"Steel" billion: how to capitalize on the coming robot invasion

The year 2025 may become the year of humanoid robots - dozens of startups are preparing to launch their devices on the market. Journalist Roman Mighty looked at the easiest way to make money on this market.

Special guests

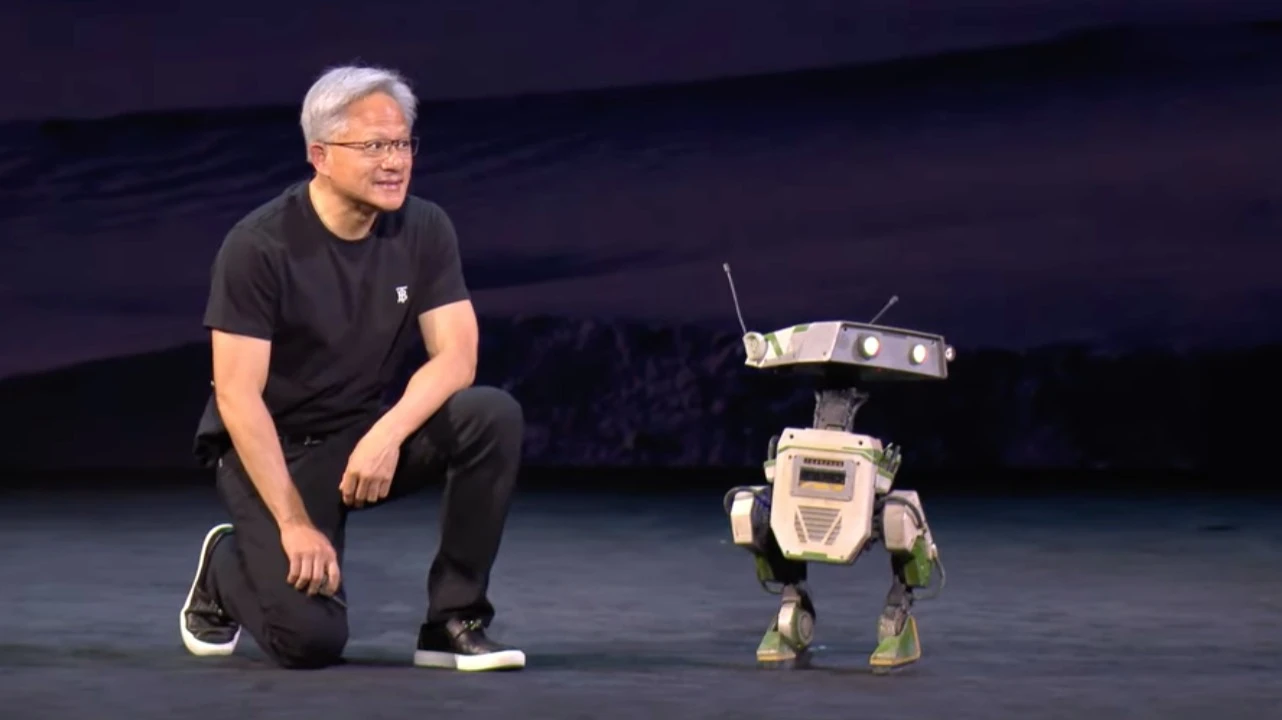

After an hour and a half of speaking at the VivaTech conference in Paris on June 11 this year, Nvidia CEO Jensen Huang called another speaker to the stage.

"Let's welcome a special guest," he said, and the hall responded with applause.

The guest turned out to be a small robot half a man's height. According to Huang, it was a girl robot named Grack. The robot represented to the audience a new industry that Huang believes will be one of the largest in human history.

How much money is already in it and what does artificial intelligence have to do with it?

