The value of Tesla shares may fall by 10% on November 6 - if investors vote against a record compensation package for the company's CEO. Investors Business Daily quoted unnamed analysts as saying this. Earlier, Elon Musk himself, as well as the chairman of the board of directors of Tesla, said that if the businessman does not get what he wants - namely, 25% of the company's shares, which are estimated at $1 trillion - he may leave Tesla. Is there life after Musk or is he worthy of a trillion - 5 main questions ahead of the vote.

Will Musk get a trillion dollars?

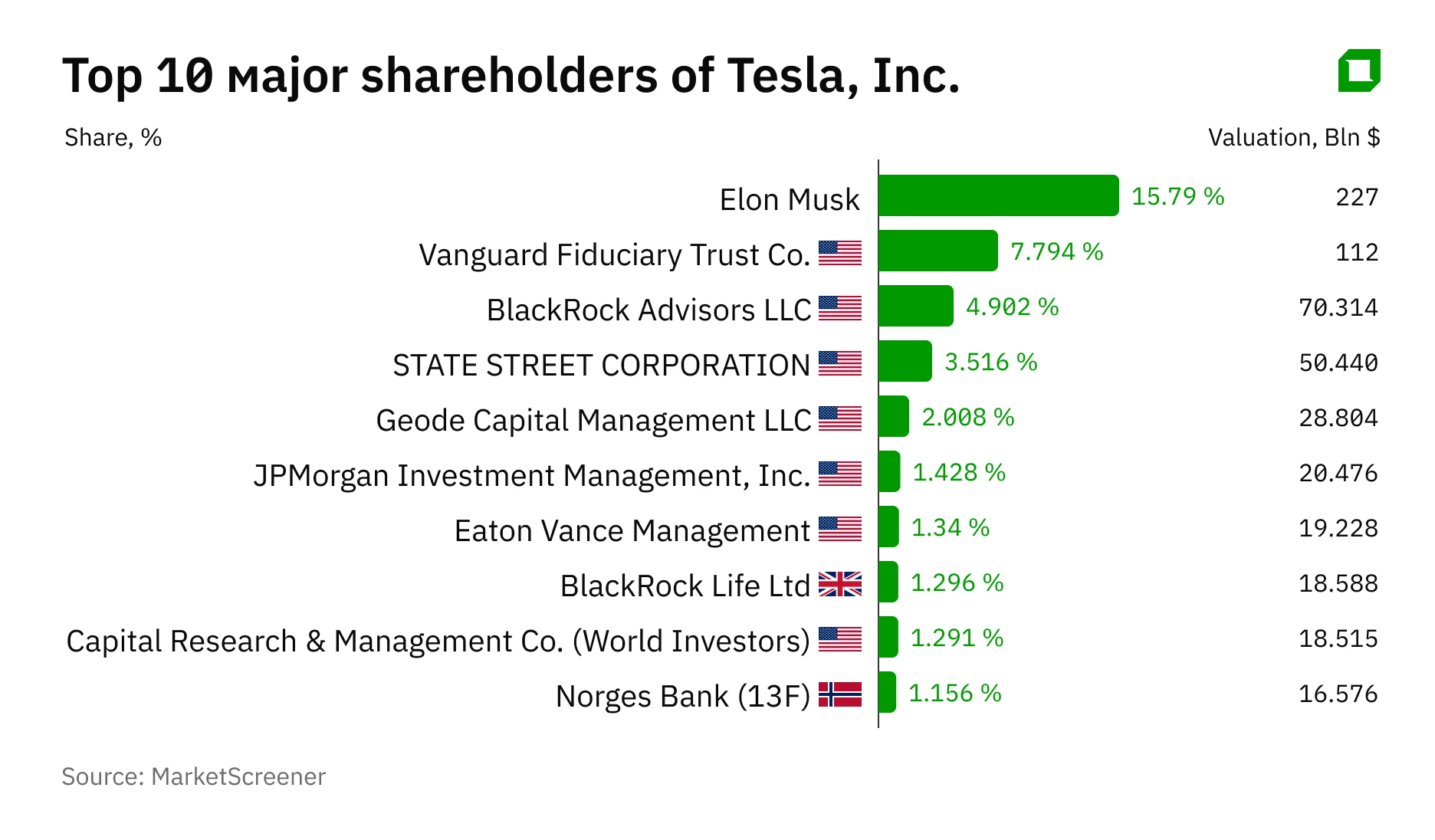

No one can seriously predict the outcome of the vote on the record compensation package today. The company's three largest investors - BlackRock, State Street and Vanguard - refused to disclose their position to journalists.

The second unknown in this equation is the position of retail investors, who owned about 40% of the company's securities as of 2024. According to Reuters, this category used to abstain from voting, but if they did decide to cast a vote, it was usually in favor of the company's management. However, never before in the history of corporate business has a trillion-dollar compensation package been discussed.

The names of opponents of Musk's remuneration are known. Two days before the vote, the Norwegian Petroleum Fund announced its decision to vote against it - it is one of the ten largest shareholders of Tesla and owns a stake of 1.1%.

"We are concerned that the amount is too large, shareholder interests could be diluted, and the company relies too much on one person," the official statement said.

Earlier, the California Public Employees' Retirement System (CalPERS), the largest public pension fund in the United States, announced its intention to deny Musk record compensation.

Democratic New York State Comptroller of Expenditures Thomas DiNapoli is also in opposition to the payout. The state pension fund, whose votes are controlled by DiNapoli, owns 3.3 million Tesla shares - that's about 0.1% of the company.

Independent organizations Institutional Shareholder Services (ISS) and Glass Lewis, the largest corporate governance and shareholder voting advisory firms, also recommended against the payout. ISS stated that the payout sets a dangerous precedent by "perpetuating exceptionally high payout opportunities for the next ten years and diminishing the board's ability to make significant adjustments to future compensation levels.

