Mystery company and other deals: what might Buffett reveal in a new report?

Berkshire Hathaway is expected to report this Thursday on its second quarter stock transactions

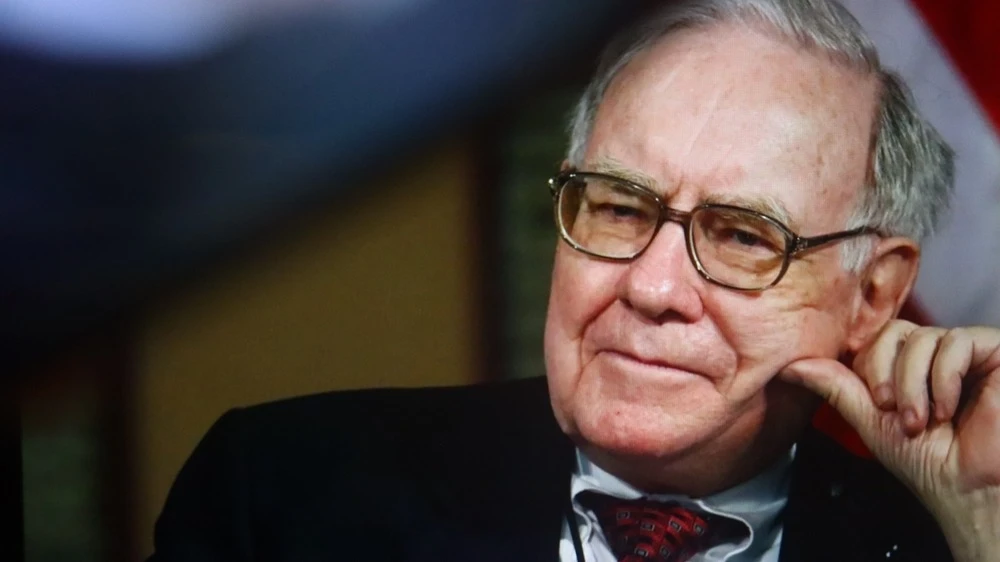

Berkshire Hathaway is preparing to make public what stocks it bought and sold in the second quarter. Warren Buffett's company may announce a new investment, which it has been hiding so far, as well as show a further reduction in its stake in Bank of America, Barron's suggests. Which stocks should you look out for before the investment guru's report?

What investors can learn from the Berkshire report

The company may be revealing its newest "mystery" investment, Barron's writes. That Berkshire may have been secretly accumulating some stock is indicated by documents. In May, while reporting on investments for the first quarter, Berkshire asked the SEC for an opportunity to keep one or more positions confidential. Buffett has used this tactic in the past when he has built up a large position over several quarters and did not want to disclose the company so as not to provoke a rise in quotations. For example, this was the case with shares of insurer Chubb, which he had been buying since late 2023 - Berkshire disclosed the deal only in May 2024, when the stake in Chubb was already valued at $7 billion. Berkshire acted similarly when buying shares of Chevron and Verizon in 2020-2021.

Buffett's "mystery" investment is very likely to be an industrial company, and the total value of the stake could be as high as nearly $5 billion, Barron's suggested, citing data from the 10-Q's first- and second-quarter reports. In those reports, Berkshire discloses only the largest positions, categorizing smaller investments into three categories: "financial sector," "consumer sector" and "commercial, industrial and other." In the first quarter, the cost of the bundle in the "commercial and industrial sector" category increased by nearly $2 billion, but the May 13-F report showed no meaningful purchases in that segment. In the second quarter, the cost basis increased another $2.8 billion, adding up to $4.8 billion in potential "mystery stock" purchases, Barron's explains.

Berkshire generally sold more shares than it bought in the second quarter. But it likely continued to build up stakes in a number of existing positions, Morningstar noted. The analyst firm suggested Buffett was buying shares in insurance company Chubb, alcoholic beverage maker Constellation Brands, pizza chain Domino's Pizza, aerospace and electronic components maker Heico Corp and the world's largest distributor of pool and spa products Pool Corp.

In addition to the purchases, Berkshire probably continued to reduce its stake in Bank of America, Barron's suggests. Between July 2024 and the end of the first quarter of 2025, the company has already reduced its stake by nearly 40% to 631 million shares worth about $28 billion. Barron's estimates that the sales could reach another $4 billion or so. In addition to BofA, Berkshire Hathaway could cut its stakes in medical company DaVita DVA, financial company Capital One Financial, cable TV and Internet operator Charter Communications, the owner of commercial rights to the Formula One championship Liberty Media Corp C Liberty Formula One, building materials manufacturer Louisiana Pacific, as well as one of the largest mobile operators in the U.S. T-Mobile, suggests Morningstar.

Context

Berkshire's report is expected to be published on August 14, the date on which the 45-day period after the end of the second quarter in which large investors must report their transactions to the SEC on Form 13F expires. Buffett's company traditionally files the report on the last day possible, Barron's notes.

Which stocks to buy ahead of Berkshire Hathaway report

Morningstar also named two stocks from Buffett's portfolio that now look undervalued and should be bought ahead of the report. The first was Occidental Petroleum, a large U.S. oil and gas company. Berkshire Hathaway owns 27% of its shares. Morningstar estimates that the company does not yet have a sustainable competitive advantage, but is close to recouping its cost of capital. Morningstar's target price on Occidental Petroleum shares is $59 per paper - 35% above the closing price on Aug. 11. Since the beginning of 2025, the company's market value has sagged 11.5%.

In addition to Occidental Petroleum, investors should also look at buying the securities of food manufacturer Kraft Heinz, says Morningstar. The research firm acknowledges that Berkshire's investment in Kraft Heinz looks controversial - Buffett wrote down $3.8 billion of his stake in Kraft Heinz in the second quarter, and this is the second write-down since the merger of Heinz and Kraft Foods in 2015 (the first was in 2019, when Buffett admitted that Kraft Foods was overpaid for). Still, Morningstar analysts believe Kraft Heinz securities are now of interest to new investors and set a target price for them at $51 per paper - up 86% from the Aug. 11 close. Since the beginning of the year, the company's shares are down 10.5%.

This article was AI-translated and verified by a human editor