Is the dollar really losing its status as the world's main reserve currency?

In recent months, the financial media has been full of news that the dollar's position as the world's main reserve currency has been shaken. "Gold is a real competitor to the dollar's reserve status," so wrote The Wall Street Journal, for example. "In Argentina, investors are increasingly turning to gold as an alternative to the dollar," Bloomberg wrote. "The dollar's crown is slipping, and fast," is the headline of the Reuters publication.

But is it really about the sunset of the dollar system now? Let's look at each trend in detail.

"Weak" dollar: putting it in perspective

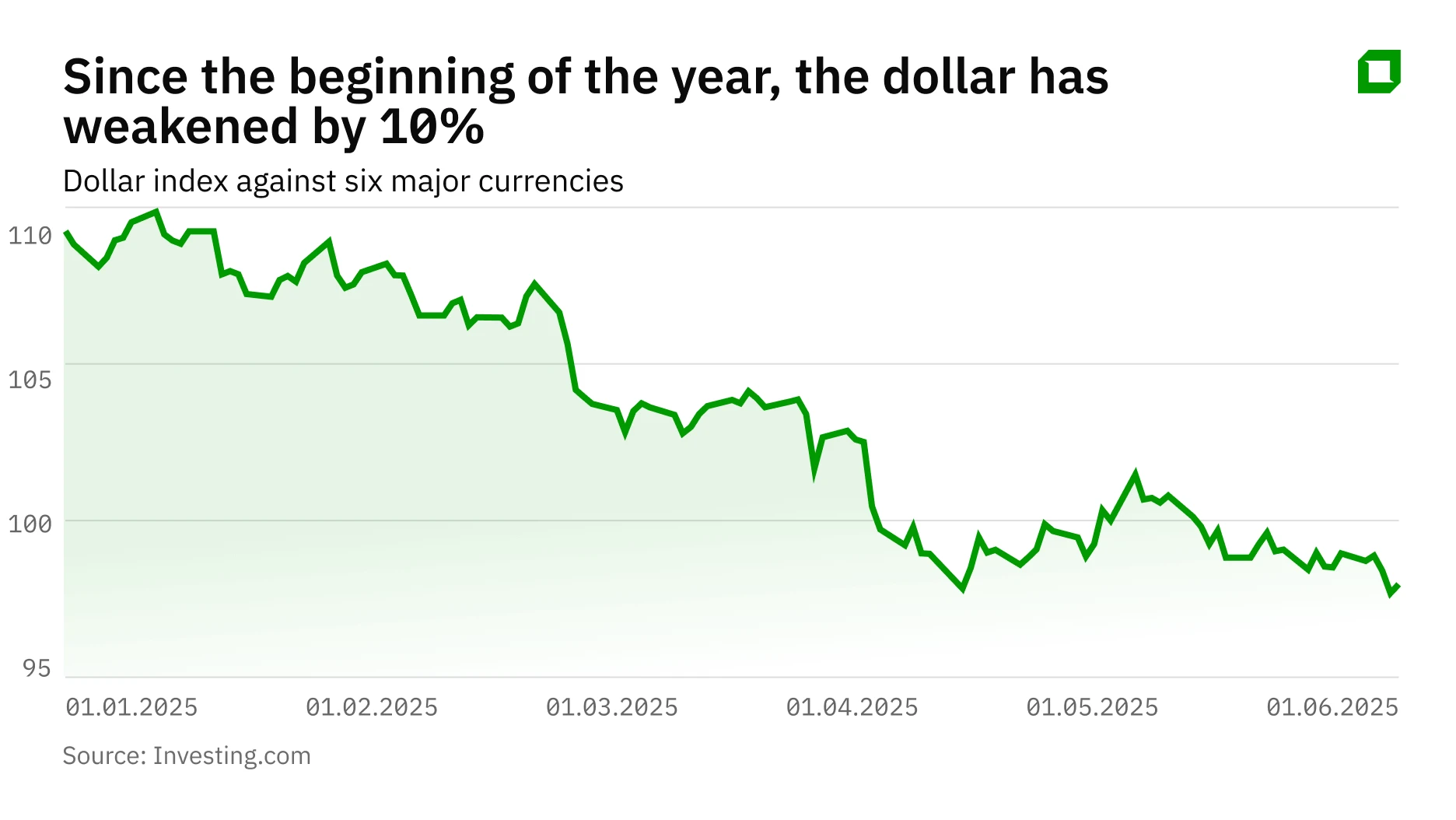

Since the beginning of 2025, the dollar index (DXY) relative to six major currencies - the euro, Japanese yen, Swiss franc, British pound sterling, Swedish krona and Canadian dollar - has actually declined by about 10%, from levels around 110 points to current values of 98-99 points.

