Raiffeisen Bank's 2025 report: what investors need to know about its business in Russia

Raiffeisenbank, a Russian subsidiary of the Austrian RBI group, generates a significant share of its profits. But its Austrian owners cannot receive dividends from it because of Russian laws and courts. On January 30, the Austrian bank will publish preliminary results for 2025. What should investors know about the bank's business in Russia?

An uneven year

In Q3 2025, Raiffeisenbank earned a net profit of €319 mln, which is about 38% of RBI's total result. For comparison: all Central European subsidiaries in July-September together brought the group €186 mln, and Southern European subsidiaries - €239 mln. The Ukrainian business, separated into a separate regional segment, brought €54 mln in profit.

Raiffeisenbank's financial result in 2025 was not flat. Having started with a net profit of €425 million in Q1 (+31% year-on-year and 56% of RBI's total profit in Q1), already in Q2 the operationally profitable bank faced a record net loss of €861 million. It was triggered by a dispute with Rasperia Trading Limited, the Russian co-owner of Austrian construction concern Strabag.

In 2023, RBI agreed to buy for €1.5 billion 27.78% in the Austrian concern Strabag from Rasperia Trading Limited, controlled by the structures of Oleg Deripaska, a Russian businessman under sanctions. Thanks to the deal, Rasperia would get rid of the European asset, Strabag would get rid of a sanctioned minority shareholder, and RBI would be able to use part of Raiffeisenbank's profits, which were stuck in Russia because of the ban on repatriation of dividends. But in May 2024, RBI backed out of the deal as it failed to get approval from European and US regulators. Soon Rasperia Trading Limited (as it became known after re-registration in the Russian Federation) and its related parties fell under the blocking sanctions of the U.S. and the EU. In the same year, this company filed a lawsuit in a Russian court, accusing other participants in the deal of removing their representatives from the management of Strabag, diluting their share and failing to pay dividends. The court ordered Raiffeisenbank to pay it €2.044 billion. The bank failed to challenge the decision in higher instances and planned to appeal to a court in Austria. But the law on "anti-suit injunctions" allowed Rasperia to obtain an injunction against continuing the dispute with Strabag and RBI outside Russia. As a rule, in such cases the Russian court sets a very high penalty for violation of the injunction. As a result, RBI abandoned its plans to litigate in Austria and wrote off €1.2 billion from its balance sheet. In 2025, Rasperia filed a new lawsuit to claim compensation for the reduction of Strabag's authorized capital in 2024 and unpaid dividends for that year. The Russian court again sided with it. Raiffeisenbank had to make new provisions for possible losses on the claim for €1.2 billion. It lost the lawsuit: the Russian court awarded the plaintiff more than €2 billion, which the Central Bank withdrew from Raiffeisenbank's accounts.

