Trump threatened 100% duties on chip imports. Intel shares jumped by 3%

The US will impose duties of 100% on chip imports, Donald Trump has announced. However, he maintains that the levies will not apply to companies that have pledged to manufacture semiconductors in the US. Nvidia shares and TSMC securities fell as much as 1.5% at one point in the postmarket, but quickly recovered the losses. Intel shares jumped more than 3%.

Details

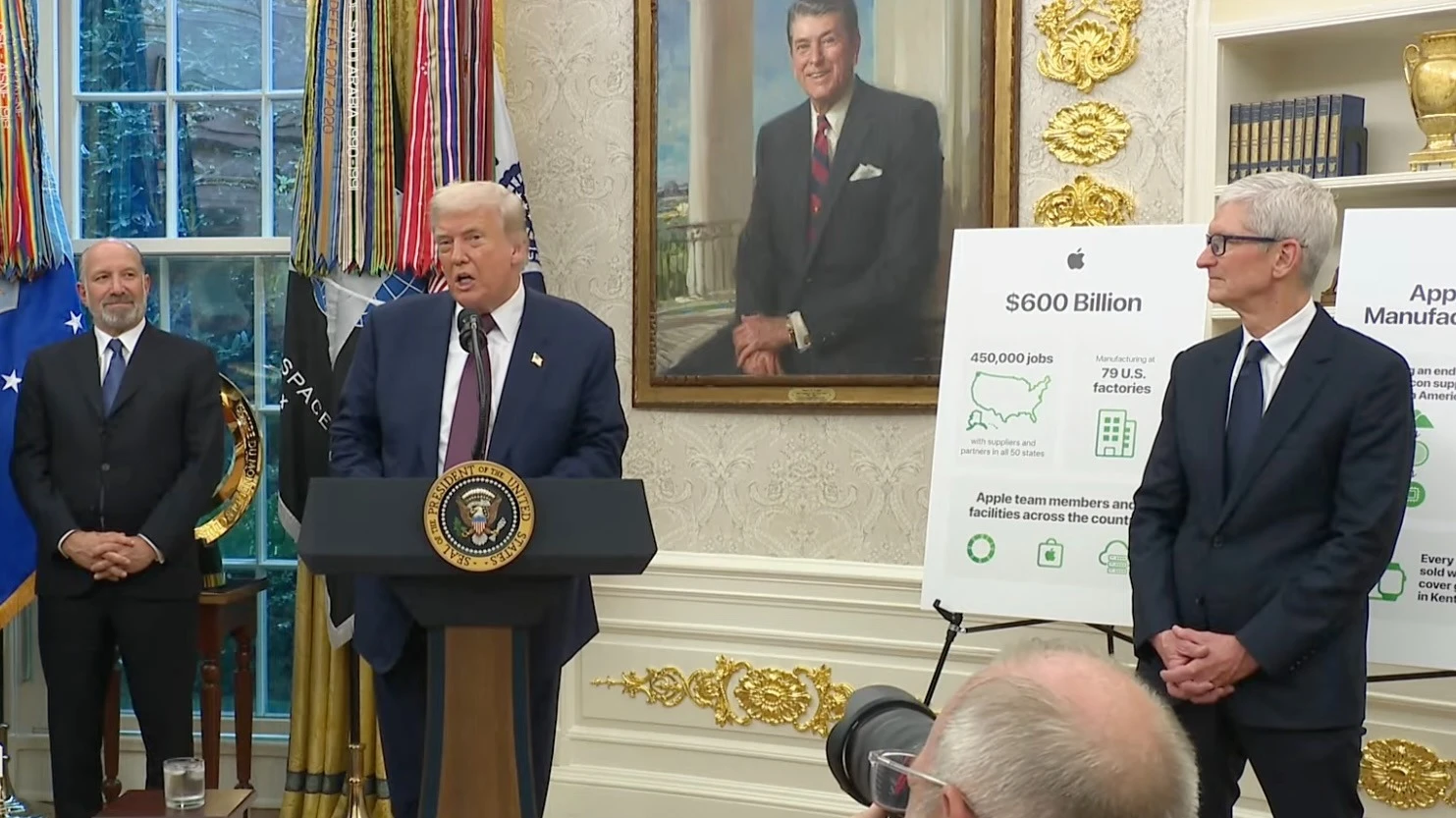

"100% duties on all chips and semiconductors coming into the US. But if you've promised to build [factories to make them in the US] or you're in the process of building them, as many are, there will be no duties," US President Donald Trump said in the presence of Apple CEO Tim Cook. The White House's YouTube channel broadcast.

If a company says it is building facilities in the US but does not actually do so, it will have to pay, including accumulated "debt," the US president has warned. He cited Apple as a company building infrastructure in the United States;

Trump did not name the exact conditions for the duty exemption, including the amount of U.S. production that companies must ensure, noted CNBC. The U.S. president said earlier that the levies on semiconductor imports could take effect as early as next week, but he has not previously announced their rate.

How the market reacted

- Shares of Nvidia, the world's largest maker of processors for artificial intelligence, initially dropped 1.5 percent in extended trading in the U.S., but quickly rebounded from losses and entered a slight plus - at 0.2 percent.

- Shares of second-place AI processor maker AMD have moved to rise about 0.75% after an initial decline turned.

- Shares of Taiwanese contract chip maker TSMC also dropped by 1.5 percent and also quickly rebounded, but then began to surge in price, up 3.3 percent at one point.

- Investors in Intel viewed Trump's statement positively: its securities immediately rose more than 3%, though they then slowed to +2.4%.

- Shares of Apple also rose by about 3% - and that's after surging 5% in major trading.

- Futures on major U.S. indexes were little changed, with the S&P 500, Dow Jones Industrial Average and Nasdaq 100 losing 0.1 percent each, reports CNBC.

Context

Trump and Cook met in the Oval Office of the White House to present a new $100 billion investment plan by Apple in the U.S. economy, bringing the total investment the company has pledged to make once Trump returns to power to $600 billion.

The promised investment could "mitigate White House irritation" over Apple assembling its iPhones for the U.S. market outside the U.S., suggested Bloomberg Intelligence analysts before the announcement. According to them, the company will focus on releasing more expensive devices, developing artificial intelligence technologies and just semiconductors in the U.S., rather than mass-producing budget electronics.

Nancy Tengler, head of investment firm Laffer Tengler Investments, compared Apple's new plan to the "olive branch" that Tim Cook extended to Trump. Earlier this year, the US president threatened to impose a 25% duty on Apple products if the company did not move iPhone assembly to the US.

This article was AI-translated and verified by a human editor