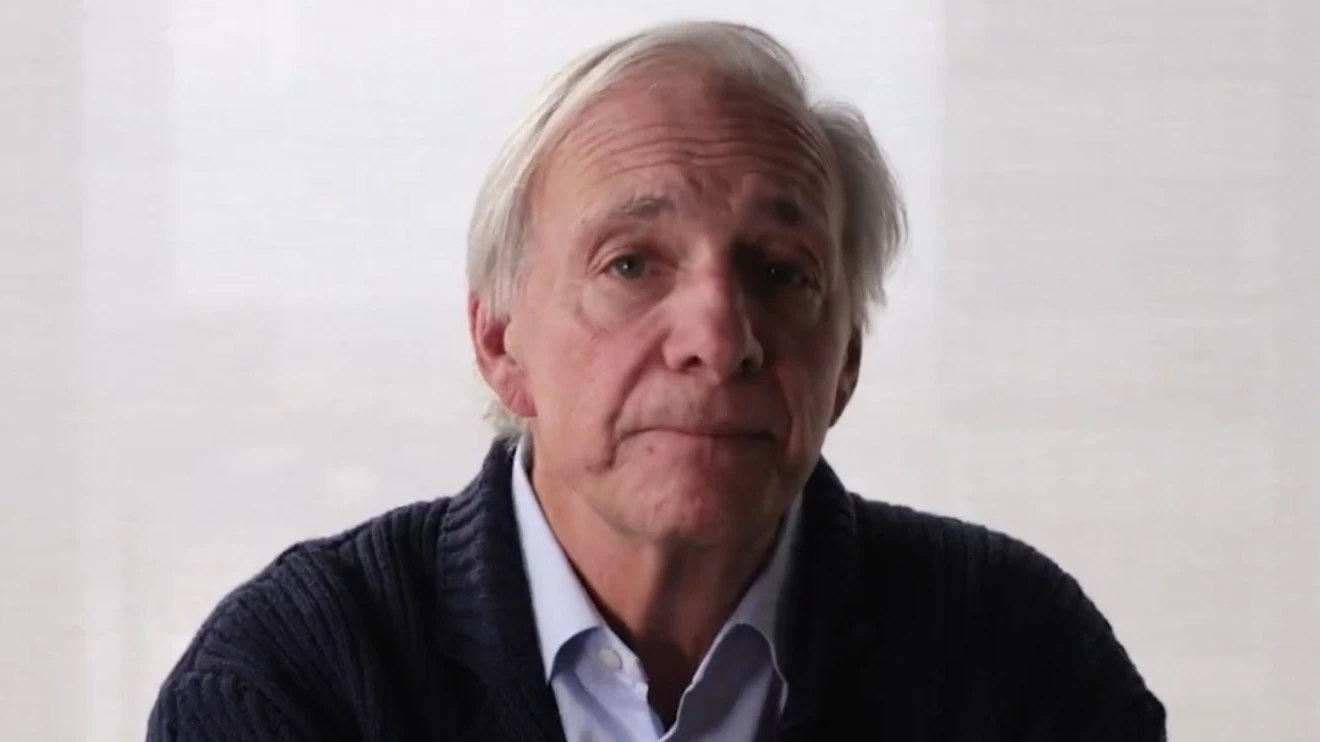

The US is moving towards a 1930s-style autocracy, Ray Dalio declared. What risks did he see?

Other investors are too afraid of Donald Trump to openly criticize him despite mounting concerns, a billionaire has said

The US under Donald Trump is moving towards a 1930s-style autocracy, Ray Dalio, founder of Bridgewater Associates, the largest hedge fund by assets, has said. His comments are a rare example of open criticism of Trump from an influential figure in the financial world, says the FT. Dalio warned of risks to Fed independence, a debt crisis and the threat of either inflation or default. All of this weakens democracy and strengthens autocracy as the public demands "tight control" from leaders for the sake of stability, the billionaire added.

Details

The US under Donald Trump is moving towards 1930s-style autocratic politics, billionaire investor Ray Dalio told the Financial Times.

"I think what is happening now in politics and society is similar to what was happening around the world during the 1930s and 40s," Dalio noted. He cited the White House's decision to acquire a 10% stake in chipmaker Intel as an example of "strong autocratic leadership." The deal is driven by a "desire to take control of the financial and economic situation," the investor said.

The US is being pushed towards "more extreme" policies by "wealth gaps", "value gaps" and a collapse in trust, Dalio argued. His comments are a rare example of an important figure in the financial world criticizing Trump, says the Financial Times. Other investors are afraid to speak out openly against the president, the newspaper noted, citing Dalio, although concern about his policies is growing on Wall Street.

"I'm just describing the cause-and-effect relationships that drive what's going on," said the founder of Bridgewater Associates. - And, by the way, in times like this, most people keep quiet because they fear reprisals if they are criticized."

The investor also warned of several risks facing the US.

The threat to the Fed's independence

Those risks intensified after Trump, who has been pushing for lower rates, fired one of the Fed's governors, Lisa Cook, and hinted at nominating a supporter to replace her.

However, easing monetary policy in Trump's scenario could be dangerous, Dalio says. A politically weakened central bank, which would be forced to keep rates low, would "undermine confidence in the Fed's ability to protect the value of money, make dollar bonds less attractive and weaken the existing monetary order," he explained. Foreign investors have already begun to move out of Treasury securities and into gold, the investor noted.

As it is, the Fed will soon be faced with a choice: "Either let rates rise and face a debt crisis, or print money and buy debt that no one else will want," the investor argues. According to him, both scenarios would hit the dollar.

Increasing state control

"Governments are increasingly taking control of central banks and businesses," Dalio told the FT, although, as the newspaper notes, he declined to explicitly call Trump's model authoritarian or socialist.

Referring to Trump's 10% stake in Intel and the allocation of a portion of Nvidia and AMD's U.S. revenue from exporting their chips to China, Dalio referred to his notion of the "big cycle": in times of major conflict and risk, leaders of countries tend to tightly control markets and economies.

"Traditionally, the growing wealth and value gap leads to increasing populism on both the right and the left, and irreconcilable contradictions between the two that can no longer be resolved democratically. As a result, democracies are weakening and autocratic leadership is gaining strength because a significant part of society wants leaders to take control of the system and make it work in their interests," Dalio emphasized.

Rising national debt

In addition, Ray Dalio warned of the risks of debt to Western economies. He compared the U.S. to an organism whose circulatory system is clogged with plaques: debt payments are crowding out other expenditures. According to the investor, Washington spends about $7 trillion annually, while revenues are only $5 trillion. This imbalance requires a massive issuance of new bonds at a time when investors are increasingly questioning whether Treasury securities can be considered safe.

"Demand for debt is unlikely to keep up with supply," Dalio emphasized. In his view, it is years of deficits and unsustainable debt growth that have brought the US to the brink of a debt crisis, although "presidents of both parties" have been making things worse long before Trump's latest fiscal plan. "The big excesses that are projected as a result of the new plan will probably lead to a debt heart attack in the relatively near future," Dalio said. - My guess is three years, give or take a year or two."

This article was AI-translated and verified by a human editor