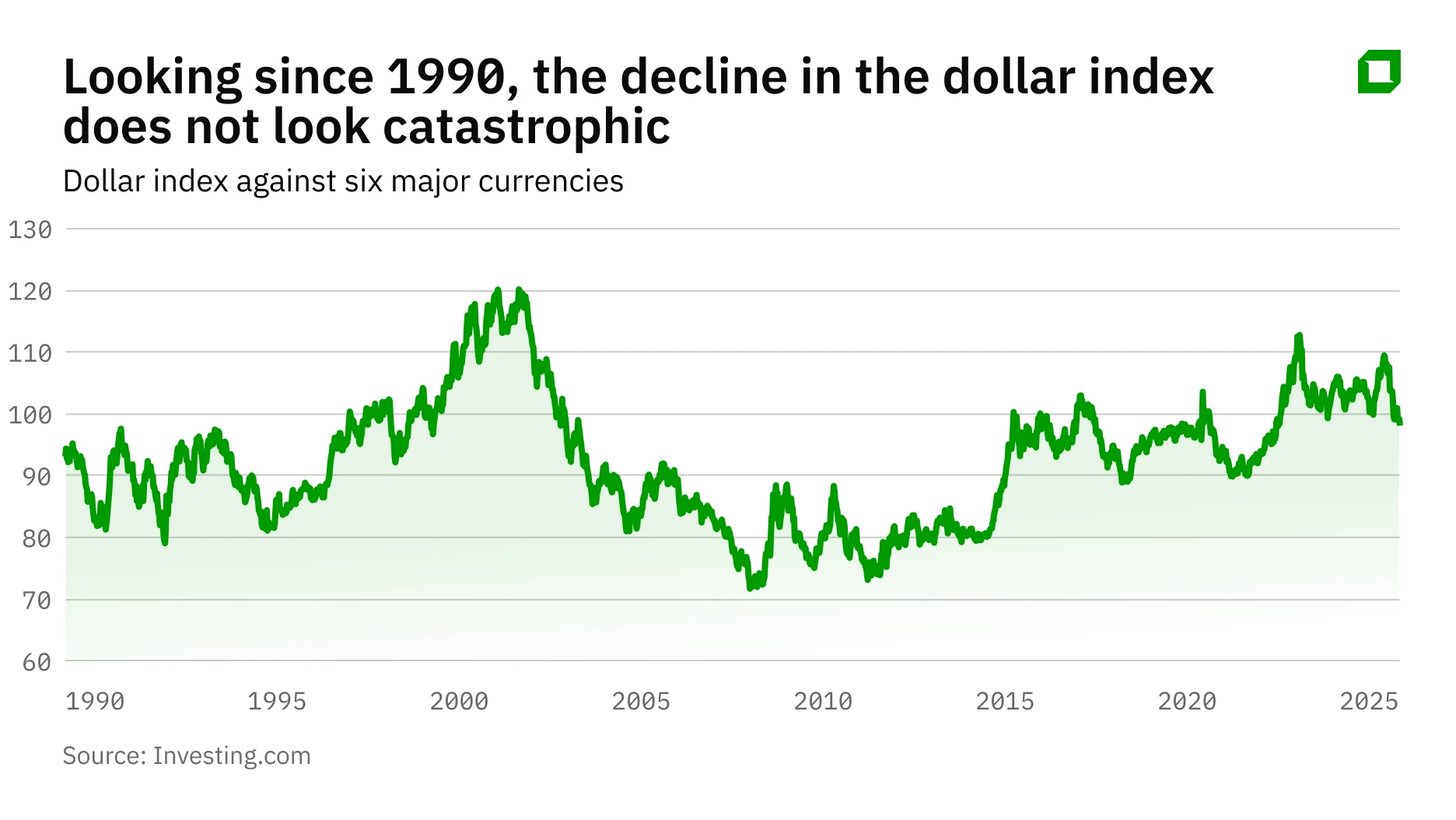

However, if we take a broader historical perspective since 1990, the picture changes dramatically. Index values around 110 points, which started 2025 (the index opened at 108.5 points on January 2, 2025), represented relatively high levels for the U.S. currency. The current decline can rather be seen as a return to normal values.

