Small-cap data center operator VNET Group in spotlight after near 200% return in 2025

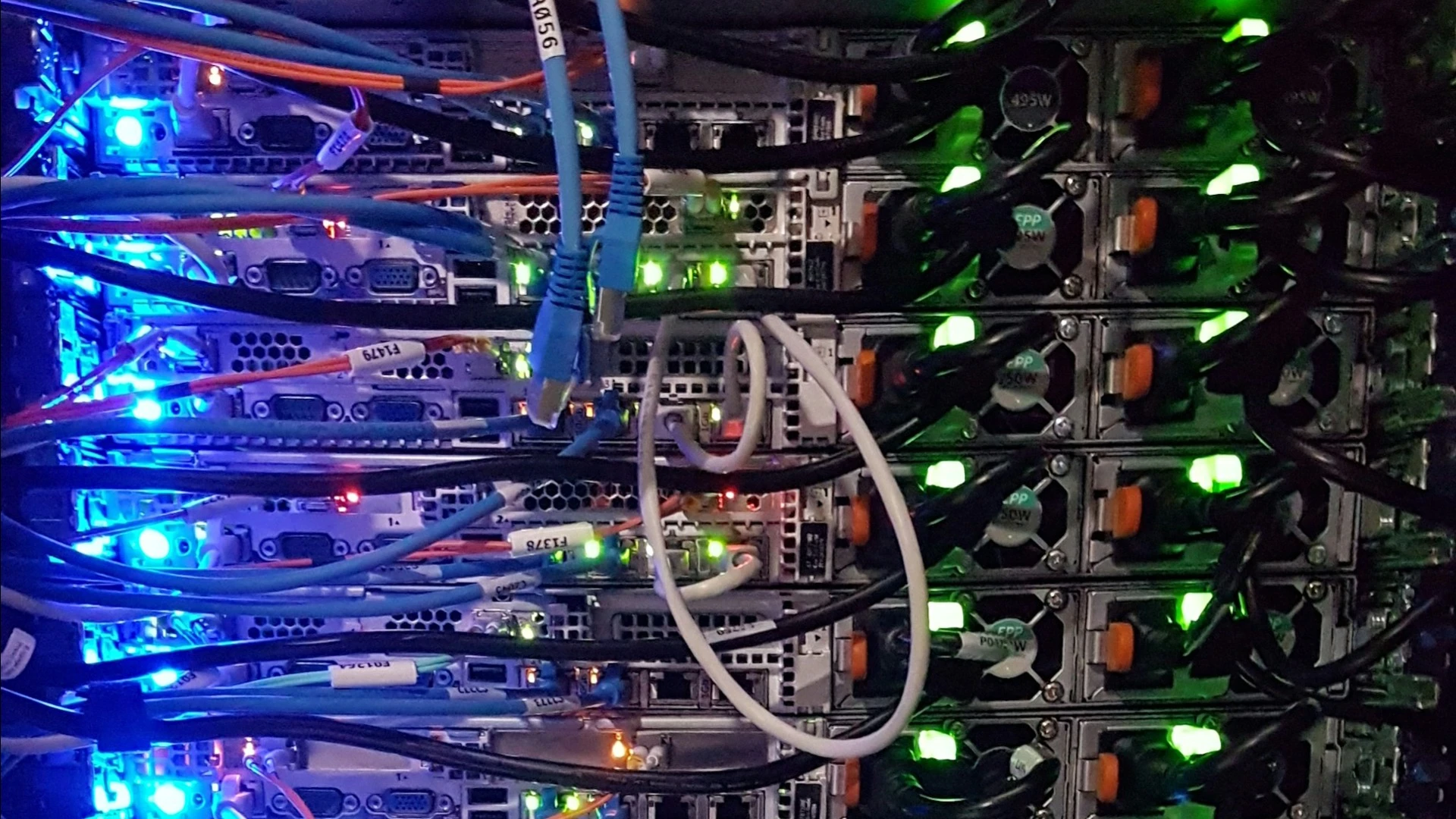

Chinese data center operator VNET could benefit from Chinese tech giants investing in AI infrastructure. / Photo: Unsplash/Massimo Botturi

Chinese data center operator VNET Group, whose ADRs trade on the Nasdaq, has soared almost 200% since the start of 2025, reports Barron’s. Investors are betting the company will benefit from a spending spree on computing power from China’s big tech firms, particularly e-commerce giant Alibaba. At the same time, Barron’s cites the cautionary tale of how Chinese tech stocks have rocketed before, only to tumble in the wake of regulatory crackdowns.

Details

Since the beginning of the year, Chinese data center operator VNET Group has soared 190.6% on the Nasdaq to $14.59 per ADR, its highest level since November 2021.

Investors expect VNET to benefit from increased spending on cloud computing and AI infrastructure from the likes of ByteDance, the owner of TikTok, and e-commerce giant Alibaba, Barron’s notes.

What Chinese tech giants are doing and how it affects VNET

Chinese tech giants’ investments in infrastructure are expected to benefit primarily data centers. Despite its recent market rally, VNET is one of the most undervalued assets, with an attractive risk-reward profile to boot, according to William Bevington of Jefferies, as quoted by Barron’s. In January, the investment bank included VNET in its list of top stock picks, citing the surge in demand for infrastructure.

In its fourth-quarter 2024 earnings report, released on February 19, Alibaba Group reported its fastest revenue growth in over a year, fueled by an AI investment boom, and announced its intention to invest more in cloud computing and AI infrastructure over the next three years than it had in the past decade, Barron’s notes. Today, February 24, the company revealed its plans for CNY380 billion ($52.4 billion) of such investments, its largest technology outlay ever, according to Investing.com.

Meanwhile, ByteDance has earmarked more than CNY150 billion ($20.64 billion) in capital expenditures for 2025, with most of it focused on AI, according to Reuters sources.

Three key risks

Barron’s warns investors who are considering buying VNET shares that Chinese tech stocks have soared before, only to see their market capitalizations plummet due to tightening regulations out of Beijing. In mid-2021, VNET was quoted at $41 per ADR before crashing below $2 per ADR in early 2024. The most recent rally pushed it above the Jefferies target price of $10.73 per ADR, Barron’s notes. According to Benzinga, the five analysts who cover VNET have an average target price of $5.53 per ADR, implying downside of almost 64%.

Additionally, Barron’s highlights the risk of U.S. policy headwinds. For now, VNET’s clients can purchase American equipment, such as Nvidia’s H20 AI chips, which have already been adapted for Chinese manufacturers in accordance with semiconductor export restrictions. However, the Trump administration is considering expanding these restrictions, Bloomberg reported in January, citing people familiar with the matter, while stressing that the discussions were still in the early stages.

The third factor Barron’s spotlights is uncertainty over VNET’s ownership. In 2022, its founder, Josh Sheng Chen, attempted to take the company private but withdrew the offer in 2024 after the government-owned investment holding company Shandong Hi-Speed Holdings Group acquired almost $300 million worth of new VNET shares.