The price of fear: How the Israel-Iran war will further affect oil prices

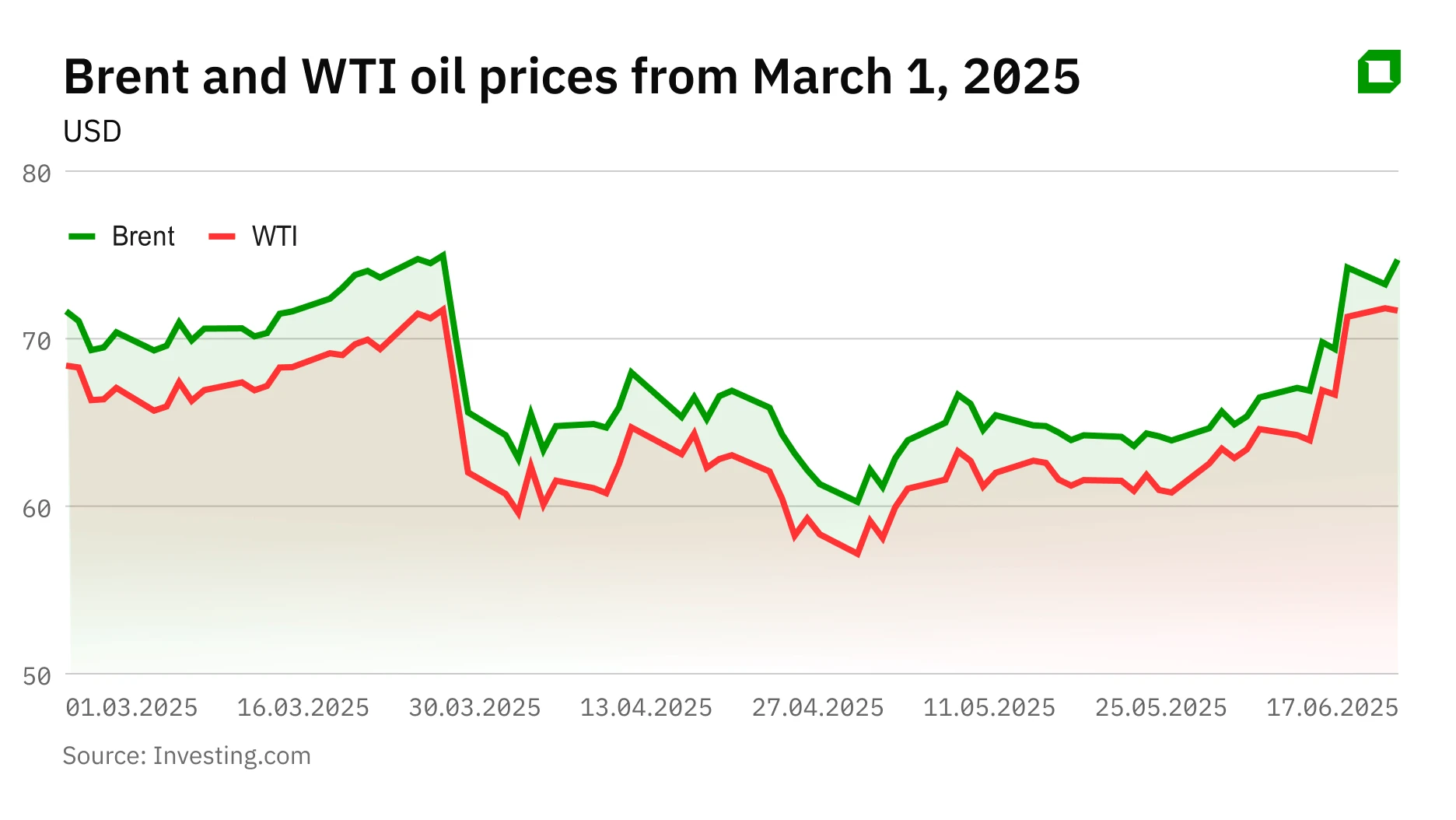

In the early morning hours of June 13, Israeli Air Force fighter jets attacked Iran. The attack was prompted by reports that Tehran is close to developing nuclear weapons. Today is the sixth day of escalating conflict between the two countries. Military action in the Middle East traditionally causes oil prices to spike. This time was no exception - immediately after the news of the attack appeared, Brent quotes jumped by 13% and at one point exceeded $78.

Brent was worth about $75.6 on Wednesday. The premium for the grade over Middle East benchmark Dubai crude topped $3 a barrel on Wednesday, reported Reuters, citing market sources. That's the highest since the end of September 2023. The premium of the Brent crude futures contract for delivery in the next month over the contract for delivery in six months hit its highest level in nearly two years on Monday this week, Reuters writes - reflecting market concerns about tight supply. Fitch analysts believe that the geopolitical premium to oil prices is in the $5-10 range.

