Rising spending and massive debt: does the U.S. have quick ways to solve the budget problem

The complete loss of the highest credit rating is a consequence of the U.S. budget problems that have been growing for years. Debt is mounting, it is becoming record expensive to service, and markets are already demanding a risk premium. Does the White House have ways to solve this problem?

Who reduced what exactly?

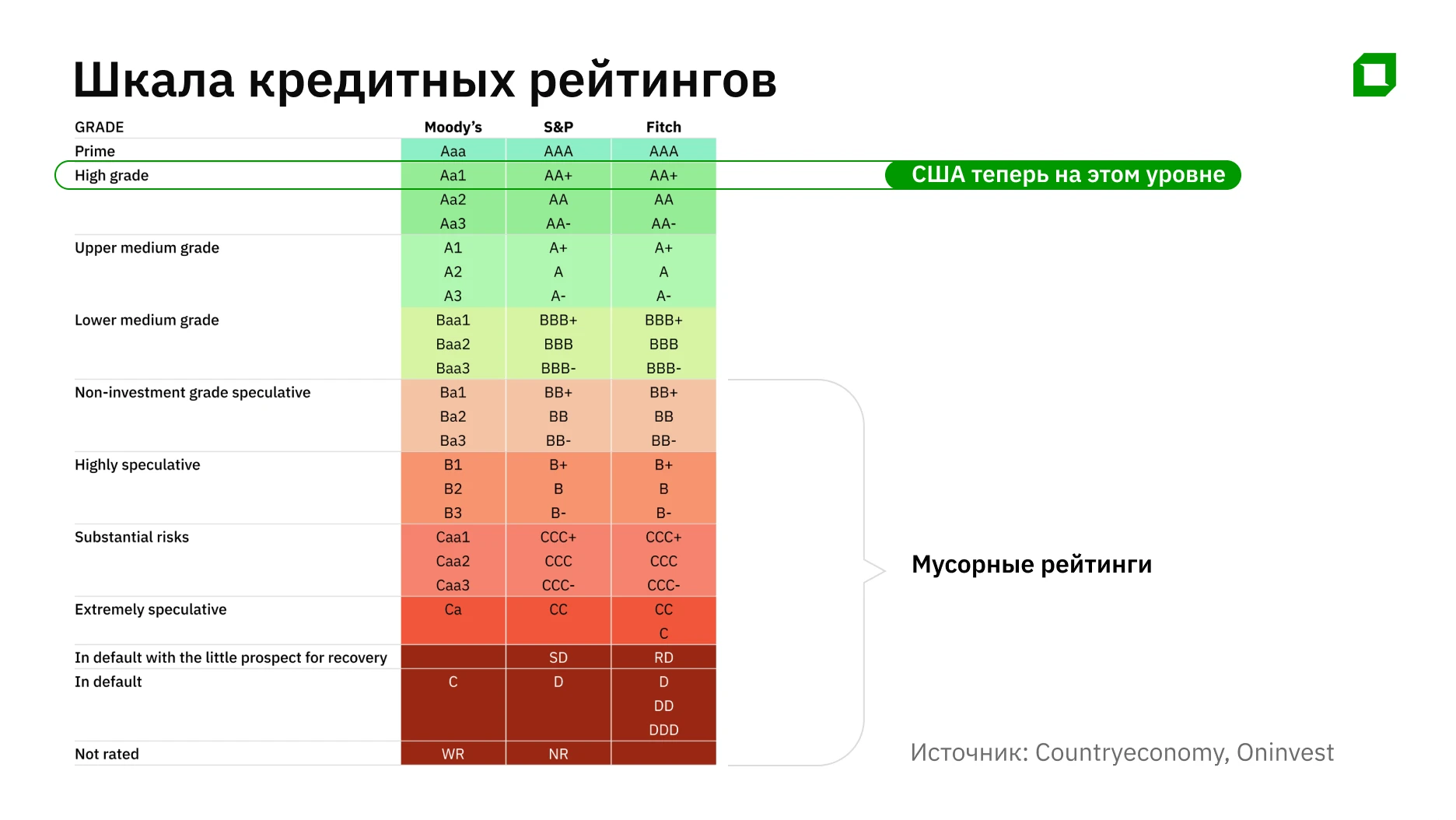

On May 16, Moody's reduced the U.S. rating from the top tier Aaa to Aa1 with a stable outlook. It became the latest of the top three global credit agencies to strip the U.S. of its top credit rating. S&P downgraded the U.S. in 2011, Fitch - in 2023.

