U.S. attack on Iran, Palantir's power, the Fed's voice: highlights from economists' blogs

The U.S. attack on Iranian nuclear facilities is certainly the big news of the week. What investors should expect when the markets open, argues Robert Brooks of the Brookings Institution. What else was discussed on the blogs this week? Former Barack Obama adviser Robert Reich sounded the alarm over the increased influence of Palantir, a major Pentagon contractor. In addition, economists wrote about the study of how the intonations of the head of the U.S. central bank can influence the markets. More details - in our review.

Consequences of the US attack on Iran

Who will be hit harder by U.S. attacks on Iran? That's what in his blog argues Robert Brooks, a senior fellow at the Brookings Institution and former chief currency strategist at Goldman Sachs.

When trading opens on Monday, barring new developments, we can expect oil prices to rise, investor demand for safe-haven assets - the dollar, Swiss franc and Japanese yen - to increase, and emerging market currencies to weaken as global investors flock to safer assets. But the negative impact on emerging markets could be particularly severe, as capital inflows to them have been unusually high in recent weeks, Brooks writes.

These inflows reached the highest level since the recovery from the COVID-19 pandemic in the fourth quarter of 2020. It reflected investors' expectations that the markets' negative reaction to the imposition of U.S. duties had convinced the White House not to escalate the trade war further. But the fact that the US has joined Israel's attacks on Iran raises the risk of a sharp capital reversal, which could lead to a sharp weakening of emerging market currencies, Brooks concludes.

Of course, emerging markets are not a homogeneous group. Oil exporters such as Russia and Saudi Arabia will benefit. Producers of other commodities, especially in Latin America, are likely to benefit as well, since higher oil prices usually lead to higher prices for other commodities as well. Energy importers, such as Turkey and Central and Eastern European countries, will be hit harder. The best advice for emerging markets is to resist the temptation to step in and manage exchange rates. Better to let currencies fall freely - this will help keep economic growth alive amid all this instability, he wrote.

Palantir Dangerous Project;

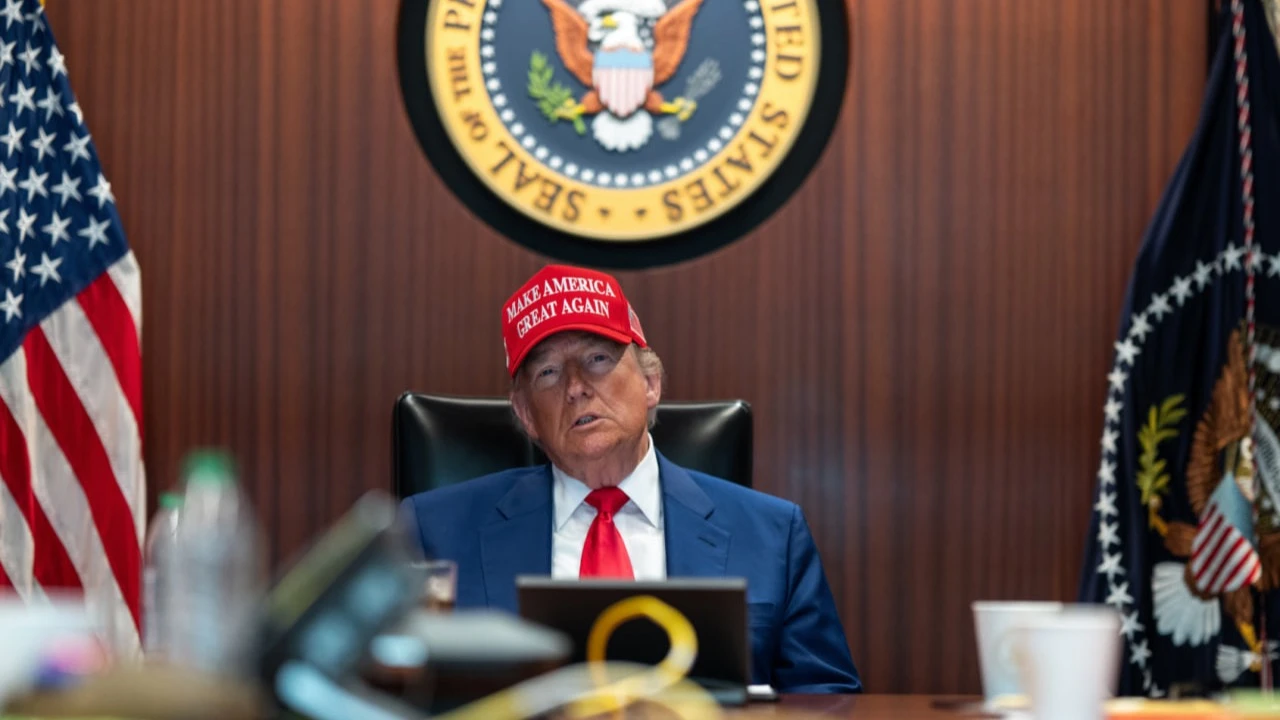

On Saturday, June 14, a military parade was held in Washington, D.C., to commemorate the 250th anniversary of the U.S. Army. It coincided with the 79th birthday of the country's President Donald Trump, who delivered a speech at the event.

