Off the coast of Venezuela, the U.S. fleet and aviation: what it means for the investor

The largest U.S. military presence in decades is off the coast of Venezuela: two U.S. destroyers are stationed near the country's maritime borders. The U.S. claims to be fighting drug trafficking - ships suspected of carrying drugs have been struck. President Trump said "the sea is under total control, now looking at land". Venezuela says Washington is determined to overthrow the government of Nicolas Maduro. The country has been under US sanctions for many years, but it could have interesting investment potential if the political situation changes. Oninvest asked Alexey Golubovich and Alexander Orlov to analyze which sectors and assets are worth looking at

A country drowning in oil

Venezuela is one of the most promising countries on the South American continent: it has the world's largest hydrocarbon reserves, a logistically favorable location and a population of about 30 million people - 67% of whom, according to the Wilson Center, live in extreme poverty. The reasons for this are the protracted attempts to govern according to the model of "socialism" - formally it has been in existence for over 25 years, in fact much longer. President Perez first nationalized the oil industry in 1976. Attempts to rebuild the economy with the help of private, mostly American capital in the 1990s failed and ended with the arrival of Chavez, who announced plans to build "21st century socialism." Then came a series of U.S. sanctions.

Oil for everything

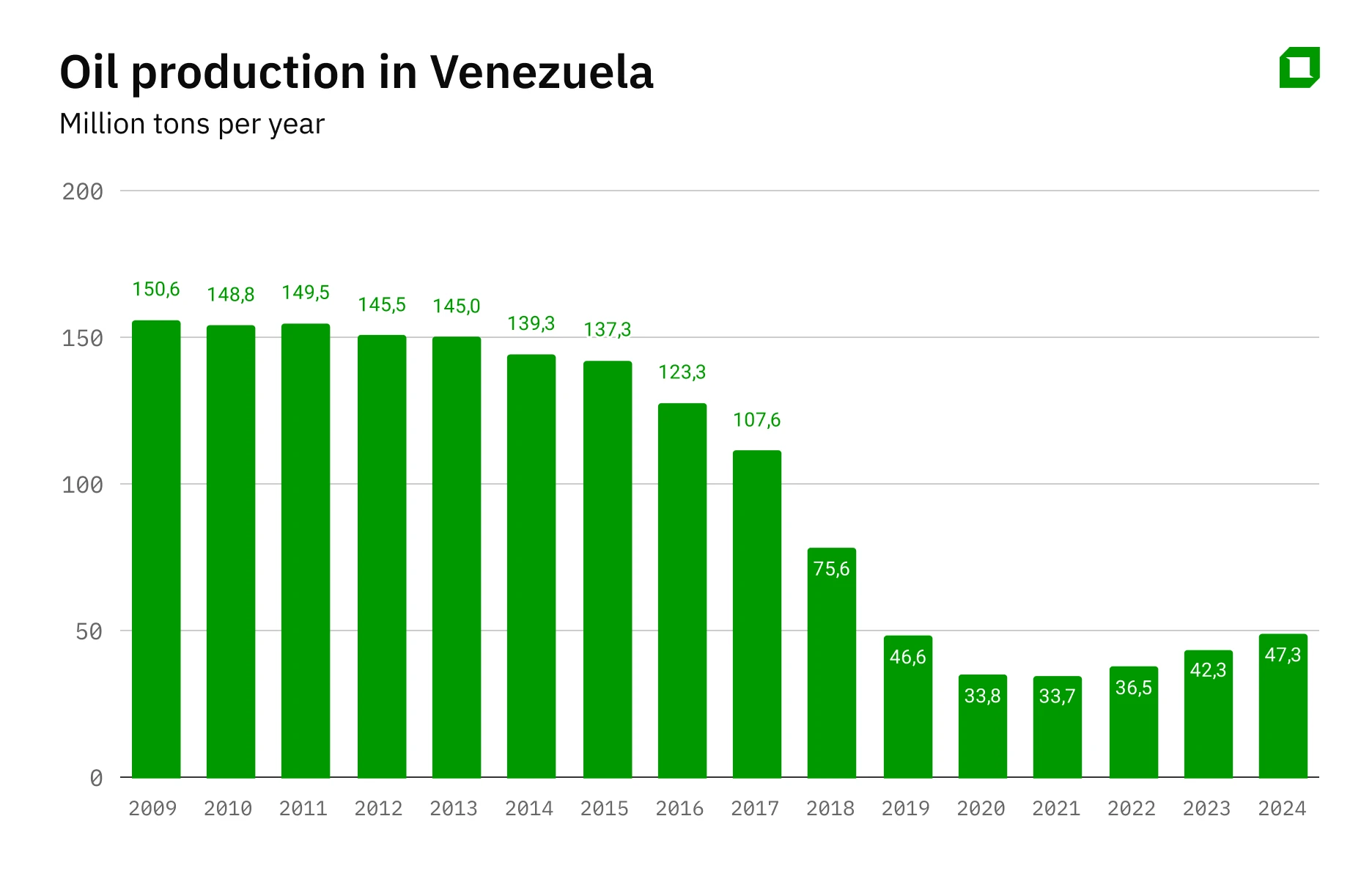

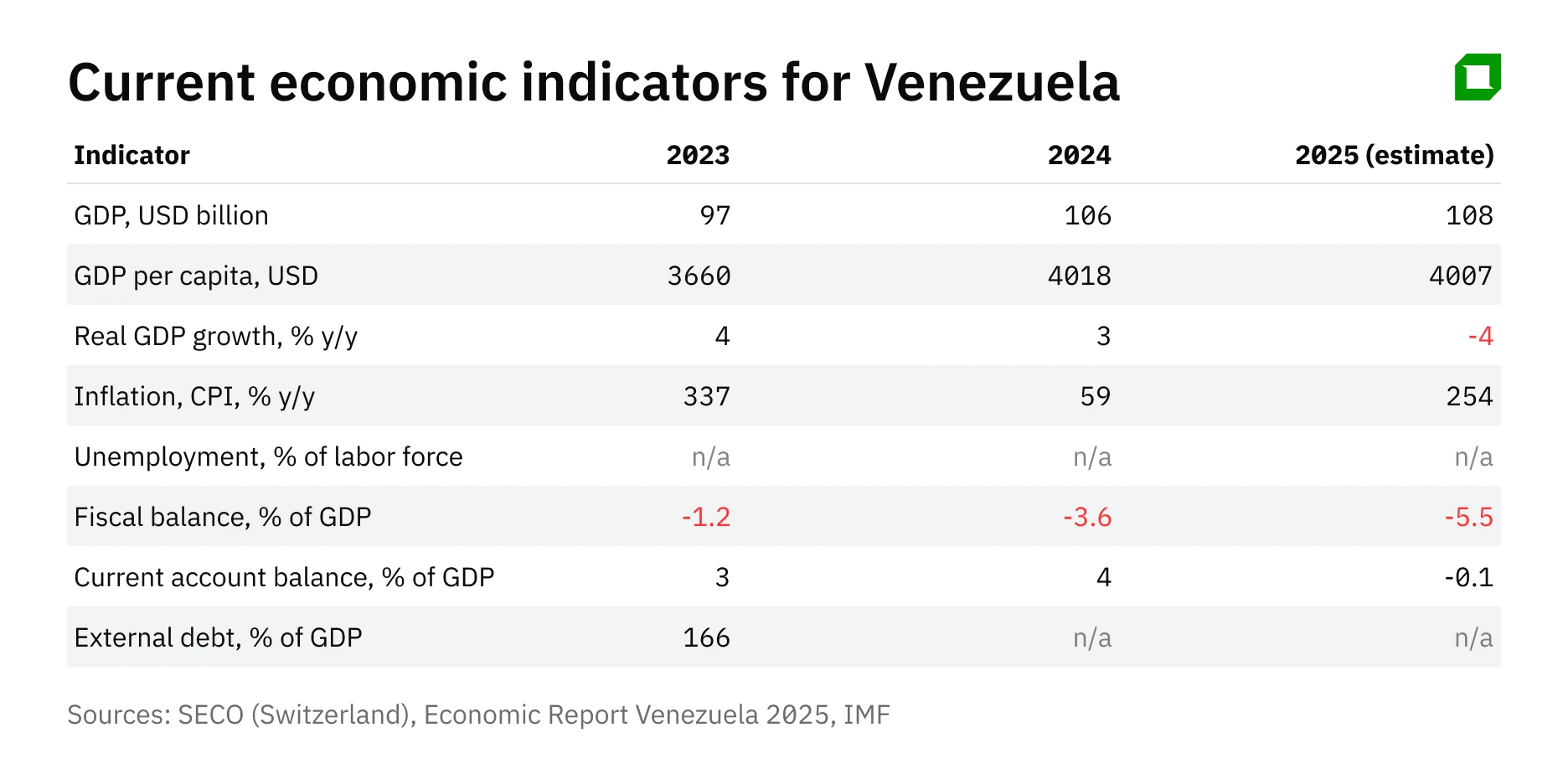

The combination of dependence on oil exports, US sanctions - in May the Trump administration imposed new sectoral sanctions on oil exports - plus social redistribution, primitive monetization of the budget deficit, corruption and investment outflow have all led to hyperinflation. In 2025, it remains one of the highest in the world - the IMF predicts it will be 254%, SECO writes that the figure could reach 530%. The fall in GDP between 2013 and 2021 was up to 80%, correlated with oil production.

The way the government continuously printed money to cover the budget deficit undermined confidence in the national currency and led to a switch to US dollars even for everyday transactions.

The crisis stimulated mass emigration: according to UN data, 7.9 million people left the country. This is the only reason why the unemployment rate is relatively low - 5.5% according to the World Bank for 2024.

The situation in Venezuela's agriculture has been "unique" for decades - only the collective farming experience of the USSR is probably worse. Having huge agricultural areas, the country has to import about 60% of the total food consumption: state control over food prices destroys farms, no incentives for business to import substitution are expected yet.

The government's economic policy in 2020-2025 was and remains focused on two areas - to prevent oil production from falling and to fill the budget to purchase the necessary minimum of consumer goods.

The country's economy depends on being able to adapt to working with counterparties that can defy sanctions. The state exchanges oil for a minimum set of goods without investing in Venezuela itself.

