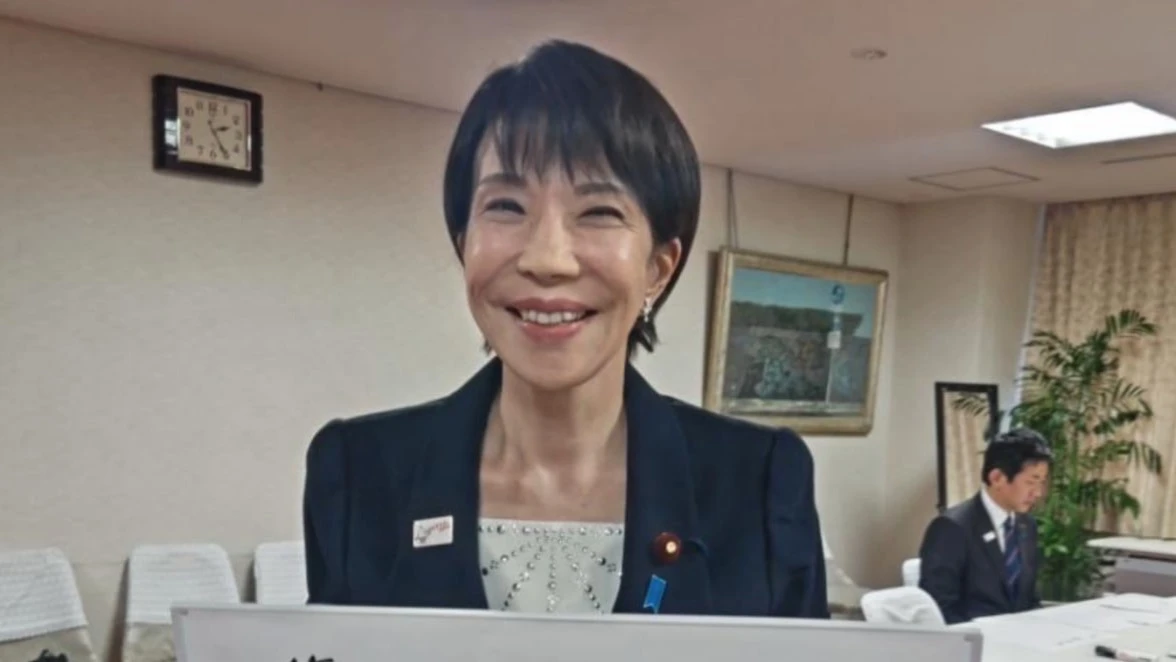

Sanae Takaichi wants to become Japan's prime minister. Why her plan could hurt investors

Japan may have its own "iron lady". In any case, it is Margaret Thatcher who is being hailed as a role model by Sanae Takaichi, who led Japan's ruling Liberal Democratic Party and may become the country's next prime minister. Conservatism and moderate nationalism have traditionally been favored by a large number of voters, but Takaichi's economic approaches are far from conservative. This benefits stock market investors, but could create long-term problems for the economy as a whole.

Takaichi became head of the ruling Liberal Democratic Party (LDP) on Oct. 4 after winning the party election. Current chairman and Japanese Prime Minister Shigeru Ishiba announced in early September that he was resigning after the LDP was defeated in parliamentary elections and lost its majority in the upper house of parliament.

Traditionally, the party leader becomes prime minister. A vote on Takaichi's candidacy in the lower house of parliament may take place in mid-October.

But the LDP, which has ruled Japan for most of the post-World War II era, is now in a weak position. It does not have a majority in either of the two houses of parliament, and on Friday its longtime partner, the Komeito Party, pulled out of the coalition over a long-running party funding scandal.

Takaichi will have to get the support of other opposition parties, which may, on the contrary, unite and nominate their own candidate.

Abenomics 2.0

Takaichi has already been elected to parliament 10 times. In previous governments, she served as Minister of Foreign Affairs and Communications and Minister of Economic Security, among others.

On the trading day after she was elected LDP chairwoman, the Nikkei 225 and Topix stock indices, which includes all stocks on the Tokyo Stock Exchange, rose 4.8% and 3.1%, respectively. Japan's national currency fell almost 2%, breaking through the 150 yen per dollar mark, and yields on long-term government bonds rose.

This reaction is due to the priorities in Takaichi's economic policy and the challenges it will face in implementing it.

Takaichi is a protégé and follower of Shinzo Abe, who served as prime minister from 2012 to 2020. It was his policies that laid the groundwork for Japan's recovery from 30 years of deflation and the beginning of a stock market recovery that had fallen more than 80% in 20 years from its peak in 1989.

Abe's policy, or "Abenomics," was called the "Three Arrows" and included significant fiscal stimulus, ultra-soft monetary policy, and corporate reforms. It brought a strong weakening of the national currency (at the beginning of Abe's premiership the exchange rate was around 80 yen to the dollar), inflation (for three years now it has exceeded the Bank of Japan's 2% target, forcing it to raise interest rates while other leading central banks cut them), a revival in the economy, and a full recovery of the stock market, which returned to its pre-crisis peak after 35 years.