An overly strong dollar creates problems for the U.S. economy: it hurts exporters by making U.S. goods less competitive in world markets, which exacerbates the U.S. trade deficit.

"The events of mid-June 2025 confirmed that in periods of sharp increase in geopolitical risks, global demand continues to shift to the dollar and U.S. Treasuries. Against the backdrop of the Israeli-Iranian conflict, the dollar index rose by 0.4%, while the "classic" protective assets - the Japanese yen and the Swiss franc - strengthened in parallel," says Vadim Merkulov, director of the analytical department at Freedom Finance Global.

Gold rush of central banks: who buys and why

Central banks in 2024 purchased a record amount of gold - more than 1,000 metric tons. This, and the record price of gold, raised its share of global reserves to 20%.

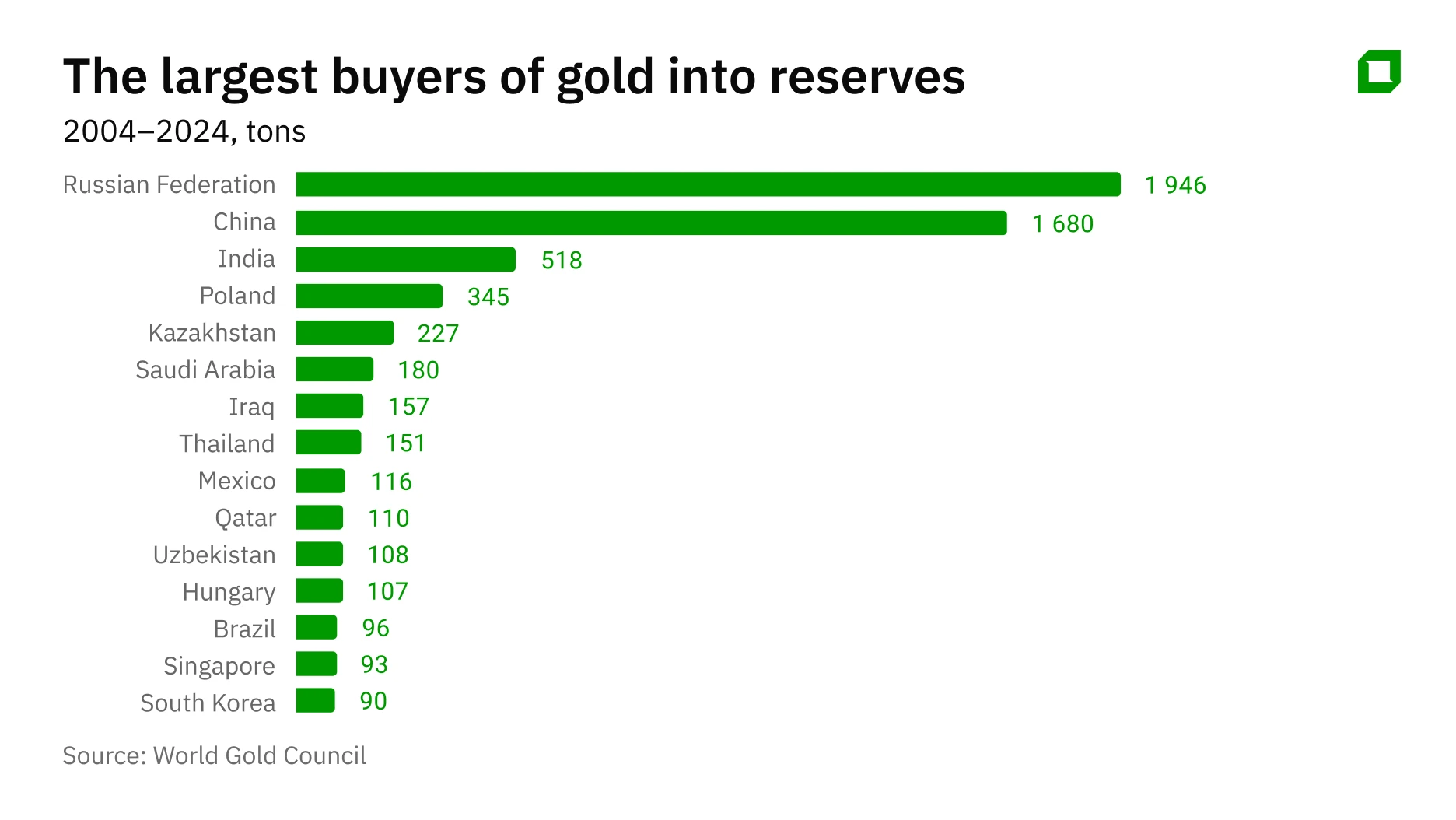

World Gold Council data shows which countries' central banks have been the largest buyers of gold over the past five years. The most active buyers in recent years have been Russia and China, countries that are seeking to reduce their dependence on the dollar system for geopolitical reasons.

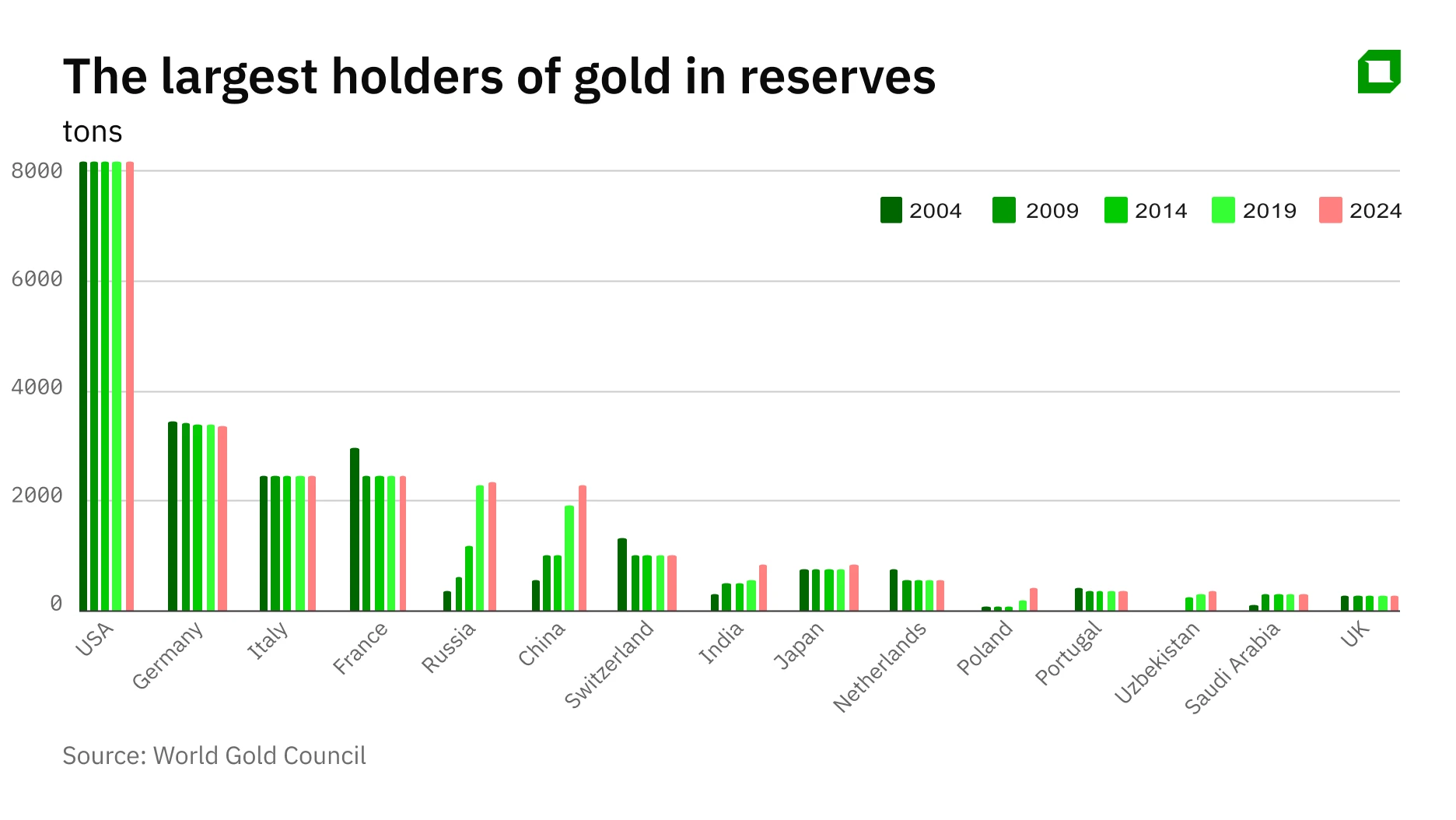

The largest gold reserves are concentrated in Western countries. The United States holds the first place. Germany, Italy, France are also in the top 5.

