Investor who predicted Enron's collapse warned of cloud services default risks

Investor Jim Chanos, who predicted the collapse of Enron, one of the largest US companies, during the dot-com bubble, has warned of the warning signs he sees in the artificial intelligence market. He worries that cloud services that rent out servers to power AI are racking up loans secured by Nvidia chips, with most lacking a sustainable business model and a clear trajectory to profitability. This makes debt repayment problematic.

Details

"Business models like those of neoblack providers, and many AI companies in general, are simply unprofitable for now," Jim Chanos told Yahoo Finance. - We can only hope that will change. Otherwise, there will be defaults on these debts.

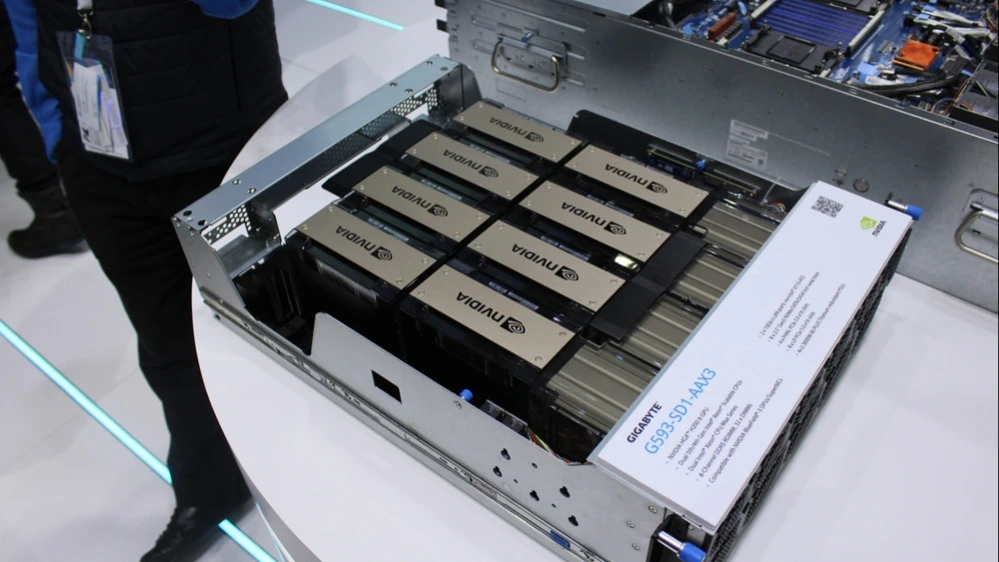

One of the investor concerns is the timing of AI processors. Most cloud companies, including CoreWeave, expect their chips to generate revenue within six years, Yahoo Finance writes. Amazon in January shortened that timeframe in the case of its AI chips to five years. According to Chanos, that horizon could be even shorter: Nvidia updates its AI chip lineup about every 18 months, which accelerates hardware obsolescence and technological obsolescence. That creates two problems: it's getting harder for companies to make enough money on old chips to service debt, and the value of the AI chips themselves could fall below the amount of loans they back, raising the risk of default.

"Even with eight- or 10-year equipment life cycles, these neoblacks remain unprofitable," Chanos noted. - We look at the business models of data centers like CoreWeave and Nebius and see that there is no profitability. The cost of capital is still higher than the return on transactions in AI infrastructure."

The investor warns that if the economic life of collateral chips is only three years in reality, "the economics of the whole scheme simply collapse."

In November, investor Michael Burry, known as the prototypical prototype of the protagonist of the movie "The Down Game," also noted that AI chips become obsolete after new models come to market, and in doing so, they don't have time to pay for themselves. Nvidia, meanwhile, claims that its chips can last more than six years.

Which companies are we talking about

The type of financing Chanos is referring to involves a loss-making company using its assets as collateral for a loan it would not otherwise have gotten, Yahoo Finance said. One of the first to resort to such a scheme was Nvidia's protégé CoreWeave, the publication added.

Since non-cloud providers are many times smaller than their giant competitors (Amazon, Microsoft, Google), collateralized financing for AI chips has become a way for them to scale quickly, Yahoo Finance explains. And Nvidia is actively investing in such players in an effort to diversify its customer base to be less dependent on its largest customers.

As The Information reported over the summer, four of those companies have accumulated more than $20 billion in debt, collateralized by Nvidia GPUs. Nvidia invested in three of them. CoreWeave and its competitor Fluidstack have borrowed about $10 billion each secured by AI chips. Lambda and Crusoe (part of Nvidia's portfolio) have $500 million and $425 million in debt, respectively, The Information claimed.

CoreWeave recorded a loss of about $65 million in 2024, and has already recorded a loss of $715 million for the three quarters of 2025. Fluidstack's 2024 loss was $0.7 million, and Lambda and Crusoe do not disclose financial statements, Yahoo Finance noted.

This article was AI-translated and verified by a human editor