered on undervalued small-cap businesses with sustainable operations, strong balance sheets, and visible cash flows – an approach that remains evident in the firm’s portfolios.

As of June 30, Royce Investment Partners managed $10.9 billion in assets, with about 95% invested in small-cap equities. How effective the strategy has been, and which investment ideas the firm is emphasizing for 2026, are examined below by analyst Aldiyar Anuarbekov.

Portfolio of Royce Opportunity Fund

The Royce Small-Cap Opportunity Fund is one of the firm’s flagship strategies and offers a clear window into how the team is positioning for the next cycle. The fund blends a traditional value approach with a focus on identifiable growth catalysts, and its portfolio structure reflects the themes the managers are emphasizing for 2026. The strategy follows a flexible value approach, targeting situations in which a company’s business trajectory may be changing, but the market has not yet priced that shift in.

Portfolio holdings generally fall into four broad categories: turnaround situations, companies with hidden or undervalued assets, growing businesses trading at attractive valuations, and issuers experiencing a temporary decline in profitability. Across all four categories, the unifying principle is the identification of a clear driver of future earnings growth, such as management change, improving industry conditions, product innovation, or margin recovery. The fund focuses on companies it believes can outperform the broader market as these catalysts play out.

Over the long term, this approach has delivered results. As of September 30, the fund had outperformed its benchmark, the Russell 2000 Value Index, across all reported time horizons, from three years to 25 years.