The cost of the parade, according to NBS, was $45 million. However, it is not so much the parade itself that has generated interest in economic blogs, but one of its sponsors, Palantir, a data analytics contractor for the Pentagon and the CIA. Its shares have already risen by more than 80 percent since the beginning of the year.

Palantir poses a threat to U.S. democratic institutions, concluded former Secretary of Labor and Barack Obama's former economic adviser Robert Reich. In March, President Trump signed an executive order requiring all federal agencies to share citizens' personal data with the company. Reich points out that Palantir forms a sort of "superbase" of data that includes information from the Department of Homeland Security, the Department of Defense, the Social Security Administration, the Internal Revenue Service and other agencies. It can be used to target immigrants, political opponents and other "inconvenient" citizens, he said.

Even former Palantir employees expressed concern about the situation, signing an open letter in May warning of the risks of abuse. Palantir's work on such a project could be "dangerous," Republican Rep. Warren Davidson of Ohio told news site Semafor. "When you start combining all these data points about a person into one database, it actually creates a digital identifier. That's the kind of power that history shows will eventually be used," he emphasized.

According to US media reports, at least three employees of the Department of Government Efficiency (DOGE), which was formerly headed by Ilon Musk, worked at Palantir, while others were linked to companies funded by Peter Thiel. He is one of the founders of Palantir and has known Musk closely since the 1990s. After Musk gained control of DOGE, he began actively recruiting specialists from Thiel's entourage - former Palantir employees and professionals associated with his projects - to the division.

As a result, the influence of Palantir and Thiel himself in shaping government policy continues to grow. According to Bloomberg data, Thiel's interests in the state apparatus are represented by former and current employees of his companies, his wealth managers and investment partners. Since Trump's election, more than a dozen people with direct or indirect ties to the billionaire have taken influential positions in government.

Intonation as an instrument of monetary policy of the Federal Reserve System

This week, the U.S. Federal Reserve decided for the fourth consecutive time to leave the rate unchanged at 4.25-4.5%.

Fed Chairman Jerome Powell at a press conference announced that the regulator had decided to take a pause due to uncertainty surrounding the impact of duties on the economy. He emphasized that despite the risks, the US economy remains in good shape: unemployment remains low, but inflation is likely to rise under the pressure of duties.

Powell said all this in a confident, calm tone. This is important because the emotional coloring of the central bank governor's voice is also an instrument of monetary policy, wrote a group of economists led by Dimitris Anastasiou, an associate professor at the Athens University of Economics and Business, in a column for CEPR.

According to the researchers, investors care not only about what the central bank chairman says, but also how he says it. They studied how the emotional tone of the Fed chairman's voice affects the dynamics of US banks' share prices.

Researchers analyzed audio recordings of Fed press conferences from 2011 to 2023, as well as the financials of 435 U.S. banks over the same period. Using machine learning algorithms, they categorized the emotional states of Powell and his predecessors into categories such as joy, sadness and anger, and then compared this to the market reaction of bank stocks.

The conclusions are quite predictable: a positive tone of the Fed head (for example, joy in his voice) reduces the risk of quotations collapse, especially for smaller banks, which are more dependent on investors' confidence. And negative emotions increase the risk of a sharp fall, especially for the largest banks, whose actions are closely monitored by institutional players. For small banks, the positive emotional tone of the Fed chief's voice is especially important - it helps to reduce investor anxiety and stabilize quotations. Large banks, in turn, react much more strongly to negative emotions, as market participants tend to interpret the Fed chief's anxious or irritated voice as a signal of political uncertainty, risk of recession or internal tension of the regulator.

Here are specific examples. In March 2020, at the height of the COVID-19 pandemic, Fed Chairman Jerome Powell spoke of "extreme market stress" and a "severe liquidity crisis" at a press conference with an anxious, strained tone. On the same day, JPMorgan Chase shares fell 16%, Bank of America fell 6.5%, and the KBW Bank Index collapsed 16.2%. In April 2025, following President Trump's announcement of higher duties, Powell spoke in a low-key, somber tone, warning of "lingering inflationary risks." His voice was characterized by researchers as "tinged with sadness," and it triggered a nervous reaction from investors: U.S. bank stocks fell to multi-month lows.