The European Central Bank, in its June 2025 wrote that "concerns about sanctions and possible weakening of the role of major currencies were raised by some developing country central banks. One in four such central banks cited sanctions concerns or expectations of changes in the international monetary system as factors driving their gold investment position."

In other words, the growing demand for gold among central banks is not related to the economic disadvantages of the dollar, but to attempts to avoid possible risks.

"In reserves around the world, gold will not replace the dollar. In 1971, the gold standard was abandoned for a reason, because gold is not suitable for the modern world," says Merkulov. - However, if we are talking about reducing potential risks and increasing the independence of central banks, then it is definitely necessary to increase the volume of gold. The demand for it will be stable for a few more years."

Foreign exchange reserves: the dollar remains out of competition

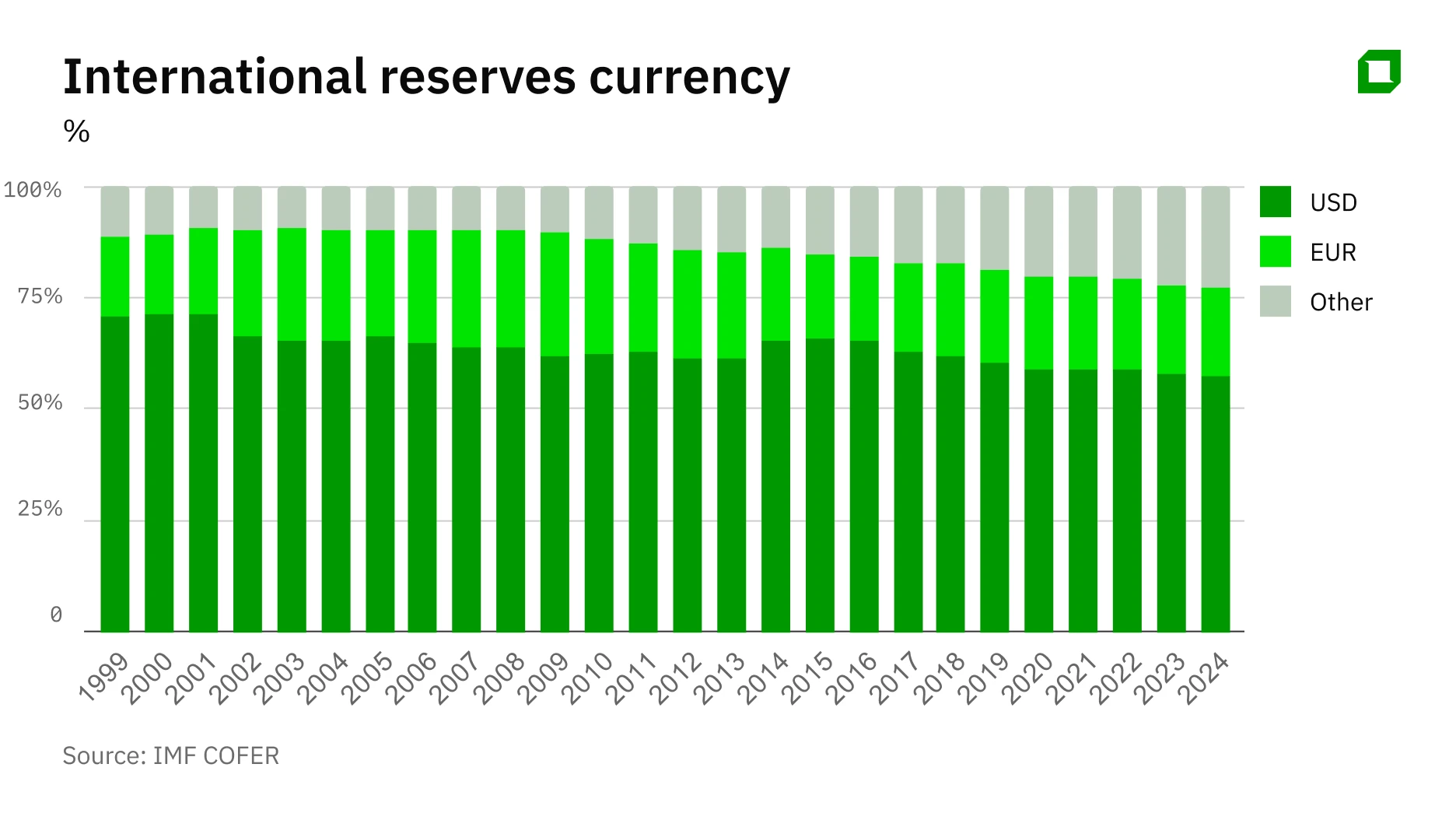

IMF data on the currency composition of countries' official foreign exchange reserves (COFER) show the real picture of the preferences of the world's central banks.

Although the dollar's share of foreign exchange reserves is declining - it fell from almost 75% at the end of 1999 to 58% at the end of 2024 - the U.S. currency continues to dominate. But the decline in its share is extremely slow. In second place is the euro with a share of about 20%. All other currencies of the world share the remaining 22%.