"Right now, unfortunately, predicting oil prices is a completely thankless task - the uncertainty is too high," says Tatiana Mitrova, founder and director of New Energy Advancement Hub.

"Before the Israel-Iran war, oil prices were falling. And the main intrigue was whether Saudi Arabia would help drive down the price of oil to fight US shale oil producers. Now, if there were such plans, they are likely to be shelved," Alexei Golubovich, managing director at Arbat Capital, told Oninvest Alexei Golubovich.

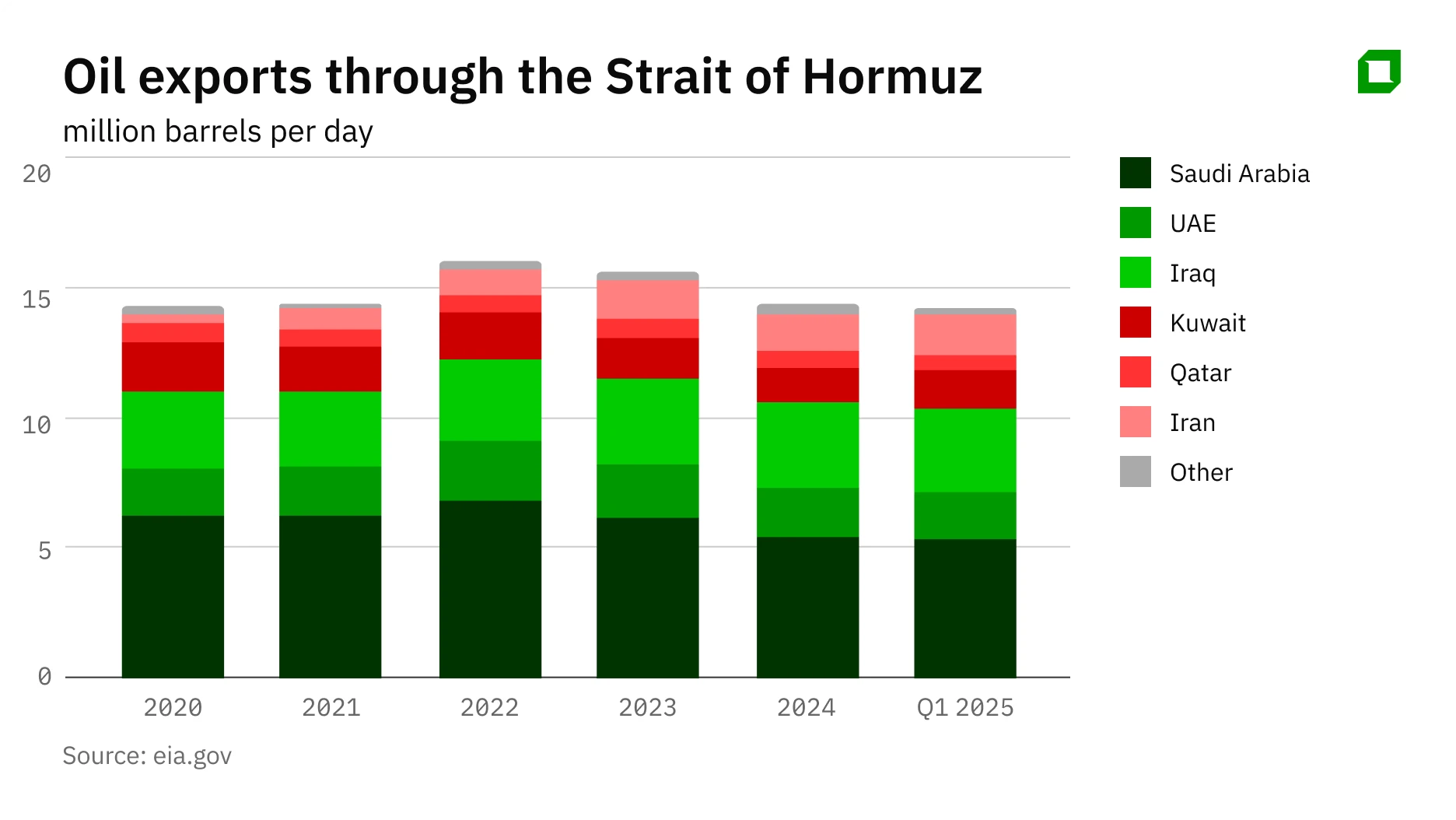

According to him, the most discussed issue now is the possible closure of the Strait of Hormuz by Iran;

"Because of these concerns, we saw oil go from just under $70 to $78 on Friday and then plummet to $71. Now the price is holding at $74-75 because there is little likelihood of the Strait being closed in the next few days. It is not profitable for the participants of the conflict to destroy Iran's infrastructure, so if the war develops as it is now, it is most likely that the oil price will remain in the range between $70 and $80," Golubovich said.