"I stand here today to bring Japan back to the top of the world," Takaichi said in announcing her candidacy for LDP leader on Sept. 19. - Economic strength is paramount. I will resolutely pursue economic growth."

"The global trend is now shifting from excessive fiscal austerity to responsible, proactive fiscal policies that expand investment through public-private collaboration to address social challenges," she added.

The prospect of Shinzo Abe's protégé becoming prime minister was a clear bullish signal for the Japanese stock market, said Jon Treacy, publisher of investment newsletter Fuller Treacy Money: "The Nikkei 225 jumped on the news [of Takaichi's election as LDP chairman]. After rising sharply over the past few months, it looks very overbought, but there are no signs yet that this upward cycle is over."

Inflationary stimulus

On Thursday night, Takaichi made comments on the exchange rate for the first time since being elected. "I have no intention of provoking an excessive weakening of the yen. But empirically, I would say a weak yen has both advantages and disadvantages," she said in an interview with Japanese television. - For export-oriented companies, it's a buffer, given fears about [Donald] Trump's import duties."

In trading on Friday afterward, the exchange rate fell to 153.27 yen per dollar.

It then strengthened to 152.57 yen per dollar when it was reported that the ruling coalition had collapsed, reducing Takaichi's chances of becoming prime minister.

A weaker yen helps exporters, but can also lead to higher import prices and a general rise in prices. Core consumer inflation, which excludes energy and food prices, was 2.7% in August. And the latest data on wholesale prices for September showed their growth also by 2.7% - as in August, but higher than analysts' expectations (2.5%), notes Reuters.

The Bank of Japan raised its interest rate in January to 0.5%, and market participants expect another 0.25 percentage point increase before the end of the year.

So far, the Japanese regulator has been procrastinating, despite the fact that inflation continues to exceed the target. On the one hand, the central bank does not want, as it has done several times in the past, to "kill" nascent inflation and bring the economy back to deflation. But on the other, Izuru Kato, chief economist at Totan Research, told Reuters, "we are starting to see a negative cycle in which the slow pace of rate hikes by the Bank of Japan leads to a weaker yen and higher cost of living."

Meanwhile, Takaichi has named combating the rising cost of living as one of her top priorities, Nikkei Asia notes. She suggests cutting some taxes and increasing tax breaks for low- and middle-income earners, abolishing the gasoline tax "temporarily" introduced in 1974 to reduce fuel prices and curb inflation. Takaichi also raised the issue of lowering the rate of consumption tax, a counterpart of VAT, although it is an important source of funding for social spending.

"So many people are suffering from high inflation, and it is the government's job to alleviate this problem," Takaichi said.

She also intends to ramp up investment in energy, food security and infrastructure - which she says will "create demand" and help increase government revenue.

Its policies could "raise fiscal risks" and lead to a rise in long-term interest rates and further weakening of the yen, which in turn stimulates price rises. And this will undermine the economic outlook and living standards, Nikkei Asia quoted a report by Takahide Kiuchi, an economist at Nomura Research Institute, as saying.

An additional problem is that the Japanese government has the largest debt burden in the world. Public debt this year is 235% of GDP, according to the IMF. In this situation, rising interest rates will complicate the government's budget plans.

But inflationary expectations are taking root in the consciousness of the population, which over three decades of deflation has formed a certain consumer behavior, providing for the refusal of immediate and large spending. According to the latest survey, 88% of households expect prices to be higher a year from now than they are today (85.1% three months ago). This should worry the Bank of Japan and push it to tighten the MPC.

In 2024, Takaichi called the central bank's rate hike a "stupid" decision. During an interview on Thursday, she laughingly responded when asked if she would characterize its hike before the end of this year in the same way, "Oh, please stop bringing it up. I know I'm in no position to comment on a rate hike."

A job for the Iron Lady.

Komeito's break with Japan's ruling party may hurt Takaichi's chances of becoming prime minister. She may try to forge an alliance with the Democratic Party for the People (DPP), which supports fiscal stimulus, but the main opposition party, the Constitutional Democratic Party, has suggested it may back DPP leader Yuichiro Tamaki as a single opposition candidate.

In the event of an alternative vote in the parliament, whoever wins a simple majority will win. If no one wins a simple majority, the two candidates with the most votes will advance to the second round. If Tamaki wins, Japan will have an opposition government. This will lead to a reversal of market expectations related to Takaichi's economic policies, Kiuchi said.

Running a country with a massive national debt when the economy is barely growing, the population is shrinking, welfare is stagnant, and many Japanese have turned their backs on the ruling party as a result, is just the right job for Takaichi, said Walter Russell Mead, a columnist for The Wall Street Journal and a Distinguished Fellow in Strategy and Government at the Hudson Institute.

It could employ some form of "military Keynesianism" strategy, where large defense spending would stimulate demand in the economy, promoting growth, Meade said: "Such a policy could help high-tech Japan solve both domestic and international problems."

Japan's aging population, while resisting immigration, is forcing the country to automate everything from auto factories to nursing homes, Mead notes: "Add to this trend the opportunities that a high-tech defense sector can create, and Japan can once again wow the world with new products as it did in the 1970s and 1980s."

This article was AI-translated and verified by a human editor