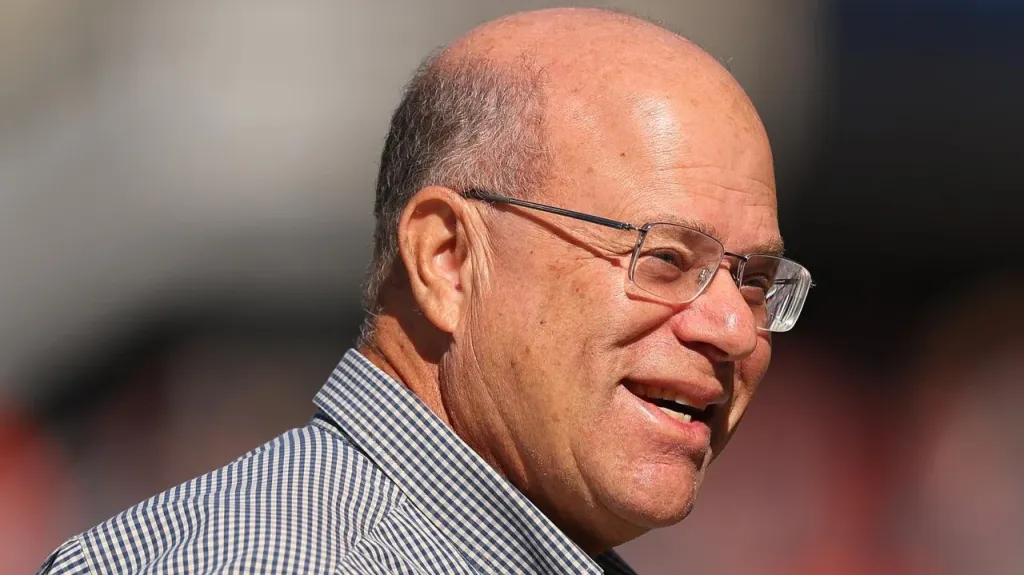

The long game: ten stocks that billionaire David Tepper has been holding for years

A breakdown of Appaloosa hedge fund's long-term positions, from tech giants to the insurance and energy sectors

David Tepper is one of Wall Street's most influential investors and founder of hedge fund Appaloosa Management. He takes what he calls a contrarian approach - acting against market sentiment by buying assets in times of fear and waiting for their real value to recover. "The time to buy is when there's blood in the streets," Tepper says, articulating a principle he has followed for three decades.

Appaloosa Management, founded by him in 1993, manages $17.7 billion in assets and is considered one of the most profitable hedge funds. Appaloosa's average annual return exceeds 25% ( 23% in 2025), and the total return to investors is estimated at more than $32 billion. At the same time, the portfolio remains concentrated: it currently holds 38 securities. About ten companies have been in the portfolio for years - shares may change, but Tepper does not leave these positions completely.

MPLX

Share of Appaloosa Management's portfolio: 0.46%

Value of position (as of September 30, 2025): $29.80 million

How many hedge funds own shares: 13

MPLX operates a network of oil and gas pipelines and terminals in the United States. It operates in two areas - crude oil and petroleum product logistics and the transportation and processing of natural gas and liquefied hydrocarbons. MPLX's operating model reduces its dependence on fluctuations in market prices for raw materials.

The company is among Appaloosa's long-term energy assets: Tepper is betting on sustainable infrastructure with predictable revenue streams and high dividends. The fund first acquired MPLX shares in late 2020 and has increased the stake several times. In the second quarter, the company reported results slightly below expectations, with earnings of $1.03 (vs. $1.08) per share on revenue of $3 billion. In September, MPLX announced it was selling North American assets in the Rocky Mountain region and focusing on more profitable areas. The market reacted with restraint: Wells Fargo maintained its "buy" recommendation, but lowered its target price from $60 to $59.

Energy Transfer

Appaloosa Management Portfolio Share: 1.39%

Position Value: $89.87 million

How many hedge funds own shares: 36

Energy Transfer is the operator of the largest oil, gas and petroleum product logistics infrastructure in the United States. Tepper joined the company in 2016 when energy prices were under pressure. At the time, Appaloosa bought about 5 million shares for $173 million, betting on a recovery in the energy sector. Since then, the position has been adjusted several times, but remains in the portfolio among long-term infrastructure assets.

According to Wells Fargo, Energy Transfer has a positive outlook: analysts believe that the key drivers of growth could be new infrastructure projects - the Desert Southwest pipeline expansion and the development of the Lake Charles complex.

Micron Technology

Appaloosa Management Portfolio Share: 1.58%

Position Value: $101.68 million

How many hedge funds own shares: 94

Micron Technology is one of the world's largest manufacturers of memory chips and storage systems. The company produces solutions for computing systems, mobile devices and data centers on which artificial intelligence infrastructure is built.

Tepper has been investing in Micron since 2006 and has adjusted the stake several times during this time. In the second quarter of 2025, he added 425 thousand shares of Micron, increasing the total value of the package to $101 million. This happened against the backdrop of strong results of the company: at the end of fiscal 2025 revenue Micron grew by almost 50% - to a record $ 37.4 billion. Citi analysts estimate the growth potential of Micron shares at about 16%, explaining it by the high demand for memory for data centers.

