Platinum vs. palladium: what investors should bet on

Platinum group metals may become an attractive alternative for investors who failed to capitalize on the gold rally. The outlook for 2025-2026 is generally favorable for platinum, while palladium faces tougher market conditions. Freedom Broker analyst Vitaly Kononov tells us what is important for investors wishing to capitalize on these metals.

Rate: platinum group metals

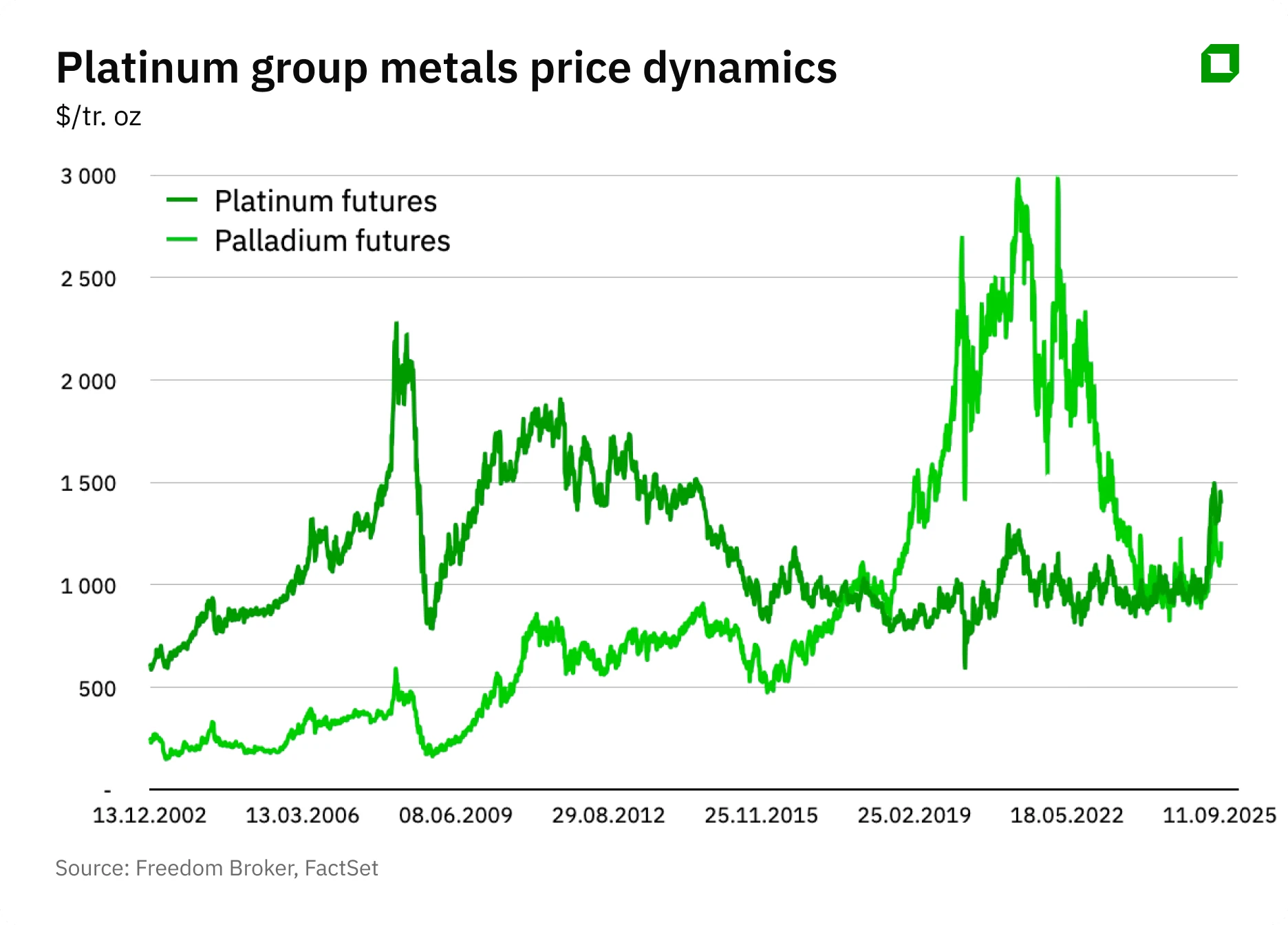

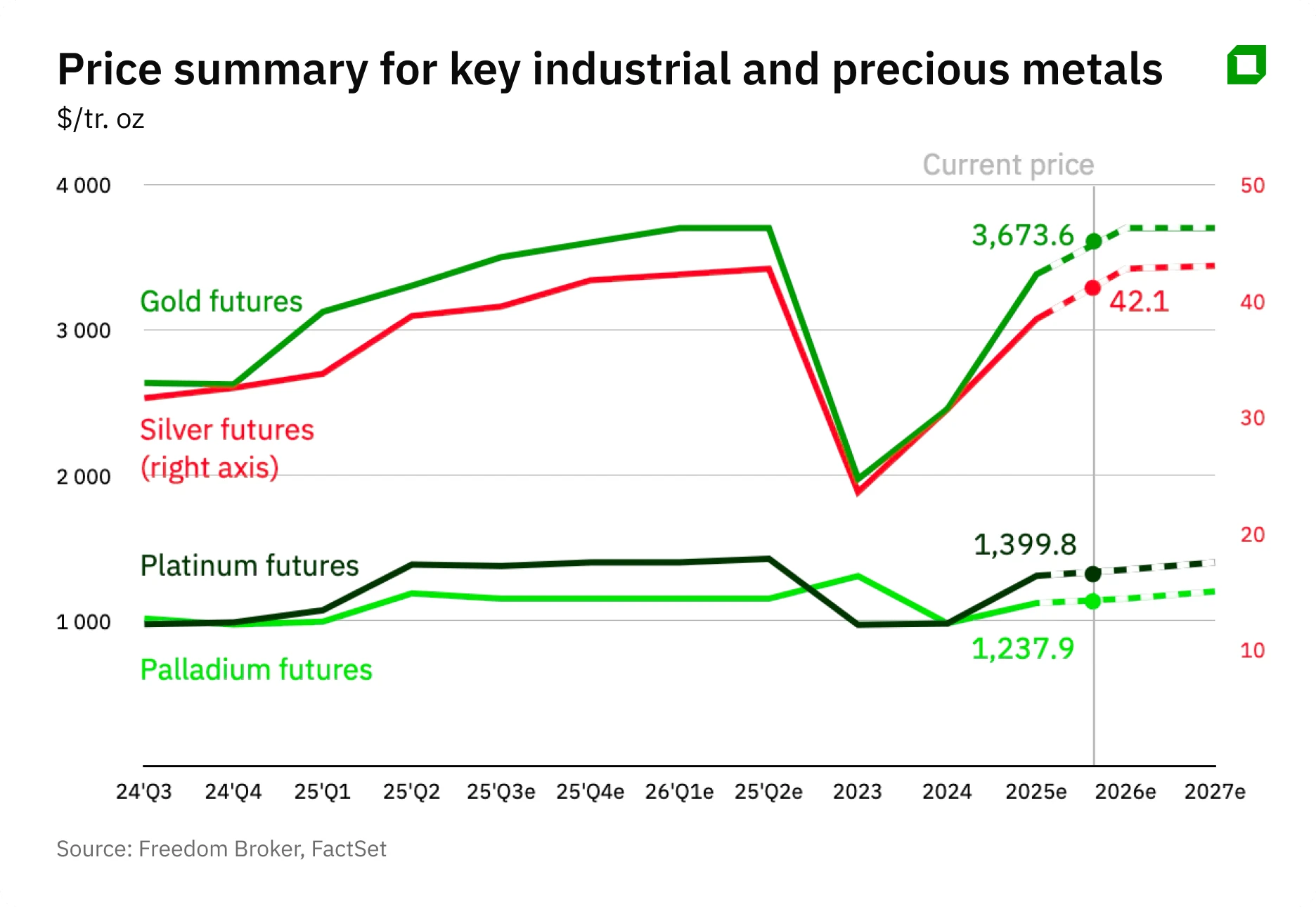

Platinum is the leading metal in 2025 without exaggeration. Platinum prices have increased by more than 50% since the beginning of the year, surpassing $1400 per ounce for the first time in four years.

C 2022 three-year prices for this metal have remained in an average range of about $900-1.1 thousand per ounce.

