"Sovereign debt bomb" and risk of "civil war" in the U.S. threaten markets - Dalio

A "semblance of civil war" is brewing in the US and other parts of the world amid rising inequality and global conflict, a billionaire investor has warned

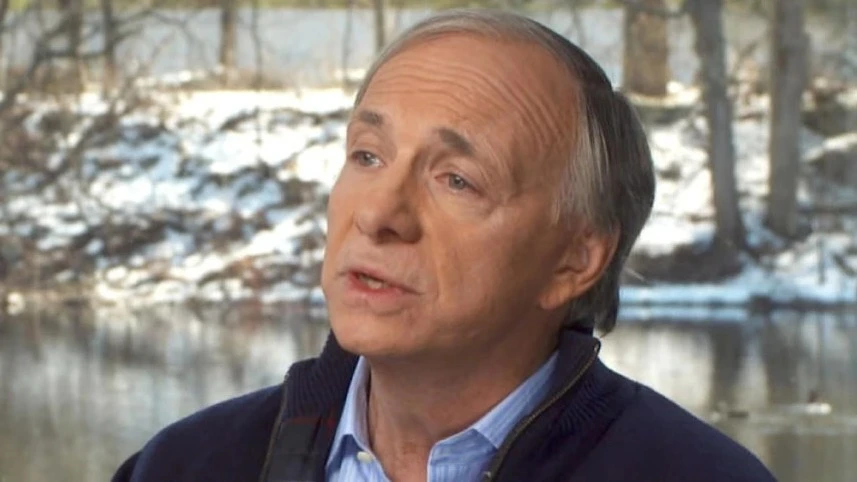

Ray Dalio, the founder of Bridgewater hedge fund, has expressed his fears about the rapid growth of the US national debt, comparing the current situation with the state of affairs before World War II. According to the investment guru, the "debt bomb" and the deep political division, which threatens to develop into a "civil war-like situation", create serious risks for the economy and financial markets.

Details

In an interview with Bloomberg TV, Dalio warned: the U.S. national debt is growing too fast, creating an environment "very similar" to the years before World War II. He said that rising debt relative to budget revenues is like "plaques in the arteries that start to crowd out spending." This phenomenon, known in economics as the crowding-out effect, slows economic growth as government borrowing absorbs capital that could go to private investment.

In September, Dalio said that the level of government debt is a "threat to monetary order": he urged the U.S. authorities to raise taxes at the same time as cutting spending to deal with the "deficit/debt bomb," Bloomberg reports. The Congressional Budget Office estimates that U.S. government debt reached about 99% of GDP by the end of 2024, and could rise to 116% by 2034 - an unprecedented level.

But Dalio sees debt as only part of the problem: global conflicts and growing financial inequality also provide a troubling backdrop. A "civil war of a certain kind" is brewing because of "irreconcilable differences" in the US and other parts of the world, he said. At the same time, complacency will only exacerbate the risks, the 76-year-old billionaire warned.

Context

Markets largely share Dalio's concerns. Tim Murray, vice president of T. Rowe Price Associates, said in February 2025 that in a situation of persistent inflation, ballooning budget deficits and political uncertainty, his fund prefers to hold an underweight in both long-term U.S. Treasuries and other fixed-income instruments in general.

In May 2025, Moody's was the last of the top three rating agencies to strip the United States of its highest credit rating, citing rising budget deficits and high debt service costs. Fitch and S&P downgraded the U.S. credit rating in 2023 and 2011, respectively.

The risks of high U.S. government debt were also warned about by Nassim Taleb, honorary scientific adviser to hedge fund Universa Investments, who called it a "white swan": an obvious threat that everyone ignores until it is too late. In addition, he called the U.S. dependence on foreign talent a "white swan". But the new "black swan" - an unpredictable shock, the concept of which made Taleb famous after the publication of his book of the same name in 2007 - can now only be some "miracle that will suddenly pull us out of this trap," the economist said.

This article was AI-translated and verified by a human editor