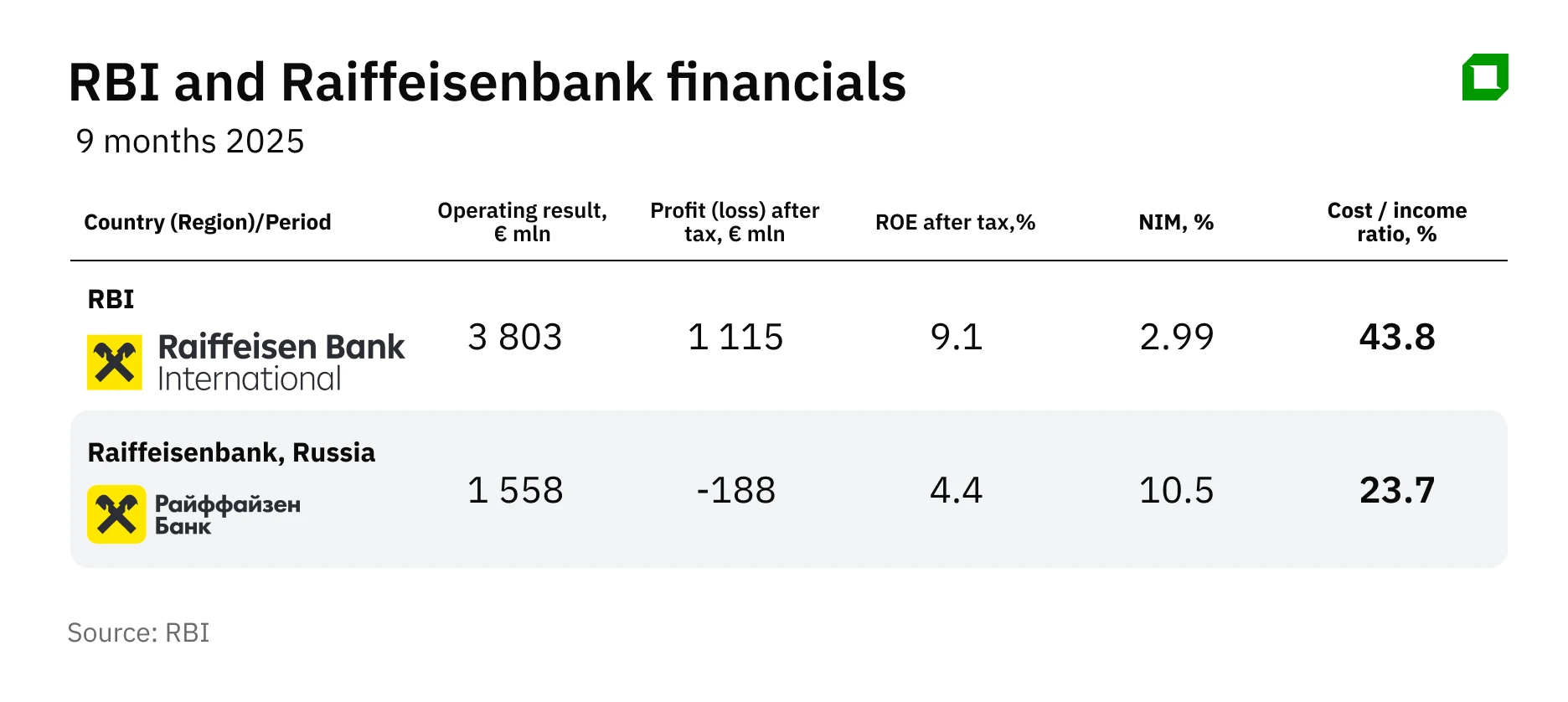

In 9M 2025, the operating result of the Russian subsidiary (operating profit) amounted to €1.558 bln, which is slightly less than half of RBI's total result. The indicator grew by 13.2% in annual terms. But due to the courts, RBI's Russian asset was left with a net loss of €188 mln.

Raiffeisenbank's cost-to-income ratio was 23.7% compared to the group's 43.8%. The lower the ratio, the more efficient the business is considered to be. By comparison, RBI's Central European banks had a 46.2% ratio and the South Eastern subsidiaries had a 40.7% ratio. The interest margin (NIM) - an indicator reflecting how successfully the bank manages the difference between the interest received on loans and the income paid to depositors - amounted to 10.05% in January-September against RBI's 2.99%.

The bank has outperformed all other RBI subsidiaries in terms of operating result, interest margin for 9 months.

The financial result for 2025 of RBI and Raiffeisenbank has not yet been published, but in the fourth quarter its Russian subsidiary had to make provisions for €339 million for the new Rasperia lawsuit, which could affect the final figures.

What does Raiffeisenbank do for a living?

RBI is worth remaining cautious about, says KBW analyst Ben Maher. "There was little to no indication in the recent financial results conference calls about how its exit from Russia is progressing," he notes.

The Austrian group has indeed been undecided for three years about how to wind down its business in Russia. In 2022, when the Russian Federation started military operations in Ukraine, many foreign banks got rid of their assets in that country with varying speed. For example, France's SocGen sold Rosbank to Vladimir Potanin's Interros, Britain's HSBC sold to Expobank, Czech PPF Group got rid of its stake in Home Credit Bank, etc. SocGen and HSBC 's deals went through at a discount, Citigroup, which is selling Citibank to Renaissance Capital, said it will record a loss of $1.1 billion after taxes in the fourth quarter of 2025 because of the deal.

RBI disclosed possible scenarios for exiting Russia in 2023 - selling the business or taking it "outside the perimeter" of the group. But in 2025, it was still negotiating with interested parties. At various times they named businessman Istvan Tiborz, son-in-law of Hungarian Prime Minister Viktor Orbán, and sub-sanctioned VTB and Sber as part of an asset swap. Later, RBI announced that it was considering selling only 60% of Raiffeisenbank and retaining 40%.

Johann Strobl, executive director of RBI, explained the long exit from Russia by the complexity of the procedure - the deal has to be approved by the U.S. Treasury Department, the ECB and the Austrian regulator. Besides, in order to sell an asset in the Russian Federation, it is necessary to obtain a special permit from the Russian legal commission for control over foreign investments, get the consent of the president and approval of the Federal Antimonopoly Service and the Central Bank. And in 2024, exiting the Russian market has also become too expensive: a foreign seller must provide a discount of at least 60% of the market value of the asset, as well as make a voluntary contribution of 35% to the federal budget.

