Israeli satcom company SatixFy soars on upsized bid from MDA Space

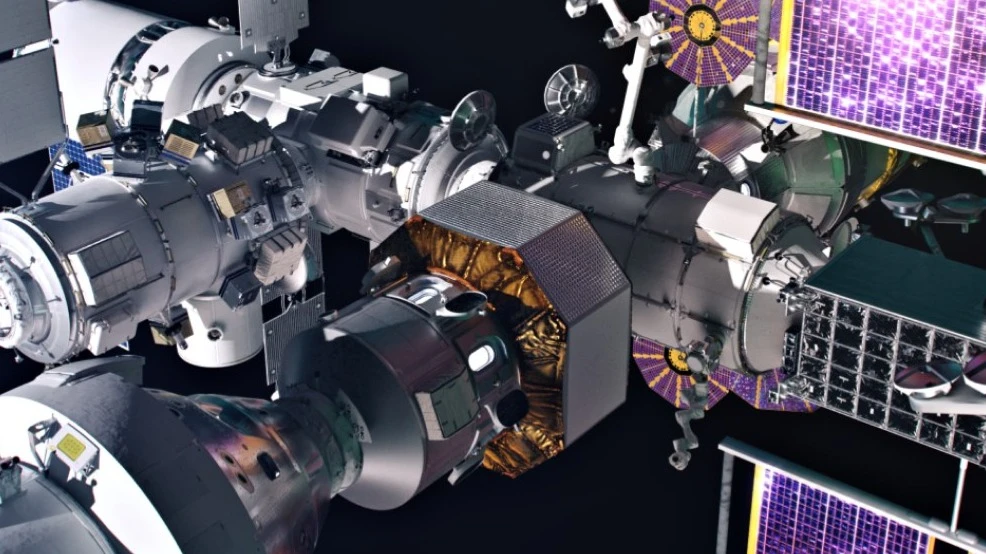

SatixFy shares advanced after Canadian satellite maker MDA Space refused to yield to a rival bidder. / Photo: Facebook/MDAspace

Quotes on SatixFy, an Israel-based but U.S.-listed small-cap satellite communications systems maker, jumped more than 44% yesterday, May 20, as a bidding war for the company seemingly came to a conclusion. Earlier in the day, it announced that Canada’s MDA Space, reacting against a competing bid, had agreed to increase its initial offer by almost 50%.

Details

Yesterday, SatixFy soared more than 44% to $2.94 per share after the Israeli company announced that Canada’s MDA Space was willing to pay 1.4 times its initial acquisition offer made two months ago. The new deal values SatixFy at about $280 million, or $3 per share.

Why the new offer

On April 1, MDA Space announced an agreement to acquire SatixFy for $193 million, or $2.10 per share. Under the terms of the deal, the Israeli company had 45 days to solicit competing bids from other potential buyers. During that period, it received an offer of $233.5 million, or about $2.53 per share, though the bidder’s identity was not disclosed.

MDA Space disputed the validity of that bid, however. After negotiations, MDA Space and SatixFy agreed to amend the initial agreement “to provide for a significant increase in the merger consideration.”

Under the revised deal, SatixFy can no longer entertain any other acquisition proposals, and its board cannot change its recommendation to support the MDA deal. However, the acquisition must still be approved by SatixFy shareholders at a general meeting scheduled for Friday, May 23. The Israeli company notes that shareholders holding 57% of its outstanding shares have already agreed to vote in favor of the deal.

What makes SatixFy valuable

SatixFy develops next-generation satellite space and ground communications systems. According to MDA Space, its technology dramatically improves satellite performance and reduces costs by enabling connectivity through radiation-hardened digital beamformers. The Canadian company expects the acquisition to enhance its end-to-end satellite systems offering as demand for next-generation digital satellite communications grows.

MDA conducts Earth and space monitoring for corporate and government clients and provides technologies and services for the space industry. Its solutions are used, for example, in the OneWeb satellites of Europe’s Eutelsat, which, like Elon Musk’s Starlink, provides satellite internet.

Stock performance

SatixFy stock has nearly doubled since the beginning of the year, up more than 92%. There have been two major jumps: On April 1, when the MDA deal was first announced and the stock jumped 64%, and yesterday.

The lone Wall Street analyst who covers SatixFy has a “hold” recommendation.