These small-cap healthcare names have rocketed YTD

Healthcare small caps have gained momentum in 2025. According to a Bloomberg Intelligence report published in November, the top-performing segments of the Russell 2000 in the first quarter of 2025 were utilities first, financials second, and health care third.

The financial and healthcare sectors together account for more than 36% of the Russell 2000’s capitalization and play a decisive role in shaping the index’s performance. Notably, health care’s advance has been driven not only by price momentum but also by improvements in key fundamentals – earnings and revenue – while valuation multiples remain relatively moderate.

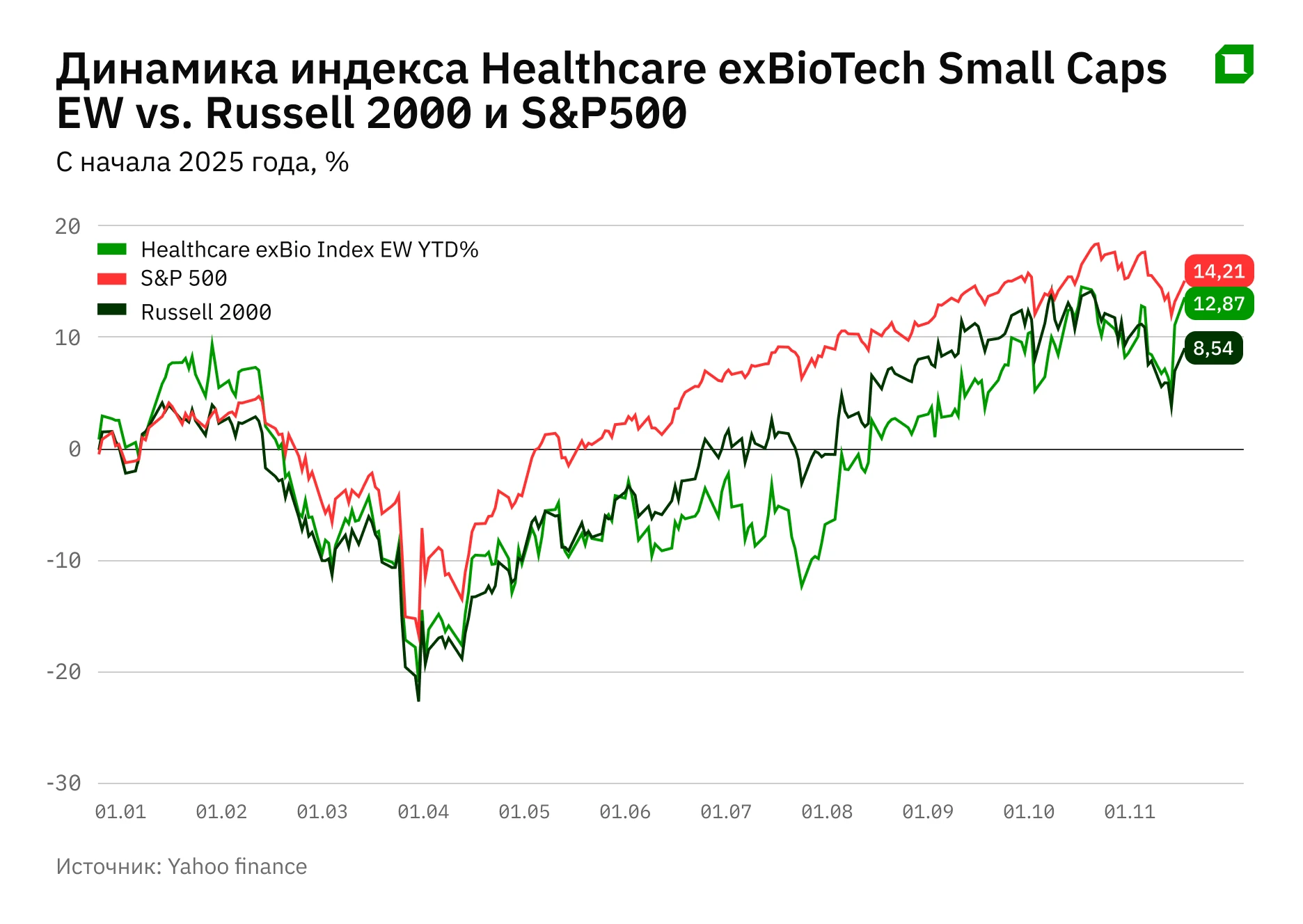

Analyst Aldiyar Anuarbekov has put together for Oninvest the Healthcare ex-Biotech Small Caps index, which includes 124 healthcare names. Year to date, the index has advanced nearly 13% (as of November 1). By comparison, the Russell 2000 has gained about 8.5%, while the S&P 500 has risen 14.2%.

