Starlink rival Eutelsat sees stock soar 30% as France to invest EUR1.35 bln

Eutelsat needs to find another EUR2.65 billion to operate sustainably, Fitch estimates

Quotes of French satellite operator Eutelsat jumped 30% on Friday, June 20. The market was reacting to the announcement of a capital increase of EUR1.35 billion coming from the French state. While the company is highly indebted, the French president considers supporting Eutelsat important as a matter of European sovereignty.

Details

Eutelsat shares rose more than 30% to EUR3.70 apiece in Paris on Friday. The company announced that France would invest EUR1.35 billion and become the largest shareholder.

APE, the French agency responsible for managing government stakes in various companies, will participate in the capital increase, as well as Indian billionaire Sunil Mittal's Bharti Space, shipping company CMA CGM and Fonds Strategique de Participations (FSP), a long-term investment fund backed by French insurers. All have been shareholders in Eutelsat before the deal.

After it closes, the French state will have a 29.99% stake in the company, Bharti Space 18.70%, CMA CGM 7.81%, and FSP 5.22%. They will buy EUR716 million worth of Eutelsat shares at EUR4 per share. This is 32% above the 30-day weighted average market price, the company notes. In addition, there is to be a rights issue of EUR634 million.

'A matter of sovereignty'

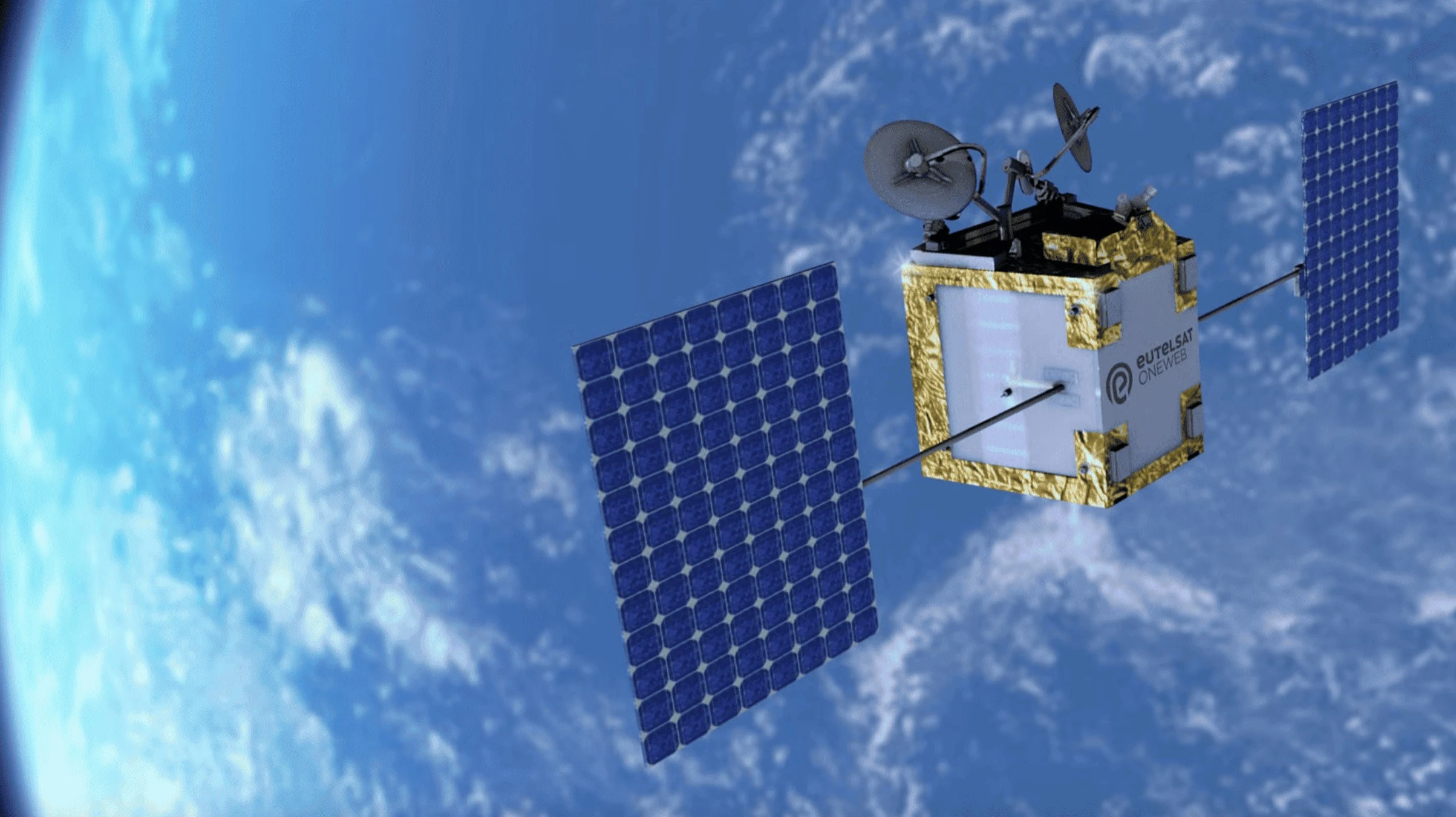

Eutelsat entered the low-Earth-orbit satellite market, in both the business and the government segment, after merging with OneWeb in 2023. The company now has only 650 satellites, a twelfth the number of its U.S.-based rival – Starlink, owned by Elon Musk. According to data from astronomer Jonathan McDowell, there were about 7,825 working Starlink satellites in orbit as of June 18. However, as the only European player, Eutelsat has attracted interest from European governments, which are eager for non-U.S. alternatives amid Trump's confrontational approach to U.S.-Europe relations, writes Reuters.

"Eutelsat is the only non-American and non-Chinese player with these low-earth orbit constellations and such a wide range of services," French President Emmanuel Macron said at the Paris Air Show on Friday. He added: "It's a matter of sovereignty, and we hope that all French industrial financial partners will also subscribe... and we also want to mobilize many other European and international partners." A source told Reuters that Paris is in talks with the UK about the UK government's possible participation in Eutelsat's rights issue. The UK holds a 10.9% stake, which is set to fall to 7.9% after the deal, Reuters points out.

What analysts say

While the capital raise should be enough to cover Eutelsat's immediate needs, the company will ultimately have to find EUR4 billion by 2032 to update OneWeb’s low-Earth-orbit satellites and participate in a project to build an EU service called Iris2, writes Bloomberg. In March, Fitch downgraded the company's credit rating from B+ to B, citing slow sales growth of OneWeb satellites, negative EBITDA, and the need for large external financing.

The company also has high debt, which was EUR2.7 billion at the end of 2024. Eutelsat expects it to fall to about three times annual earnings after the capital increase, down from four times today and a projected five times by mid-2026, JPMorgan stated in a note to investors. It added that "We struggle to see this rights issue as sufficient to support what we would consider to be a truly competitive LEO strategy."

Nevertheless, Eutelsat shares are up 63% since the start of the year, including Friday's rally. They rose in early March when Trump and Zelensky verbally sparred in the White House and the U.S. briefly suspended military support for Kyiv, including intelligence sharing. The episode showed how dependent Europe is on Starlink and Musk's SpaceX for secure satellite communications, Bloomberg wrote. European officials began hastily looking for an alternative among local players, including Eutelsat. As a result, quotes jumped 600% in a few days, but by the end of March the excitement had subsided.

Of the nine analysts who track the company, four have "hold" recommendations, three have "sells," and the other two "outperfom," as indicated by Yahoo Finance data. Their average target price is $2.87 per share, a quarter lower than the closing price on Friday.