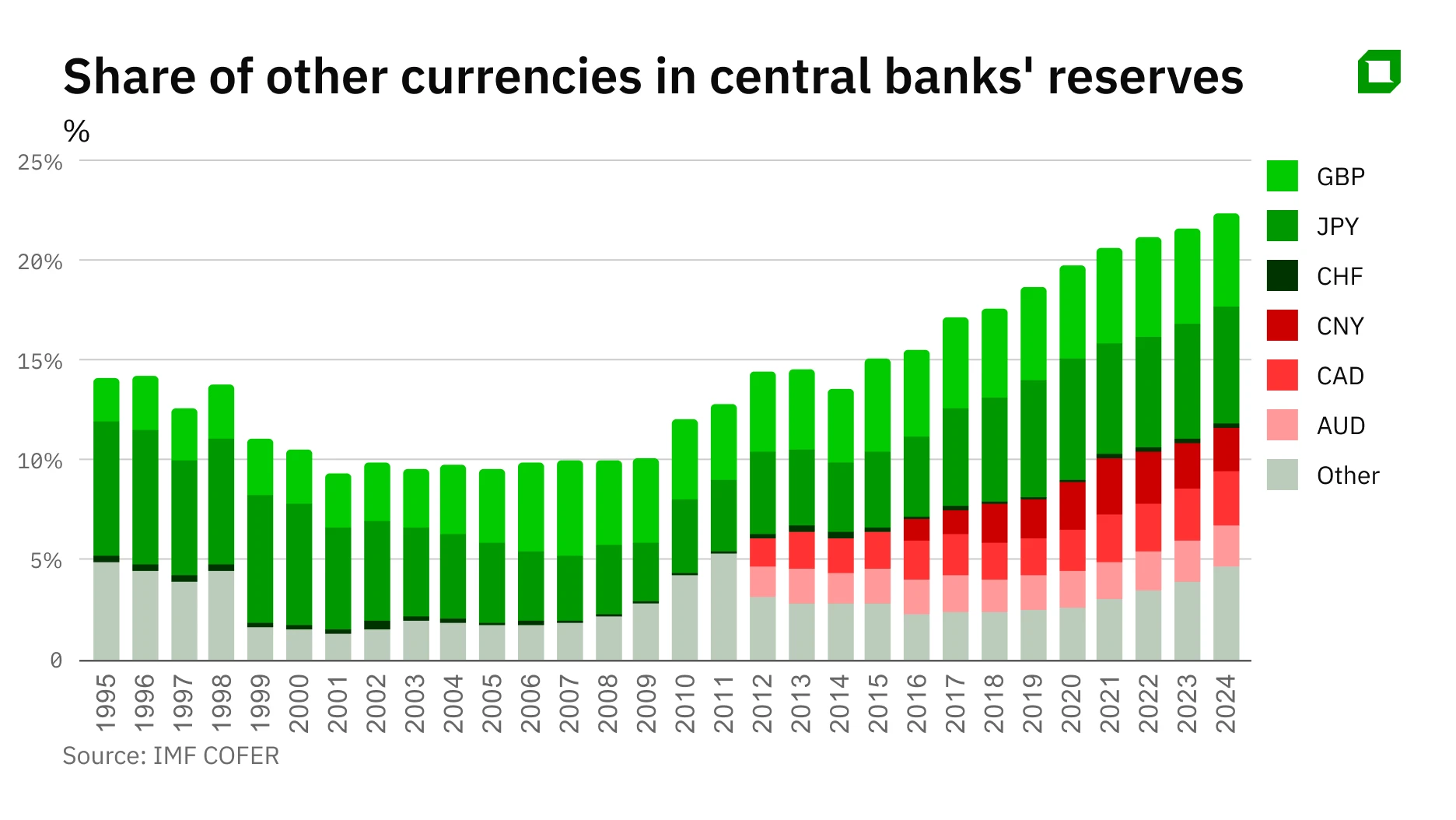

It is interesting to observe the evolution of the "other" currencies. Until 2000, they were dominated mainly by the Japanese yen and the British pound. Since 2012, shares of the Canadian and Australian dollars have become prominent. The Chinese yuan has stabilized at around 2.5% after rising until 2020.

"The U.S. share of global highly liquid government bonds exceeds 40%. No other jurisdiction can provide a comparable sea of liquidity. And this is the main reason why the dollar will not be leaving the pedestal of reserve currency anytime soon," Merkulov explains.

In a statistical sense, all these trends and changes in the shares of currencies in reserves are at the level of "white noise," adds Arbat Capital Managing Director Alexander Orlov: the dollar and euro in assets, transactions and credit resources occupy two-thirds to three-quarters;

He said studies show that for a challenger currency to emerge as a competitor to the "major" world currency, it needs to take a "total" share of 20-25% - in trade settlements, reserves and so on.

The main thing preventing the dollar from losing its status is the lack of an alternative. "And the yuan does not yet have the strength or determination of the authorities to launch a full-fledged attack on the dollar. And the institutional problems of the yuan have not gone anywhere, and the capacity of the international bond market in yuan is minuscule compared to the dollar, and the risks of a sharp change "party policy" also remain at a high level," says Orlov. The Chinese authorities still adhere to a policy of tight control over the yuan exchange rate.