The Troika of agencies assigns ratings to states that reflect their ability to repay government debt. The agencies' scales are similar and are divided into an "investment" part and a "junk" part. The lowest rung are default ratings for countries unable to pay their debts.

Alexander Orlov, Managing Director of Arbat Capital, believes that the downgrade itself is not a problem for the U.S. Ministry of Finance. A bigger downgrade - by two notches at once, to AA- level - would affect corporate borrowers, he believes. "The events of 2011 have shown: then, "junk" bonds suffered more, as funds had to sell more low-rated bonds and buy AA-rated U.S. government bonds to maintain the average rating of the portfolio, while there is very little AAA-rated corporate debt on the market," Orlov told Oninvest.

Reasons for downgrade

Moody's said in a statement that the downgrade by one notch "reflects the rise over more than a decade of the ratio of government debt and interest payments to levels that significantly exceed those of similarly rated sovereign borrowers."

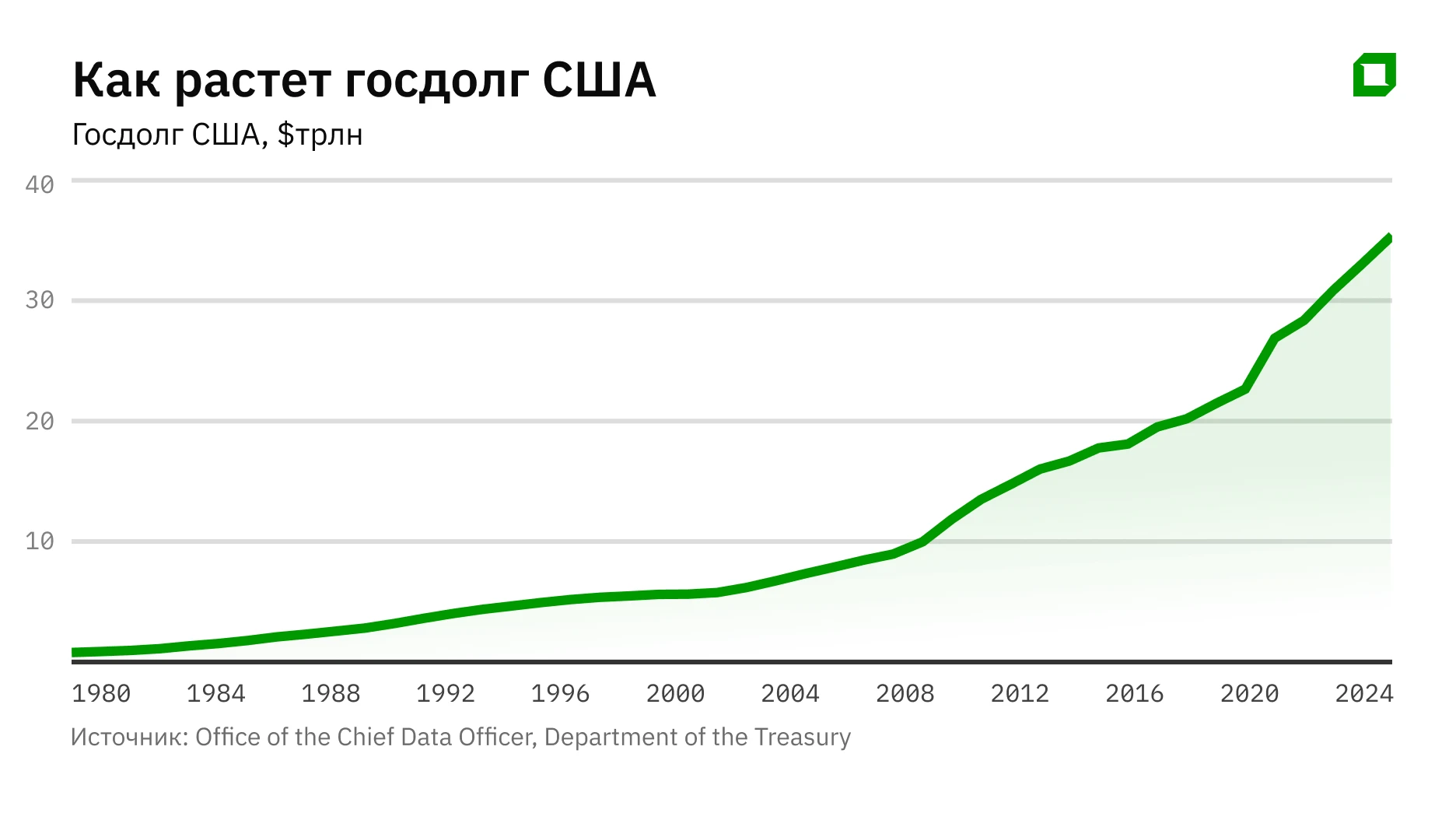

The national debt is actually rising. According to the U.S. Treasury, the 2024 budget year (through September 30, 2024) ended with a debt of $35.5 trillion.