There are those who believe 25% of the company's stock for Musk is adequate compensation for his role.

Florida's largest pension fund, said it's ready to vote yes.

Cathie Wood, head of Ark Invest, said that if Musk and the company meet its goals, "employees and their families will be richer than they ever imagined."

"I don't see it as a major problem," Andrew Rocco, a stock strategist at Zacks Investment Research, shared his opinion with the NYT. - "As controversial as Musk is, he sets ambitious goals for himself - and over time he achieves them, and sometimes even surpasses them."

What are investors afraid of?

The battle isn't about money - it's about power. Musk - the richest man in the world - says he's not interested in a trillion dollars. All he wants is more control over Tesla.

If we create this robot army, will I even have serious influence over it? I don't feel comfortable creating a robot army if I don't have control over it

The entrepreneur said he needs "about 25%" of the voting shares to have a "strong influence" on Tesla but still retain the ability to be fired if he "goes crazy."

And here Musk coincides with the opponents of the payout - they are not interested in the cosmic cost of the compensation package either. They are frightened by the freedom of action that the entrepreneur will be able to gain.

It's not a reward for results. It's a reward for unlimited power

"It's not a reward for results," says Thomas DiNapoli. - It's a reward for unlimited power."

Opposition investors - including several major labor unions - have launched a public campaign called "Take back Tesla". Their main fear is the same: the new package would strengthen Musk's control over the automaker and revive what New York City Comptroller Brad Lender called "the era of robber barons."

"In essence, Tesla is asking shareholders to give up any real influence over the company's affairs," said Tejal Patel, executive director of the union-affiliated SOC Investment Group. The company advises union pension funds, which together own about 1 percent of Tesla's stock.

Another concern of some Tesla stock owners is that Musk seems to have cooled on the company as a whole. Back in May, during an unscheduled meeting with employees, Musk said:

"I'm literally on a deadline. I have, I think, 17 jobs."

