The Motley Fool spotlights three ‘green’ small caps to buy on the dip

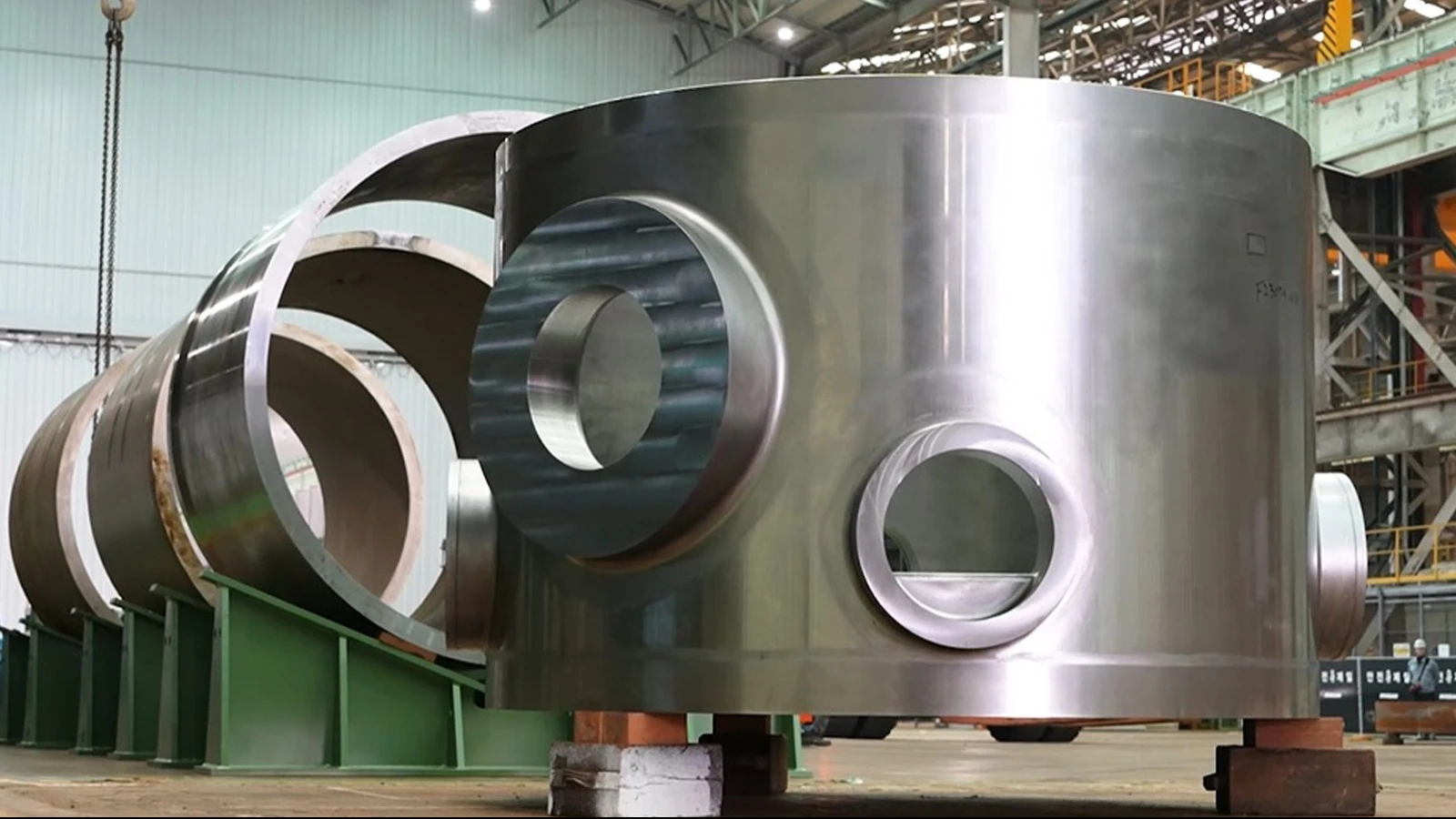

NuScale builds nuclear reactors that can be assembled on site. / Photo: facebook.com/nuscalepowercorp

The Motley Fool has highlighted three small-cap stocks in the renewable energy sector for investors to buy right now. All three are speculative investments but could grow if the companies scale up their businesses. Moreover, these stocks have not been immune to the recent slump triggered by President Trump’s pro-fossil fuel stance, which, according to the Motley Fool, might represent a “golden buying opportunity” for long-term investors.

NuScale Power Corp

Quotes on nuclear reactor developer NuScale are down more than 15% for the year to date. The company’s current market capitalization on the Nasdaq stands at $2 billion.

Wall Street analysts expect NuScale’s revenue to reach $402 million in 2027, almost 11 times the sum in 2024, the Motley Fool writes. The growth could be driven by its new NRC (Nuclear Regulatory Commission) design approvals, a rising number of U.S. contracts, and increasing energy demand from data centers, the financial news outlet adds.

Plug Power

Shares of Plug Power, which develops hydrogen fuel cells and charging, storage, and transport technologies, are down nearly 47% since the start of the year. Its market capitalization now stands at just over $1 billion.

In 2024, the company reported a 29% year-over-year decline in revenue to $629 million and a net loss of $2.1 billion, a 50% rise versus the previous-year period. However, Wall Street analysts expect its revenue to grow at a CAGR of 32% from 2024 to 2027. This growth could be fueled by the stabilization of the hydrogen market, new contracts, and a $1.66 billion loan guarantee from the U.S. Department of Energy for the construction of six green hydrogen manufacturing plants. However, the Motley Fool warns that the company is not expected to become profitable anytime soon.

CleanSpark

Bitcoin miner CleanSpark has seen its share price drop almost 19% since the start of 2025. The company’s current market capitalization is $2.1 billion.

Wall Street expects CleanSpark’s revenue in the 2027 fiscal year to reach $1.1 billion — nearly triple its 2024 figure (the company’s fiscal year ends on September 30) — as it narrows its net loss. The company could face headwinds if Bitcoin’s price plummets, but it could also outperform many industry players if the cryptocurrency's price stabilizes and it attracts more investors, the Motley Fool concludes.