Small cap Warby Parker to develop smart glasses for Google, shares jump

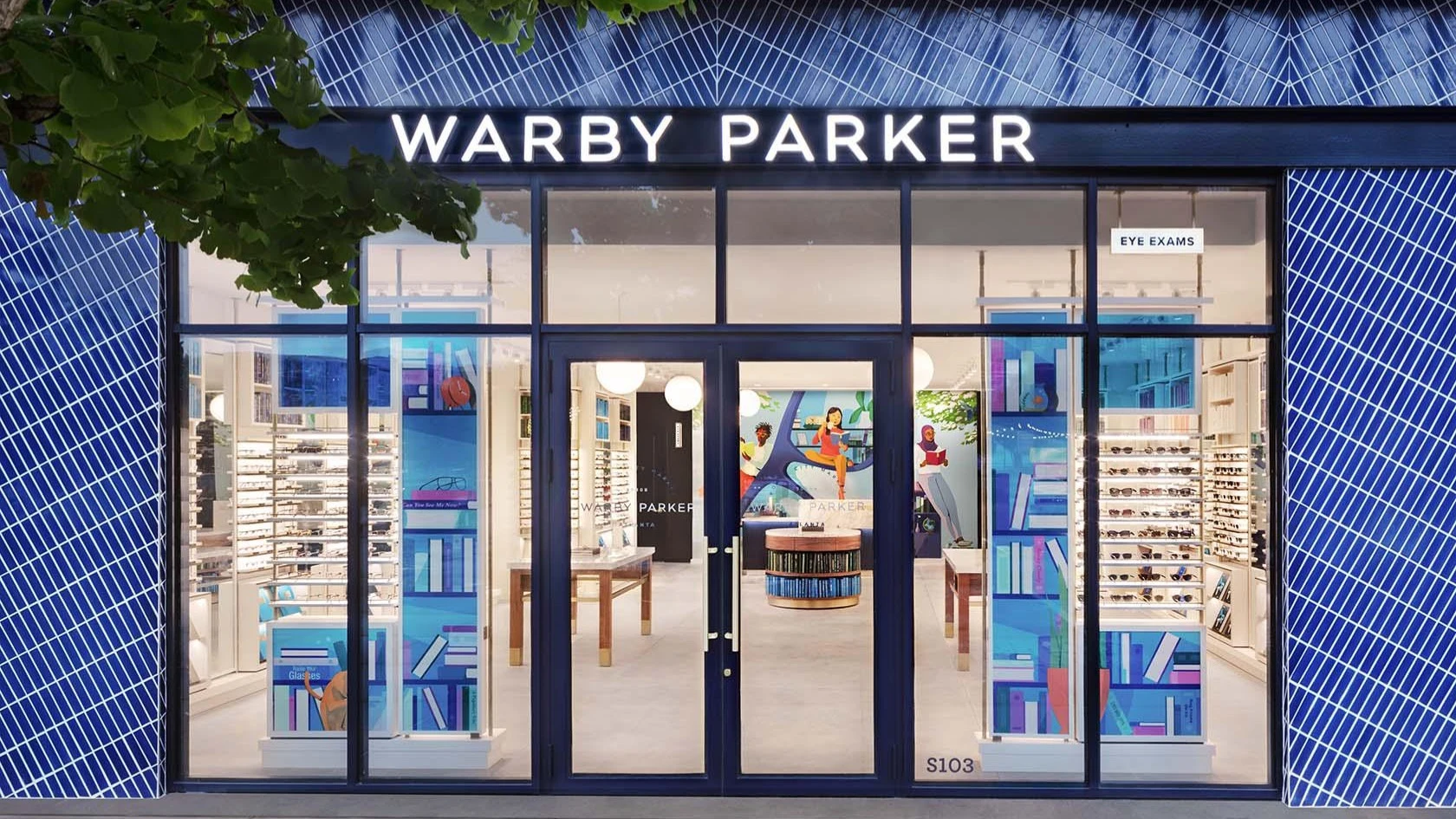

Small-cap eyewear maker Warby Parker is teaming up with Google to challenge the Meta–Ray-Ban alliance. / Photo: warbyparker.com

Shares of Warby Parker, the small-cap eyewear brand and retailer of prescription glasses, contact lenses, and sunglasses, surged nearly 16% yesterday, May 20. The rally came on the announcement that the company would partner with Google to develop AI-powered smart glasses — a move that would put them in direct competition with the Meta and EssilorLuxottica/Ray-Ban alliance.

Details

Warby Parker jumped nearly 15% yesterday to close at $20.34 per share, its highest close in two months. The rally followed the announcement of a partnership with Google at the annual Google I/O developer conference, as noted by CNBC.

Warby Parker will develop AI-powered glasses for Google. The tech giant has committed up to $150 million: half for development and commercialization of the product, and the other half as an equity investment, contingent on “reaching certain collaboration milestones.”

The first product line is expected to debut after 2025, according to Warby Parker. The glasses will run on Google's Android XR (extended reality). CNBC notes that the devices may feature Google’s Gemini AI assistant, enabling users to control them with voice commands.

“These need to be stylish glasses that you’ll want to wear all day,” said Shahram Izadi, vice president and general manager of Android XR at Google, as quoted by CNBC.

Context

Warby Parker and Google are stepping into competition with Meta, which has been producing smart glasses in partnership with EssilorLuxottica under the Ray-Ban brand. The two companies struck a deal in 2020, launched their first generation of smart glasses in 2022, and rolled out a second version the following year. Work on the third generation is currently underway.

Partnering with Warby Parker marks a return to the smart glasses market for Google’s parent company, Alphabet. It previously launched Google Glass in 2013, a product that raised privacy concerns. The high price tag of $1,500 and unconventional design also turned off potential buyers, according to Yahoo Finance.

Apple is also reportedly working on its own smart glasses, though Bloomberg has suggested they are unlikely to hit the market before 2027.

Stock performance

“[The partnership] is indisputably a boon for the eyeglass maker. Investors are right to be hot on the stock,” wrote the Motley Fool.

Warby Parker’s stock is down nearly 16% year to date but still up almost 22% over the last 12 months.

According to MarketWatch, nine Wall Street coverage analysts currently rate the stock a “buy,” versus seven who rate it a “hold.” However, after yesterday’s rally, their average target price of $21.21 per share implies just over 4% upside.