"The most important thing is to be hyper-realistic": 12 lessons from Ray Dalio about money and life

How to survive a debt storm, why you need a digital twin and why choosing a partner is more important than building a portfolio - the famous investor answered questions from users of the online platform Reddit

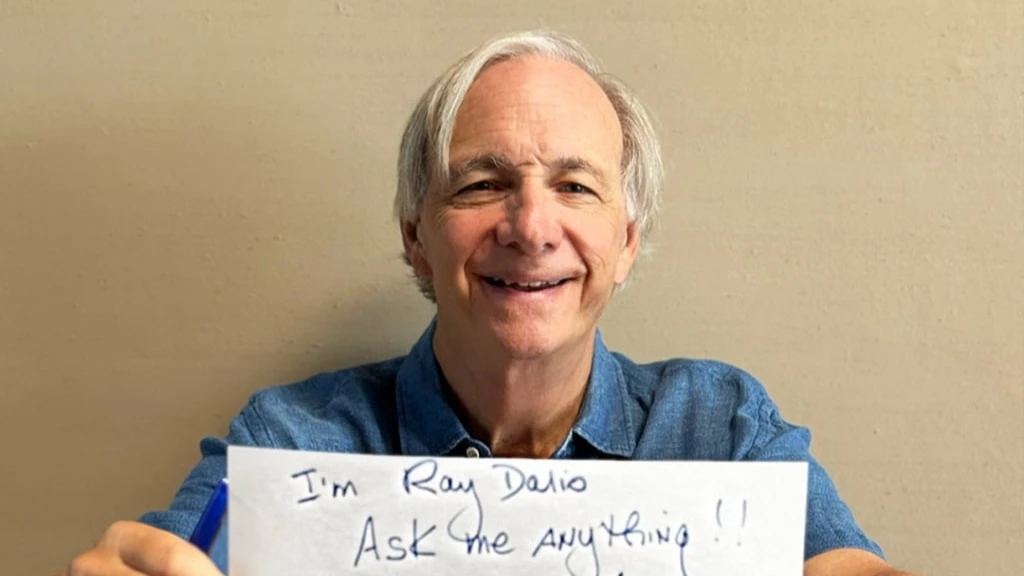

Ray Dalio - American billionaire and founder of the world's largest hedge fund Bridgewater Associates - held an AMA session on Reddit (from Ask Me Anything). Users asked him more than 600 questions, and Dalio answered 21 of them. Initially, he wanted to discuss historical patterns that help understand current economic processes. But the questions were more about other things: capital protection, artificial intelligence that helps make investment decisions, and life principles.

Oninvest collected Dalio's key answers: about diversification and "all-weather portfolio", dollar risks, alternative assets, "digital Ray" who is ready to give advice to everyone. And also about why contributing to relationships brings more return than any investment.

About money, portfolio and global risks

What is the best way to protect assets from a potential drop in value?

To best protect your assets, you need to diversify your portfolio well. Certainly, some assets will yield more, others less, just as some countries will develop better than others. And it is always more profitable to be in those that perform better. However, many market makers are already betting on these outcomes, so the expected events are already factored into the price. It's like betting on a horse race: with the odds factored in, betting on the slowest horse is just as good as betting on the favorite. In our turbulent world, it's best to invest in companies that will make breakthroughs thanks to AI, in hard assets, in global diversification, not in debt instruments. My main advice: learn how to allocate your investments wisely, this will significantly reduce your risks without reducing your expected returns.

If investors stop buying U.S. bonds because of the U.S. debt load and it causes inflation and recession, what is the best way to protect capital - maybe invest in Swiss bonds?

While I share your concerns, I urge you not to get into the "betting on the future" game. Instead, I suggest having a well-balanced "all-weather portfolio": no matter what happens, it can provide your capital with steady growth. That's because every economic situation is favorable for some assets and unfavorable for others. For example, stocks perform well when the economy is growing strongly and poorly when the economy is growing weakly; bonds tend to behave the opposite. Gold tends to appreciate when currencies are weak and inflation is high.

On monetary policy and risks for the economy

What happens if the Fed cuts rates when inflation is high? And can investors benefit if the regulator comes under pressure?

My fear in this scenario is that short term bond rates and the dollar will decline, especially relative to gold. Long-term bond yields would rise slightly, the yield curve would steepen, and equities would perform poorly despite policy easing. This will mean that investors are moving out of debt instruments into other forms of capital preservation and the Fed is trapped and the risk of stagflation is growing

You have said that the U.S. credit system is heading for a "debt heart attack." What measures could save it?

