U.S. stocks are falling for the fifth day. Investors are cautious ahead of Powell's speech

The main Wall Street indices opened trading on Thursday with a decline. Investors' appetite for risk is decreasing due to the approaching symposium of the Federal Reserve System in Jackson Hole - the head of the regulator Jerome Powell will speak at it on Friday. The improvement in sentiment was not helped by quarterly results of the largest retailer Walmart, whose profit was below expectations, writes Reuters.

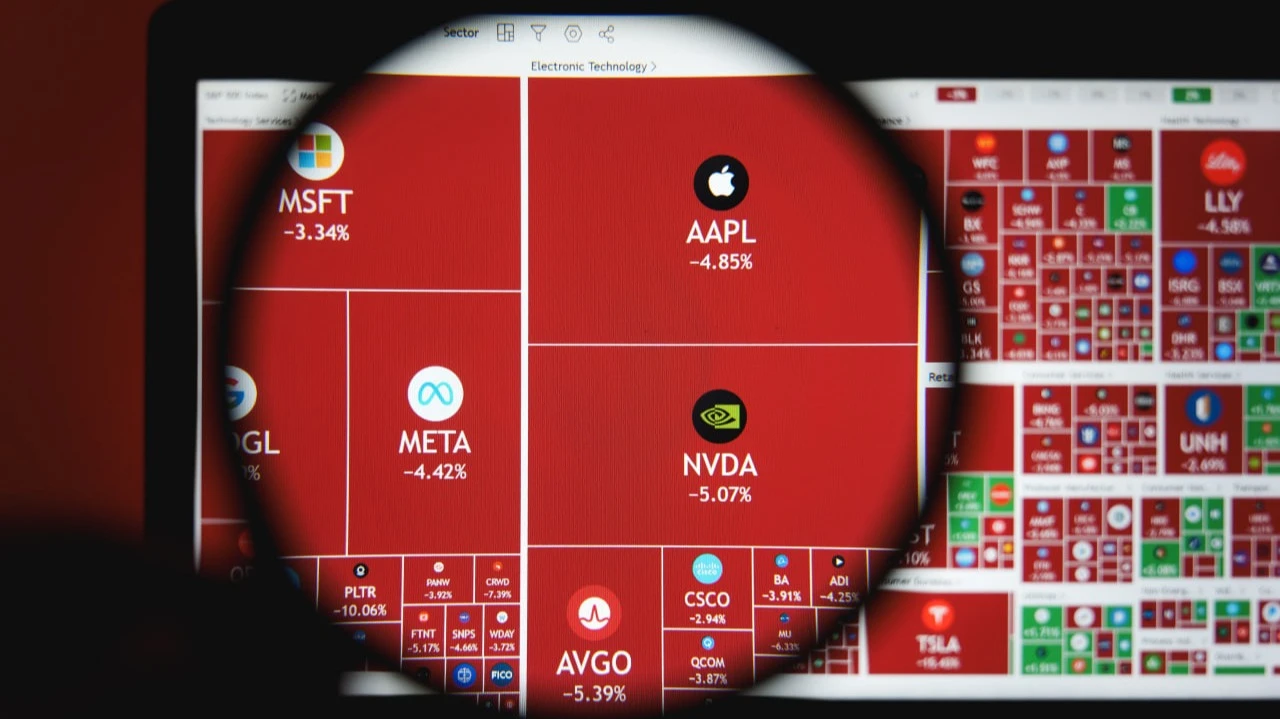

The S&P 500 broad market index fell 0.4% in early trading. This is the fifth consecutive day of decline in the index. The blue-chip index Dow Jones Industrial Average fell by 0.7%. The Nasdaq Composite index fell 0.4%, continuing its decline for the third day in a row.

The VIX index, also called the Wall Street Fear Index, jumped nearly 7% to about 17 points.

What's weighing on the markets?

Investors are waiting for Fed Chairman Jerome Powell's speech, where he may outline the outlook for interest rates. According to CME's FedWatch tool, traders are laying out a nearly 80 percent probability of a Fed rate cut at the next meeting in September, CNBC reported.

"Stock valuations ahead of the Jackson Hole symposium are very high and investors are waiting for Powell to hint at a rate cut in September. If that doesn't happen, players may lock in some profits, especially given the low trading activity in August and a reluctance to take on risk ahead of the weekend," said Rick Gardner, chief investment officer at RGA Investments.

Stocks were also pressured Thursday by Walmart's disappointing second-quarter results - the retail giant missed Wall Street's profit expectations for the first time since Ma 2022, CNBC writes. Walmart shares fell 4.4 percent.

In addition, investor sentiment was not improved by unemployment data released Thursday by the Labor Department. The number of initial applications for unemployment benefits for the week ended August 16 increased to 235,000, while economists expected 225,000 applications, writes The Wall Street Journal. A week earlier, the number of those applying for benefits was 224,000.

The minutes of the Fed's July meeting, released the day before, showed that officials were concerned about the labor market and inflation, although most agreed that it was too early to cut rates. Board of Governors members Christopher Waller and Michelle Bowman opposed keeping rates unchanged - the first time since 1993 that two members of the board disagreed.

"The Fed fears accelerating inflation if companies start passing on duties to consumers. The minutes are consistent with Powell's tough comments at the last meeting. The bull market may get a cold shower in Jackson Hole," said David Russell, head of global markets strategy at TradeStation.

This article was AI-translated and verified by a human editor