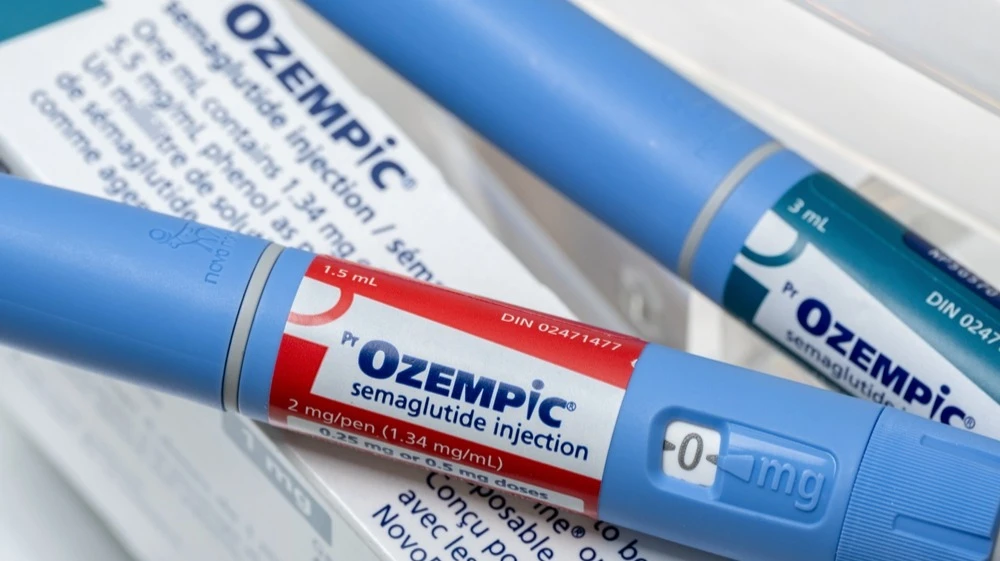

Novo drug outperformed its Eli Lilly counterpart in trials. Time to buy stock?

Novo Nordisk's Ozempic has shown to reduce the risk of heart attack, stroke and death in patients with diabetes and cardiovascular disease

Novo Nordisk's Ozempic was more effective than its US counterpart Eli Lilly in a study of patients with type 2 diabetes and cardiovascular disease. The drug, which has transformed diabetes management, was able to reduce the risk of heart attack, stroke and death by almost a quarter. Novo's U.S. receipts jumped nearly 7% in trading Thursday.

Details

American depositary receipts of the Danish pharmaceutical company Novo Nordisk rose sharply in trading on Thursday, September 18, after the publication of data on the study of the impact of its drug Ozempic on patients with type 2 diabetes and cardiovascular disease.

At the main trading on September 18, Novo's U.S. receipts rose by almost 7% at the moment, reaching $62.25. This became their maximum price since July 28.

Shares of Novo Nordisk's U.S. competitor in the diabetes and weight management market, Eli Lilly, rose by more than 2% in trading, but then lost almost all of their growth and by the time of publication of this text were gaining less than 0.2%.

What Novo's research has shown

Novo Nordisk announced Thursday morning that in a study of patients with type 2 diabetes and cardiovascular disease, its popular drug Ozempic (semaglutide) showed a 23% reduction in the risk of heart attack, stroke and death compared to the older drug dulaglutide (dulaglutide). Dulaglutide is manufactured by Eli Lilly under the brand name Trulicity.

The findings are based on a study involving nearly 60,000 Medicare-insured patients in the U.S. over the age of 66, Novo reported.

"These data ... close an important gap and confirm the well-documented clinical efficacy of semaglutide," said Novo Nordisk Chief Medical Officer Philip Kragh Knop. - This is great news for both older patients and the medical community."

Knop emphasized that not all GLP-1-based drugs, which include Ozempic and its competitors, are the same. GLP-1 (glucagon-like peptide-1) is a class of drugs that mimic a natural gut hormone that regulates blood sugar and appetite.

What else is important for investors

Investors are trying to keep up with the flow of news from the European Association for the Study of Diabetes (EASD) annual congress, which takes place Sept. 15-19, 2025, in Vienna, Barron's notes.

Eli Lilly on Tuesday night presented full data on its next-generation weight-loss pill orforglipron, as well as results from a study of tirzepatide (trade name Mounjaro) in children and adolescents with diabetes. Orforglipron provided an average weight loss of 12.4% over 72 weeks, while patients in the placebo group lost only 0.9%. Taken together, these data do not reinforce the drug's position as an alternative to Novo solutions for patients interested solely in weight loss, Barron's writes, but the studies suggest its potential as an important tool for the treatment of type 2 diabetes.

Novo, for its part, also presented updated data at EASD on its over-the-counter version of its weight-loss drug Wegovy: obese patients lost 16.6% of their weight in 64 weeks versus 2.7% in the placebo group.

What the analysts are saying

On September 17, analysts at Berenberg, Germany's oldest private bank, went against the Wall Street consensus and said that the Danish company now looks more attractive to investors than Eli Lilly. In raising the recommendation to "buy," Berenberg simultaneously lowered the target price of Novo's American depositary receipts - from $90 to $67. But that's still 15% above the closing price on Sept. 17. The lowered target reflects how much investor expectations have fallen, Barron's explains. Over the past 12 months, Novo's securities have fallen about 55%, while the shares of its main competitor, US-based Eli Lilly, have lost only 16% over the same period.

However, for shares of Eli Lilly Berenberg, on the contrary, downgraded the rating from "buy" to "hold". Although over the last five years Lilly securities have shown outstanding returns - 413% against the sector average of 71% - Berenberg believes that current expectations are already too high. The target price on Lilly shares was lowered from $970 to $830. This is 9.2% higher than the current value of the securities.

Novo Nordisk securities were rated by 32 analysts. Of these, 18 recommend to buy the securities, 13 advise to hold, one - to sell. Wall Street consensus target price is $70.8. This is 21.6% higher than the closing price on September 17.

The market's attitude to Eli Lilly shares is much more favorable. According to MarketWatch, out of 30 analysts tracking the securities, 22 recommend to buy them, eight - to hold. There is no advice to sell. The Wall Street consensus price target is $905.2, up 19% from Thursday's closing price.

This article was AI-translated and verified by a human editor