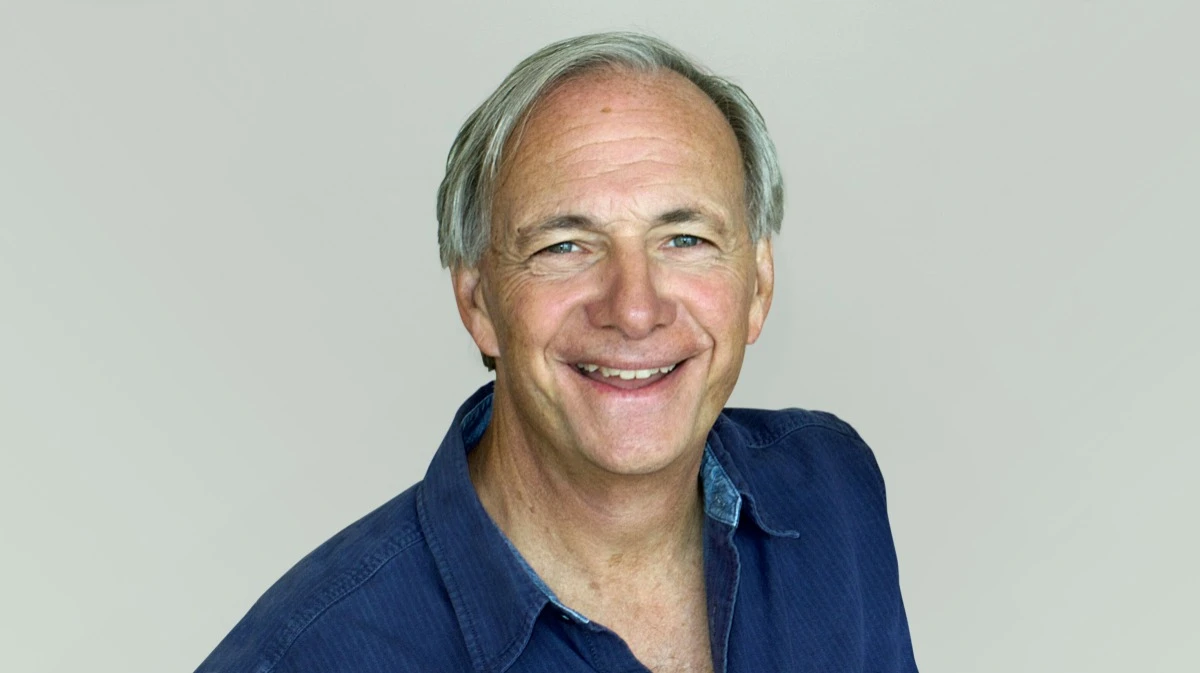

"The new Silicon Valley": why is Ray Dalio betting on the Middle East?

Investors see the region as a new center of capital and technology

The Middle East is gaining ground in the artificial intelligence race thanks to the scale of investment and the influx of specialists, according to billionaire Ray Dalio. He says the region is launching multibillion-dollar projects - from data centers to partnerships with Google Cloud, OpenAI and Nvidia - forming a full-fledged technology ecosystem. At the same time, he warns: the global economy is entering a riskier period due to debt distortions, political tensions and signs of overheating in the AI segment.

Details

The Middle East is rapidly becoming one of the world's key centers of artificial intelligence development, says Ray Dalio, founder of hedge fund Bridgewater Associates. According to him, the region is developing as rapidly as Silicon Valley once did, CNBC reports.

"You can feel the same drive here as in San Francisco and other places where everyone is talking about AI and technology. The atmosphere is very similar," Dalio noted.

The investor emphasized that the UAE and neighboring countries have managed to combine huge financial resources with an influx of international specialists, becoming a center of attraction for both investment managers and AI developers.

What projects are we talking about

The UAE and Saudi Arabia this year launched large-scale initiatives to develop cloud infrastructure, build data centers and form a technological base for AI, CNBC notes. The projects are funded by sovereign wealth funds and partnerships with global technology corporations.

One key example was a $10 billion agreement between Google Cloud and Saudi Arabia's Public Investment Fund in October 2024 - it aims to create a "global AI center" in Saudi Arabia and expand local data processing capacity.

In addition, OpenAI, Oracle, Nvidia and Cisco announced in May 2025 to jointly develop a large-scale AI campus, Stargate, in the UAE.

Asked about the Middle East region's prospects in the artificial intelligence race, Dalio emphasized: "They [in the Middle East] have done the most important thing - they have gathered talented people. The region is becoming something like the Silicon Valley of capitalists. Capital is coming here, specialists are coming here, talent is coming here."

Dalio, as CNBC notes, has been a regular visitor to Abu Dhabi for more than 30 years. According to the analyst, the transformation of the Persian Gulf countries is the result of thoughtful government policy and long-term planning. The founder of Bridgewater Associates calls the UAE "a paradise in a troubled world".

What Dalio says about bubble risk

That said, the global economy could be in for a challenging period in the next couple of years, Dalio warns. "The next year or two will be more volatile," he said, citing three key coincidences that the analyst calls "dominant cycles": the debt crisis, domestic political tensions in the U.S. and geopolitical risks.

The growing global debt load, according to the analyst, is already creating tension in certain segments of the market. "We're seeing cracks in the markets in a number of areas," the expert pointed out, "private equity, venture capital, refinanced debt and all that. So I believe we are in a bubble in almost all of those parameters," Dalio noted, emphasizing the similarities to the 2000 bubble, but not the 1929 bubble.

The political environment in the U.S. will also become more difficult as the 2026 elections approach, with high interest rates and over-concentration of growth in a limited number of companies adding to the vulnerability, the analyst explained Dalio.

The expert also reiterated his point of view on the AI market, which, in his opinion, is now in a "bubble". However, Dalio advised investors not to rush to exit positions just because valuations are inflated. "All bubbles have occurred during periods of major technological change," Dalio said. - You don't need to get out of the market just because there's a bubble somewhere. You need to look for the moment when that bubble starts to pop."

Context

A November Bank of America survey showed that 45% of global investment fund managers consider the AI bubble to be the main risk that could trigger sharp negative market events in the coming months. Market participants' concerns about this are based on inflated valuations on shares of AI giants, Reuters noted. However, there is no consensus on this among investors and analysts. Dan Ives of Wedbush, for example, does not believe in a bubble in the AI market, while ARK Invest CEO Cathie Wood believes that talk about it is misleading investors.

This article was AI-translated and verified by a human editor