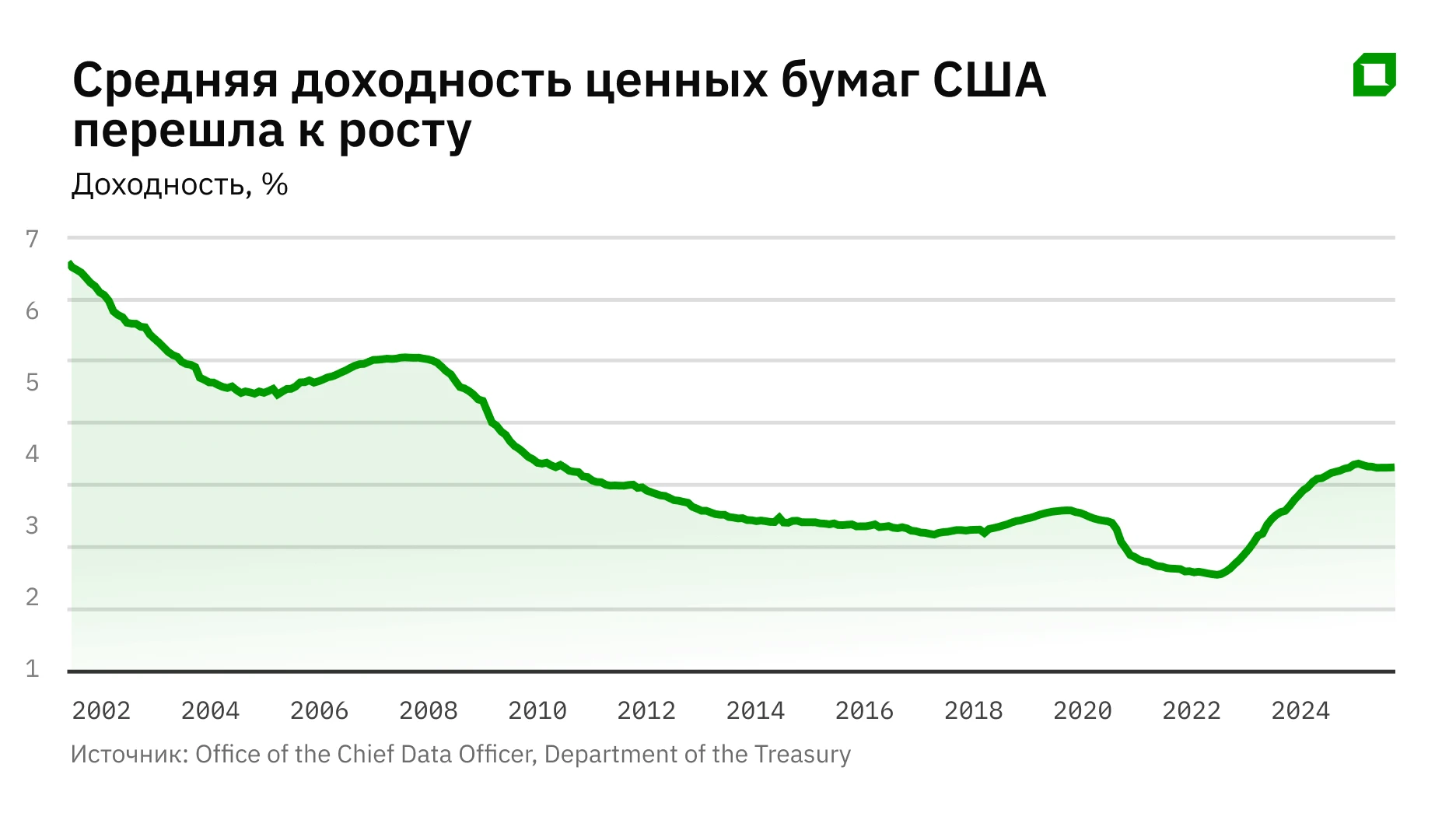

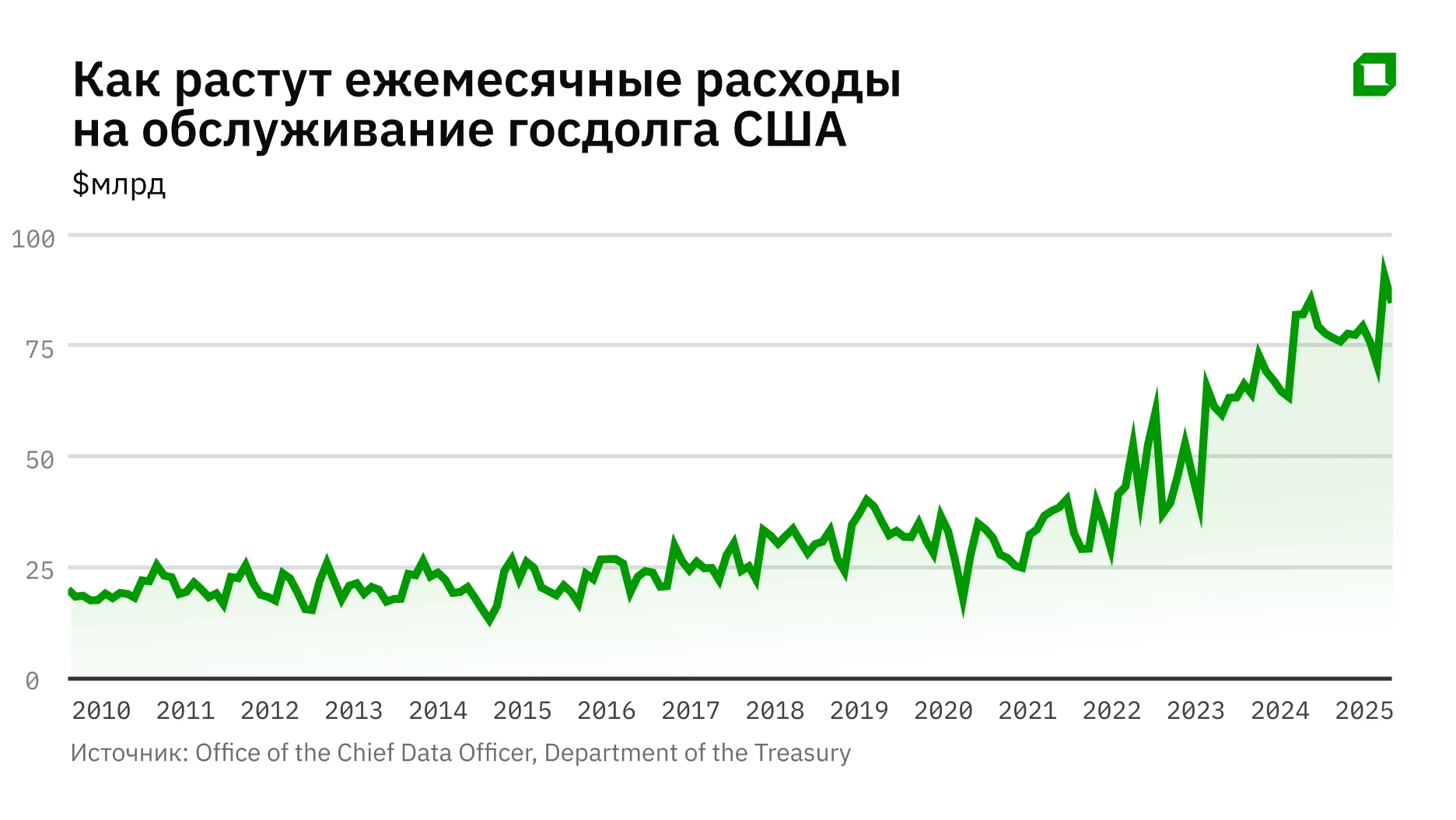

Along with the government debt, the cost of servicing it is also growing - both because of the increase in the amount of debt itself, and because of the growth of interest rates, which broke the twenty-year downward trend. The chart below shows how the average yield on U.S. securities is growing (we mean all types of U.S. government bonds, data as of April 30, 2025).

As a result, annual debt service costs rose from $255 billion in 2014 to $896 billion in 2024. The Congressional Budget Office projects that debt service will cost $952 billion in 2025, and over $1 trillion in 2026. The graph below clearly shows the trend in U.S. debt service spending (data as of April 30, 2025).

According to the Congressional Budget Office, between 1975 and 2024, it took an average of 2.1 percent of GDP per year to service the national debt. In 2024 - 3.1% of GDP, forecast for 2035 - 4.1% of GDP.

Orlov believes this is a critical problem that needs to be addressed while markets are still willing to lend to America: He cites Japan as an example. "They have an even higher debt-to-GDP ratio... (over 236% of GDP in Japan and 123% of GDP in the U.S. - ed. note), plus 'lost decades,' deflation, zero growth. Plus Japanese debt is almost all domestic - they have