Micron improved its outlook due to rising demand for AI memory. The stock jumped 8%

The company's revenue grew by 57% in the reporting quarter

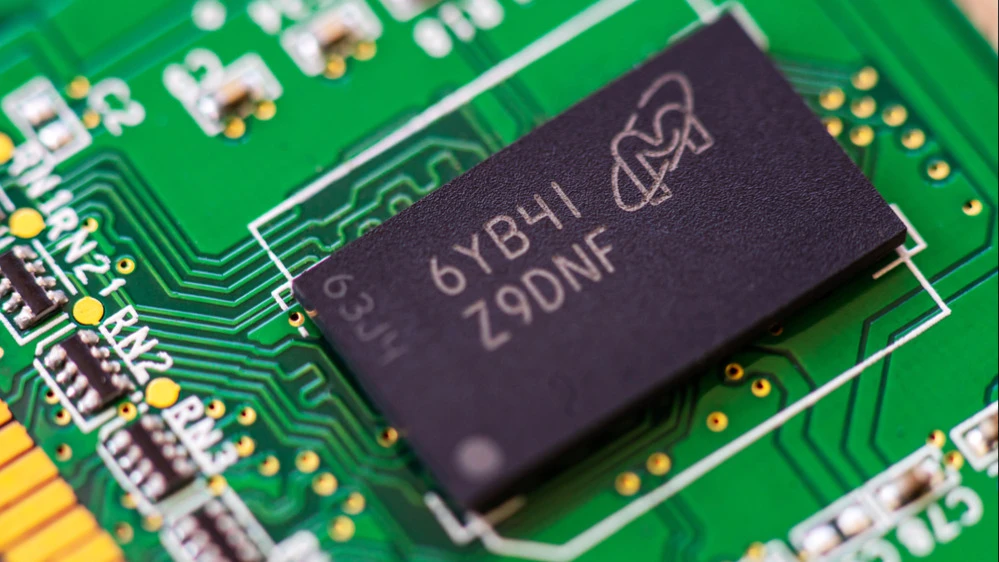

Micron Technology, the largest U.S. manufacturer of memory chips for AI processors, gave an optimistic outlook for the current quarter. This indicates that explosive demand and tight supplies are allowing the company to set higher prices for its products, Bloomberg writes. The company's shares soared in the postmarket.

Details

Micron expects that in the second quarter of its 2026 fiscal year (the period will end in February) its revenue will be from $18.3 billion to $19.1 billion, while the average estimate of analysts was $14.4 billion, writes Bloomberg. The company forecasts adjusted earnings in the range of $8.22-8.62 per share, while the market consensus, according to the agency, suggested only $4.71.

After these data, published together with the report for the first quarter, shares of Micron at the extended trading on Wednesday jumped by more than 8%: the price exceeded $246. The main trading on Dec. 17 ended with a 3% drop due to a general sell-off in technology stocks related to artificial intelligence. Compared to the beginning of 2025, the chipmaker's shares are now 168% more expensive.

How the company reported

The company's revenue rose 57% to $13.6 billion in the first quarter of fiscal 2026, which ended Nov. 27. Wall Street had forecast revenue of $13 billion, Bloomberg writes. Adjusted earnings amounted to $4.78 per share, while analysts expected $3.95 per share.

Micron also warned that the company's capital expenditures will rise: to keep up with demand, the chipmaker has already invested $13.8 billion in new fabs and equipment purchases in fiscal 2025 and intends to increase investment this year.

"Micron plays a key role in the development of AI as a supplier of mission-critical memory," said CEO Sanjay Mehrotra, he was quoted as saying in a company statement. - "We are investing in capacity expansion to meet customers' growing memory and storage needs.

Context

The rapid growth in demand for components for AI platforms is outstripping supply capacity, and that's playing into the hands of companies like Micron, Bloomberg notes. At the same time, there is also a shortage of simpler memory chips used in personal computers. This is due to the fact that memory manufacturers have shifted resources to producing more advanced chips for data centers working with AI.

PC makers including Dell Technologies and HP have already warned investors of memory chip shortages next year, which could drive up component prices. That has given Micron an edge with customers, Bloomberg notes.

"Memory prices are unlikely to go down in the near term," said Bloomberg Intelligence analyst Jake Silverman.

Micron has become one of the major beneficiaries of the AI boom, as its high-bandwidth memory (HBM) is an integral part of chips and systems involved in training neural networks, the agency explained.

This article was AI-translated and verified by a human editor