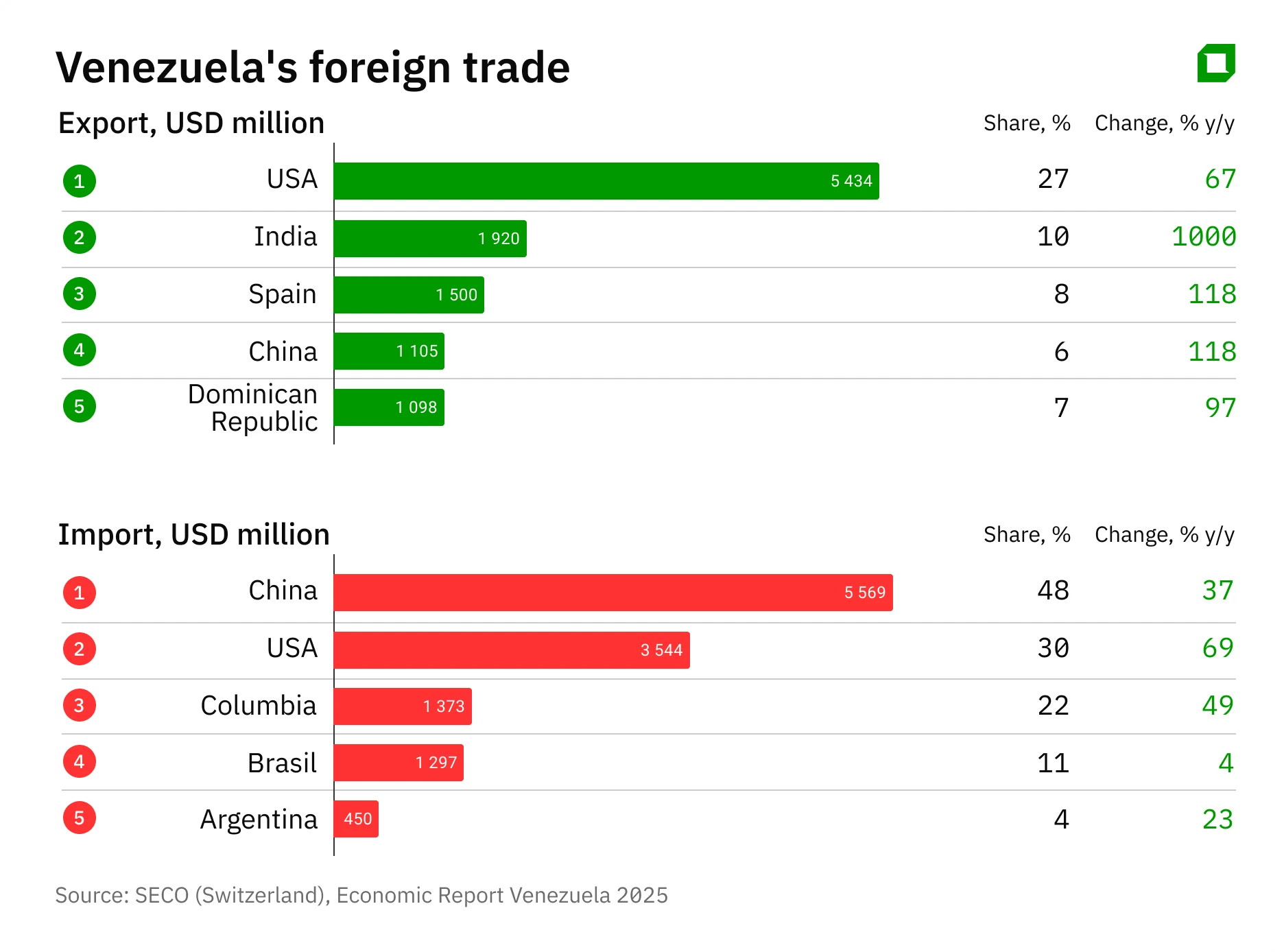

Since 1999, under Chavez, the country's foreign trade doctrine has shifted from the West to the countries of the "Global South," primarily China, Turkey, Iran, and India. Cooperation with Russia was also discussed, but in practice the trade volumes were minimal - also due to lack of financing and complicated logistics) At the same time, despite the sanctions, Venezuela's largest export trading partner remains the United States - and in 2024 the volume of Venezuelan goods sold to the United States increased by 67%.

Alternative payment mechanisms to circumvent sanctions have been arranged with China: China is the main supplier of goods to Venezuela, with imports growing by 52% in 2024 (year-on-year) China also accounts for the most outstanding debt - up to $12 billion.

Overall, the economic situation remains dependent on oil exports, hence sanctions and access to capital.

What an investor needs to know

In July, Atlantic Council analysts wrote that Washington is now considering two fundamentally different paths toward Venezuela: either a "push for reform" through the lifting of some sanctions and business incentives, or a "maximum pressure" regime aimed at changing the government.

Any scenario suggests the need for a transition to a liberal, market-oriented course - to become interesting for investors, the government must quickly "open up" the economy and achieve the removal of US sanctions.