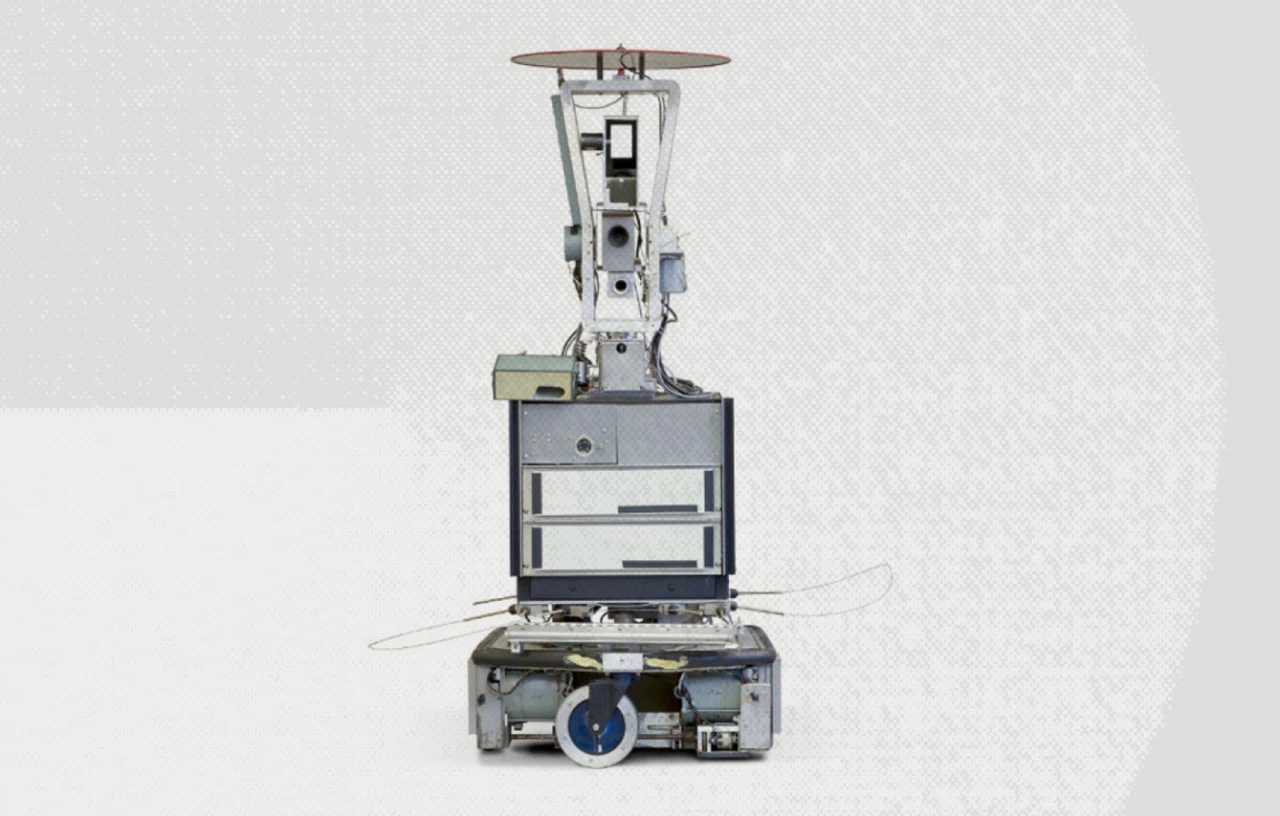

Robotic devices have been created in laboratories since the mid-1950s. In 1966, SRI's Center for Artificial Intelligence began developing the first mobile robot, Shakey, capable of reasoning about its surroundings. Four years later, Life magazine called it "the first electronic human."

Shown to the public in 2000, the humanoid robot Asimo could walk up and down stairs and recognize people. The cost of producing each such robot was estimated at $2.5 million.

In 2025, according to the data Third Bridge, the production of humanoid robots can already be called mass production - the supply of humanoid robots from China alone may reach 10 thousand pieces. This will be helped by the development of artificial intelligence.

According to Huang, it's too difficult to program robots right now, but AI technology will get around that limitation. "We know how to make robots, how to train them and how to use them," notes the Nvidia president.

At a conference in Paris, his company presented a new platform for manufacturing and programming robotic devices. During the show, Huang showed 16 other robots from various development companies behind him: Boston Dynamics, Agibot, XPENG.

And that's not all the contenders in this market.

Huang estimates the potential capacity of the global market for robotic assistants at 1 billion devices. The same estimate appears in a recentreport by Morgan Stanley. The bank believes that by 2050, the number of humanoid robots could exceed 1 billion, 90% of which will be used in industry and commerce, with China leading the way. Morgan Stanley estimates the market potential at $5 trillion.

Last year, Goldman Sachs estimated that with a favorable outlook, the market would grow from nearly zero to $38 billion by 2035.

Boston Dynamics plans to bring Atlas robot workers to Hyundai's plant in the U.S. state of Georgia as early as this year. Elon Musk's Tesla had previously announced the start of mass production of Optimus robots (later, however, the company warned investors that the trade war with China and a ban on rare earth metals could delay production). Sources from Reuters and popular technobloggers have reported possible robot development at Meta and Apple.

