Prices at peak, the biggest investors are in: how to make money from cryptocurrency now

The current rally in cryptocurrencies is impressive - it may even go down in history as the moment when cryptocurrencies finally established themselves as a full-fledged investment class. Why this happened and how you can now make money on cryptocurrencies, wrote portfolio manager Astero Falcon Alyona Nikolaeva. s portfolio manager;

Main Drivers

Back in early July, it seemed that the crypto market was trading in a narrow corridor with no obvious reason for growth. However, in recent days, it has synchronously rushed upward on all fronts. For the first time in a long time, the three largest cryptocurrencies - bictoin, ether and Ripple - have simultaneously rushed into growth.

On July 1, bitcoin traded around $105,000, and on July 14, it reached a peak of $123.15,000, after which it corrected. Ether rose above $3k, its highest level since February. Ripple was the surprise of the season: this currency of the XRP network added 12% during the day from July 11 to July 12 and almost 26% during the week of July 16, coming close to $3. Thanks to this, it again surpassed Tether and regained the third place in capitalization - now it exceeds $170 billion. The total capitalization of the crypto market approached $3.7 trillion, a level unthinkable a year ago.

The main driver is record inflows of institutional capital through spot bitcoin-ETFs. Last Thursday, net inflows into such funds totaled $1.22 billion - a record since Donald Trump won the U.S. presidential election (an event that sparked optimism in the crypto market last year). And since the beginning of the year, the total inflow of investors' funds has exceeded $15 billion. The flagship exchange-traded fund iShares Bitcoin Trust ETF from BlackRock attracted about $1 billion just last Friday. The fund has accumulated more than 700 thousand bitcoins, about 3.5% of all existing "coins" of this cryptocurrency;

In parallel, companies continue to build up crypto reserves: Strategy holds more than 600,000 bitcoins, and the total balance of corporate crypto assets for the first time exceeded $150 billion, which is already comparable to the official foreign exchange reserves of a number of countries.

An equally important factor is the dramatic reversal of US public policy in favor of the crypto industry. President Trump wants to lead the crypto race. On March 6, 2025, he signed an executive order to create a strategic cryptocurrency state reserve of the United States.

And on July 14, Congress kicked off Crypto Week, the biggest political event for the industry in years. This, too, spurred the cryptocurrency rally.

Three systemically important laws are on the legislators' agenda: the GENIUS Act, which removes stablecoins from the gray zone, effectively equating them with the digital dollar, the Clarity Act, which for the first time clearly categorizes cryptocurrencies, delineating the oversight of the Securities and Exchange Commission and the Commodity Futures Trading Commission and giving the industry clear rules of the game. And finally, the Anti-CBDC Surveillance State Act, which bans the issuance of central bank digital currency, enshrining the priority of private stablecoins and decentralized currencies.

The House of Representatives was supposed to vote on the GENIUS Act on Tuesday, July 15, but the vote failed - albeit due to procedural issues. But Trump has already intervened in the process and assures there will be a second vote today. This is more of a pause than a change of heart. Overall, however, it is safe to say that the process of simplifying and clarifying regulation of the cryptocurrency market is accompanied by broad bipartisan support.

The U.S. is de facto shaping global standards for the crypto market, influencing not only local participants, but also setting the tone for Europe and Asia.