Notable results could be achieved within a year if the authorities focus on reforms in the following areas:

- Allow free circulation of the dollar and freely convertible currencies, remove currency controls and restore the independence of the Central Bank

- Guarantee property rights and adopt anti-corruption laws. As an option for a radical solution to the problem, it is possible to create an International Financial Center in the country, where the legal system would be based on the principles of British law - as it was implemented in Kazakhstan.

- Abolish state price controls and simplify licensing.

- Provide state guarantees to investors, attract and allow all brands interested in the Venezuelan market to return

- Reduce the tax burden on business, move to a simplified taxation system for small businesses with minimum rates on turnover - up to 5%).

- Tariff reforms and privatization of the most worn-out generation facilities are needed to attract investment in the power sector

- Logistics and supply chain reform: reduce dependence on imports from China by removing all limited competition in maritime services as well as high freight costs.

- Development of Free Economic Zones (FEZs) for investors and not only from the Global South

Promising sectors for investment

The country will become interesting for investors only in case of reforms. And here are a few promising, in our opinion, industries:

- Food and agriculture

The sector depends on imports of raw materials and ingredients, with imports of agro-commodities totaling $3 billion in 2024, according to the U.S. Department of Agriculture. At the same time, the food industry remains fragmented, with hundreds of small companies operating, and only a few major brands - Alimentos Polar, Nestlé, PepsiCo, P&G, Colgate-Palmolive - holding key positions.

In agriculture, the potential remains in the production of corn, rice, sugar cane, coffee, cocoa and beef. The removal of sanctions and payment barriers will give access to loans and leasing of equipment, purchase of fuel, fertilizers. In this case, we can forecast growth in the harvest of grains and oilseeds for 3 seasons, expansion of capacity of flour milling, dairy, meat, sugar, oil and fat industries and production of beverages.

Investments will quickly pay off in the creation of elevators, seed production, agro-insurance, lending against the security of crops, and the development of distribution networks. In the agricultural sector and the food industry, growth of up to 40% in the output of basic products and reduction of imports to 20% is possible in 2 - 3 years.

- The telecom sector will capitalize on investments in growth and quality of connectivity - which also stimulates local media development. Frequency spectrum buyout; niche B2B solutions, import and local assembly of communications equipment.

- Tourism will start to recover from a low base. The historical peak was in 2013, when about 1 million tourists came to the country. In addition to visa facilitation for customers from "target" markets - the EU, the US and Canada - high security standards are also needed. Destinations such as the Los Roques Archipelago, Canaima, Margarita, Andean routes, and the Orinoco Delta will attract tourists.

"Caribbean Plus" - beaches and diving in Los Roques, World Class Nature in Canaima and Roraima, Heritage & City Breaks in Caracas. It is possible to sell concessions for airports and cruise ship marinas. Payback will be faster in small hotel projects with 30-80 rooms and apart-hotels. The goal is to increase tourist traffic in two years to 2-2.5 million foreign tourists and the introduction of 15-20 thousand new hotel rooms.

Air service to Venezuela is available: Iberia has restored regular Madrid-Caracas flights from 2024, Turkish Airlines and a number of other airlines have ramped up flights for the 2024-2025 Northern Hemisphere winter season.

Retail

"Dollarization" gave some stimulus to development, accelerating both non-cash currency payments and e-commerce. The industry that saw notable growth was retail. Growth is estimated at up to 20% in 2025 as the market structure changed from "street markets" to supermarket chains. Chains such as Central Madeirense, Excelsior Gama, Automercados Plaza's showed rapid turnover growth in 2024-2025 Need investment in distribution centers. Consolidation and the arrival of regional chains will have an effect if price controls are abolished, import tariffs are reduced, and uniform sanitary rules and labeling are introduced.

