'Some will win, others will lose': Amazon founder and Goldman CEO on AI bubble

Goldman Sachs head admits stocks will fall in the next 12-24 months

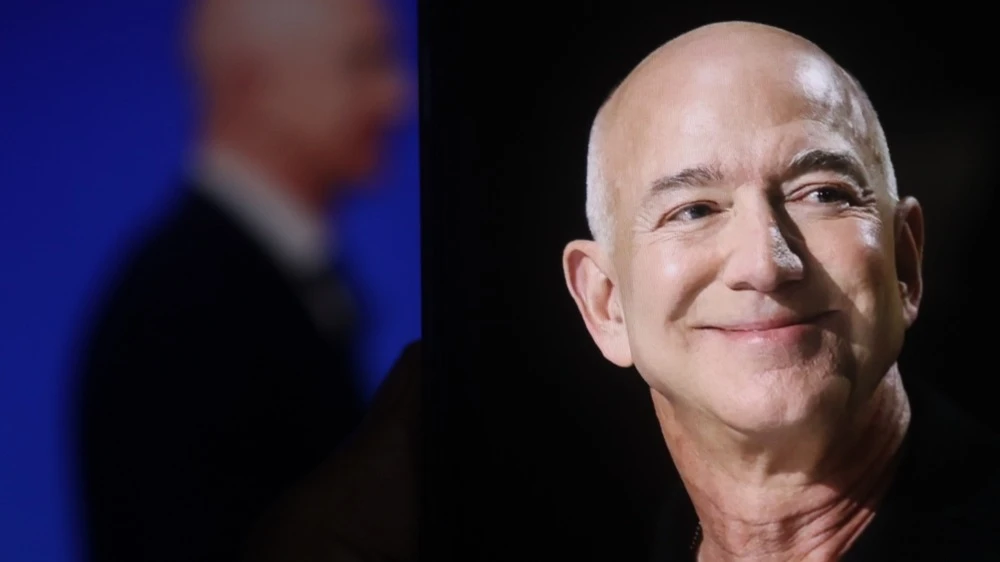

The hype around artificial intelligence is encouraging investors to pour billions into both good and bad ideas, says Jeff Bezos, one of the world's richest men and founder of Amazon. According to him, the surge of investment in artificial intelligence will benefit society, even if the bubble eventually bursts, bringing down stocks. Shortly before that, Goldman Sachs CEO David Solomon warned that many investors will be left disappointed when their investments don't pay off.

Bezos: a bubble isn't always a bad thing

The surge in investment in artificial intelligence is fueling a good bubble, not a bad one, Jeff Bezos is convinced. "It's more of an industrial bubble than a financial bubble," Bezos said at a technology conference in Turin(quoted by the Financial Times). He cited the 2008 crash as an example of a bad bubble.

The billionaire drew a parallel between the dot-com boom and the current hype around AI. In 2000, for example, Amazon's stock plummeted from $113 to $6 "in a very short time," causing panic among investors and anxiety among employees. According to Bezos, the quotes then simply "broke away from the fundamentals," although the business itself remained strong.

"When people are enthusiastic, as they are today with AI, all projects and all companies are funded," Bezos noted. - In such a frenzy, it's hard for investors to separate the good ideas from the bad. The same thing is probably happening now. But that doesn't mean what's happening is fiction. Artificial intelligence is real, it will change every industry. We don't know exactly how long it will take, but it is inevitable," emphasized the Amazon founder.

Bezos noted that even if the AI bubble bursts and stocks collapse like they did after the dot-com crash 25 years ago, AI will still leave society with long-term benefits. "A banking bubble, a crisis in the financial system is bad, like in 2008, and those are the kind of bubbles society tends to avoid," he said. - And industrial bubbles are not so bad - they can even be beneficial. When the dust settles and it's clear who won, society benefits from their inventions. The same will happen with AI: its benefits to humanity will be enormous."

Solomon: markets will have to face reality

At the same event, Goldman Sachs CEO David Solomon warned that much of the capital going into AI "will not yield returns." However, he admitted that it is not yet clear whether the technology market is in a bubble.

"I won't use the word 'bubble' because I don't know," emphasized Solomon, whose words were quoted by CNBC. - But one thing is clear: investors are taking more and more risk because of excitement. When they are excited, they think about what can go right and ignore what can go wrong."

Nevertheless, Solomon also compared the current situation to the late 1990s and early 2000s, when the mass adoption of the Internet gave birth to the world's largest companies, but also resulted in losses for investors and the dot-com bubble. He believes that the markets may also see "something similar" now.

"At some point, the reality check will begin. I would not be surprised if equity markets face a correction in the next 12-24 months. Its magnitude will depend on how long this rally lasts," emphasized David Solomon. In the end, he said, the AI boom will "benefit some, while others will lose".

Who else warned about the bubble

In August, Sam Altman, CEO of ChatGPT startup OpenAI, said that the AI market had inflated into a bubble like the dot-com crisis. In those days, he said, people were "overly excited" about the Internet and technology and enthusiastically invested in Internet companies that failed in the 2000s.

"Are we now at a stage where investors are generally overly enthusiastic about AI? In my opinion, yes. Is AI the most important development in a very long time? In my opinion, also yes," Altman added.

OpenAI itself remains a private company, not listing its shares on the stock exchange. The day before, the ChatGPT developer was valued at $500 billion, making it the most expensive startup in the world.

This article was AI-translated and verified by a human editor