The Motley Fool names three quantum computing stocks to 'make a millionaire'

Investors interested in quantum computing should look at mid-cap companies D-Wave Quantum and Rigetti Computing, as well as the larger IonQ, writes Keithen Drury, a contributing Motley Fool technology analyst. Each company already has advantages over peers as the quantum computing arms race is heating up and could start to shape up over the next few years, Drury argues. Still, investors must understand the risk and keep position sizing relatively limited.

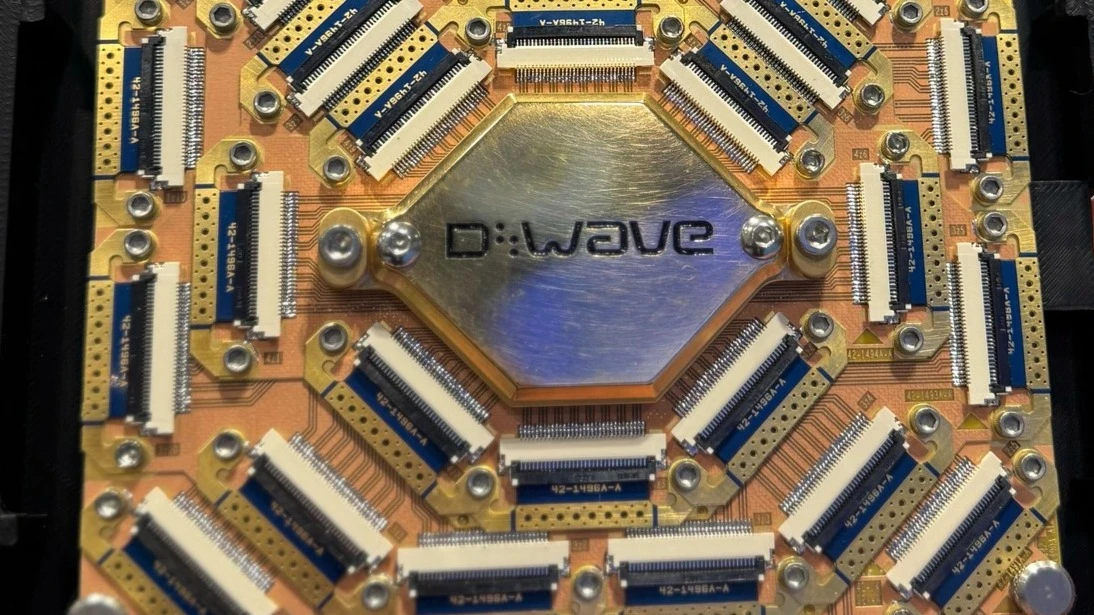

D-Wave Quantum

With a market capitalization of $9.2 billion, D-Wave, is taking a different approach than nearly any company in the space: instead of developing a broad-purpose quantum computer that can be applied to many applications, it's focusing on a specific approach that allows it to tackle problems in the most relevant fields. D-Wave utilizes quantum annealing technology, which can be used for optimization and sampling problems by finding the lowest energy state in the system. This makes the technology useful for logistics networks and statistical calculations, which are two primary uses of quantum computers, Drury points out

All 10 analysts tracking D-Wave recommend it as a "buy," according to MarketWatch. Their average target price of $23.30 per share is below current market quotes.

Rigetti Computing

Rigetti Computing ($9.25 billion market cap) may eventually become an investor favorite among quantum computing stocks, according to Drury. It has the industry's largest multichip quantum computer, which can process complex calculations. Meanwhile, Rigetti's management claims that its gate processing speeds are over 1,000 times faster than a trapped ion computer. As quantum computing technology progresses to the point where the calculations are accurate enough, the industry will likely turn to processing speed as a determining factor for what system to buy, Drury believes.

All eight Wall Street analysts covering Rigetti Computing recommend the stock as a "buy," according to MarketWatch. The average target price is $19.29 per share, below the current market share price.

IonQ

IonQ is the only company on Drury's list that is not a small cap, with a capitalization of $22.7 billion. IonQ, instead of using the superconducting quantum computing approach like most of the larger competitors are doing, uses a trapped ion approach, which gives it a few key advantages.

First, the particle being used for quantum computing does not need to be cooled to absolute zero; it can be utilized at room temperature. This cuts down on input costs, making quantum computing more commercially viable for a wider range of applications, Drury writes. Second, the trapped ion approach offers "impressive fidelity." IonQ holds world records in quantum computing accuracy, which is the primary hurdle that quantum computing companies are looking to overcome.

The stock has nine ratings from Wall Street analysts: six "buy" and three "hold" ratings, according to MarketWatch. The average target price of $64.63 per share is below current market quotes.

The AI translation of this story was reviewed by a human editor.