Microsoft

Appaloosa Management Portfolio Share: 3.86%

Position Value: $248.70 million

How many hedge funds own shares: 294

Appaloosa has held Microsoft shares since 2020: the fund entered the company during the growth phase of its cloud business. The holding peaked at the end of 2023, when the IT corporation's securities accounted for more than 11% of the portfolio.

In the spring of 2025, Appaloosa began to reduce its position in Microsoft, selling almost half of its shares - 470 thousand. The deal was most likely part of a strategy to take profits: since the beginning of the year, the company's quotations have grown by almost 25%.

Uber Technologies

Appaloosa Management Portfolio Share: 3.98%

Position Value: $256.57 million

How many hedge funds own shares: 152

Appaloosa increased its stake in ride-ordering service Uber by 113% in the first quarter of 2025, bringing the position to 3.2 million shares. In the second quarter, after reporting revenue growth of 18% to $12.65 billion, the fund partially booked a profit and reduced its stake by 14%.

Analysts generally share a positive view of the company's prospects. Mizuho Securities believes that Uber's revenue will grow by an average of 15% annually in 2025-2028. Bernstein maintains a buy recommendation on the company, noting that investments in new technologies and regional expansion may become drivers of development.

Alphabet

Appaloosa Management Portfolio Share: 4.13%

Position Value: $266.08 million

How many hedge funds own shares: 219

Alphabet's revenue grew 14% to $96.4 billion in the second quarter of 2025 - primarily driven by growth in its cloud and advertising services businesses. Tepper has maintained a position in Alphabet for more than a decade: during this time, the investment has generated a return of more than 200% for the fund.

Appaloosa cut its stake by 25% in the second quarter of 2025, getting rid of 510,000 shares of the holding and recording about $84 million in gains. The sale was part of a strategy to rebalance the portfolio in favor of healthcare and semiconductors.

Meta Platforms

Appaloosa Management Portfolio Share: 4.58%

Position Value: $295.24 million

How many hedge funds own shares: 260

Meta is one of the longest-standing positions in Appaloosa's portfolio: the fund has been investing in the company since 2014. During this time, the value of the stake has almost tripled - from $99 million to $392 million. In 2025, Tepper revised his stake in Meta: he increased the stake in the first quarter and sold 150,000 shares in the second quarter.

According to Citi's assessment, Meta's potential is shifting towards AI and hardware solutions, and it is this area - including the launch of smart glasses - that will be a source of growth for the company in the coming years.

Amazon

Appaloosa Management Portfolio Share: 9.19%

Position Value: $592.35 million

How many hedge funds own shares: 335

Tepper has been invested in Amazon since 2019. Over the six years of ownership, the stock has generated about 120% returns for the fund: an initial $264 million has grown to $581 million. Appaloosa has been making tactical adjustments in 2025 - reducing the position by 3.5% in the first quarter and increasing it by 7.6% in the second quarter, adding about 190,000 shares.

Analysts expect an acceleration in Amazon's revenue growth due to the expansion of data center capacity, as well as the integration of artificial intelligence technologies and cooperation with Anthropic. According to Wells Fargo's forecast, sales of Amazon Web Services (AWS) cloud division could grow by 22% in 2026.

UnitedHealth

Appaloosa Management Portfolio Share: 11.85%

Position Value: $764.33 million

How many hedge funds own shares: 159

Insurance company UnitedHealth Group was going through a rough patch in the second quarter of 2025, as business valuation errors and pressure on performance caused the stock to plummet and led to a sudden change in leadership. It was at this point that Appaloosa increased its position in UnitedHealth by 1,300%, buying 2.28 million shares at an average price of about $330 per paper. The move reflects Tepper's characteristic contrarian style of buying strong companies when the market is against them.

Tepper wasn't the only one to take advantage of the declining stock price. Warren Buffett, Michael Burry, George Soros' fund and Michael Platt's BlueCrest Capital Management invested in UnitedHealth. After Buffett's purchase of about $1.6 billion was disclosed, UnitedHealth securities rose nearly 10%.

Bernstein forecasts UnitedHealth's earnings growth as the industry recovers. UBS also reiterates a positive outlook, noting that the company is holding its 2025 earnings guidance and taking steps to strengthen margins ahead of changes to the Medicare Advantage program taking effect in 2026.

Alibaba

Appaloosa Management's Portfolio Share: 12.43%

Position Value: $801.50 million

How many hedge funds own shares: 101

Appaloosa has been investing in Alibaba since 2020. After several years of growth, the fund began to cautiously reduce its stake in response to changes in the Chinese technology sector. In the second quarter of 2025, Appaloosa sold 2.14 million shares, reducing the position by 23.4% and freeing up about $240 million in capital.

Alibaba is expanding its presence in Europe and Latin America, attracting sellers from Amazon to the AliExpress platform due to lower commissions and shipping costs. E-commerce remains the company's key source of revenue. At the same time, Alibaba is actively developing cloud services: the company's revenue in this segment grew by 26% to $4.67 billion, exceeding the expected growth of 18.4%. After the company announced plans for the future: increased AI investments, partnership with Nvidia, expansion of the data center network - analysts raised the target price of the stock.

This article was AI-translated and verified by a human editor