Transportation and logistics: ports and roads

Major ports including Puerto Cabello (Carabobo) and La Guaira (Varacas), Maricaibo and Guanta Puerto la Cruz are in need of modernization. After 2019, when Washington tightened sanctions, cargo flows sagged, direct links to the US are currently limited and a significant share of containers go through Panama. Big logistics companies are still serving Venezuela's importers and exporters through regional services and partners. Liberalization of logistics is needed: return and expansion of regular container services, concessions for terminals, digitalization of procedures and single window at ports, as well as development of modern warehouses at ports.

Development

Many years of lack of investment causes a shortage of quality housing, modern offices and warehouses. There is no financing for projects. With liberalization, the "first wave" in the industry will cover the renovation of shopping malls and hotels; last-mile warehouses; co-working spaces and class A offices in Caracas. "Second wave" investments - within 2-5 years - are possible in mid-price segment housing clusters and industrial parks.

Financing instruments: in addition to banks (primarily foreign banks), REIT funds, issuance of project bonds, export credit agencies providing loans for equipment and materials. In two years it is possible to create 1 million m² of reconstructed and new quality space.

Investments in securities

The current state of the country's securities market can be characterized as "very small but alive". In 2025, with the authorities not really interfering with the work, the Caracas Securities Exchange - Bolsa de Valores de Caracas, BVC - has even seen an increase in activity. The IBVC index in US dollars added about 70% in January-July 2025 and total turnover on the BVC reached %83 million, of which 42% was in debt securities.

Abroad, the Eurobonds of Venezuela and PDVSA are primarily known: the total amount of all issues - about $60 billion - are in default since 2017-2019, but are traded in some countries on the interbank market. The ban on secondary trading of part of the issues for US citizens was lifted in 2023, but the primary market for government borrowers and PDVSA in the US remains closed. In September 2025, a New York court upheld the validity of the PDVSA 2020 bonds and the processes around asset security continue. This has caused market prices for some bonds to rise from 10% of face value to 17-20%, but it is not yet clear how much they may rise on significant political news.

A number of companies of Venezuelan origin are listed in Latin American countries, for example, Mercantil Servicios Financieros Internacional on Panama's exchange - Latinex But the main issue for investors is likely to be the prospect of transferring funds from abroad to the accounts of brokers working for the Caracas exchange and back. The beginning of liberalization of this sphere may mean an unprecedented growth of the market.

Another critical factor in the success of reforms: beat crime

The crime rate in Venezuela is one of the highest in the world, which is a consequence of the systemic economic crisis, massive poverty and the peculiarities of the development of local and international criminal networks in the country. including drug trafficking. If reforms are initiated, this factor will be an extremely strong brake on economic development. It will be especially difficult to overcome such entrenched under the socialist regime "sources of strength" of OCGs as the presence of large armed groups - colectivos - and their political "roofing", on the one hand. And the weakness of state institutions, especially corrupt law enforcement agencies and courts, on the other hand.

The country is divided into territories with local as well as Colombian gangs, which de facto permit or not any business. Nonviolent but pervasive criminal practices - extortion and fraud - abound. Businesses at all levels bear direct costs - security, insurance, systemic "rent" from logistics and retail. Everyone pays the "criminal tax", including it in the prices of goods and services. This has already reduced the flow of investment and credit - legal uncertainty and violence will deter any business in the future - even big oil.

The state will need to return the "right to violence" and disarm gangs with the help of the army and possibly after lustration of law enforcement agencies. Reform criminal justice: independent courts, create a system of witness protection, establish a special prosecutor's office for organized crime, including with foreign assistance. The U.S. air force and navy, as Washington claims, are already destroying drug traffickers' ships in the region.

If the authorities really want to move to a new economic model and achieve economic growth, the entire domestic policy of Venezuela will have to undergo enormous changes. It will require not only a reconfiguration of the mechanisms of economic management to radically increase the role of private - including foreign capital, but also to reduce the role of the inefficient public sector.

The economy has huge potential not only in the oil sector, but also in many others. And everything depends on the determination of reformers here even more than on their international support.

This article was AI-translated and verified by a human editor