The market is maturing

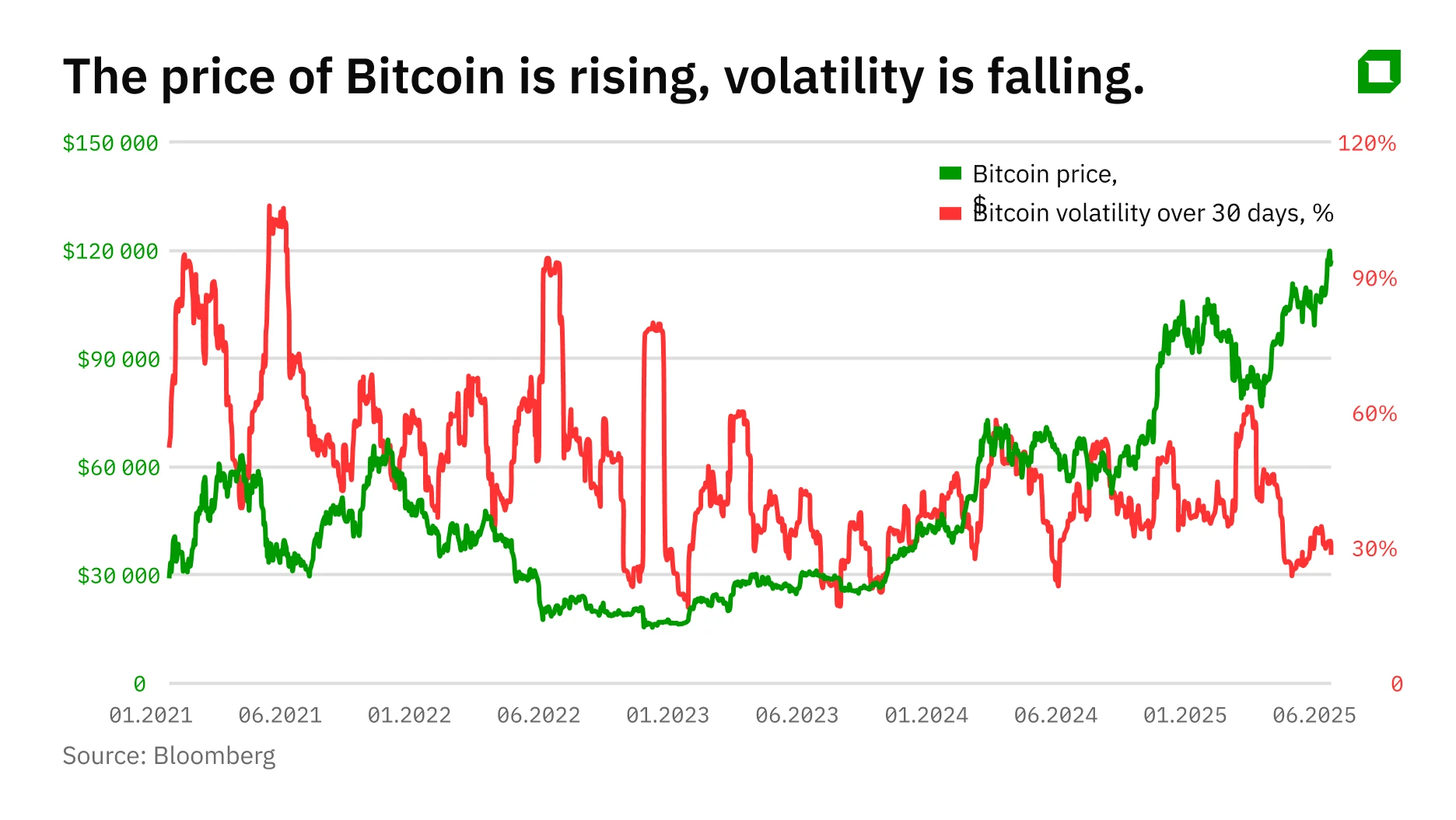

The current growth is taking place against the backdrop of a noticeably lower volatility of bitcoin. Since the end of March last year, the price of this cryptocurrency has grown by more than 85%, from about $63 thousand, but without the usual "hysteria" in the market. Meanwhile, the 30-day realized volatility has fallen from about 60% to 28% during the same time. These are near the lowest levels since 2023.

This fuels talk of a maturing market and confirms a shift in demand patterns: funds and large investors, rather than small retailers, now create the main movement.

The arrival of the big players brings with it hedging practices and the building of positions through options, which smooths out sharp market movements. The "strong growth = excessive volatility" linkage no longer works.

Retail is returning to the market, more in the role of a catch-up player. After a prolonged "cryptozyme," many private traders stayed away, recovering from the 2022-2023 collapses.

But bitcoin's ascent to new heights has caught the attention of the general public and revived the familiar FOMO effect - fear of missing out, the fear of missing out on something interesting, in this case, a promising opportunity to make money;

Trading volumes on Coinbase and Binance have increased, search queries and social media activity have returned to the level of previous peaks. Nevertheless, the key tone is set by institutional investors, who have been keeping the bitcoin price above $100,000 for more than two months. Spot liquidity is concentrated in ETFs and over-the-counter transactions. More than 70% of bitcoins stay unmoved for more than 90 days - a record high in the history of observations.

Mass liquidation of short positions became an additional "fuel" for growth. For a long time bitcoin was trading below $100 thousand, and many people bet on its fall. But the rise in price above $116,000 triggered a chain of short-squeezes: over $1 billion worth of short positions were liquidated overnight, according to data Coinglass for July 11. "Bears" were literally being taken out of the market, pushing the price even higher.

The impact of the derivatives market on investors' mood should be noted separately. For several weeks already traders have been actively betting on bitcoin growth to $140-150 thousand via options on Deribit exchange. Such "option magnets" often become benchmarks for the market, and this coincides with the targets we indicated in our analysis back at the beginning of the year;

A consensus is forming around bitcoin that it can be used as a "shield" in the face of inflation and tariff uncertainty. Although previously the cryptocurrency was considered a purely speculative instrument. Inflation in the U.S. and the announcement of new duties starting August 1 only reinforce this narrative. Bitcoin is already perceived as a separate "protective" part of a portfolio - along with gold and bonds.

What's an investor to do now

In the current crypto rally, investors are choosing between several strategies depending on their risk profile. The basis for the majority is to hold cryptocurrency and in parallel make money from selling options on it without losing the asset itself. For more conservative players, ETFs and stocks of crypto companies like Strategy are available. This is easier to manage and works with a direct link to market dynamics.

The basic rule for a cryptocurrency portfolio remains the same: bitcoin as the flagship plus altcoins for diversification. Ether and Ripple are especially relevant in the catch-up phases of the cycle. Plus, there is growing interest in tokenized assets and securitized products based on Ethereum.

Passive income is another working option: ether staking (when a market participant blocks coins online), which yields about 5%, or opening VTS deposits through large providers and regulated platforms like Binance Earn. This is not a quick buck, but a tool to monetize long-term storage.

The universal principle remains the same: do not invest more than you are prepared to lose and keep a sober head. Yes, the crypto market is becoming institutionalized, but it remains volatile and requires discipline. There is nothing to be done here without a clear strategy and a pre-thought-out exit.

Overall, the outlook for long-term holders looks optimistic;

The crypto industry is experiencing a moment of triumph: prices are at their peak, major financial players are on board, lawmakers are finally helping rather than hindering. Bitcoin is now seen as part of the macro portfolio, along with gold, bonds and stocks.

At the same time, the structure of the crypto market has become closer to traditional assets with a concomitant decrease in volatility on the rise. In this sense, the summer rally of 2025 will go down in history not only by reaching new highs, but also as the moment when cryptocurrencies finally established themselves as a full-fledged investment class.

This article was AI-translated and verified by a human editor