At the time, the entrepreneur was still heavily involved in government affairs in Washington. But even without politics, the businessman and visionary still has several huge projects in parallel with Tesla - including Space X and xAI.

According to CNN, Musk was once head over heels in Tesla's business and even slept at the factories. But the history with the Department of Government Efficiency has shown: it is easy to lose the attention of an entrepreneur and difficult to get it back, even in times of crisis.

"The board has allowed Mr. Musk to be overextended for years, allowing him to remain CEO despite spending significant time running his other companies - xAI/X, SpaceX, Neuralink and The Boring Company," said the letter from SOC Investment Group, which was signed by more than a dozen managers and investors.

What does Musk have to offer Tesla?

Today, in addition to selling electric cars, Tesla is actively developing its energy generation and storage business, which was its main growth driver in the third quarter. Revenues from it grew by 44% to $3.42 billion. Tesla's energy products include large battery backup power systems and solar photovoltaic installations capable of powering data centers and other facilities.

However, the visionary Musk seems to be interested in other, more futuristic areas of business, including robotic cabs Cybercab and the production of humanoid robots Optimus. Tesla's CEO even has an understanding of production launch dates: the first robots could see the light of day as early as the first quarter of 2026, Cybercab - in the second quarter. The problem is different - it is still unclear who will buy them.

Tesla's robots and autopilot cars may not generate significant revenue - let alone profits - for several more years, the New York Times reports. Skeptics say some of Musk's promises, including that Tesla's robots will be able to care for children or perform surgery, look unrealistic.

"Musk has convinced some investors that soon everyone will be driving robot cabs. I don't believe that," John Paul McDuffie, a professor of management at the Wharton School of Business at the University of Pennsylvania, shared his opinion with the publication.

Here we note that the professor's opinion does not coincide with numerous forecasts on the growth of the robotaxi market: for example, Fortune Business Inside wrote that by 2031 its volume will reach $118.61 billion, in 2022 it was estimated at $1.71 billion.

As CNBC wrote in mid-October, investors are particularly concerned about the slow progress in the development of the autopilot system - only 12% of electric car buyers order the Full Self-Driving option, i.e. less than 900,000 subscriptions. And Musk needs 10 million electric car owners to subscribe to FSD in order to receive his trillion-dollar compensation.

All in all, as the channel summarizes, recounting the October sovzon of the board of directors and Elon Musk with investors, Tesla's management provided very little concrete guidance to share owners, and Musk only repeated his grandiose futuristic visions.

At the same time, the conditions for obtaining a 25% stake are quite specific and extremely ambitious. Over the next 10 years, Musk needs to increase the company's capitalization from $1.5 trillion to $8.5 trillion by fulfilling each of the 12 points stipulated in the agreement.

To understand how difficult these conditions are to fulfill, Reuters provides some illustrative examples. To reach the $8.5 trillion mark, Tesla would have to sell 100 million humanoid robots a year. Or create a network of robot cabs with revenue more than ten times that of Uber. If Elon Musk somehow manages to achieve this capitalization, Tesla will be worth slightly less than the two most expensive public companies in the world combined: $8.5 trillion is slightly less than the combined current value of Nvidia and Microsoft.

Effective manager or risk taker?

Another risk factor for hesitant investors is the personality of Musk himself.

A recent study by Yale University economics professors states that "Musk's polarizing and politically biased actions over the past three years have cost Tesla a loss of between 1 and 1.26 million unsold cars in the U.S. market; while sales of its competitors in the electric car segment have grown by 17-22%."

Musk, according to the authors of the study, made a serious strategic mistake when he decided to support Donald Trump: he went against Tesla's main target audience - US residents who vote for the Democratic Party and care about the environment.

Unsold cars are only part of the financial problems. In March and April , Tesla plants, dealerships, charging stations and cars became easy targets for angry Americans. People who disagreed with Trump's policies and the Republican president's alliance with the businessman took out their anger on anything with a Tesla logo.