Individual performance within the index has been uneven. Only 50 of the 124 names have posted meaningful gains. Several stocks, however, have delivered explosive returns. Shares of the Oncology Institute have surged about 975% year to date, Nutex Health has risen 225%, and medtech Claritev Corp. has climbed 324%. They are followed by digital parenting platform Owlet (up 201%), ophthalmology equipment maker Sight Sciences (up 134%), and animal health products manufacturer Phibro Animal Health (up 109%).

At the other end of the spectrum, some stocks have recorded steep declines, including medical device maker RxSight (down 66%), healthcare solutions provider Semler Scientific (down 62%), Procept BioRobotics (down 61%), and healthcare platform Evolent Health (minus 63%).

Below Anuarbekov takes a closer look at the three top performers.

The Oncology Institute

The Oncology Institute (TOI) operates under a model in which it receives fixed payments per patient and is responsible for both care quality and total costs. As a result, the company has strong incentives to improve efficiency and reduce unnecessary spending.

In the third quarter of 2025, revenue rose 36.7% year over year to $136.6 million, while gross profit increased 31.7% to $18.9 million. The adjusted EBITDA loss narrowed to $3.5 million from $8.2 million a year earlier. The management raised its full-year revenue guidance to $495-505 million, from $460-480 million previously, and now expects to reach EBITDA breakeven in the fourth quarter, which has been a key driver of the stock’s rally.

According to Refinitiv Eikon, analysts at Noble Capital Markets, B. Riley Securities, and BTIG rate the shares “buy” or “outperform.” The average target price of $6.50-7.00 per share is roughly double the closing price on December 11.

Nutex Health

Nutex Health (NTUX) operates a network of 24 micro hospitals and outpatient facilities across 11 U.S. states, alongside other healthcare services. A major revenue driver in 2025 has been the company’s success in recovering unpaid claims from insurers through the federal Independent Dispute Resolution mechanism (for resolving payment disputes between insurers and healthcare providers).

In the third quarter of 2025, revenue surged 240% year over year to $267.8 million. For the first nine months of the year, EBITDA jumped 616% to $142.9 million. Net income reached $59.0 million, versus a loss a year earlier. Net cash flow for the first nine months of the year totaled $177.7 million, up 670% year over year.

Freedom Capital Markets has reiterated its “buy” rating on Nutex with a target price of $220 per share, implying upside of about 25%. This reflects a record operating performance and an attractive valuation: the stock trades at about 2.0 times forward EBITDA, versus roughly 7.5 times for peers. According to MarketWatch data, the consensus rating on the shares is “buy,” with an average target price of $250 per share.

Claritev Corp

Claritev (CTEV) develops software solutions for cost management in the U.S. healthcare system. Its platforms help insurers and healthcare providers to optimize medical billing verification, allowing users to avoid unnecessary costs.

In the third quarter of 2025, revenue increased 6.7% year over year to $246 million, while adjusted EBITDA rose 9.5% to $155 million. The management also raised its outlook and now expects revenue growth of 2.8-3.2% in 2025, versus its previous expectation of flat growth.

Piper Sandler has rated the shares “outperform” and raised its target price to $90 per share following the strong quarterly results. The new valuation implies upside of more than 150% versus the closing price on December 11. The consensus rating on the stock is “buy,” with an average target price of $88 per share.

Outlook

Healthcare small caps are trading at a notable discount to their historical valuations. According to Bloomberg Intelligence, the sector is currently the cheapest segment of the market: the price/sales ratio is 1.2 standard deviations below the five-year average, suggesting that share prices are lagging fundamentals.

Rising costs across the U.S. healthcare system provide an additional tailwind. Insurers are tightening cost controls, thereby boosting demand for optimization solutions. This environment favors niche players, including developers of payment optimization software, providers of analytics solutions, and independent clinics with lean operating models.

Taken together, cheap valuations and improving fundamentals make healthcare small caps one of the more compelling segments heading into 2026.

This material does not constitute investment advice.