a trade surplus. And the US has the opposite: a huge trade deficit. In fact, the only commodity for export is dollars. As long as the world is willing to exchange real goods for American money, the system works. But every cycle of rising debt and interest makes things worse. Sooner or later this vicious circle may break," Orlov told Oninvest.

Meanwhile, the market is already beginning to reevaluate its attitude to U.S. government securities. For example, on May 21, the U.S. Ministry of Finance placed 20-year government bonds for $16 billion at 5% per annum. The rate was the highest since 2020 due to lower-than-normal demand for these securities. This Thursday, June 12, the Ministry of Finance is scheduled to place $22 billion in 30-year bonds.Bloomberg writes that the outcome of this offering will receive special attention: it will be seen as a test of market sentiment, said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. "It seems like 30-year U.S. government bonds are the least favorite securities in the market," he said.

Every year, the U.S. government borrows new amounts to cover the federal budget deficit. In 2024, the U.S. budget revenue was $4.92 trillion, while expenditures amounted to $6.82 trillion. The difference of $1.9 trillion had to be covered by borrowing, increasing the national debt. According to the Congressional Budget Office forecast, by 2035 the budget deficit will increase to $2.7 trillion.

To solve the problem, budget revenues need to cover expenditures, or at least the gap between them should not grow so fast. What options does the U.S. administration have to improve the situation?

Cost reduction opportunities: eliminate inefficient spending

Of the $6.82 trillion in budget expenditures for 2024, $4.13 trillion is mandatory: social benefits, health care (Medicare, Medicaid, CHIP program for children). Their size depends on the number of recipients. About $900 billion - expenditures on servicing the national debt - are also mandatory.

"Unobligated" spending - $1.82 trillion that Congress and the president approve each year.

The Department of Government Efficiency (DOGE), which until recently was headed by Ilon Musk, began to fight inefficient spending. However, it quickly became clear that DOGE would not show breakthrough results for deficit reduction.

Reduction of "mandatory" expenditures is possible through verification of social payments - to eliminate "dead souls". According to the World Bank, errors and fraud in social payments account for 2-5% even in developed countries - for the United States it is $80-200 billion. But such verification requires serious regulatory and analytical preparation.

