Surgical robot maker SS Innovations soars after first cardiac surgery in Americas

SS Innovations, a developer of surgical robotic technologies, soared 42% yesterday, June 18. That is how investors reacted to the news of the successful completion of its first robotic cardiac surgery in the Western Hemisphere. The stock has been trading on the Nasdaq for only about two months.

Details

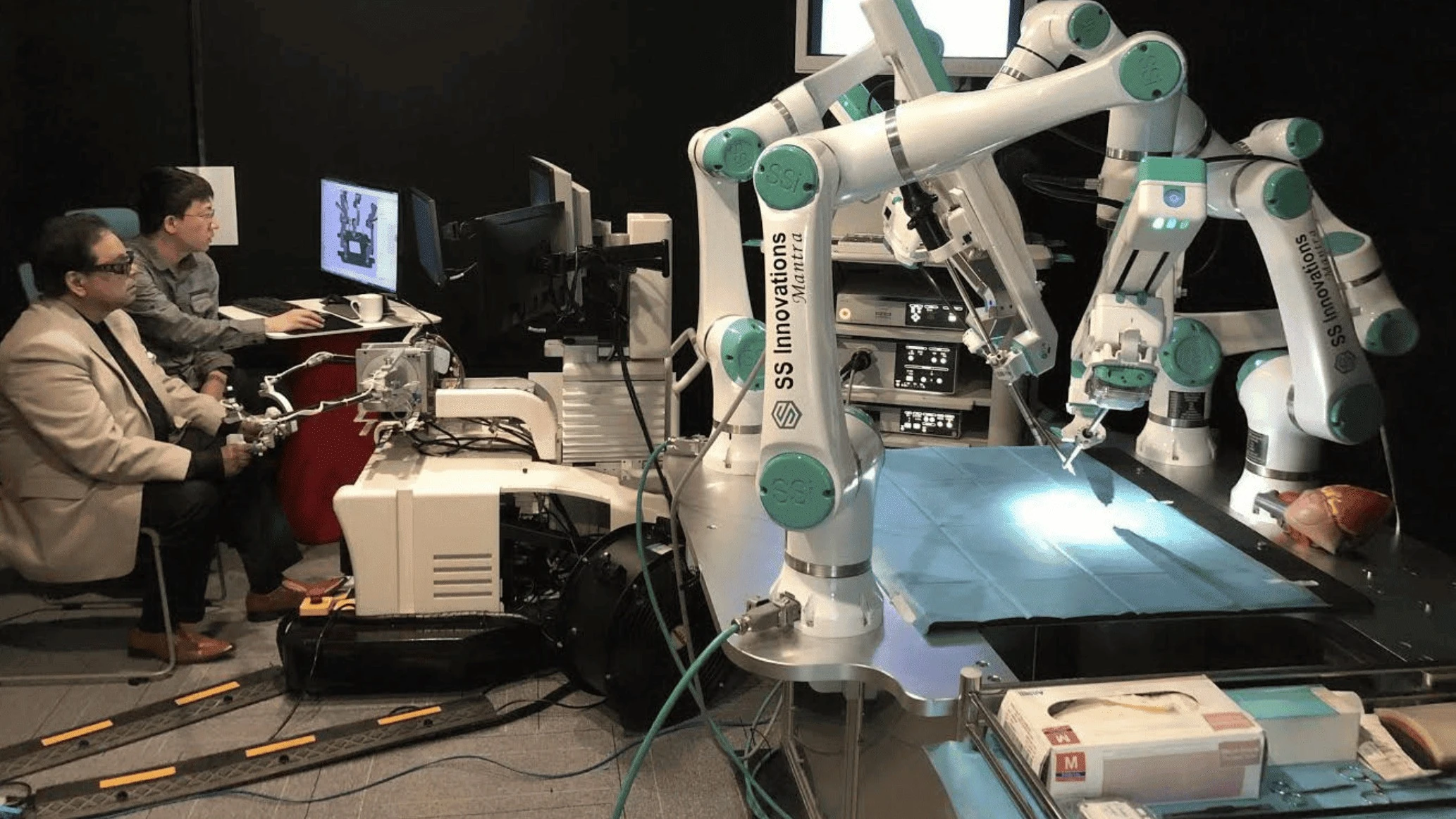

India's SS Innovations International rose 42% yesterday to $4.80 per share. In after-hours trading, it gave back some of the gain, slipping 5%. On Monday, the company announced the first robotic cardiac surgery successfully performed utilizing its SSi Mantra 3 surgical robotic system in the Western Hemisphere.

The surgery was performed in Ecuador. Using the robot, the surgeon repaired a hole between the upper two chambers of the heart.

In late May, SS Innovations reported more than 4,000 robotic surgeries had been performed using its robotic system without any complications, injuries, or mortalities, including approximately 215 cardiac surgical procedures.

The company believes it can differentiate itself from market leader U.S.-based Intuitive Surgical with a technologically advanced system that is affordable and accessible, wrote MedTech Dive.

Market for surgical robot systems

The global surgical robot systems market was valued at $11.48 billion in 2024 and is projected to grow at a CAGR of 12.4% over the next five years, according to a report by Research and Markets. Intuitive Surgical is the leader. Its stock is up 161% in the last five years and more than 25,000% since its IPO in 2000.

The market is not without its challenges. According to a report by Coherent Market Insights, the high initial costs associated with medical robotic systems are a significant barrier for hospitals and healthcare providers, especially small and low-cost facilities. For example, according to data from supplier R2 Surgical, Intuitive Surgical's da Vinci surgical system costs between $500,000 and $2.5 million, depending on the model. The SSi Mantra will cost INR50 million (about $600,000), wrote India Today.

The second challenge is U.S. tariffs. Intuitive Surgical has already reduced its 2025 profit guidance because of this. It has also suggested that rising costs for its systems could prevent it from winning future tenders, Reuters writes. However, SS Innovations has yet to enter the U.S. market. It must first obtain a license from US medical regulators, which it hopes to do in early 2026.

About the company

SS Innovations is an Indian company founded in 2015 by Dr. Sudhir Srivastava, a robotic cardiac surgeon. According to data from Crunchbase, the surgical robot developer has two investors, but the amount of their investments is not disclosed.

The company reported a 41% year-over-year increase in revenue to $5.1 million in the first quarter of 2025. The top line was supported by higher sales of the SSi Mantra system, the company noted. Device sales increased about two thirds to 15 units. The company's quarterly loss narrowed to $5.7 million from $9.8 million a year earlier.

SS Innovations has plans to enter the U.S. market: It opened an office in New York City in July 2024. The company has stated it seeks to obtain certification in Europe later this year and market clearance from the U.S. FDA in the first half of 2026.

It expects to submit a de novo classification request for the SSi Mantra 3 to the FDA in July for multiple surgical indications.

In April, SS Innovations stock was approved for listing on the Nasdaq Capital Market. It was valued at about $4 per share when trading started, and in a month and a half, the shares have risen 22%. Because the company only recently went public, it has yet to receive coverage and ratings from investment banks.