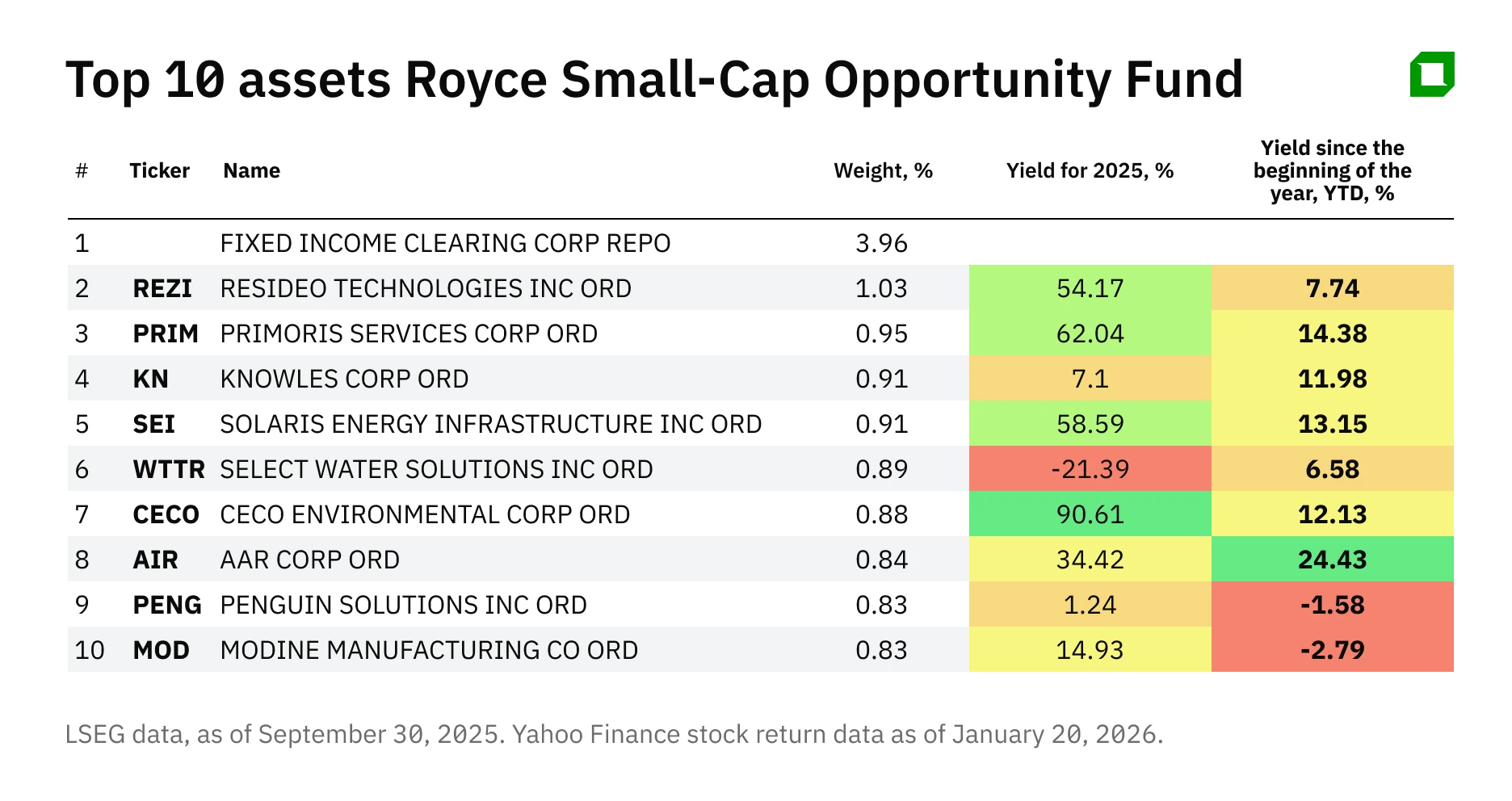

The portfolio is broadly diversified, with about 214 holdings and total assets of roughly $1.12 billion as of September 30. The 10 largest positions account for just 8-9% of assets, and individual position weights generally do not exceed 1%, limiting concentration risk.

Among the fund’s largest holdings are Resideo Technologies (about 1% of the portfolio), a provider of thermostat and fire safety systems, as well as a number of smaller industrial and technology companies, including Primoris Services (infrastructure contractor, about 0.9%), Knowles Corp. (electronics, about 0.9%), and Modine Manufacturing (heat exchange equipment, about 0.8%). A separate line in the asset mix is repo transactions through Fixed Income Clearing Corp., which the fund uses to manage liquidity and deploy temporarily uninvested cash.

Strategy of Royce Opportunity Fund

The sector allocation of the Royce Small-Cap Opportunity Fund shows a pronounced tilt toward industrial and tech companies. Industrials account for about 26% of assets, while IT represents roughly 21%. In the Russell 2000 Value Index, those sector weights are about half as large, underscoring the fund’s more active and selective positioning versus its benchmark.

The portfolio is also overweight energy and materials. Energy represents around 9% of assets, compared with about 7% in the Russell 2000 index, while materials account for roughly 6% versus about 5% in the benchmark. By contrast, financials make up only about 12% of the portfolio, well below the roughly 26% weighting in the index. Exposure to utilities and real estate is minimal, totaling no more than 1%.

This allocation reflects the team’s preference for cyclical and industrial businesses with recovery and earnings growth potential, while deliberately avoiding segments with more limited upside, particularly utilities and REITs.

Geographically, the portfolio remains concentrated in the U.S., which accounts for about 89% of assets. Foreign holdings represent roughly 8-9%, a typical profile for a U.S. small-cap fund.

Among the fund’s largest positions, Resideo stands out as the highest weighted holding. Amentum Holdings and Mayville Engineering are highlighted separately as investment ideas with clear catalysts that the Royce team believes could begin to materialize as early as 2026.

Resideo Technologies

Resideo Technologies (REZI) was spun off from Honeywell International in 2018. The company develops smart climate and security solutions for residential and commercial buildings and also operates ADI Global Distribution, a distribution business serving professional installers of security, video surveillance, and smart home equipment.

The stock is up nearly 8% year to date and about 65% over the last 12 months. Resideo is preparing to spin off its distribution business into a separately listed company and refocus on product manufacturing. Analysts at Morgan Stanley expect the transaction to close before the third quarter of 2026, a move they believe could reduce uncertainty around the business and act as a catalyst for the stock.