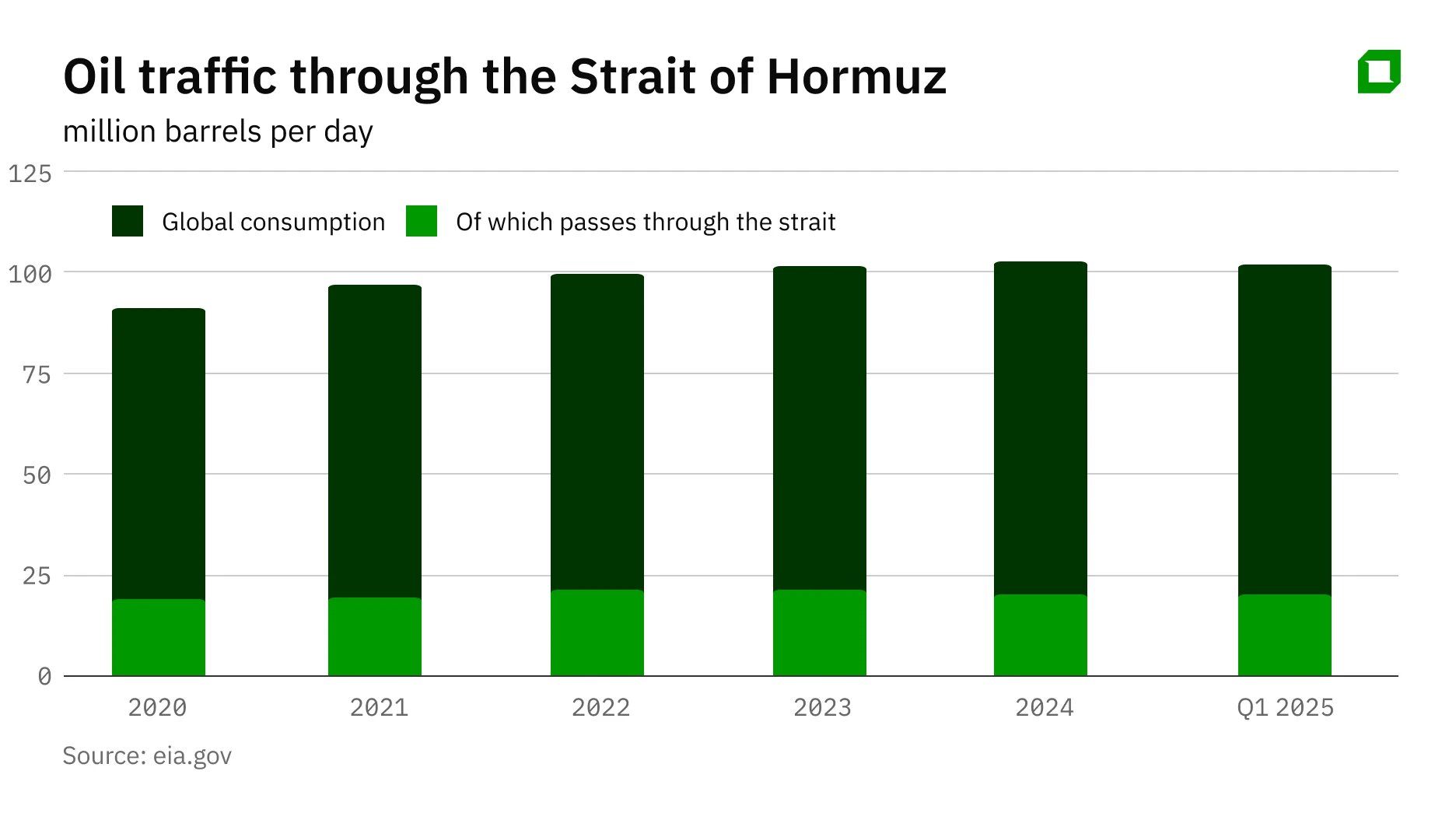

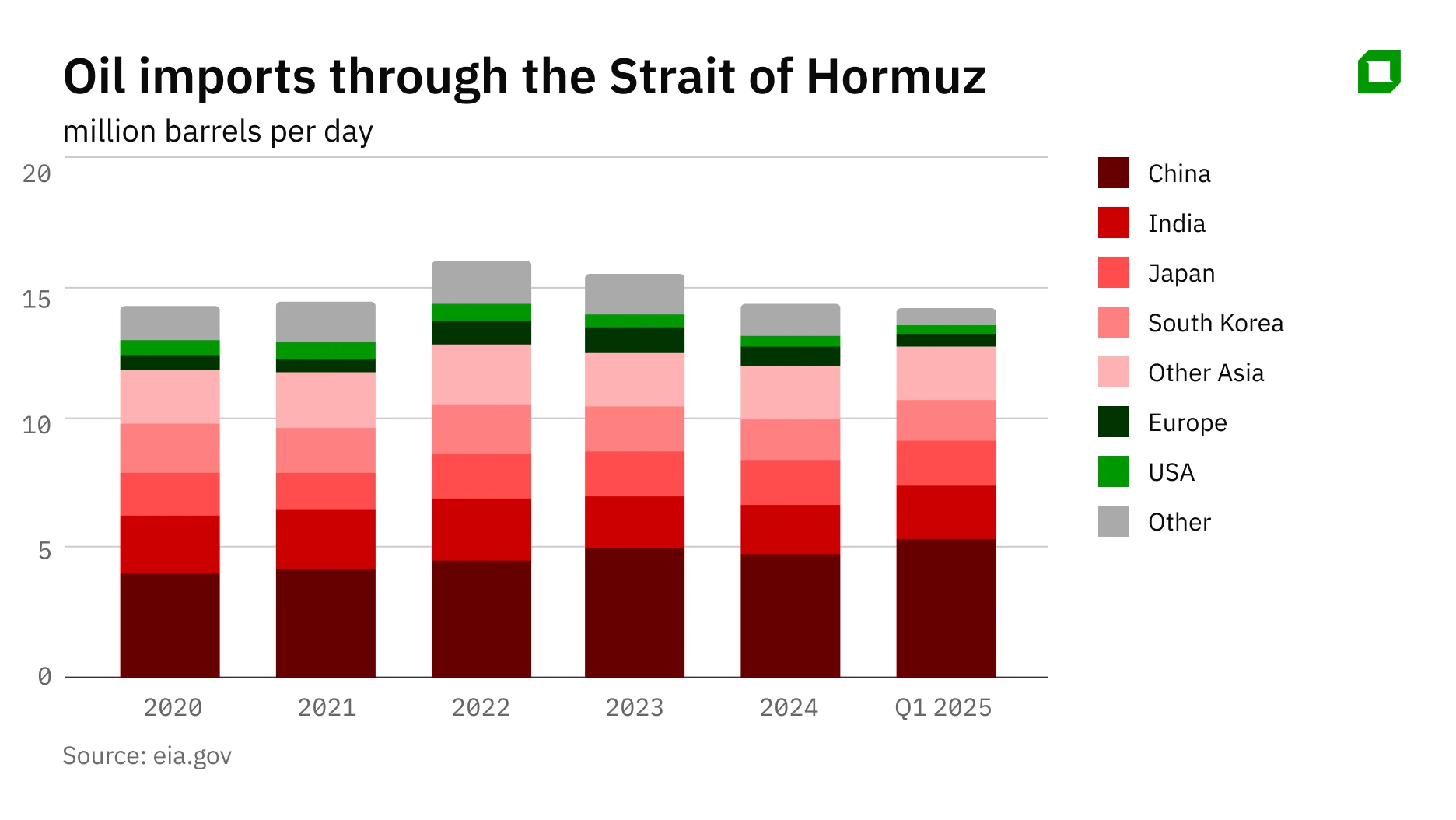

Astero Falcon portfolio manager Alena Nikolaeva believes oil prices have stabilized because the market has seen the main thing: physical supplies have remained intact. The Strait of Hormuz is working, tanker traffic is almost at normal levels. On June 15, she said, 111 ships passed through the strait, while before the conflict there were about 116.

"The Dubai crude oil grade added less in price than the cost of Brent futures. All this is a signal that the physical market is not operating in panic mode. Right now, GPS signals in the Gulf are being jammed, but deliveries are going on. Ships are not being diverted to other routes, there is no catastrophic force majeure. In essence, the market assessed the fear, put a premium on escalation, but also quickly snapped it up," she says;

According to her, another important moment for investors is the fact that the news reports about Iran's readiness to return to the negotiating table on the nuclear deal with the US if the US does not intervene in the conflict directly. This also reduces the degree of uncertainty. In the moment for the global market, the confrontation is already over, as the worst thing has not happened - the disruption of supplies. So this is not a new war, but a routinization of the old conflict, she concludes.

"Investors are not seeing any real shortages yet, it's more noise and news headlines. Going forward, the market is looking pragmatically. As long as there are no attacks on tankers or blockage of the Strait of Hormuz, the $80-$85 oil scenario is postponed. Yes, there are options on $100 oil, but this is not the base case. The main trade is now in the $70-75 range. If there is a real shock, the market will react quickly. But for now, the focus is back on stocks, OPEC+ actions and macro statistics. Even Donald Trump's abrupt departure from the G7 and his calls for immediate evacuation from Tehran are seen more as a show and "grandpa's hype". Without critical blows to logistics, the price shock is postponed," said Alyona Nikolaeva.