In general, prices for platinum group metals (which, in addition to platinum, include palladium and rhodium) have been declining for several years. One reason was that platinum and palladium are widely used to make catalysts in diesel and heavy-duty vehicles. Prices were falling on the assumption that demand for the metal would weaken as electric cars displace internal combustion engine vehicles.

But already last year the market saw the prerequisites for price recovery. The growth was fueled by the news of staff cuts at South Africa's Implats - in April 2024, the company said it might lay off 3,900 people due to low prices. The company produces 20% of the platinum group metals market volume (based on 2024 data), and investors perceived the news of staff layoffs as an increase in the risk of shortage of these metals on the market. In February of the same year, two other producers - Anglo American Platinum (now Valterra) and Sibanye-Stillwater - also announced plans to lay off 3.7 thousand and about 2 thousand people respectively.

According to the World Platinum Investment Council (WPIC), this year the platinum market deficit will amount to 850 thousand ounces, it will remain until 2029 and will average 727 thousand ounces per year. This is about 9% of annual demand. WPIC forecasts production to stabilize around 3.9 million ounces per year by 2029, but only after a long period of curtailments. By the end of the decade, above-ground reserves of this metal may be completely exhausted.

The persistent shortage of this metal is influenced by three key factors. First, South African miners produce about 70% of the world's platinum output and operate some of the oldest and deepest mines in the world. Companies in the region face chronic power outages, and internal labor disputes and restructuring only reduce production. The already mentioned stories of Implats and Sibanye-Stillwater are prime examples.

Secondly, companies in North America are incurring high costs - affected by the high inflation of the past two years, which has affected all components of costs - from salaries to equipment and contract services.

Earlier this decade, platinum group metals mining enabled Sibanye-Stillwater, for example, to reduce its dependence on aging mines in South Africa and brought it generous profits. But the subsequent drop in prices forced the company and its competitors to cut costs and staff. The restructuring plan called for Sibanye-Stillwater to cut production by about a third in 2025 at its U.S. assets from 2025 production levels from last year.

Finally, the third factor is the weak recycling recovery. Despite rising prices, recycling volumes have not returned to pre-2022 levels. WPIC forecasts only a moderate recovery in 2025, which does not relieve the deficit.

Palladium is losing

As for palladium, the situation here is not so unambiguous. Automakers are increasingly replacing this metal with platinum, while processing volumes remain stable.

Back in early 2024, palladium lost its multi-year premium to platinum - it reached $2 thousand per ounce. Prices for this metal this year fluctuated in the range of $890-1350 per ounce, mainly driven by speculators. Now the volume of short positions (i.e., those designed to reduce the price of the asset) is close to a record high, which increases the likelihood of volatility or "short-squeezes" in case of unexpected changes in fundamental factors.

WPIC forecasts a small deficit of the metal in 2025 and a moderate surplus in 2026. Automakers are replenishing inventories and suppliers are maintaining supply discipline, all of which will support prices in the short term, but palladium's upside potential is notably lower than platinum's.

So far, the situation is still in platinum's favor. Car manufacturers replacing palladium with this metal will continue to increase demand for it.

In addition to the automotive industry, platinum is used to make jewelry. And high gold prices - on September 15 it was trading near the $3.64 thousand per ounce level - have stimulated growth of its consumption in jewelry in China in 2025. WPIC has already raised its forecast for jewelry demand for platinum by 8% in 2026-2029.

Platinum is also important in the production of hydrogen fuel cells and some chemical processes. Even if these technologies are still developing slowly, a slight increase in their use could increase the scarcity of this metal.

Palladium, on the other hand, lacks comparable investment support, and its demand remains more vulnerable. For this metal, prospects in niche segments (glass fiber, microelectronics, electrolysis, jewelry alloys for white gold) are less significant and do not compensate for losses due to substitution by platinum.

Investment Conclusions

Platinum remains a priority asset among platinum group metals.

Conservative investors should consider the Physical Platinum Shares ETF (PPLT), while investors with a higher risk profile should buy shares of low-cost producers, such as Sibanye-Stillwater. Since the beginning of the year, this company's securities have increased in value by more than 170%.

Palladium is more suited for tactical positions, especially in the event of an auto-industrial recovery or speculative bounces.

Investors may consider investing in the Physical Palladium Shares ETF (PALL). However, its substitution and lack of a broad investment base make it less attractive in the long term.

Does not constitute an investment recommendation.

This article was AI-translated and verified by a human editor