Silver is up more than 55% since the beginning of the year. Is it too late to buy it?

The price of silver is up more than 55% since the beginning of the year / Photo: Scottsdale Mint / Unsplash

On January 26, the dollar fell to a four-month low, gold and silver broke records and traded at the time of publication around $5130 and $112 per ounce, respectively. Moreover, silver is rising in price faster than gold. The dramatic rise in the prices of protective assets is considered a market fear indicator - investors react to geopolitical shocks. Alexey Basov, head of investment bank BSF Partners, writes in his Telegram channel "Investments of the highnet" why it may be too late to enter this rally.

The lure of silver

Since the beginning of the year, the value of silver - gold's weaker sibling - has risen by bitcoin's capitalization.

Ideas for participating in the frenzied metals rally appeared in brokers' personal accounts. Bad sign.

As the song by an ancient obscure band goes, "I didn't go. I love fishing. You sit on the shore. "Cast your line. It bites!"

Only professional financial bloggers manage to jump between bubbles in fundamentally different markets. And that, I suspect, only in the format of posts.

Expertise is not infinite, and I prefer to risk money where I understand and feel the market. At any given time, I study and experiment in some new area of investment. Somewhere I master, and then I add it to my toolkit. I put something on pause and postpone it for the future.

At one time I was actively working with commodity markets. It worked, but the feeling of confidence did not come.

There you are trading mostly a geopolitical premium/discount to a very stable fundamental value. So you are overly dependent on deliberately unpredictable, manipulative factors.

I now favor a different balance of fundamentals and conjuncture.

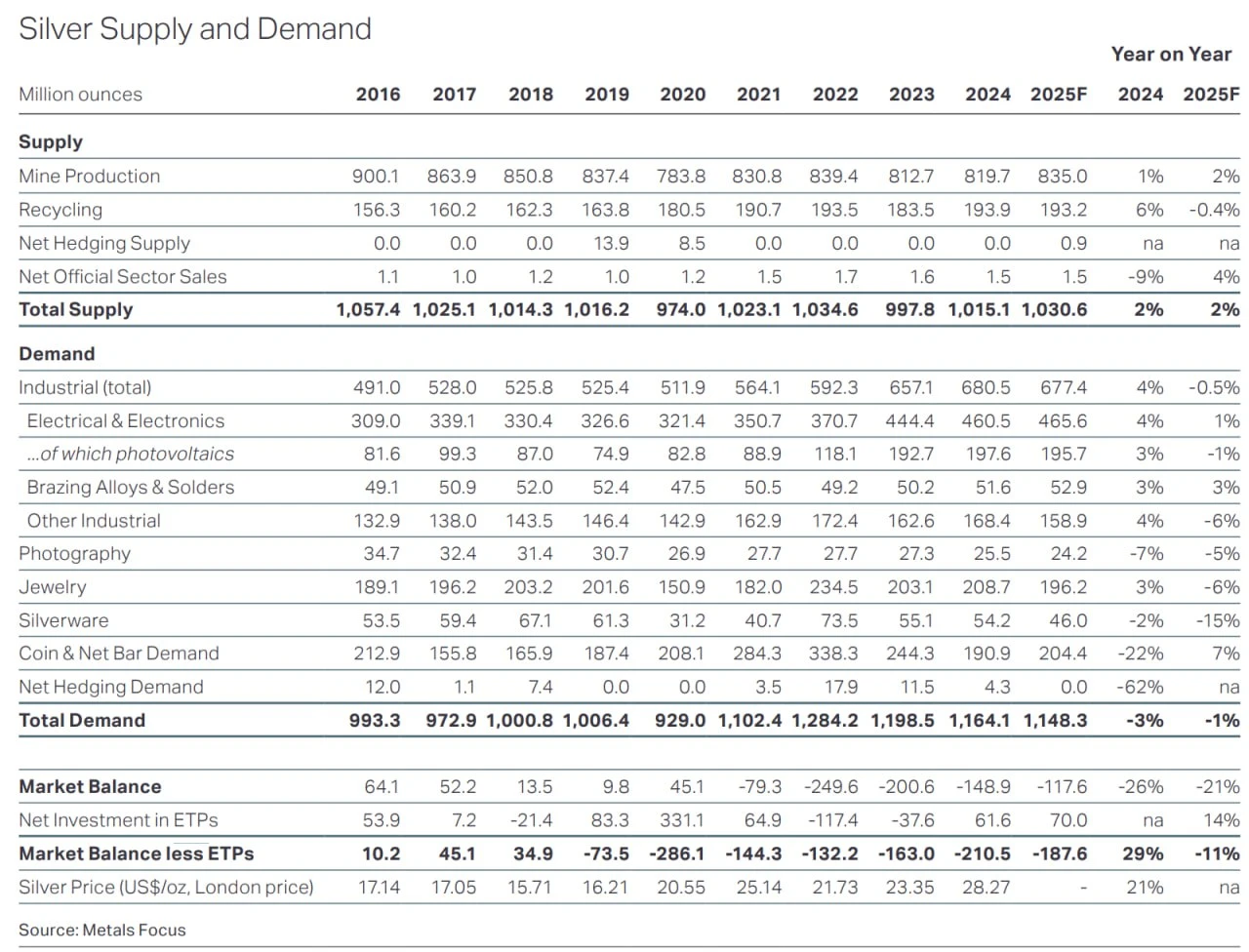

As for the current metals hype, I think it is too late to jump in. After studying profile channels and primary sources like World Silver Survey 2025, I came to the conclusion that the correction will be quick and fast.

The industry's demand has become prohibitively disconnected from the market value due to massive physical investments and purchases by funds (see the Demand Outlook chapter). And the history of quotations shows that reality is catching up with investors in respectable metals almost as in crypto.

I attribute the current run-up in silver to the gold rally. The rosy outlook for Greenland, the dedolarization of economies, trade wars, and the frantic buying of gold by central banks drove up its value.

Silver has always been the shoulder derivative of gold. It flew, a little bit lower, in a bundle with gold, but even more vigorously. By the same algorithm, as people jump into shitcoins, having failed to get into bitcoins in time.

I'll envy, and then I'll sympathize - from afar.

What's in it for us? Alas. Risk management requires giving up some investment opportunities. Over the long horizon, it pays off. On the short horizon, it can be frustrating, who can argue with that?

This article was AI-translated and verified by a human editor