Trade settlements: the dollar and the euro rule the world

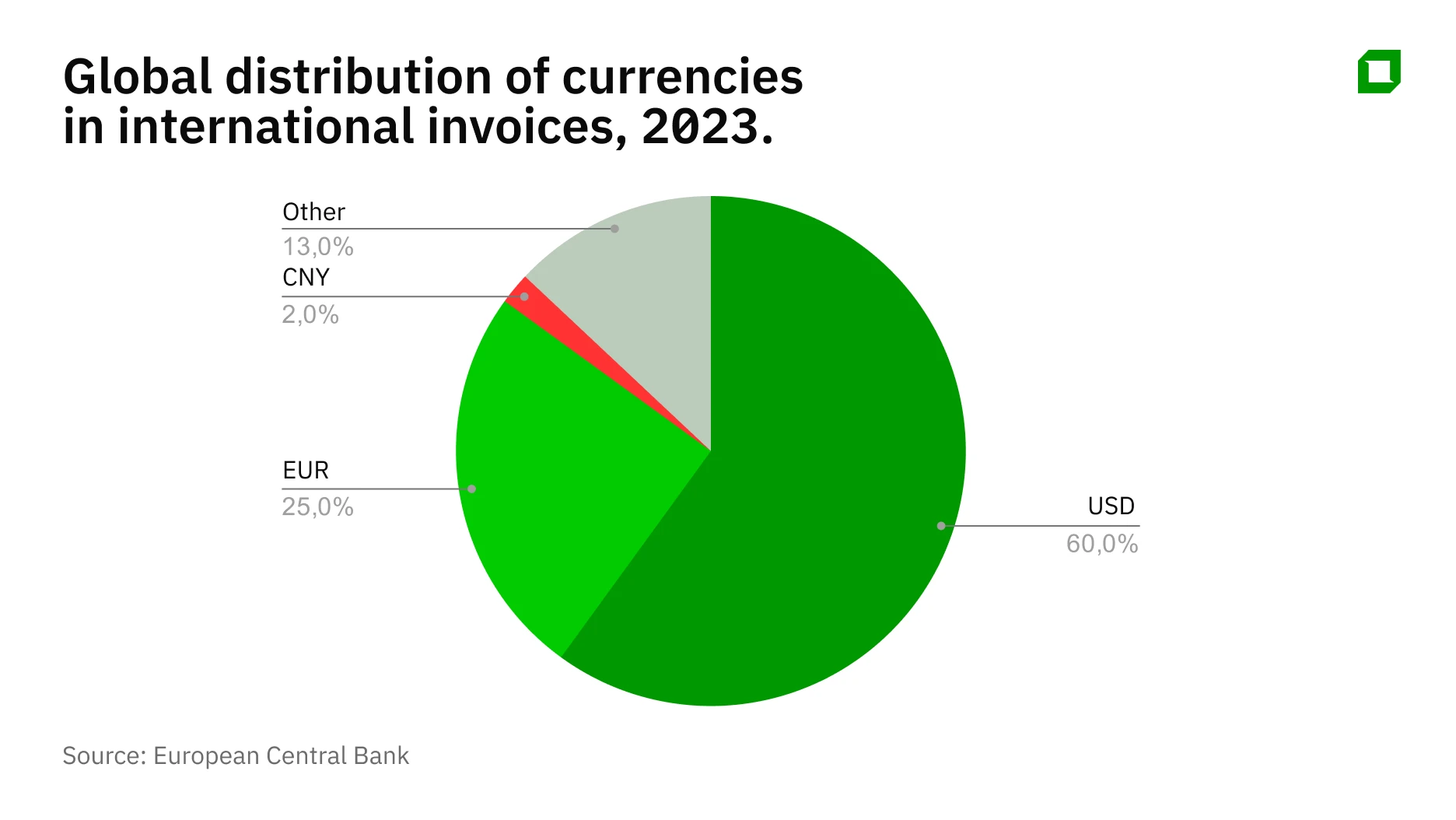

New European Central Bank data from more than 120 countries shows in which currencies are most commonly invoiced (invoiced) in international trade as of 2023.

The US dollar and the euro remained the dominant currencies of international settlements, together accounting for more than 80% of accounts. At the same time, the share of the dollar was about 60% and the euro about 25%.

The Chinese renminbi's share remained low at less than 2%, although it is rising in Asia-Pacific and parts of Europe.

According to the ECB report, the most notable changes in the structure of settlement currencies occurred in countries that have distanced themselves from the West for geopolitical reasons, such as Russia, Belarus, Kyrgyzstan and Uzbekistan, where the share of exports denominated in US dollars and euros was 10-50 percentage points lower in 2023 compared to 2015-2019.

What could threaten the status of the dollar?

The main factors threatening the dollar "lie in the hands of the dollar itself," Orlov said.

"2008 showed the absence of limits on the dollar issue, and then we watched the dollar turn into a tool of foreign policy after the introduction of anti-Russian sanctions, plus the U.S. began to wage trade wars with China. On the horizon of 5-10 years, it is possible that the dollar will lose its leading position, but only if there is a full-fledged crisis in global trade with an aggressive trade war by the US and China's readiness to become the new leader of the 'free market'," he says;

Merkulov is more cautious in his assessments: "Slow changes towards diversification by currencies can definitely be expected within 10-15 years, but so far there are no normal alternatives".

Orlov recommends having more protective assets from different regions and currencies - in gold and other precious metals, in government bonds of Germany and China in local currencies, in real assets in the national currency;

But at the same time, according to him, it is not worth completely leaving the dollar yet - it is still possible to earn and save capital there. "It is necessary to trade more actively and reduce the financial leverage (the ratio of own funds to borrowed capital - editor's note) both on the stock market and in life, especially if borrowed funds are not in the currency of the main income," he said;

Merkulov proposes to increase the share in gold to 12% of the portfolio when geopolitical risks escalate, and to reduce the share to 2-5% when Fed rates normalize;

The US market is still a great investment, including the technology sector of the S&P 500, he believes. "On a 2-5 year horizon, a diversified portfolio with a focus on technology, financials, industrial sector and utilities looks like a good solution. It is certainly worth choosing companies with a quality balance sheet," he said.

International markets can also attract investors. In Latin America, Merkulov singles out Brazil on the horizon of a year, in Europe - Italy and Germany, in Asia - Japan. He recommends investing in international markets through country exchange-traded funds.

This article was AI-translated and verified by a human editor