"Humanoid robots powered by artificial intelligence have the potential to change the physical world around us and how we exist in it," wrote U.S. venture capital legend Mary Meeker in her new reportMary Meeker.

In 2023, Pearson, a British company specializing in training and skills assessment, analyzed more than 5,000 occupations in five countries and concluded that generative AI could perform up to 30% of white-collar tasks, while robots could then automate just 1% of blue-collar tasks, i.e., blue-collar workers. But now AI is moving beyond the office - and is heading into workshops, construction sites, and warehouses.

How can an investor capitalize on the growing robotics market?

Humanoid robots, AI and rare earth metals

Many of the robot manufacturers are already traded on the stock exchange. Tesla may start producing humanoid robots in 2025; UBtech Robotics, which plans to start supplying robot workers to factories as early as this year, is traded on the Hong Kong stock exchange; Boston Dynamics is now owned by the publicly traded Hyundai Motor Company.

But if there is no possibility to make a "robotic" portfolio on your own, you can invest in an exchange-traded fund - this will give you the opportunity to bet on the sector related to robotics;

In June, management company KraneShares launched an exchange-traded fund KOID (KraneShares Global Humanoid & Embodied Intelligence ETF). It is based on the MerQube Global Humanoid and Embodied Intelligence index and includes companies that develop and manufacture humanoid robots and anything that gives AI a "physical body."

The portfolio KOID - 51 companies, including Nvidia, Tesla, Xpeng, lidar makers Melexis and RoboSense, rare earth supplier Lynas, cable, connector, sensor and bearing manufacturers Amphenol, Melexis, Jabil, Infineon, TE Connectivity.

"The price of a humanoid robot could soon be below the cost of a car," considers KraneShares senior investment strategist Derek Yan. The fund also invests in cars (AI technology and robotization have reached this industry as well). Including in the securities of German and Canadian auto parts manufacturers Schaeffler and Magna. The management fee is 0.69% through August 2026 and 0.79% afterward. The fund's size as of mid-June is just $3.1 million.

Personal list of popular analyst

Wedbush managing director Dan Ives launched the Dan IVES Wedbush AI Revolution ETF (Dan IVES Wedbush AI Revolution ETF) in early June. It includes microchip, cloud infrastructure, software, robotics, drone and cybersecurity providers. The list includes both well-known IT giants like Microsoft, Nvidia and Apple, as well as less popular Innodata, Elastic and Pegasystems (Oninvest detailed wrote about the fund after its launch).

The fund is based on the Ives AI 30 research list curated by the analyst. The fund's structure will be reviewed quarterly, but unscheduled changes are possible in the event of corporate events. Ivescalls the development of AI the fourth industrial revolution and predicts $2 trillion in spending in the sector over the next three years. The author's expertise will be paid for by an increased management fee of 0.75% - that's higher than most ETFs. At launch, the fund had $1 million in assets under management, and in the first 5 days of trading itexceeded $100 million.

Conservative robots and medicine

BOTZ (Global X Robotics & Artificial Intelligence ETF) is one of the oldest and most well-known exchange traded funds focused on robotics and artificial intelligence. It focuses on the industrial side of AI, including automation of manufacturing, medicine and transportation.

It tracks the Indxx Global Robotics & Artificial Intelligence Thematic index, which includes companies that develop industrial robots, components for AI systems and related equipment.

The biggest names in it now are Nvidia, computer vision system maker Keyence, surgical robot supplier da Vinci Intuitive Surgical, and industrial robot makers Fanuc and ABB.

The portfolio includes mainly securities from Japan, the USA and a number of other industrialized countries. The fund's composition is reviewed semi-annually. BOTZ has $2.6 billion under management as of mid-June. The management fee is 0.68%.

Choice Europe

The WTAI European ETF (WisdomTree Artificial Intelligence UCITS ETF) invests in global companies related to the development and application of artificial intelligence based on the Nasdaq CTA Artificial Intelligence Index.

Unlike more narrowly specialized funds, WTAI offers a broad coverage of artificial intelligence topics, including not only hardware manufacturers, but also software and service developers;

The portfolio is based on Palantir, Broadcom, Nvidia, Meta, Cloudflare, with European companies accounting for only 3.44% of the fund. Its volume is $189.8 mln. The management fee is 0.45%.