Resideo missed revenue expectations in the third quarter of 2025, and its fourth-quarter guidance came in below consensus, primarily due to cyclical and operational factors. Despite that, Morgan Stanley maintained its “overweight” rating and $42 per share target price, implying upside of more than 15%. Analysts see fourth-quarter 2025 results and progress on the ADI spin-off as near-term catalysts. The stock currently carries three “buy” ratings from Wall Street analysts.

Amentum

Amentum (AMTM) provides engineering, technology, and IT services, ranging from cybersecurity to logistics, for defense, intelligence, space, and civilian programs. About 80% of its revenue is derived from U.S. government customers.

When the Royce team initiated its position, Amentum carried a relatively high debt load but traded at an attractive free cash flow yield of about 11%. The investment case centered on the company’s ability to rapidly deleverage through strong FCF generation and post-merger scale-related economies.

According to the managers, integration and synergy realization are progressing faster than expected, a trend reflected in the stock’s roughly 20% gain year to date. Key drivers for 2026 include accelerating organic growth, expanded cross-selling, and margin improvement as commercial contracts become a larger share of revenue. Risks include dependence on government spending and execution on synergy targets, while sustained deleveraging and margin expansion remain the primary upside catalysts.

In early December 2025, BTIG reiterated its “buy” rating and raised its target price to $35 per share from $30 per share, offering no upside currently. According to MarketWatch data, five analysts rate the stock “buy” or “overweight,” while six recommend “hold.” The average target price is $35.70 per share.

Mayville Engineering

Mayville Engineering (MEC) is a U.S.-based contract manufacturer of metal components for trucks and automobiles, operating 26 plants nationwide. The Royce team’s thesis is built around the company’s pivot toward data center and critical power infrastructure following its acquisition of Accu-Fab in 2025. Mayville booked $30 million of orders in the DC/CP segment in the third quarter of 2025 and expects the business to approach about 20% of revenue in 2026, with short bid-to-revenue cycles of 8-12 weeks, according to Royce estimates.

Royce portfolio managers expect the company to generate positive FCF in the fourth quarter of 2025 and reduce net debt by the end of 2026. Key risks include delays in DC/CP projects, while catalysts include rising DC/CP revenue share and sustained positive FCF.

D.A. Davidson reiterated its “buy” rating and raised its target price to $21 per share from $19 in late December. On January 13, Citi maintained a “buy” with a $24 per share target, nearly 35% above the close on Tuesday, January 20. MarketWatch data shows four analysts rate the stock “buy,” versus one “hold.”

Outlook for 2026

The Russell 2000 rose about 12% in 2025, yet small-cap funds as a group continued to see outflows. According to Bloomberg Intelligence data, small-cap ETFs recorded net outflows of $816 million in 2025, even as ETFs overall saw record inflows, a sign of investor disengagement from the segment.

Institutional allocations to small caps have fallen to historic lows. Small-caps are valued and positioned as if they no longer matter – until they do again – Bloomberg Intelligence analysts wrote in a January 9 report.

History suggests that such periods of neglect can precede strong rebounds. After extended dominance by large-cap stocks from 1994 through 1999, small caps outperformed for eight consecutive years. Early 2026 has shown tentative signs of rotation: the iShares Russell 2000 ETF is up 5.16% year to date, compared with a 1.24% gain for the S&P 500 ETF.

Valuations also appear supportive. According to JPMorgan, small-cap stocks are trading at a near-record discount versus large-caps. Even in a downside scenario, analysts estimate relative underperformance risk of just 0-5%, while upside potential over a three- to five-year horizon could reach 30-60%.

Royce portfolio managers point to the same structural trends, highlighting U.S. reindustrialization and expanding AI infrastructure – from data centers to energy systems – as key tailwinds. In this environment, small-cap companies can capture demand by supplying the infrastructure and inputs required by larger players. The team also sees selective opportunities in consumer and healthcare niches where valuations remain depressed. According to portfolio manager Brendan Hartman, the current market is generating a growing pipeline of new ideas, reinforcing the fund’s confidence in long-term opportunities among smaller companies.