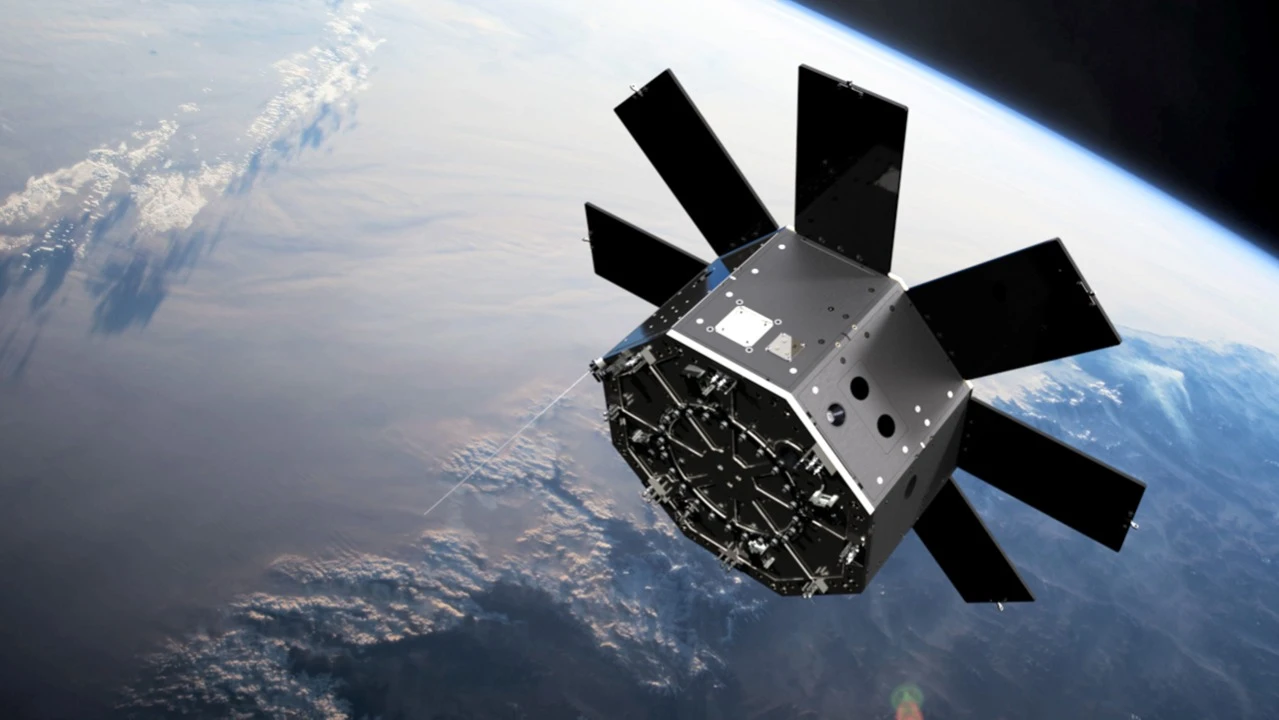

Over the last 12 months, Sidus Space has launched three satellites, with each costing less than the previous one. / Photo: facebook.com/sidus.space

Shares of micro-cap space services provider Sidus Space have slid more than 6% in premarket trading today, April 1, after the company released its 2024 financial results, which showed a deterioration in nearly all key metrics.

Details

In premarket trading today, Sidus Space has dropped more than 6% to $1.39 per share.

Yesterday evening, the company released its 2024 full-year financial results, revealing declines in key metrics: Revenue fell 22% year over year to $4.7 million, while the net loss grew the same 22% to $17.5 million. Sidus Space also posted a gross loss of $1.5 million (indicating that costs exceeded revenue), versus a gross profit of $1.6 million the previous year.

Sidus Space vowed to get back on track. “2024 was a defining year for Sidus,” claimed company founder Carol Craig. Last year, Sidus Space tested its technologies, launched two satellites, expanded its customer base, and secured “key strategic contracts” that could drive growth, she added.

At year-end, the company had $15.7 million in cash, 13 times the amount at end-2023. Sidus believes that with this cash, it can shift toward higher-margin businesses.

About Sidus Space

Craig, one of the first women authorized to pilot combat aircraft in the U.S. Navy, founded Sidus Space in 2021 as a space services provider. The company plans to build a constellation of hundreds of its LizzieSat satellites, which allow clients to integrate their own sensors and technologies to collect the specific space-based data they need.

Over the last 12 months, Sidus Space has launched three satellites: in March 2024, December 2024, and March 2025. The company points out each satellite was cheaper and had greater capabilities than the previous one, meaning improved capital efficiency, which could pave the way for margin expansion and sustainable profitability.

Stock performance

Sidus is down almost 70% for the year to date and off 56% over the last 12 months.

According to MarketWatch, the lone Wall Street analyst who covers the stock has a “buy” recommendation, with a target price of $10 per share, almost seven times current quotes. Yesterday, March 31, Sidus closed at $1.48 per share.