An RBI representative confirmed to Oninvest that the sale plans remain in place and Raiffeisenbank is "reducing the volume of operations in Russia" as required by European and Austrian regulators. When asked how the speed of the deal would be affected by Russia's inclusion in the EU's money laundering blacklist, RBI did not respond in substance. Raiffeisenbank declined to comment.

There was an upside to this slowness: Raiffeisenbank earned €2.058 billion in 2022, four times more than a year earlier. Its main income came from currency exchange operations and transaction business. That year, the bank became one of the hubs for capital withdrawal from Russia and cross-border settlements, as Russian banks proved unsuitable for such operations due to international sanctions and loss of access to SWIFT.

But already in 2023 its income fell to €1.341 billion, and in 2024 - to €1.024 billion. The impact of the reduction of business in Russia. The bank almost completely stopped issuing new loans, and its loan portfolio from January 1, 2022 to December 2025 shrank by 75% to 245.6 billion rubles. According to Expert RA (rating Raiffeisenbank), as of July 1, 2025, the share of loans to individuals and legal entities in the structure of the bank's assets was only 15.1%. For comparison, at the beginning of 2022 it was 58.9%.

Raiffeisenbank's operating activities are now limited to placing liquidity released from loan repayments into risk-free assets, primarily deposits with the Bank of Russia, Ivan Uklein, senior director for bank ratings at Expert RA, told Oninvest.

According to Expert RA estimates, as of July 1, 2025, 40.5% of the bank's assets were placed on deposits with the Central Bank, and another 25.2% in other banks. At the beginning of 2022, the bank held 9.7% of assets and 11.9% of assets in the Central Bank and banks, respectively.

Since 2023, the Bank of Russia has been raising the rate, in October 2024 it reached a record level of 21%, the regulator began to gradually reduce it only in the summer of 2025. It now stands at 16%. The rate hike helped the bank to maintain its interest income: it did not raise deposit rates, which reduced its interest expenses.

In addition, from 2022 Raiffeisenbank significantly reduced its transaction business by introducing fees for holding currency on accounts and outgoing SWIFT transfers, as well as increasing the threshold amounts for transfers. In 2024, the bank closed outgoing currency transfers for individuals and businesses, leaving such a service only for a limited number of corporate clients. According to Uklein, the bank continued to conduct settlement operations for them in 2025.

What problems does the "subsidiary" in the Russian Federation create for RBI?

First, Raiffeisenbank's contribution to RBI's profits is purely paper-based: the group cannot count on repatriation of the subsidiary's profits in the form of dividends. In 2022, the Central Bank banned the withdrawal of funds from Russia for legal entities from "unfriendly" countries (all EU members are in it). The ban was supplemented by a number of presidential decrees. Excluding Raiffeisenbank, RBI's financial result looks weaker.

Secondly, starting from 2022, RBI is obliged to report additional risks associated with military operations in Russia and Ukraine. In the third quarter of 2025, the group estimated the total amount of assets and financial liabilities under such risk at €4.73 billion for Ukraine and €8.75 billion for Russia. Earlier, similar risks were taken into account for Belarus. But in 2024 RBI managed to sell 87.74% in Belarus' Priorbank. The deal reduced the group's profit - due to the difference between the book value and the sale price - by €300 million in the first phase and up to €500 million after the deal was completed.

In addition, RBI has reputational risks. For example, in 2023, the U.S. Ministry of Finance requested information about the transactions of its clients. And investors were dissatisfied with the fact that Raiffeisenbank, obeying the laws of the Russian Federation, should provide credit vacations to mobilized people and write off debts of dead military men. Ukrainian authorities put Raiffeisenbank on the list of "war sponsors" but excluded it for approval of the EU's 12th package of sanctions against Russia.

Finally, RBI securities traded on the Vienna Stock Exchange have become sensitive to geopolitics. The group's shares reacted negatively to the outbreak of hostilities in Ukraine in 2022, experiencing a 45% drop in value between February and June. But this was not the biggest failure in its trading history.

Since the beginning of the year, RBI shares have added about 10% in price. Out of 13 analysts, 8 recommend its securities to buy, four have a "hold" recommendation and one has a "sell" recommendation. The average target price is €40.6. At the close of trading on January 28, they cost €41.74.