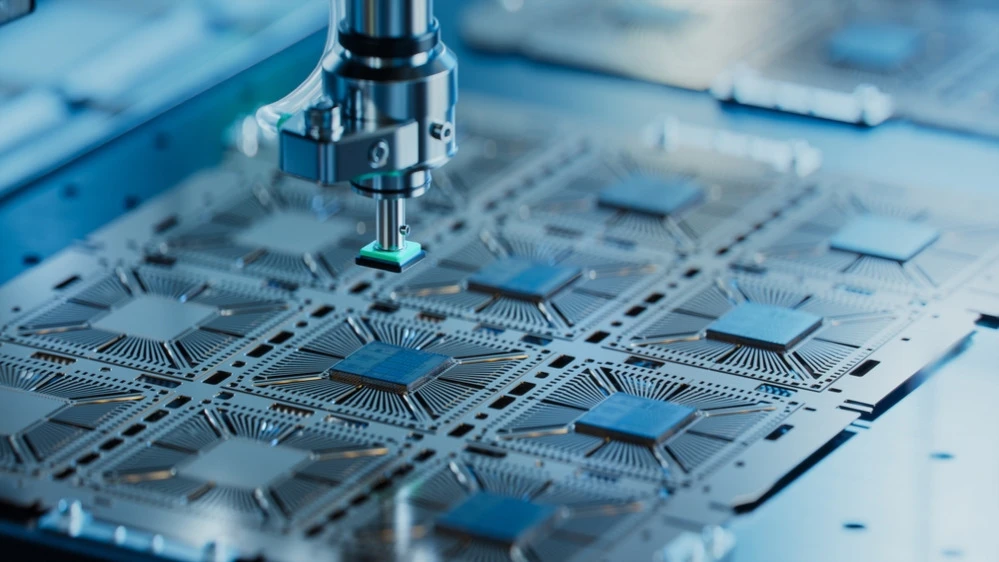

The US has banned shipments of chipmaker equipment to China. Who will lose from this?

The ban would limit Samsung and SK Hynix's ability to manufacture chips in China and jeopardize Beijing's access to a range of technologies

U.S. chipmakers Lam Research, Applied Materials and KLA fell in price in trading on Friday due to a decision by the U.S. Department of Commerce to ban shipments of chip printing machines to China. The decision hits South Korea's Samsung and SK Hynix, which have factories in China, Reuters reported .

Details

Shares of American companies-manufacturers of equipment for printing chips and microchips fell in trading on Friday, August 29. Their key customers are South Korean chipmakers Samsung and SK Hynix, whose production in China, the U.S. government decided to complicate the production in China. Quotes of Lam Research fell by 4.3%, Applied Materials - by 2.9%, and KLA - by 2.2%.

The Ministry of Commerce has revoked licenses that allowed South Korean companies with Validated End User status to use U.S. semiconductor manufacturing equipment in the PRC. The restrictions will take effect in 120 days, according to a publication in the U.S. Federal Register.

Intel is mentioned there among the companies that lost their permits, but it sold its unit in Dalian, China, to SK Hynix earlier this year.

"President Trump's administration is committed to eliminating loopholes in the export control regime, especially those that put U.S. companies at a competitive disadvantage," Deputy Commerce Secretary Jeffrey Kessler said in a statement, as quoted by Bloomberg.

The U.S. Department of Commerce, Samsung and SK Hynix did not respond to Reuters' requests for comment.

What does that mean

The Donald Trump administration's actions will reduce China's chip manufacturing capabilities and jeopardize Beijing's access to certain technologies, according to Bloomberg. The Commerce Department granted Samsung and SK Hynix exemptions from export restrictions imposed in 2022; they will now have to obtain separate licenses to buy equipment for their Chinese fabs. Meanwhile, thousands of applications from U.S. companies to supply goods and technology to China have been stuck in the Commerce Department's system in recent months, including billions of dollars worth of exports of chip-making equipment, Reuters wrote in early August.

This decision may play into the hands of Chinese equipment manufacturers, whose products can partially replace American ones, Reuters admits. It is also beneficial to the American memory chip manufacturer Micron, which is one of the main competitors of Samsung and SK Hynix.

Context

When in June the U.S. Department of Commerce for the first time allowed the possibility of canceling exemptions for supplies of equipment for semiconductor production, a White House spokesman explained that it was only "preparation for a possible breakdown" of the truce in trade negotiations between the U.S. and China, recalls Reuters. The White House was unable to comment promptly on the situation to the agency.

A trade truce is now in effect between the countries: duties on Chinese imports to the United States are 30%, while duties on American goods from China are 10%. The trade war between the world's two largest economies has affected everything from rare-earth metals needed for U.S. industry to the purchase of U.S. soybeans for the Chinese market.

This article was AI-translated and verified by a human editor