"It's a distraction for the company and a problem for the brand," summarized Illinois State Treasurer Michael Frerichs.

Problems for the brand were not only in the U.S.: after Musk expressed support for the party "Alternative for Germany" (AfD), the number of applications for the purchase of electric cars Tesla in February fell by 76% - to 1,429 cars, and this is against the background of the fact that the market for electric cars in the country as a whole grew by more than 30%. Sales in Europe as a whole fell. In Sweden, for example, they fell by 89% in October.

An additional challenge for investors and analysts was the unpredictable reaction of the markets to the relationship between Elon Musk and Donald Trump. In December 2024, Tesla shares rose by almost 70% and the company's market value increased by more than $556 billion on the news that the entrepreneur would become an advisor to the president. And in June, the stock plummeted, reducing the company's capitalization by more than $150 billion overnight - due to Musk and Trump's public spat over tax reform.

"Elon's political views continue to hurt the company's stock. First he sided with Trump, which alienated many potential Democratic buyers. And now he's taken a swipe at the Trump administration," said Tesla shareholder Dennis Dick, chief strategist at Stock Trader Network.

Even a break with the Trump administration and a return to business ventures didn't help quell the doubts of some of the company's big investors.

"No matter how much time Musk spends in Tesla's offices, it won't change many people's new perception of his personality - indeed, it may only make things worse, as it's now too late to separate the man from his company," shared Xi Benson, CEO and founder of marketing agency The Behaviours Agency.

Many investors, as well as some members of Tesla's board of directors, are concerned not only about the behavior of the entrepreneur, but also about the reasons behind it. In early 2024, the WSJ newspaper released a major investigation in which, citing sources, it was claimed that Elon Musk has a drug problem.

"Because Musk's identity is inextricably linked to the value of his companies, such actions potentially put about $1 trillion in investor assets, tens of thousands of jobs and a significant portion of the U.S. space program at risk," the article said.

As a result of these allegations, Musk posted several results of his drug tests to X - all of which were negative. Musk's lawyer also called the claims made in the WSJ false and said that Tesla regularly conducts drug tests - Musk has always been clean.

Does Tesla have a future without Musk?

Tesla's board of directors is now agitating investors to vote in favor of the compensation package. Chairman Robin Denholm and other top managers are traveling to meetings with major stock holders to talk to them in person to persuade them to give Musk what he wants. Earlier, board members set up a special website to promote the compensation plan and launched video ads on social media.

"I strongly believe - as do my board colleagues - that only Elon has the unique combination of leadership and technical manufacturing expertise that keeps us on course to maximize long-term shareholder value while delivering public value," Denholm says.

An army of retail investors and visionary fans are writing posts in support of the entrepreneur on social media X. Their main message is simple: Musk is Tesla, Tesla is Musk.

Even the robots from Tesla became part of the promotion: next to the Nasdaq building they put one Optimus on display - he gives out candy and takes pictures with everyone.

The CEO himself is also indirectly included in the campaign, with the New Youk Times estimating that Musk has published more than 60 posts in the past few months about the future of voting.

Musk's threats to leave are part of a negotiating strategy, says the New York Times.

Cemeteries are full of irreplaceable people

Tesla has already once stood on the brink of a crisis that its investors characterized as "decision-making paralysis." In March 2025, when Musk was fully immersed in political issues, Ross Gerber, a major Tesla investor, expressed concerns that Musk was Tesla's sole manager, that his absence could "create a culture in the company where no one feels confident making decisions."

Perhaps that's why Tesla's board of directors is still discussing a "plan B" in case the CEO leaves the company. As Robin Denholm, chairman of the board of directors, told journalists, different options are being discussed. The most likely scenario is the appointment of one of the current top managers as CEO. Denholm even named a possible successor - it is the head of global production and head of the Chinese division Tom Zhu. However, according to her, there is no final decision, and any options are still possible.

This article was AI-translated and verified by a human editor