The main "victim" of DOGE was the spending on the state apparatus - $960 billion. Ilon Musk in his farewell speech at the cabinet meeting announced that savings of $160 billion had been achieved. The DOGE website says that savings of $175 billion have been achieved. But this is a difficult amount to verify, especially since DOGE itself has previously adjusted its data on spending cuts. One can definitely talk about tens of billions of dollars.

"The idea with DOGE was the right one - inefficient spending abounds. But the bureaucracy proved stronger than Musk. The hope of lowering interest costs through a Fed rate cut is also weak. The obvious solutions - to cut social security benefits - are unavailable because of two-year election cycles," said Alexander Orlov.

The Pentagon's slashed inefficient spending will be overlapped by an overall planned increase in the defense budget.

Opportunities to increase income

Another way to improve the budget situation is to increase the tax burden. This is an unpopular action. And in the current presidential term, it is almost impossible - after all, one of the main slogans of US President Donald Trump during his election campaign was to reduce taxes. "Big Beautiful" bill, promoted by the Republicans in the U.S., on the one hand, suggests tax cuts, on the other - the denial of tax breaks for "green" projects, for example.

According to the OECD, in 2022, U.S. tax revenues accounted for 27.6% of GDP compared to the OECD average of 34%. Meanwhile, World Bank research shows that tax revenues should be 12.5% of GDP to maximize economic growth. That is, both the U.S. and other developed countries already collect well above the optimal level, but the U.S. retains a competitive advantage in the form of a lower burden.

The main difference is in tax collections: the U.S. has no VAT, but it does have a sales tax. Its revenues account for just over 2% of GDP for 2024. The sales tax rate in the U.S. varies, from 5.7% in Wisconsin to 10.12% in Louisiana.

Most OECD countries have a VAT. The average rate of this tax in the world is 15%, in Asia it is 12%, and in Europe it is 20%. VAT revenue in OECD countries averages 7% of GDP.

The topic of the lack of VAT in the U.S. and its presence in most other countries was brought up by Trump when he talked about U.S. trade inequality. Roughly speaking, a French product with a cost of $100 can be exported to the U.S. and with sales tax it will cost about $106 in Wisconsin, but in France, a similar U.S. product with VAT will already cost $120. It is more profitable for foreign manufacturers to sell in the U.S. than at home. The opposite situation is true for U.S. producers - they have a lot of foreign competitors in the domestic market, and entering foreign markets is disadvantageous to them because of the need to either reduce the profit margin to maintain the same retail price as in the U.S., or to increase the retail price, thus reducing potential sales.

The second way to possibly raise revenue is to increase the number of taxpayers. There should be more companies, jobs, and industries in the US. Ideally, taxes should be raised for foreign manufacturers without hurting domestic businesses, motivating them to move to the US. This is exactly what the current U.S. administration is accomplishing with import duties. Domestic producers keep their tax burden low, and it becomes unprofitable for foreigners to sell in the U.S. - they need to move production to America to keep their profits. But this option has a drawback: duties alone will not cover the budget deficit. According to U.S. Treasury Department data cited by Politico, by June 3, the U.S. received nearly $70 billion in customs duties - 79.1% more than in the same period last year. But in doing so, they are disrupting supply chains. The effect of business relocation will not be quick, and companies will also have to invest money to open or develop production in the U.S., which could reduce their tax base.

Orlov adds: "The transfer of production to the US by the largest companies will stimulate economic and tax growth in the long term, but it is unlikely to solve the current debt problems. Moreover, there will be more competition for investment resources with the private sector - it will become even more difficult for the Ministry of Finance to place bonds".

What to expect next

Trump is not going to cut budget spending, and this is a negative call, and the above measures will only help to postpone harsh negative scenarios during his presidency, according to Vadim Merkulov, director of the analytical department at Freedom Finance Global;

If the U.S. enters a recession, he said, imports will decline, in which case the United States could even achieve a trade surplus, as it did in 1982, 1991-1992 and 2009. "A severe recession is unacceptable for the administration, but a slowing economy coupled with a weakening dollar will produce results," Merkulov said.

Import duties are an additional tax on consumers and businesses. "They will add to the budget, but they will reduce sales and cause inflation, which will prevent the Fed from lowering rates. We don't expect them to fall this year because of the duties. The active cycle will start in 2026 after a new Fed chief is chosen," Merkulov said.