We need to reduce the budget deficit to about 3% of GDP (at the end of 2024 it amounted to 6.4% of GDP. - Oninvest ). This will stabilize the debt-to-income ratio, as the economy is likely to grow by about 3%. To achieve this goal, it is necessary to adjust all three components affecting the deficit: government spending, taxes and interest rates on the debt. If one tries to balance the budget using only one or two of these levers, the consequences will be dire.

On hard and alternative assets

Which to choose - gold or bitcoin? (the question on Reddit has now been deleted, only Dalio's answer remains).

Bitcoin is an alternative currency with limited supply. Therefore, all other things being equal, if the supply of dollars rises or demand for dollars falls, cryptocurrency is likely to be an attractive alternative. However, it also has serious drawbacks in times of instability. It can be tracked, governments could potentially take control of it, and it is possible that its program code could one day be hacked using new technologies. For the same reasons, it is unlikely to become a reserve currency. Gold, on the other hand, is the third largest reserve currency. Governments and ordinary people use it when they feel they are under threat. Gold has a much longer and more proven history, although it too has its downsides. So I have some bitcoins and a lot more gold. But the most important thing is to have assets that serve as a reliable means of saving. Most fiat currencies, especially those of highly indebted countries, will have trouble maintaining their value and will depreciate against hard currencies.

How do you feel about real estate investing?

Real estate is not a safe investment because it cannot be moved. Because of this, you can't take it with you, and the government can easily tax it. Therefore, it is not the best asset to hold capital in times of major change when the government needs extra money.

On decision making and artificial intelligence

How do you make decisions in a world where politics, news and markets change every day?

I came to the conclusion that the only workable way was to write down my decision-making principles and translate them into computer code. I have thus created a kind of "decision-making machine" that works in parallel with me. It is as if a grandmaster creates a chess program that plays alongside him, and both get stronger. This approach is invaluable: the computer processes more information faster and without emotion, and the formalized and tested criteria give me a proven plan of action. I've used expert systems before, but now I'm enthusiastic about applying new AI approaches to improve results. I plan to share this so that everyone can use such a method. I think the time when decisions were made "in the mind" is going away. The future lies with such "decision-making machines".

You're going to release an AI agent based on your principles - sort of a "What would Ray Dalio do?" kind of thing.

Yes, we are beta testing right now. "Digital Ray" will be very well trained because I've written down thousands of decision principles over the last 35 years. Right now, Digital Ray is going through a rigorous quality control process. I truly believe he will be able to effectively answer questions from all people and at all times, so that we won't be limited as we are now: because I can't answer everyone on Reddit. You will be able to have a dialog with Digital Dalio, he will give you useful answers, based on your specifics.

About choices and life principles

At 22, how do you find your own strengths and qualities to realize your potential and achieve meaningful results in life, rather than just following other people's directions?

Realize that life is a fascinating journey full of discovery and adaptations, where your job is to discover your nature and relate it to what you do and who you are with. I invite you to take the free PrinciplesYou personality test I created so that everyone can understand their own psychotype and the psychotypes of the people they build relationships with.

If you consider the most important financial decision in life to be choosing who to marry or who to marry, what advice would you give people for that choice?

There is no more important decision in life than choosing a life partner. If you have a wonderful partner by your side who loves and cares for you as much as you care for him or her, you will reap tremendous practical and emotional rewards. I am convinced that the most important things for a fulfilling life are a labor of love and a meaningful relationship, especially one that is long and deep. When I was 70 years old, I pondered what I would choose if I had to - a labor of love or a meaningful relationship. Though the choice was difficult because I value both, I chose meaningful relationships. And by far the most meaningful of them all is a relationship with a wonderful life partner.

What is your biggest regret?

It's hard for me to answer your question. Sure, I've had many mistakes, and looking back, I wish I had avoided them. But I consider blunders and the pain of them part of the natural process of learning and development, so I'm not sure I wish those mistakes hadn't happened. You know that advice, "God, give me the serenity to accept the things I can't change, the courage to change the things I can, and the wisdom to distinguish one from the other"? I feel like I'm succeeding at that, so I don't have many regrets.

Are you an idealist or a realist?

I consider myself a hyper-realist because I am convinced that understanding how reality works and being able to interact with it effectively is the key to achieving any goals, especially idealistic ones. The most important condition for achieving goals is to be a hyperrealist.

This article was AI-translated and verified by a human editor